Sovereign wealth funds are special-purpose investment funds owned by a national government. Over the past decade, these funds have grown rapidly and now play an important role in the global financial system. This was particularly evident during the global financial crisis, when investment decisions by these funds had a large impact on global financial markets. The newfound prominence of sovereign wealth funds has led to calls for greater transparency and accountability and the establishment of best practice guidelines.

Asian sovereign wealth funds are primarily financed from foreign exchange reserves or are government pension funds. This differs from many of the world’s other large sovereign wealth funds, which are financed by the proceeds of natural resources. As a region, Asia accounts for 39% of total sovereign wealth fund assets. The large number of sovereign wealth funds financed by reserves in Asia is linked to the region’s rapid accumulation of foreign exchange reserves, driven, in part, by reaction to the Asian Financial Crisis, when many Asian countries depleted their reserves trying to maintain the strength of their currencies.

After the crisis subsided, many Asian countries deliberately increased their holdings of foreign exchange reserves to create a buffer in the event of a future crisis. The downside of holding large amounts of foreign exchange reserves is that they are typically invested in low-yielding assets such as government bonds, and fluctuations in exchange rates can produce “paper losses” on the value of reserves.

As a result, many Asian governments have created reserve investment funds in order to invest foreign exchange reserves into higher-yielding assets, such as equity and corporate bonds. For example, several Asian reserve investment funds have made large sum equity investments into public and private companies in the United States and Europe.

Asian sovereign wealth funds have been the subject of controversy both domestically and abroad. In their home countries, these funds are subject to high levels of scrutiny because they are viewed as the custodians of national resources. Corruption, losses, or even subpar returns typically attract negative media attention. When investing abroad, Asian sovereign wealth funds may fall under suspicion if their investments are seen as motivated by foreign policy objectives rather than economic considerations.

To allay these concerns, Asian funds have been active in establishing international guidelines for the conduct of sovereign wealth funds. The most well-known of these guidelines are the Santiago Principles. Created in 2008 through a joint effort between the International Working Group of Sovereign Wealth Funds (IWG-SWF) and the International Monetary Fund, the Santiago Principles offers 24 standards for fund conduct. These standards range from operational guidelines to disclosure and transparency. By adhering to these principles, sovereign wealth funds hope to persuade domestic critics that national assets are well-managed and foreign critics that investment decisions are based upon economic rather than political factors.

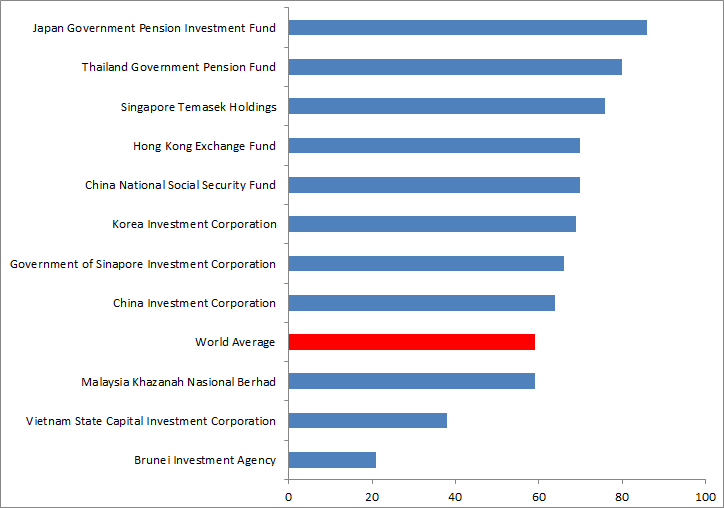

Many analysts have begun using the Santiago Principles, or modified version of these principles, as a benchmark to grade sovereign wealth funds. One of the more comprehensive rating methodologies is produced by the Peterson Institute for International Economics. Authors Truman and Bagnell periodically assess the transparency and accountability of major sovereign wealth funds and government pension funds according to 33 separate guidelines, 25 of which are from the Santiago Principles.

Transparency and Accountability of Asian Sovereign Wealth Funds

Source: Peterson Institute for International Economics

Compared to the global average for sovereign wealth funds and government pension funds, Asian funds perform well. Of the 10 largest funds, eight are above the global average. Only funds in Malaysia, Vietnam and Brunei perform below the average.

While Asian sovereign wealth funds broadly adhere to the Santiago Principles, there is still room for improvement with respect to transparency and accountability. Very few Asian sovereign wealth funds match Norway’s Oil Fund in terms of public disclosure of assets, returns, performance and the use of independent auditors. Progress on these issues will be essential to ensuring that these Asian sovereign wealth funds remain effective custodians of national resources.

A full report on this issue was published in Asia Focus. Please see The Rise of Asian Sovereign Wealth Funds.

The views expressed here do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System.