Good evening and thank you for coming tonight. It is a great honor to be part of the Marian Miner Cook Athenaeum Lecture series. I saw that Allan Meltzer spoke at an Athenaeum luncheon a few weeks ago. Allan wrote what many consider to be the definitive history of the Fed. So, many of you have already embarked on an intensive course in money and banking this semester. I hope my remarks, on top of the wisdom you heard from Allan, will contribute to a better understanding of monetary policy.

This evening, I’ll try to give you a real sense of how I, and many central bankers, think about monetary policy. We must make difficult decisions in the face of intense pressures and conflicting demands. For example, at any given time, should we worry more about unemployment or inflation? What are the most dangerous risks to the economy and how can we defuse them? My aim is to explain some of the ways we analyze such questions. This is a particularly compelling subject now, more than two-and-a-half years into a lackluster recovery marked by weak demand and a still very high unemployment rate.

I’ll start my talk by describing the mission Congress has assigned the Federal Reserve, often described as our dual mandate. I’ll describe how the Fed interprets the mandate and the ways in which our goals may reinforce each other and when they may conflict. That will lead to a discussion of how we carry out policy operationally, what might be called “best practices” monetary policy. And I’ll close with a brief description of our current policy stance. I should stress that I am speaking entirely for myself and not for anybody else in the Federal Reserve System.

The Federal Reserve’s mandate

Let me start with the Fed’s mission. It’s often said that Congress assigned the Federal Reserve a dual mandate: maximum employment and stable prices. But, that’s not quite accurate. In fact, the Fed has a triple mandate. Section 2A of the Federal Reserve Act calls on the Fed to maintain growth of money and credit consistent—and I quote—“with the economy’s long-run potential to increase production, so as to promote effectively the goals of maximum employment, stable prices, and moderate long-term interest rates.”1

These are excellent and desirable aspirations. However, they fall short in providing specifics. After all, what does it mean to say “maximum” employment or “stable prices”? Is a 4 percent interest rate moderate? Six percent? Ten percent? Moreover, what do we do if these goals are in conflict with each other?

To answer these questions, let’s take a closer at each individual goal in turn. Let me start with the goal of stable prices. Now, taken literally, stable prices would seem to imply that the costs of all goods and services should be frozen in time. But, that can’t be right. After all, prices fluctuate all the time in response to shifts in supply and demand. For example, a deep freeze in Florida sends orange juice prices soaring. Flat panel TV prices tumble as production becomes more efficient. These kinds of relative price movements are beyond the control of a central bank like the Fed. The Fed can’t do anything about the weather or the development of new TV manufacturing technologies. Nor should it. Relative price movements—with some prices going up and others going down—are a natural part of a well-functioning market economy. It’s the way markets signal which goods are scarce and which are relatively abundant.

Instead, the Fed looks at price stability in an overall, or average, sense. We strive to make sure that the average prices of a comprehensive set of consumer goods and services don’t change much from month to month or year to year. The well-known consumer price index is one measure of average prices. We at the Fed tend to focus more on the somewhat broader personal consumption expenditures, or PCE, price index, which is reported along with the GDP data.

What objective should we seek for the rate of increase of average prices? Should we strive for no change at all, that is, zero inflation? At first blush, that seems sensible. But, there are a number of reasons why aiming for zero inflation would be too low and inconsistent with our maximum employment mandate. Here I’ll mention two.

First, a small amount of inflation can help grease the wheels of the labor market. There is considerable evidence that nominal wages don’t easily fall even when demand is weak, something economists call downward wage rigidity.2 In other words, it’s unusual for workers to have the dollar value of their wages reduced. In this regard, wages are very different from, say, airline ticket prices, which are quickly discounted when seats can’t be filled. Weak labor demand may necessitate a reduction in real wages, that is, wages adjusted for inflation. Even if the nominal, or dollar value, of wages won’t budge, the real wage will fall as prices rise. As a result, a little bit of inflation can help the labor market adjust to negative shocks and, in this way, help keep employment closer to its maximum level.3

Second, a small amount of inflation gives the Fed a little more maneuvering room to respond to negative shocks to the economy.4 The problem is that nominal interest rates can’t go below zero. Economists refer to that limit as the zero lower bound. Let me define terms. The nominal interest rate can be divided into its two components: the real, or inflation-adjusted, interest rate; and expected inflation. A little bit of inflation tends to raise nominal rates on average in order to provide a positive yield to investors. That gives the Fed more room to lower interest rates in a recession before hitting the zero lower bound.

The more we can lower interest rates when appropriate, the more we can stimulate the economy and boost employment when needed. That helps us keep closer to our maximum employment goal. Research on this question has found that an inflation objective of 2 percent or higher generally provides plenty of maneuvering room for the Fed, except in the most severe recessions.5

So a little bit of inflation may be desirable. But, of course, too much inflation would be inconsistent with our price stability mandate. Moreover, high inflation carries with it considerable costs in terms of economic efficiency. Weighing these considerations, my fellow Fed policymakers and I have concluded that a 2 percent inflation rate—as measured by the personal consumption expenditures price index—is most consistent, over the longer run, with our mandate. It represents the best compromise between having inflation close to zero, but not so low that downward nominal wage rigidity or the zero lower bound pose significant problems for the economy. The Federal Reserve’s policy body, the Federal Open Market Committee, or FOMC, officially announced this objective of 2 percent inflation in a statement entitled “Longer-Run Goals and Policy Strategy” released following our most recent meeting in January.6

What about the second component of the Fed’s mandate—maximum employment? The dictionary defines “maximum” as “the greatest quantity possible.” Once again, that goal can’t be taken too literally. It’s absurd to interpret the law to mean that every man, woman, and child in the nation should be working three full-time jobs, 24 hours a day, 365 days a year! Child labor laws and the human needs for food, rest, and recreation make it plain that maximum employment must mean something far short of nonstop work. Nor does maximum employment suggest we should be aiming for an unemployment rate of zero.

A more reasonable and practical interpretation is that maximum employment is the level that’s consistent with the other aspects of the mandate. To make this clear, I’ll need to delve into economic theory about the relationship between inflation and employment.

Imagine that the economy was stronger than it is today and that the rate of unemployment was low. What would happen if the Fed tried to stimulate the economy further and drive employment even higher? It would be harder for employers to find and keep qualified workers. Employers would have to offer hefty increases in pay and benefits, driving up labor costs rapidly. Since labor costs make up around 60 percent of the cost of producing U.S. goods and services, employers would feel rising pressure to boost prices or accept narrower profit margins. In other words, if the Fed attempted to drive unemployment too low, labor costs and prices would eventually spiral upwards. And that would run smack into our mandate to promote stable prices.

Economists speak of the Phillips curve, which describes how, in the short run, inflation tends to rise as unemployment falls below a certain level. And inflation tends to fall when unemployment is high. The level of unemployment at which there are no upward or downward pressures on inflation is called the natural rate of unemployment. Importantly, if the central bank were to try to push unemployment consistently below its natural rate, the result would be an uncontrollable upward spiral of wages and prices. In the end, such a policy would fail to drive unemployment below its natural rate anyway!7

The logic of the Phillips curve tells us that literally maximum employment—or minimum unemployment—is inconsistent with the price stability mandate. To strike a balance between these conflicting objectives, we need to interpret our employment mandate as the goal of achieving maximum sustainable employment. By sustainable, we think of a level of employment that doesn’t create pressure for inflation to rise or fall—that is, one consistent with the unemployment rate equaling the natural rate of unemployment.

But what actually is the natural rate of unemployment, that is, the level that creates neither upward nor downward pressure on inflation? Clearly, it’s not a zero unemployment rate. Even in an ideal economy, it takes time to search for work and actually get hired, just the way it takes time to find a mate using a computer dating service. We use the word “frictions” to describe the things that make finding a job—or a spouse—time consuming. Because of these frictions, the natural rate of unemployment is a positive number that depends on the dynamics of the labor market.

In this regard, the Fed’s maximum employment goal fundamentally differs from the price stability goal. In the long run, inflation is determined by the actions the central bank takes—in other words, by monetary policy. So we Fed policymakers can set an inflation target we think best. But the natural rate of unemployment is not determined by the central bank. Rather, the natural rate reflects market forces and tends to shift as labor market frictions change. According to the FOMC statement that I mentioned before, quote, “The maximum level of employment is largely determined by nonmonetary factors that affect the structure and dynamics of the labor market,” and “These factors may change over time.”

Unfortunately, there is no way to know exactly what the natural rate of unemployment is. It’s not a number you can look up in a statistical table. In fact, the natural rate is the subject of intensive economic research and debate. Economists must estimate it using economic or statistical models. In addition, because it fluctuates over time due to changes in labor force demographics and other factors, economists must regularly refine these estimates as new data come in. As a result, each FOMC participant estimates the natural rate of unemployment for him or herself, and makes policy judgments accordingly.

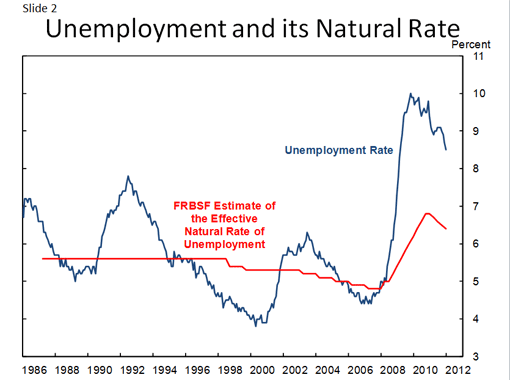

Typical estimates of the current natural rate of unemployment tend to range between 6 and 7 percent.8 These estimates are higher than usual because of the damage the recent recession did to the efficient functioning of the labor market. Slide 2 shows estimates of the natural rate of unemployment computed by the staff of the San Francisco Federal Reserve Bank, along with the actual unemployment rate. Since 2008, the unemployment rate has been far above our estimates of the natural rate. In fact, the gap between unemployment and our natural rate estimates has been larger than at any time in the past 25 years. Economists generally expect the natural rate of unemployment to decline somewhat over the next decade as the effects of the recession on the labor market diminish. In the Federal Reserve’s recent statement, most FOMC participants’ longer-run estimates of the natural rate of unemployment range from 5 to 6 percent.

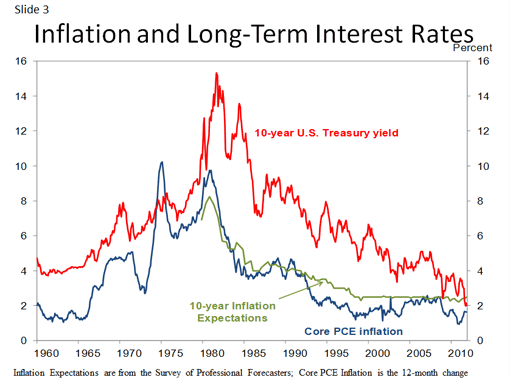

Now, let’s turn to the third part of the Fed’s mandate, the injunction to promote moderate long-term interest rates. This goal receives the least attention of the Fed’s three mandates. And justifiably so. That’s because it’s a natural corollary of the price stability goal. To see this, it’s helpful to break down an interest rate into two parts: the inflation-adjusted, or real, rate; plus expected inflation. Slide 3 shows the yield on 10-year Treasury bonds and the rate of inflation from 1960 to 2010. It also shows a survey measure of 10-year expected inflation, which starts in 1980. As you can see, expected inflation was high in the early 1980s, when inflation was high. It has been much lower and more stable over the past decade, when inflation has been low.

There’s no question that Fed policy affects long-term interest rates in the economy. But monetary economists have long known that the Fed cannot permanently affect the first part of the interest rate equation—the real interest rate. In the long run, real interest rates depend primarily on real returns to investments in productive capital, such as plant and equipment. The Fed has little ability to control long-term trends in the productivity of investment in the U.S. economy.

However, we can and do affect long-term interest rates through our influence over the second part of the equation—long-term inflation expectations. If we succeed in keeping these expectations low, then, all else being equal, long-term interest rates should be moderate on average. In this way, the Fed’s mandate to achieve moderate long-term interest rates is simply a reaffirmation of its mandate to keep inflation low and prices stable. And that’s the reason most people speak of the Fed having a dual mandate, rather than a triple mandate.

Best practice monetary policy

So far, I’ve translated the broad mandate that Congress gave us in terms of two more-concrete goals. First, aim for an average inflation rate of 2 percent. And, second, try to keep the unemployment rate near our best estimate of the natural rate of unemployment. To a great extent, these goals are harmonious and monetary policy is pretty straightforward. Sometimes though, we face tradeoffs between our goals. And that’s when difficult policy choices are unavoidable.

Let me quote again from the FOMC statement: “the Committee seeks to mitigate deviations of inflation from its longer-run goal and deviations of employment from the Committee’s assessments of its maximum level,” end quote. If the Committee judges that these goals are in conflict in the short run, then, quote, “it follows a balanced approach in promoting them, taking into account the magnitude of the deviations and the potentially different time horizons over which employment and inflation are projected to return to levels judged consistent with its mandate,” end quote. In other words, we look at how much unemployment and inflation are deviating from ideal levels. And we consider how long it is likely to take them to return to ideal levels. Let me elaborate.

A large literature argues that monetary policymakers should set the policy interest rate in such a way as to bring the expected future paths of unemployment and inflation as close to their goals as possible.9 Technically, a simple way to capture this idea is for monetary policymakers to formulate a plan for interest rates and any other monetary policy instruments that minimizes a loss function.

I’m going to leave the equations to an extended footnote.10 What I want to stress here is that such a technical exercise provides a clear summary of the kind of real-world choices Fed policymakers must make. Unemployment and inflation typically fluctuate around the longer-run levels consistent with our mandates because of various economic shocks. Sometimes they veer very far from the levels consistent with our mandates. Certainly, that’s the case now with unemployment. Given these fluctuations, it’s impossible for the FOMC to achieve a perfect outcome. Instead, we must try to do the best we can, given that monetary policy affects output and inflation with substantial lags.

Let me give an example from before the financial crisis to drive home this point. Let’s suppose that the economy is hit by a large increase in oil prices. This has all the features of a classic supply shock. It causes both the unemployment rate and the inflation rate to increase. Our employment and price stability goals may be in conflict.

Easing policy would help bring unemployment back to its natural rate. But that would imply that it would take longer to get back to 2 percent inflation. Even worse, it might mean that 2 percent inflation wouldn’t be attainable at any reasonable time horizon! Conversely, tightening monetary policy would bring inflation back to 2 percent more quickly. But unemployment would take longer to get back to its natural rate.

In this example, the extent to which monetary policy should ease or tighten depends on many factors. It would partly depend on the relative weight we assign to economic losses caused by unemployment and excess inflation. Other important considerations would be how quickly unemployment and inflation would be expected to return to levels consistent with our mandate. And we would want to estimate the relative sizes of the effects of monetary policy actions on unemployment and inflation. But, whatever the specific policy choices, the important point is that both inflation and unemployment would eventually return to levels consistent with our goals.

The current stance of monetary policy

What does this tell us about where monetary policy should be now? Inflation in 2012 and 2013 is likely to come in around 1½ percent, below the FOMC’s 2 percent target. And clearly, with unemployment at 8.3 percent, we are very far from maximum employment. At the San Francisco Fed, our forecast is that the unemployment rate will remain well over 7 percent for several more years.

This is a situation in which there’s no conflict between maximum employment and price stability. With regard to both of the Fed’s mandates, it’s vital that we keep the monetary policy throttle wide open. This will help lower unemployment and raise inflation back toward levels consistent with our mandates. And we want to do so quickly to minimize total economic damage. The longer we miss our objectives, the larger the cumulative loss to the economy.

What does this mean in practice? Our ability to affect the economy is rooted in our influence over interest rates. In the simplest terms, when the Fed raises interest rates, that tends to damp economic activity and lower inflation. By contrast, cutting interest rates spurs economic activity and allows inflation to rise.

Our standard tool is the federal funds rate, which is what banks pay to borrow from each other on overnight loans. We have substantial control over the federal funds rate through what are called open market operations, that is, buying and selling U.S. Treasury securities to inject or withdraw money from the banking system. The federal funds rate serves as a benchmark for other short-term interest rates, and it indirectly influences longer-term rates as well. In this way, the Fed has a broad ability to affect the level of interest rates throughout the economy.

We have pushed the federal funds rate close to zero because of the severe recession of 2007 through 2009, and the weak recovery since. We’ve said we expect to keep the federal funds rate extremely low at least through late 2014. Meanwhile, with the fed funds rate near zero, we’ve used some unconventional monetary policy tools to try to push down longer-term interest rates further. Our policy initiatives are a major reason why interest rates across the entire yield curve are at or near record low levels for the post-World War II period.

This is truly an extraordinary time for monetary policy. I’ve talked about some of the tradeoffs central bankers face. But I don’t see such tradeoffs today. Now is one of those moments when everything points in the same direction. The Fed is committed to achieving maximum employment and price stability. And we’re doing everything in our power to move towards those goals. Thank you very much.

# # #

End Notes

1. See Slide 1. A copy of the Federal Reserve Act is provided online by the Federal Reserve Board of Governors. It is interesting to note that the Federal Reserve’s legal mandate has evolved over time in response to economic events and advances in understanding of how monetary policy and the economy function. For example, in the original Federal Reserve Act of 1913, the Fed had no mandate for macroeconomic stabilization and was only charged with providing an “elastic currency” and to act as a lender of last resort for banks. The quote here originates in the Federal Reserve Reform Act of 1977 and remains in place today. See Judd and Rudebusch (1999) for some discussion and more details.

2. See Dickens et al. (2007).

3. See Akerlof, Dickens, and Perry (1996).

4. See Summers (1991) for an early exposition on this point.

5. See Reifschneider and Williams (2000) and Williams (2009).

6. See Board of Governors (2012). Other central banks have generally chosen inflation goals of around 2 percent as well, presumably for much the same reasons as I laid out here. See Kuttner (2004).

7. See Friedman (1968) and Phelps (1968) for early expositions of this principle.

8. For other estimates of the natural rate of unemployment, see Weidner and Williams (2011), Daly et al. (2011), and the Congressional Budget Office (2012).

9. See Woodford (2003).

10. A simple way to capture this idea mathematically is for monetary policymakers to formulate a plan for interest rates and any other monetary policy instruments that minimizes a loss function. The following equation has several parts.

![]()

The minimization operator in front denotes that policymakers are trying to minimize the loss function to the right by choosing the optimal interest rate plan, {it}, where t ranges over all future dates and the plan for interest rates or other monetary policy instrument itwill typically be a function of the realizations of shocks and new information that come to light as time progresses. The expectations operator E means that there is uncertainty about the loss function, and policymakers are trying to minimize the expected value, or average of that loss function, across all possible uncertain outcomes. The sum is over all future dates t, and the quantity δ < 1 describes the rate at which policymakers, on behalf of society, discount the future relative to the present. The variable Πt denotes the inflation rate at each future date t, and Π* denotes the mandate-consistent inflation rate of 2 percent per year. The variable ut denotes the unemployment rate at each future date t, and ut* denotes the natural rate of unemployment, which might vary over time. The parameter λ represents the relative weight that policymakers place on stabilizing unemployment vs. stabilizing inflation around their mandate-consistent levels. It is important to note that both the deviation of inflation from its mandate-consistent level and the deviation of unemployment from its natural rate are squared—that is, the loss function penalizes us for letting unemployment or inflation get too low as well as too high.

References

Akerlof, George A., William T. Dickens, and George L. Perry. 1996. “The Macroeconomics of Low Inflation.” Brookings Paper on Economic Activity, 1996(1), pp. 1–59.

Board of Governors of the Federal Reserve System. 2012. “Press Release,” January 25.

Congressional Budget Office. 2012. The Budget and Economic Outlook: Fiscal Years 2012 to 2022. Washington, DC, January.

Daly, Mary, Bart Hobijn, Aysegul Sahin, and Robert Valletta. 2011. “A Rising Natural Rate of Unemployment: Transitory or Permanent?” Federal Reserve Bank of San Francisco Working Paper 2011-05.

Dickens, William T., Lorenz Goette, Erica L. Groshen, Steinar Holden, Julian Messina, Mark E. Schweitzer, Jarkko Turunen, and Melanie E. Ward. 2007. “How Wages Change: Micro Evidence from the International Wage Flexibility Project.” Journal of Economic Perspectives 21(2), pp. 195–214.

Friedman, Milton. 1968. “The Role of Monetary Policy.” American Economic Review 58, pp. 1–17.

Judd, John, and Glenn Rudebusch. 1999. “The Goals of U.S. Monetary Policy.” FRBSF Economic Letter 1999-4.

Kuttner, Kenneth. 2004. “A Snapshot of Inflation Targeting in its Adolescence.” In The Future of Inflation Targeting, Conference Volume. Sydney: Reserve Bank of Australia.

Phelps, Edmund S. 1968. “Money-Wage Dynamics and Labor-Market Equilibrium.” Journal of Political Economy 76, pp. 678–711.

Reifschneider, David L., and John C. Williams. 2000. “Three Lessons for Monetary Policy in a Low-Inflation Era.” Journal of Money, Credit, and Banking 32 (4, part 2, November), pp. 936–66.

Summers, Lawrence. 1991. “Panel Discussion: Price Stability. How Should Long-Term Monetary Policy Be Determined?” Journal of Money, Credit, and Banking 23(3), pp. 625–31.

Weidner, Justin, and John C. Williams. 2011. “What Is the New Normal Unemployment Rate?” FRBSF Economic Letter 2011-05, February 14.

Williams, John C. 2009. “Heeding Daedalus: Optimal Inflation and the Zero Lower Bound.” Brookings Papers on Economic Activity 2009(2, Fall), pp. 1–37.

Woodford, Michael. 2003. Interest and Prices: Foundations of a Theory of Monetary Policy. Princeton, NJ: Princeton University Press.