Companies across emerging markets issued a record $276 billion in U.S. dollar-denominated bonds in 2014 as they took advantage of low U.S. interest rates, and Asian corporates were no exception. Combined with the strengthening dollar, high levels of dollar-denominated debt increase risks to Asian banking asset quality, particularly when borrowers leave foreign exchange risk unhedged. Asia has made substantial progress building financial system resilience and foreign exchange reserves over the past two decades, but external debt still poses risks for many countries including India, Indonesia, and even China.

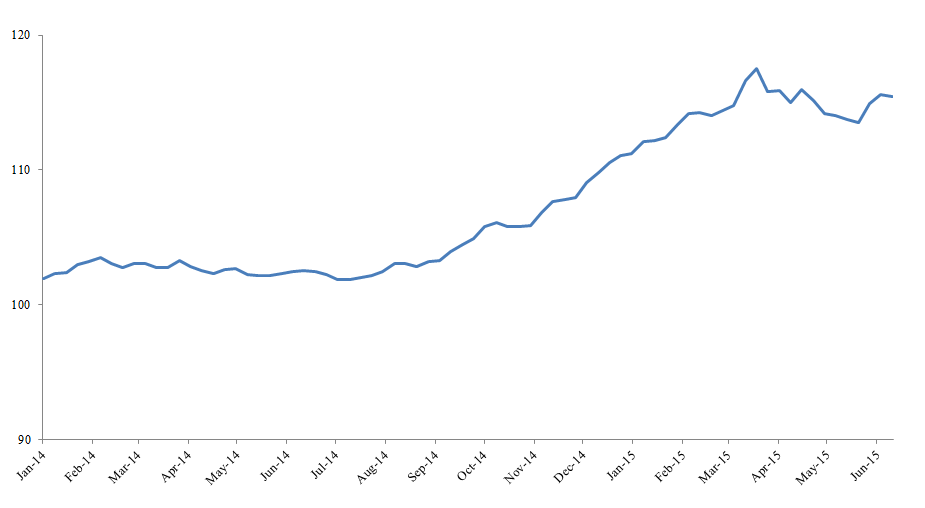

Strengthening Dollar Weighs on Overseas Borrowers

Trade Weighted U.S. Dollar Index (January 1997=100)

Source: Federal Reserve Bank of St. Louis

India has seen broad economic improvement over the past year with accelerating growth, slowing inflation, and bullish capital markets, but corporate borrowers face increasingly expensive payments on foreign-denominated debt as the Rupee has weakened against the dollar. This trend is exacerbated by many companies’ decision not to hedge sizable portions of their debt portfolio. Over 2014, Indian corporates borrowed nearly $20 billion overseas, bringing total outstanding foreign borrowings over $200 billion. According to multiple estimates, roughly 50 percent of that foreign-denominated Indian corporate debt is unhedged, including short-term debt. That puts roughly $100 billion in borrowings, equivalent to 5 percent of Indian GDP, at risk whenever the Rupee depreciates.

Other Asian economies face similar risks from external borrowing. China, the region’s largest economy, has seen its external debt rise with large inflows of so-called “hot money” to higher-yielding Mainland assets. UBS estimates that as of the end of 2014, Chinese companies had issued roughly $1 trillion in unhedged foreign debt—equivalent to over 10 percent of GDP—as part of this carry trade. While the Renminbi has a narrow trading band against the dollar, continued financial sector reform may involve further liberalization of the Renminbi and capital account, putting stress on foreign debt service. In Indonesia, private sector borrowing represented more than half of the country’s overall foreign borrowings (over $300 billion in total as of Q3 2014), while elsewhere in Southeast Asia, Malaysia also has high levels of external debt.

International lenders and investors bear the direct risk of any loss from dollar debt owed by Asian corporates, but financial stress from foreign debt can spread domestically as borrowers squeezed by higher foreign currency debt payments have difficulty repaying loans in their home countries, as happened during the Asian Financial Crisis of 1997-98. While many Asian corporates rely on existing exports—which benefit from depreciation through an increase in domestic earnings after conversion from foreign currency—as a natural hedge against rising foreign interest charges, non-exporting companies do not have such advantages embedded in their business models. Recent analysis from Morgan Stanley indicates large-cap Asian corporates hold 38 percent of their liabilities in foreign currency while generating 32 percent of EBITDA in foreign currency, with roughly 30 percent of borrowers unmatched in their U.S. dollar assets and liabilities. Just two years ago, Indian companies unhedged at rates roughly similar to current levels faced problems as the Rupee plunged after the “taper tantrum,” leading many to post mark-to-market losses despite the profitability of the core business.

These risks have led some regulators to consider measures to address unhedged foreign borrowing. Concerned about corporate balance sheets and potential spillovers to Indian banks’ asset quality already under pressure from several prior years of sluggish economic growth, the Reserve Bank of India (RBI) has reportedly considered more forceful action to get corporates to hedge, or at the very least increase the transparency of their foreign exposures, while RBI Governor Raghuram Rajan has called on Indian corporates to monitor this risk more closely. Meanwhile, Bank Indonesia is mandating hedging. Effective January 1, 2015, Indonesian corporates must now hedge a minimum of 20 percent of short-term foreign borrowing not covered by current foreign exchange assets, with the minimum set to rise to 25 percent by 2016. Imposing new hedging requirements can be difficult, however, given the frequent lack of reliable data on the true nature of some borrowers’ overseas debt.

Hedging foreign currency debt is particularly important for borrowers in economies that lack large foreign exchange reserves, limiting the potential support central banks could provide in the event of rapid currency depreciation. Broadly speaking, Asian central banks made substantial progress building foreign exchange reserves over the past two decades since the Asian Financial Crisis, but the 2013 “taper tantrum” reinforced Asia’s concerns over vulnerability to rapid capital flows. In India, the RBI has made a concerted effort to build reserves since 2013, and short-term external debt was 26.7 percent of reserves as of end-2014, an improvement from 30.1 percent six months prior. Indonesia’s short-term external debt exposures represent roughly 38 percent of reserves as of February 2015, while China’s short-term external debt represents under 16 percent of foreign exchange reserves, which remain the world’s largest. In each case, these central banks have sufficient reserves to cover external debt maturing over the next year, a measure the IMF deems the most important indicator of foreign currency reserve adequacy.

Entering the second half of 2015 amid a complex global monetary policy environment, foreign borrowing by Asian corporates warrants continued monitoring, particularly in economies with high levels of unhedged external debt, mismatched foreign currency debt payments and earnings, and declining levels of foreign exchange reserves.

The views expressed here do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System.