After years of gloomy housing reports, we’ve been seeing some promising signs of a national housing market recovery. For example, from June 2012 to June 2013, U.S. home prices increased by 11.9 percent1 and the number of properties that received a foreclosure filing fell by 35 percent.2 However, these encouraging indicators mask the realities of what’s happening on the ground in low- and moderate-income (LMI) communities that were disproportionately affected by the housing crisis. Complicating matters is the unprecedented role of investors in the housing recovery and the changing nature of local housing markets.3 A new Community Development Research Brief, Housing Market Recovery in the 12th District: Implications for Low- and Moderate-Income Communities, presents data and analysis on the recent housing market recovery and its implications for LMI communities.

For example, consider what’s happening in LMI areas:

- In the third quarter of 2012, low- to mid-value homes (less than $200,000) had a negative equity share of 28.7 percent, almost twice that of borrowers with home values greater than $200,000, who had a negative equity share of 14.6 percent.4

- Negative equity is more likely to occur among households that are of color, younger, or have less than a high school degree.

- As of October 2011, investors had acquired 42 percent of all properties that went through foreclosure since 2007 in Oakland, California; of these investor acquisitions, 93 percent are located in low-income neighborhoods of the city. Additionally, only ten out of the top 30 most active investors are located in Oakland.

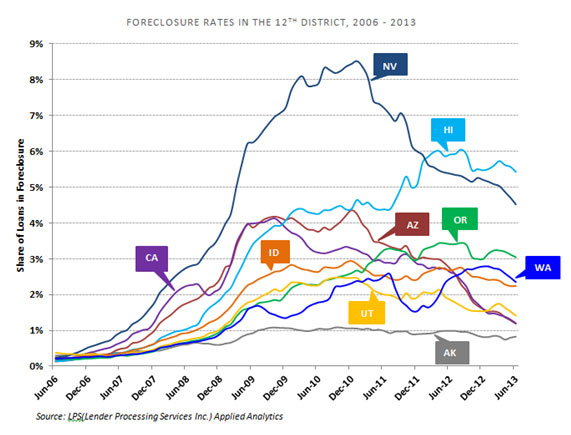

In addition, housing market trends vary dramatically by geography. For example, as shown below, foreclosure rates in the Fed’s 12th District follow very different patterns by state. Areas with sizeable distressed property inventory and high growth potential saw heavy investor activitiy, which raises questions about the potential impact on communities, particularly in areas such as Oakland, Phoenix and Las Vegas that have seen heavy investor purchases. Major concerns surround the ability and willingness of absentee owners to invest in and maintain properties, with LMI renters bearing the burden. All of this uncertainty creates particular challenges for LMI households and communities, which often lack the financial and political resources to mitigate risk and advocate for appropriate protections.

This is not to suggest that all investors are alike, or that any and all investor activity will be detrimental to communities. Investors differ in their skill, resources, and priorities, and there may be important opportunities for the community development field to partner with and learn from them. For example, many investors will be experimenting with scattered-site single-family rental property management (an issue which has posed numerous challenges for non-profit housing developers) creating opportunities for improvement and innovation. Similarly, direct partnerships may also form in an effort to support local communities.

Given the wide-range of housing recovery issues across the District, it is imperative that strong public policies play a role in promoting neighborhood stabilization and protecting LMI households and communities. For example, a number of cities have adopted rental registries to collect data on rental properties and owners, which allows for better code enforcement and improved property maintenance. The City of Oakland has implemented a foreclosed property registry to manage blight and monitor properties through various stages of delinquency. Other approaches, such as policies that promote land banking or community land trusts, can help sustain local property ownership. In addition, efforts such as the National Community Stabilization Trust’s First Look program allows municipalities and locally based housing providers to gain access to foreclosed and abandoned properties in targeted neighborhoods, without facing competition from investors, in a more streamlined and predictable manner that saves valuable time and resources. Just as each market is unique, the appropriate policy response will vary by community.

To learn more, read the latest Community Development Research Brief, Housing Market Recovery in the 12th District: Implications for Low- and Moderate-Income Communities.

1. CoreLogic. Home Price Index Report, June 2013.

2. RealtyTrac. National Real Estate Trends & Market Info, Market Summary, June 2013.

3. In February 2013, the Federal Reserve Board of Governors and the Federal Reserve Banks of Philadelphia and Cleveland hosted a conference entitled Renters, Homeowners & Investors: The Changing Profile of Communities.

4. CoreLogic, “Number of Residential Properties in Negative Equity Declines Again in Q3 2012.” January 17, 2013.

The views expressed here do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System.