One of the functions of the Financial Sector Assessment Program (FSAP) is to issue a “report card” for an economy’s compliance with the Basel Core Principles for Effective Banking Supervision (BCP). Since the FSAP’s inception in 1999, many economies have undergone the assessment which is conducted jointly by the World Bank and the International Monetary Fund (IMF). The program was launched after the Asian Financial Crisis of 1997-8, and there are currently around 140 economies that have completed an FSAP assessment (many more than once.) Assessments are now mandatory for 29 jurisdictions with financial sectors that are deemed “systemically important”, i.e., those that have the greatest impact on global financial stability.

By way of background, the FSAP is administered jointly by the World Bank and IMF staff in developing and emerging market countries, and by the IMF alone in advanced economies. The program provides in-depth examination of a country’s financial sectors, and includes assessment of two components: financial stability and financial development. As part of the FSAP assessment, an FSAP team reviews compliance with BCP, which are based on the Basel Committee on Banking Supervision’s “Core Principles for Effective Banking Supervision” issued in 2006 and revised in 2012. There are 29 Basel Core Principles, which are a framework of minimum standards for effective supervisory practices and are considered universally applicable. The core principles focus on topics such as supervisory techniques and tools, risk management, corporate governance, capital adequacy, and financial reporting and auditing. Ratings are assigned to each of the 29 core principles; the ratings scheme is summarized below:

Ratings Scale for Compliance with Basel Core Principles

| Rating | Description |

|---|---|

| Compliant (C) | A “Compliant” assessment indicates that all essential criteria have been met without any significant deficiencies. |

| Largely Compliant (LC) | A “Largely Compliant” assessment indicates that only minor shortcomings are observed, and are not sufficient to raise serious doubts about the authority’s ability to achieve the objective of the core principle. |

| Materially Non-Compliant (MNC) | A “Materially Non-Compliant” assessment is given when there are severe shortcomings which raise doubt about the ability of regulators to achieve compliance, and clear evidence that supervision has not been effective. |

| Non-Compliant (NC) | A “Non-Compliant” assessment is assigned when no substantive progress toward compliance has been achieved. |

Source: Basel Committee on Banking Supervision. “Core Principles for Effective Banking Supervision.” September 2012.

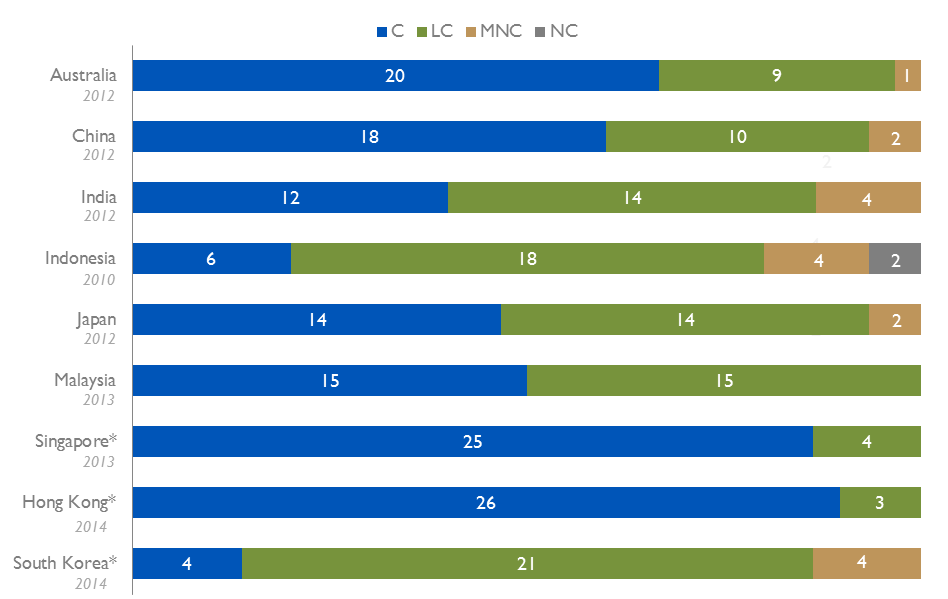

Major Asia-Pacific economies, including Australia, China, Hong Kong, India, Indonesia, Japan, Malaysia, Singapore, and South Korea, have gone through an FSAP assessment since the global financial crisis.

The figure below shows the breakdown of assessment ratings for these nine Asia-Pacific economies that have disclosed their BCP assessment results.

Assessment Ratings for Asia-Pacific Economies

Source: International Monetary Fund. “Supporting Document Country FSAPs.”

* Based on September 2012 revised BCP that included a different number of categories.

Overall, the Asia-Pacific economies received satisfactory assessments. Of the nine jurisdictions, Singapore, Malaysia, and Hong Kong received “Compliant” and “Largely Compliant” ratings in all assessed categories. In addition, Hong Kong and Singapore received “Compliant” ratings in the majority of assessed categories (26 and 25, respectively). The number of “Materially Non-Compliant” ratings ranged from one for Australia, to two for China and Japan, to four for India, Indonesia, and South Korea. In addition, Indonesia received two “Non-Compliant” ratings.

In summary, the FSAP includes an evaluation of a jurisdiction’s compliance with best banking supervisory practices. While arguably there could be some subjectivity involved in the assignment of ratings, the BCP review nonetheless serves as a good “report card” on the adequacy and effectiveness of each jurisdiction’s supervisory regime.

The views expressed here do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System.