The expression, “Location, location, location,” describing the three things that matter most when it comes to property, has been part of our culture for so long that no one seems to know where the phrase originated. Its truth was made evident during the foreclosure crisis, and it continues to be true even as housing market recovery takes hold across the country. The geographies that were hard-hit by the foreclosure crisis are now struggling with the rise of investor-owned single-family homes. This tenure shift from ownership to rental was most pronounced in those areas that experienced severe price depreciation and offered an abundant supply of distressed property. This trend of growing absentee ownership raises important community development questions around the issues of neighborhood stabilization, rental costs, property maintenance, and lost asset building opportunities for potential first-time homebuyers. To borrow another pithy saying, “When it rains, it pours.”

A new Research Brief, “The Rise of Single-Family Rentals in Arizona, California, and Nevada,” examines trends in rental housing composition in Arizona, California and Nevada and takes a closer look at local areas that have seen the fastest growth in single-family rentals. These include Phoenix and Tucson in Arizona; the SF Bay Area, Central Valley, and Southern California; and Las Vegas and Reno in Nevada. Let’s take a closer look at some of the data.

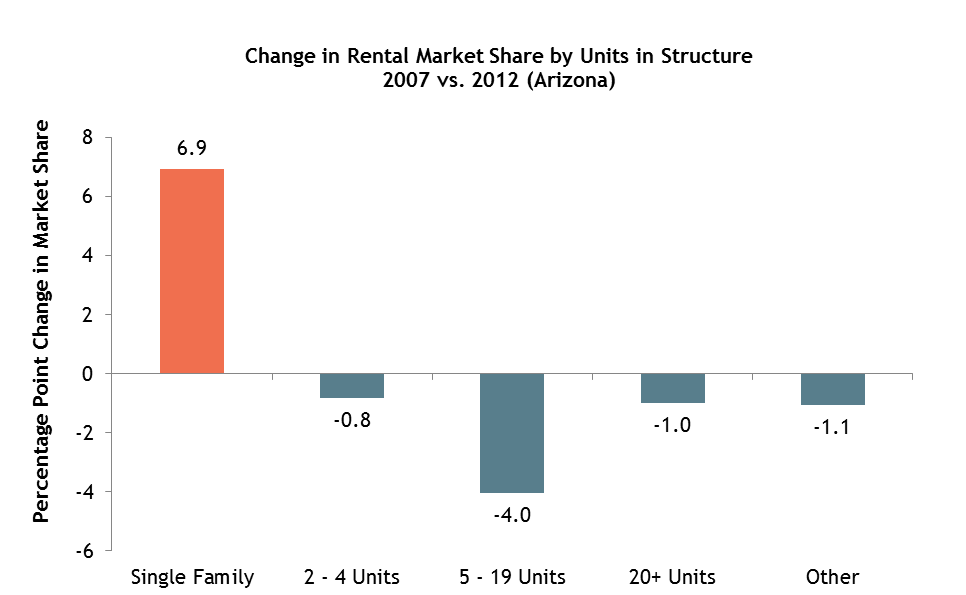

In Arizona, single-family units made up a growing share of the rental housing stock, from 36.9 percent in 2007 to 43.8 percent in 2012, a market share change of 6.9 percentage points. The shares of all other types of rental housing declined over this period, as seen below, with multi-family rentals with 5-19 units seeing the largest decline.

Note: Other includes mobile home, RV, boat, van, etc.

Source: American Community Survey, 1-year estimates

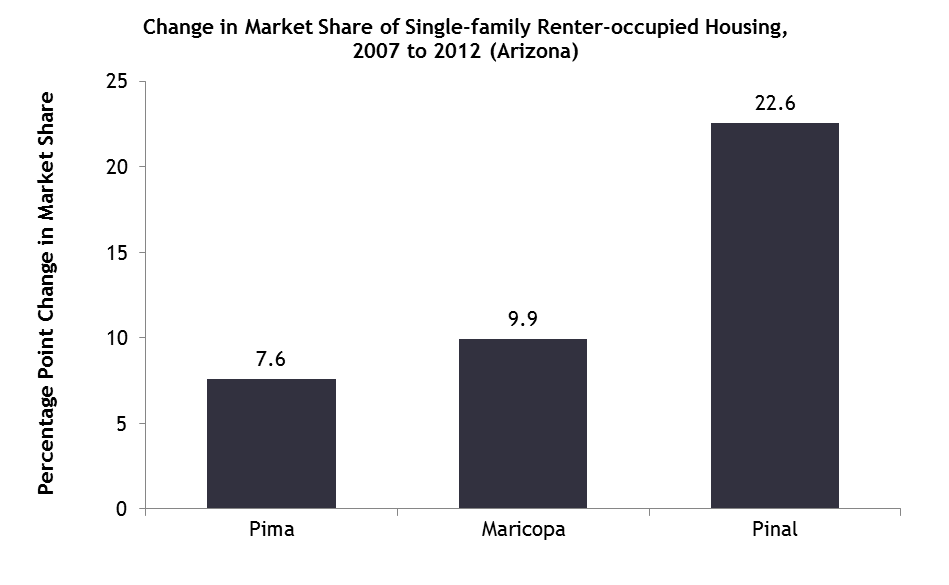

Pinal County is situated between Phoenix and Tucson and suburban growth from these major metros spilled over into the County during the housing boom. But Pinal also experienced the worst of the foreclosure crisis, which translated into an abundance of distressed properties, making the area attractive for investors. From 2007 to 2012, the market share of single-family rental housing increased 22.6 percentage points, which represented much faster growth than Pima or Maricopa Counties.

Source: American Community Survey, 3-year estimates

Source: American Community Survey, 3-year estimates

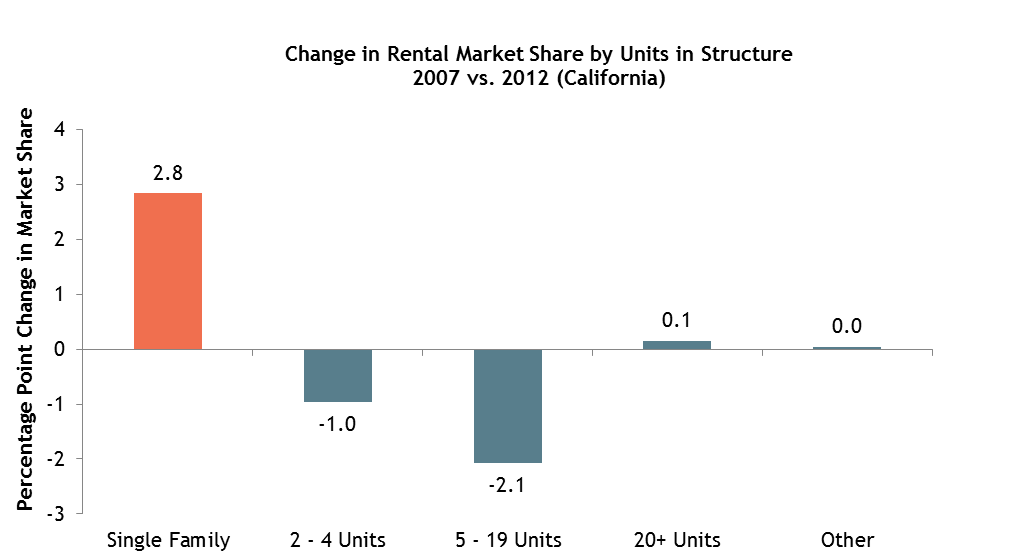

The data for California tell a similar story. Statewide, single-family homes made up a growing share of the rental housing stock, from 34.1 percent in 2007 to 37.0 percent in 2012, a change of 2.8 percentage points.

Note: Other includes mobile home, RV, boat, van, etc.

Source: American Community Survey, 1-year estimates

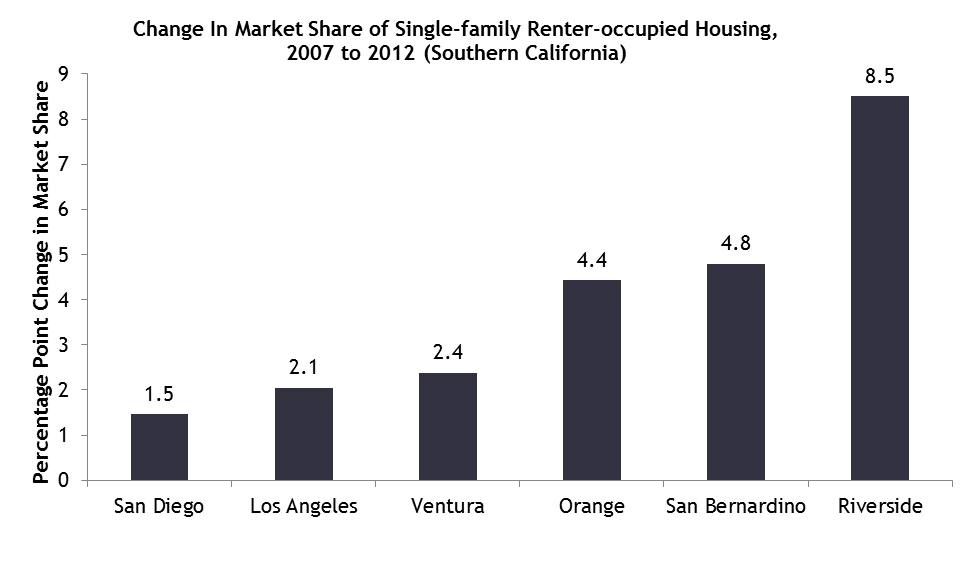

In the Southern California region, the Inland Empire, which was hard-hit by the foreclosure crisis, is also experiencing the fastest growth in single-family renter-occupied housing. Riverside County saw rapid population and housing growth during the boom, as many residents from Los Angeles and Orange Counties moved inland in search of more affordable homes. In the wake of the foreclosure crisis, Riverside is now leading the region with the largest market share growth of single-family renter-occupied housing.

Source: American Community Survey, 3-year estimates

These trends raise a number of ongoing questions: What are the implications of institutional versus individual investor activity on communities? How can a variety of entities, such as local governments, community-based organizations, and investors, partner to address growing single-family rental market share? To what extent are these trends disproportionately affecting LMI communities and communities of color? We hope this data will enrich the efforts of local practitioners and policymakers who are working to promote stable and equitable neighborhoods.

Read more in “The Rise of Single-Family Rentals in Arizona, California, and Nevada.”

The views expressed here do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System.