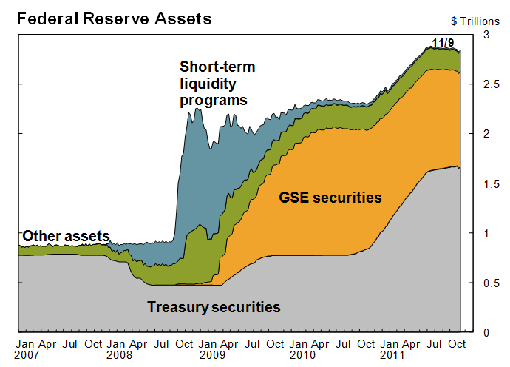

We are now nearly two-and-a-half years into the recovery from the worst U.S. recession in decades. The Federal Reserve has taken extraordinary actions during the past four years to stem what could have been a meltdown of the financial system and a horrific depression. These actions included several lender-of-last-resort programs aimed at alleviating liquidity shortfalls in the financial system. In addition, the Federal Open Market Committee (FOMC) undertook a series of aggressive monetary policy actions aimed at stimulating the economy and avoiding deflation. It lowered the target federal funds rate nearly to zero in December 2008 and subsequently carried out purchases of Treasury and agency, or GSE, securities that expanded the Fed’s holdings by about $2 trillion, as shown in Figure 1.

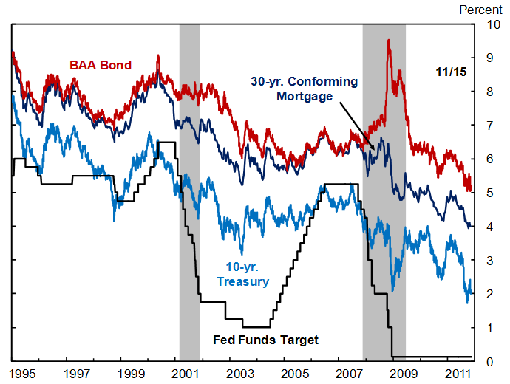

These monetary policy actions have brought Treasury, mortgage, and corporate bond rates down to their lowest levels in decades, as seen in Figure 2.1 Indeed, financial conditions in the nonfinancial corporate sector, whether measured by corporate bond rates or stock prices, have improved markedly since the crisis.

These bold and decisive actions succeeded in forestalling economic disaster. But they have not been enough to deliver a robust recovery. Instead, my outlook is for the unemployment rate to remain above 7 percent for three more years. I don’t expect the rate to reach levels consistent with the Fed’s mandate of maximum employment until 2016. And inflation is expected to remain very low.

In the remainder of my talk, I will address the question: Why hasn’t aggressive monetary accommodation fueled a rapid recovery in economic activity? I will focus on three powerful currents that have slowed the pace of recovery. The first is the massive destruction of wealth from the crisis brought about by the declines in house and stock prices. The second is the severe tightening of credit resulting from the financial accelerator mechanism, triggered by the decline in real estate prices and the upsurge in residential foreclosures. The third is heightened uncertainty regarding European sovereigns and the overall health of the financial system. These renewed concerns about the financial system have diminished the appetite for risk and sent investors fleeing to safe assets, such as U.S. Treasuries.

The Fed’s substantial monetary accommodation has worked hard to swim upstream against these currents, but progress has been frustratingly slow and halting. I should note here that these remarks represent my own views and not necessarily those of others in the Federal Reserve System.

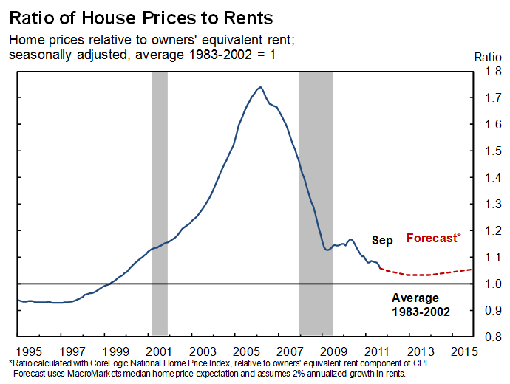

The natural starting point for any discussion of the U.S. economy today is housing. The dramatic boom and bust of the housing market over the past decade has been at the heart of the slow recovery. Figure 3 shows the ratio of house prices to a measure of home rents in the United States over the past two decades. This price-to-rent ratio is analogous to the price-to-earnings ratio for stocks. In this figure, the numbers have been normalized so that the historical average of this ratio equals one. According to this metric, house prices were about 70 percent overvalued at their peak in 2006. Since then, house prices have fallen by about 30 percent and rents have risen, bringing the price-to-rent ratio roughly in line with its long-run average.

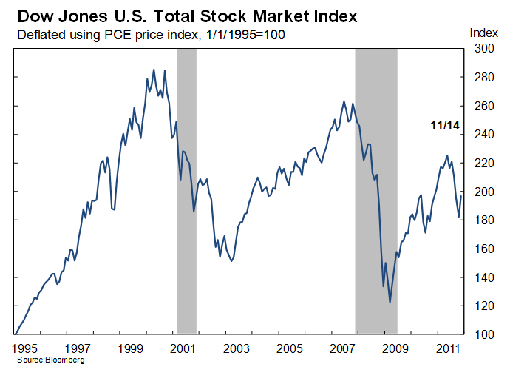

The sharp decline in house prices has had profound effects on the economy. It directly reduced the wealth of households by six-and-a-half trillion dollars. In addition, the housing crash and ensuing financial crisis caused stock prices to plummet. This stock market collapse in part reflected expected losses to financial institutions that had invested heavily in mortgage-related securities. Figure 4 traces a broad measure of inflation-adjusted U.S. equity prices since 1995. At its worst point in early 2009, stock market wealth had plunged 50 percent. That equals a decline of 11 trillion dollars in household wealth relative to its pre-crisis peak. As the crisis has receded and nonfinancial corporate profits have strengthened, the stock market has recovered a good portion of these losses.

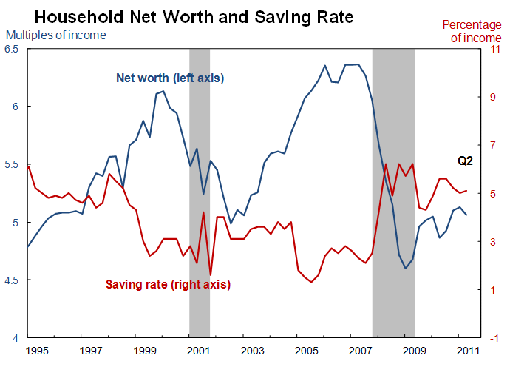

What has been the effect of the massive wealth destruction represented by the sharp declines in housing and stock prices? If we apply a standard marginal propensity to consume out of wealth of four cents on the dollar, then the decline in real household wealth since late 2006 translates into about a 4½ percent sustained reduction in consumer spending. And, in fact, the theoretical relationship between wealth and consumer spending is borne out in the data. Figure 5 plots household net worth against the personal saving rate. As seen in the figure, the saving rate has been much higher since the start of the recession. Thus, the wealth effect on consumer spending is the first strong current holding back a robust recovery.2

But the wealth effect is only the beginning of the story. The decline in housing wealth also wiped out the home equity of millions of mortgage borrowers. Indeed, it’s estimated that nearly 30 percent of mortgages—about 16½ million in total—are currently “underwater,” meaning that borrowers owe more than their homes are worth. Millions more are “above water,” but have less than the 20 percent equity typically needed to refinance. This evaporation of home equity has had severe repercussions for the economy.

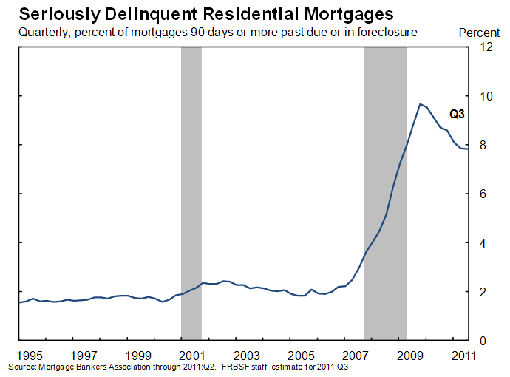

Widespread negative equity has contributed to a dramatic rise in mortgage delinquencies and foreclosures. The combined mortgage delinquency and foreclosure rate soared to nearly 10 percent in 2009 and remains elevated, as seen in Figure 6. The spike in foreclosures and delinquencies was at the center of the financial crisis. As borrowers failed to make payments, mortgage lenders posted massive losses. Some major financial institutions failed due to mortgage-related losses, which undermined confidence in the solvency of other institutions. It culminated in an enormous panic that nearly brought down the financial system.

Fortunately, calamity was averted. Nonetheless, the housing market has not bounced back. Today, three years after the financial crisis reached a climax, we still see millions of homes in foreclosure and millions more on the verge. The foreclosure crisis entails massive deadweight costs to society and brings with it a cloud of uncertainty regarding the liabilities of financial institutions and prospects for house values.

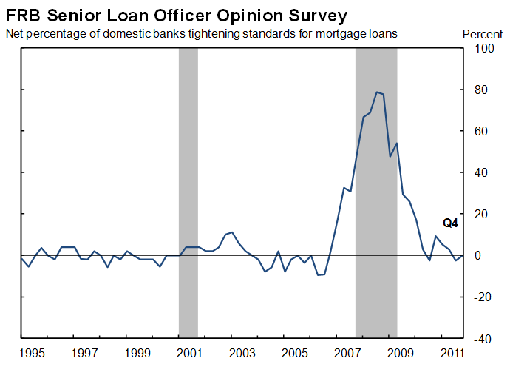

Stung by massive mortgage and other loan losses, lenders tightened credit standards sharply. Figure 7 shows the results from the Federal Reserve’s Senior Loan Officer Opinion Survey.3 The survey responses indicate that lenders systematically tightened standards on mortgage loans between 2007 and 2009. Since then, standards have changed little, indicating that credit has remained tight. Indeed, anecdotal reports indicate that mortgages are available only to those with excellent credit and the ability to make hefty down payments.

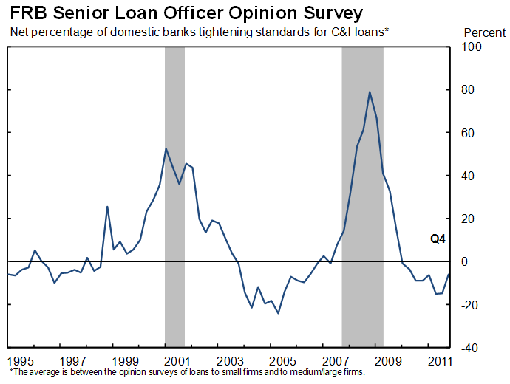

Figure 8 shows the loan officer survey results for commercial and industrial loans. Business lending standards also tightened sharply following the crisis and have relaxed only a bit since then.

As I noted earlier, the prevalence of negative home equity means that many homeowners have little or none of the collateral needed to borrow or to refinance existing loans. The same applies for small and medium-size businesses, which do not have access to capital markets the way big corporations do. Small businesses frequently rely on collateral from their homes or commercial real estate to get credit. With real estate prices slumping, they are essentially shut out of the market.4 Thus, this combination of tighter credit standards and borrowers without collateral has led to a broad-based credit crunch that is restraining both consumer and business spending. This is the second current holding back the recovery.

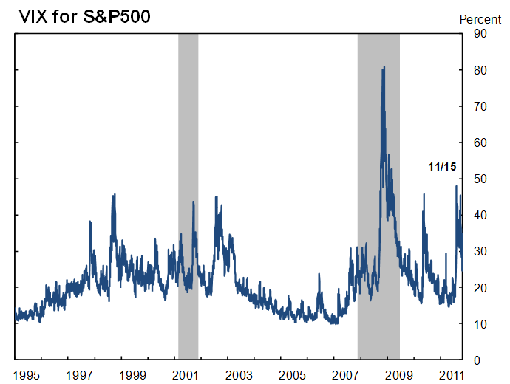

The third major current holding back the recovery is uncertainty. One standard measure of financial market uncertainty is the VIX for the S&P 500, shown in Figure 9. The VIX has spiked three times in the past few years in response to financial and economic developments. It is currently at very high levels. More generally, the tumultuous events of the financial crisis, the household debt overhang, and the U.S. and European fiscal crises have sapped confidence and diminished people’s willingness to take on risk. In this environment, investors flock to the safe havens of U.S. government securities and the highest-rated private securities. Risk spreads on lower-rated securities are elevated.

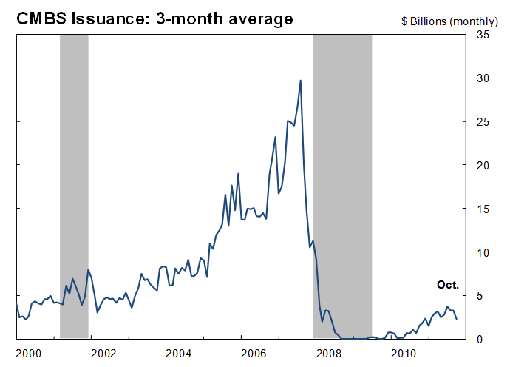

The lack of risk appetite is also seen in securitization markets. Securitization of commercial real estate mortgages has largely been dormant, as seen in Figure 10. And securitization of non-agency private residential mortgages is frozen. Despite very low interest rates, investors are extremely cautious about pulling the trigger on investment projects. Instead, they prefer to hold on to the option value of waiting to see how the economic situation develops.

In summary, the Fed has been very aggressive in using monetary policy to lower interest rates to stimulate the economy. These policies have been effective at improving financial conditions in important ways, but they are swimming against strong countercurrents that impede recovery.

In this environment, monetary policy alone would take a very long time to bring about the desired outcome of maximum employment. Fiscal policy actions that reduce uncertainty and stimulate recovery are badly needed. What would be especially helpful at this juncture are fiscal policy actions that work in tandem with monetary policy to stimulate the economy. One example of such a policy is the recently announced U.S. government initiative to make it easier for underwater homeowners to take advantage of very low rates and refinance their mortgages. This will trim monthly payments for some households and could reduce foreclosure rates. And it could also eventually provide a modest boost to consumer spending. Other actions that address the continuing problems in the housing market could help spur recovery and enhance the effectiveness of monetary policy as well. Thank you very much.

# # #

End Notes

1. See Williams (2011) for a further discussion of the effects of the Fed’s unconventional monetary policy actions.

2. See Glick and Lansing (2011) and Mian and Sufi (2011).

3. Federal Reserve Board (2011).

4. Wilcox (2011).

References

Federal Reserve Board. 2011. “Senior Loan Officer Opinion Survey on Business Lending Practices.” October (current survey).

Glick, Reuven, and Kevin J. Lansing. 2011. “Consumers and the Economy, Part I: Household Credit and Personal Saving.”FRBSF Economic Letter 2011-01 (January 10).

Mian, Atif, and Amir Sufi. 2011. “Consumers and the Economy, Part II: Household Debt and the Weak U.S. Recovery.” FRBSF Economic Letter 2011-02 (January 18).

Wilcox, James A. 2011. “Securitization and Small Business.” FRBSF Economic Letter 2011-22 (July 18).

Williams, John C. 2011. “Unconventional Monetary Policy: Lessons from the Past Three Years.” Speech to the Swiss National Bank Research Conference, Zurich, Switzerland, September 23.