Recently South Korea has experienced a dramatic increase in household debt, including mortgages, capped by two years of greater than 10% annual growth. After earlier attempts missed the mark, more recent regulations have been successful in limiting credit growth and letting some air out of the housing market—a sharp reversal from the relaxation of loan requirements in 2014 meant to gin up the market. Household loan quality is performing well as of yet, with total household loans classified as substandard or below (SBL), the key measure of asset quality in Korea, at a low level and falling in recent quarters. Still the parallel rise in home prices and household debt have left lingering fears that the country’s debt burden will be a drag on economic growth, and that a major fall in home prices could ultimately create asset quality issues for the country’s banks.

Credit Growth Continued after a Brief Lull

As discussed in an earlier blog post, Korean household credit was growing at an above-trend annual pace of 7.1% as of the first quarter of 2015. Growth was spurred by low interest rates and the easing of debt-to-income (DTI) and loan-to-value (LTV) ratio requirements put in place in 2014 to support the sluggish real estate market. Household debt as a share of GDP had reached 84% at that time, according to the Bank for International Settlements.

By 2015, the debt build-up had already caught the attention of the Financial Services Commission (FSC), which subsequently enacted a series of measures to control household debt. These measures included increasing the share of fixed rate and amortizing loans (as opposed to floating rate and bullet payments) among new and existing mortgages and shifting the focus of new loan approval from collateral value to repayment ability. The goal was to lower LTVs to 50% for newly issued non-residential mortgages issued by non-bank financial institutions.1 Mortgage growth briefly moderated in the quarters immediately after the new regulations.

But the slowdown in mortgage growth was short-lived. Growth rates for mortgages shot up again in 2016. Largely driven by the growing mortgage debt, overall household debt-to-GDP rose above 90% by the end of 2016 (see Figure 2).

Growth Rates by Credit Type

Household Debt-to-GDP (percent)

Note: Includes non-profit organization debt.

New Measures Bear Fruit

In order to rein in household credit growth, the FSC enacted new prudential measures to augment its 2015 efforts. In July 2016, the FSC began requiring financial institutions to monitor household income (instead of just collateral), perform debt service ratio assessments, and to make onsite inspection of projects associated with collective loans—issued to groups of individuals buying apartments not yet constructed. The 2016 actions also limited the role of the Korea Housing Finance Corp. and the Korea Housing and Urban Guarantee Corp.2 in buying and guaranteeing collective loans. Finally, the government tightened “monitoring and management” of mortgages from the non-banking sector and commercial property-backed loans by applying tighter screening standards and tightening the LTV ratio on commercial property loans.

This new round of measures proved to be more effective in curbing debt growth. Year-on-year mortgage and household credit growth started to slow in the first half of 2017. Mortgage growth hit its lowest rate in five quarters and drove total credit to its lowest growth rate in almost 2 years. Last month the government took its most aggressive stance yet by lowering the LTV and DTI ratios to 40% for newly issued loans in major cities susceptible to real estate speculation such as Seoul. There are also reports that the FSC will increase capital gains taxes on owners of multiple homes beginning in April 2018.

Risks are Real, but No Reason to Panic

The risks associated with rapid household credit growth appear manageable, largely thanks to the enactment of the most recent prudential measures. However, high household leverage and elevated real estate prices remain concerns.

Average residential property prices in Seoul have increased by 20% over the past four years, making it easy, but perhaps dangerous, to assume that the increase in household debt is justified by the increase in home prices. The fear is that a housing price overcorrection could have negative repercussions for the broader economy. The government’s recent measures on overheating in “bubble prone” areas such as Seoul and Busan appear aimed at halting the parallel rise in debt and real estate prices.

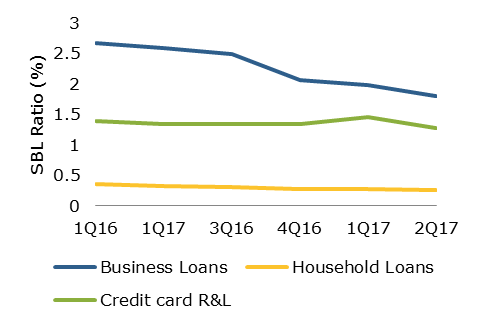

So far, household loans as an asset class have performed quite well. The number of household loans characterized as SBL has dropped by greater than 10% for each of the past four years. The SBL ratio for household loans was 0.26% in the second quarter of 2017, the lowest (by more than a percentage point) among all types of loans. Finally, household loans represent a small and shrinking proportion of banks SBLs (see Figure 3).

Household debt has performed well despite this intense growth at least in part because a majority of borrowers tend to have high income: those borrowing appear to be able to afford it. Government efforts to promote amortizing and fixed rate loans may have also insulated some households from recent increases in market rates. Also, as during our last review, household financial assets have grown along with liabilities and, at 45.3%, the liabilities-to-assets ratio is close to the 2010-15 average.

Household Substandard or Below Loans as a % of All SBLs

SBL Ratio By Loan Type

According to the Bank of Korea’s March 2017 Quarterly Bulletin, households’ ability to repay their debt remains good, despite the increase in debt. A chief risk, therefore, is that “vulnerable households” may have issues making payments if market interest rates continue to rise. This problem is presumably more acute for those who continue to hold floating rate debt after past efforts to alter loan structure. Any increase in debt payments or deterioration in household financial conditions might further crimp consumption, which represents 60% of GDP, but whose contribution to growth has fallen steadily as debt burdens rose.

The real estate market is also starting to cool down, which may dissuade new buyers from entering. Average national home prices fell from 3.5% in 2015 to 0.7% in 2016; the fall was steeper in Seoul and other metropolitan areas. The central bank attributes the shift to the measures implemented late last year. Major price drops, however, would be more worrisome since they could dissuade real estate investment, which grew 10.7% in 2016 and is one of the key growth drivers in the Korean economy.

South Korean policymakers are well aware that the increase in credit to households stems from the earlier decision to stimulate real estate markets with looser regulations. While initial measures to control the growth of debt and increase in real estate prices were not as effective, more recent moves to slow both trends by tightening standards have been promising. Still, while risks appear manageable, policymakers are not taking any chances and appear ready to intervene again should credit growth rebound, debt repayment capacity deteriorate, or bubble conditions persist.

1. A follow up to the 2015 measure specifically omitted group lending for apartment buyers. Group loans are loans provided to groups that buy apartments in unconstructed complexes.

2. Korea Housing Finance Corporation is a state run entity that supports government housing policy by providing loans to low and middle income families, providing loan guarantees, and securitizing its loans. Korea Housing & Urban Guarantee also helps implement government housing policy by providing housing guarantees, assistance with rental deposits, and assistance with completion of cooperative projects.

The views expressed here do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System.