Not long ago, Japan was at the cutting edge of digital payments. Japanese consumers could make payments by phone as early as 2001, a decade earlier than in the United States. Despite this early lead in payment technology, visitors to Japan today often note the remarkable persistence of cash. In this context, Japanese banks are launching digital currencies, while changes to regulation in China have made Japan a hub for bitcoin trading. These trends could renew Japan’s role as a leader in payments innovation.

Cash Remains Popular

In many ways, Japan was ahead of its time in the digitization of payments. Consumers could pay for train tickets using their phones in 2001, six years before the invention of the iPhone and more than a decade prior to the launch of mobile payment features on platforms like Apple and Android Pay. The Bank of Japan was even testing the use of virtual currencies in the 1990s. Still, as is often the case in Japan’s economy, world class research and development capabilities do not always translate into mass adoption and commercialization of new technology, and mobile payments never became ubiquitous. This may be in part due to Japan’s embrace of older, if reliable technology. A visitor might appreciate the country’s care in maintaining and expanding high-functioning transportation infrastructure like the shinkansen bullet train network, originally built over 50 years ago ahead of the 1964 Tokyo Olympics. The country even has a strong preference for music CDs amid a global decline in sales. In the same way, Japanese remain obsessed with cash, a time-tested form of monetary technology.

From a macroeconomic perspective, Japan is an extreme outlier in cash in circulation as a percentage of economic activity. Outstanding cash represents 19.4% of GDP as of 2015 according to data from the Bank for International Settlements, more than double the figure in the United States (7.2%) and five-times the United Kingdom’s (3.7%). Cash is still the payment method of choice for most Japanese consumers, with 70-80% of transactions by value occurring in cash form, compared to just 9% in the United States. Explanations for the persistence of cash vary, but a common theory centers on Japan’s low prevalence of crime, which makes cash holders feel more secure carrying large amounts of money. Japanese also tend to view debt with caution, limiting the frequent use of credit cards which might otherwise encourage digital payments.

Replacing Cash with e-Coins of the Realm

Japanese banks are aiming to boost the role of non-cash payments with the release of new digital currencies for goods and services. A consortium of Japanese banks including Mizuho Financial Group and Japan Post Bank has received approval from the Bank of Japan and Japan Financial Services Agency to launch J Coin, a digital currency for smartphone-based payment. Customers will exchange yen into J Coin on a one-to-one basis by using an app or QR code. In a separate venture, Mitsubishi UFJ Financial Group has announced its own plans to launch MUFG Coin, a similar digital currency. Meanwhile, the Bank of Japan has acknowledged it is considering the potential for a virtual yen currency in the future.

The banks hope that by tokenizing cash into a digital format backed one-to-one by yen they can convince customers of the safety and convenience of digital currency. Transactions using the coins would not incur any fee, unlike credit cards. The banks see a potential benefit in greater access to consumption data for customers that would otherwise use cash. The J Coin consortium estimates that its launch could save the economy roughly $100 million annually by reducing the costs of cash management.

The release of competing digital currencies raises several issues. Interoperability among J Coin and MUFG Coin would make it easier for businesses to accept all forms of payments. Conversely, the launch of a national virtual yen by the Bank of Japan could make such private coins redundant. Interoperability is key to even limited success of Japanese experiments with digital currency, as network effects are important to increase the usability of a payment form for consumers and retailers while minimizing transaction costs. The banks are notably forming their plans amid the Japanese launch of Alipay, the popular Chinese digital payments platform, though Alipay’s global strategy is focused on serving Chinese tourists traveling overseas.

Openness to Cryptocurrencies Could Make Japan a Hub as Chinese Trading Declines

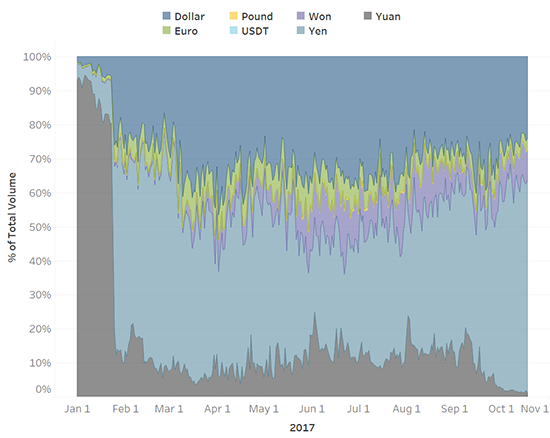

As Japan moves to adopt digital currencies that act like a virtual yen, the country is a growing hub of cryptocurrency activity. With bans of Initial Coin Offerings (ICOs) and exchanges in neighboring countries like China and South Korea, which had hosted significant cryptocurrency trading hubs, Japan has taken the lead as a bitcoin trading center, representing over 60% of trading in major currency pairs as of October 2017 (see Figure 1).

Though cryptocurrency trades are inherently decentralized given their foundation in distributed ledger technologies, trading hubs have still developed, as specialized third parties offer various services, from custody of private encryption keys to exchange into other currencies. Prior to 2017, China was the center of these bitcoin exchanges. It hosted the world’s largest miners and represented the bulk of usage and exchange trading. China’s role in cryptocurrency exchanges has declined dramatically over the past year, however. Regulators first mandated transaction fees on exchanges in January, and the increased transaction cost drove high-volume traders away. Most recently, Chinese authorities banned financial institutions from offering services to cryptocurrency market participants and also outlawed ICOs.

Trading migrated to Japan because of the country’s relatively advanced regulation of cryptocurrencies. After experiencing the first major cryptocurrency cyberattack when hackers stole $460 million in bitcoin from the Tokyo-based Mt Gox repository in 2014, Japan has established a formal legal and regulatory regime for the sector. In April 2017, the Japanese government recognized bitcoin as legal tender while also declaring cryptocurrency trading tax free. In September, the Japan Financial Services Agency (JFSA) officially approved 11 cryptocurrency exchanges. The JFSA will mandate a number of policies at the exchanges, including robust computer systems, segregation of customer accounts, and Know Your Customer anti-money laundering compliance. The JFSA has not indicated its plans with regard to Initial Coin Offerings, which have been banned in China and South Korea.

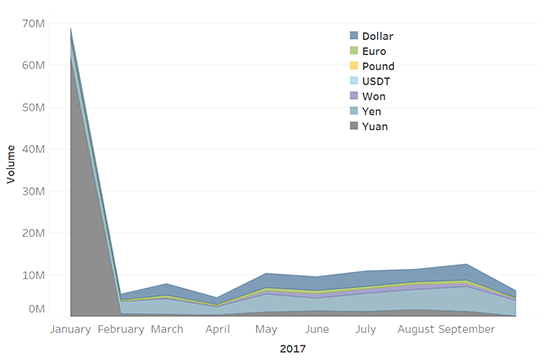

There could be even further growth potential on Japanese exchanges if trading demand continues to migrate from other markets. While Chinese exchange trading plummeted over 2017, the decline in global bitcoin trading volume on exchanges (see Figure 2) belies a likely shift in Chinese trading patterns. Though data on the location of cryptocurrency trading is difficult to track given the decentralized and anonymized nature of most trading, market analysts argue that this Chinese volume has not disappeared, but simply migrated to over-the-counter trades (OTC, i.e. off exchange). Indeed, data compiled by IFCERT, a Chinese think tank dedicated to internet finance security, shows a transition to OTC trades at the same time Chinese exchange volumes dropped in February 2017 (original Chinese-language report available here). This is consistent with the overall increase in worldwide bitcoin trading volume over 2017—one would have trouble explaining a dramatic rally in the price and usage of bitcoin if the large mining and trading customer base in China simply disappeared overnight. If Chinese regulators were to expand their crackdown on exchanges to OTC platforms, which provide many services common to formal exchanges (e.g. matching buyers and sellers and assuring payment before asset transfer), the migration to Japan could strengthen.

A Return to a Familiar Role

With traditional Japanese banks launching digital currencies and the government considering a national virtual currency while establishing a framework for cryptocurrency trading, Japan is entering a new era of digital payments innovation. Should restrictions on cryptocurrency trading in other jurisdictions expand, Japan’s growing crypto markets and legal framework could solidify its role as a hub for digital currencies, returning the country to a familiar role as a leader in digital payments innovations.

The views expressed here do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System.