As part of the Federal Reserve Bank of San Francisco’s work to understand how people are experiencing the economy, the Community Development & Analysis team have been analyzing homebuying trends in the Twelfth District and across the nation to understand how homebuying has shifted following the COVID-19 pandemic. Our recently released brief, “The Evolving Homebuying Landscape: An Update with 2023 Data,” assesses data from 2018 through 2023.

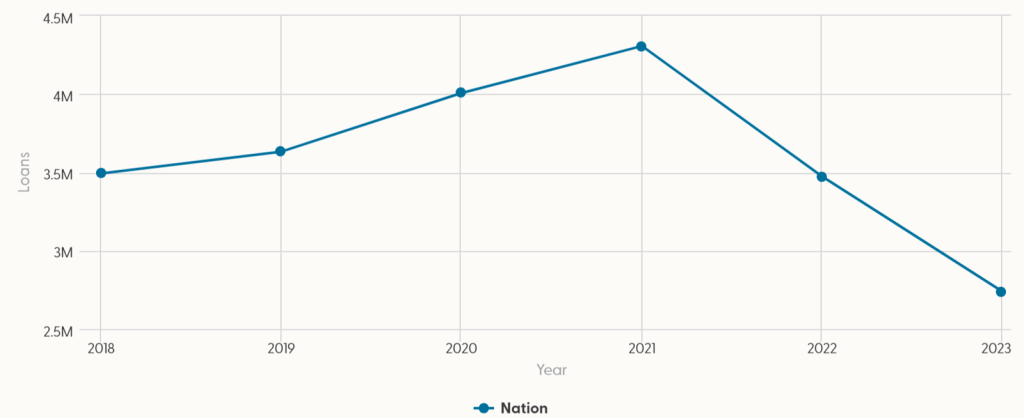

Our analysis finds that the homebuying market shrank significantly in 2023, with 21.1% fewer home purchase mortgage loans made compared to 2022 (nearly 734,000 fewer loans) (Figure 1). This brought loan volumes 21.6% below 2018 levels (nearly 752,900 fewer loans). The contraction extended to all geographic types and demographic groups analyzed and was felt across the nine states that make up the Twelfth District. The contraction was most severe among low- and moderate-income homebuyers, which declined 26.4% from 2022 to 2023.

Figure 1

Home Purchase Mortgage Loans, 2018-2023

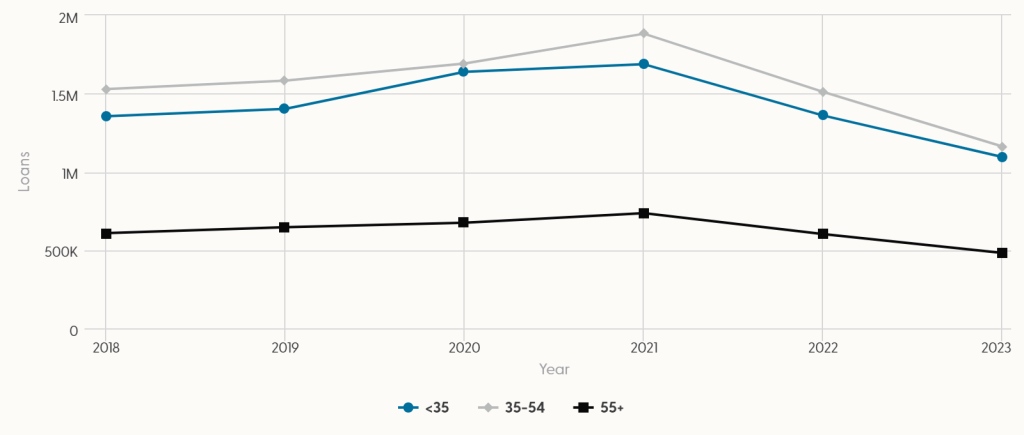

While declines in the number of home loans were experienced across geographies and by all demographic groups, there were some shifts in the trends in 2023. For example, relative to other types of places, the suburbs of large metro areas experienced the smallest declines in 2023 and they represented a larger share of loans than in 2022. Younger buyers, whose share of the market peaked in 2020, also recovered relative to other age groups (Figure 2). Whether these shifts represent more durable trends or temporary movements is yet to be seen.

Figure 2

Home Purchase Mortgage Loans by Age, 2018-2023

The views expressed here do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System.