The San Francisco Fed’s Community Engagement and Analysis team connects with communities across the nine western states and the Pacific Territories and Commonwealth, sharing research and insights to support a stronger economy for all. One example of how we do this is through the Federal Reserve’s Small Business Credit Survey (SBCS), which gathers insights from small business owners about the health of their businesses and financing needs.

In 2024, small businesses across the Twelfth District reported that:

- The most commonly experienced operational challenge was reaching customers / growing sales (56%).

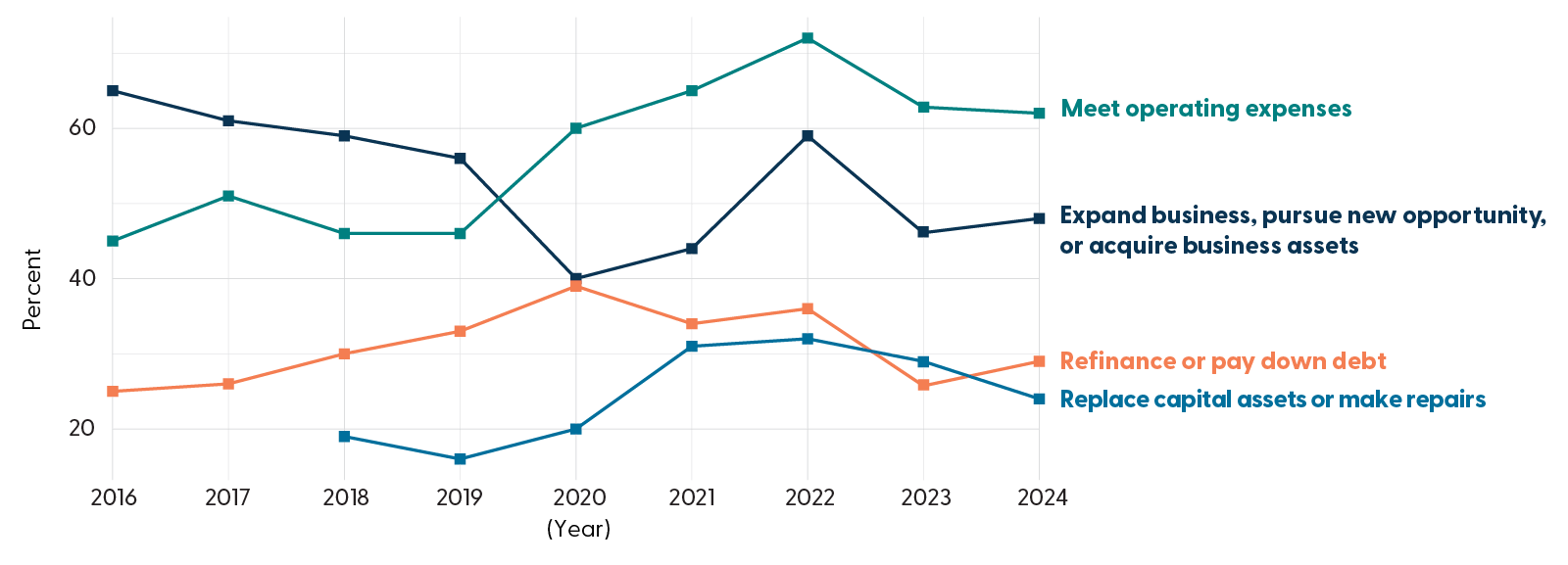

- A majority of firms applied for some type of financing (59%). Of these, the most frequently reported reason was covering operating expenses (62%).

- Applicants that sought financing at small banks were most likely to be fully approved.

Reasons 12th District Firms Applied for Financing

Prior 12 months

A collaboration of the 12 Federal Reserve Banks, the annual SBCS collects data on small businesses’ financial needs, business performance, and emerging issues. The 2024 survey was fielded from September to November 2024 and reached more than 7,600 small employer firms nationally.

2024 Small Business Credit Survey Findings

Arizona

California

Hawai’i

Washington

How does the SBCS support small businesses?

These timely insights are shared with policymakers, lenders, and those who support small businesses. The information gathered provides detailed insight into the needs of small businesses, enabling the development of targeted solutions that increase access to credit. The findings also inform the core functions of the Federal Reserve, including monetary policy.

More responses from small businesses mean more granular data and analyses, allowing the Fed to highlight local-level insights into the experiences of small businesses seeking financing.

2024 SBCS findings in the Twelfth District

As a result of strong response rates in recent years, the Federal Reserve Banks created Firms in Focus, a series of chartbooks analyzing SBCS data across various business characteristics and owner demographics, as well as by state and metropolitan statistical area (MSA).

In 2024, we received enough SBCS responses for results for 4 U.S. states and 5 MSAs across the Twelfth District.

Share the 2025 SBCS Survey

Available in both English and Spanish, the SBCS is open through November 14 and takes approximately 10-12 minutes to complete. Help us elevate the voices of small businesses in your community by taking the survey or sharing it with small businesses you know.

The views expressed here do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System.