China’s rapid credit growth has generated increasing concern over the past several years, with corporate debt traditionally being the main culprit. Recent regulatory action and debt restructurings have slowed the pace of corporate debt build-up, but new risks are emerging as Chinese households lever up. On the whole, continued increase in household credit is aligned with China’s efforts to rebalance its economy towards consumption, but the fast growth of the sector warrants close monitoring.

Corporate debt slows, but household debt picks up pace

China’s non-financial private sector debt climbed to 210 percent of GDP by mid-2017 driven largely by corporate debt. The sheer size of the debt and its extraordinary growth have drawn wide attention from investors and observers, including financial stability concerns articulated by the International Monetary Fund.

Corporate debt growth has decelerated in recent quarters, thanks to prudential measures implemented to slow the pace of credit extension and debt work-out programs to reduce bank exposure to risky corporates. Corporate debt growth moderated to 7.9 percent year-over-year in Q2 2017, compared to an average of 18 percent over the previous decade, and its share of GDP declined slightly to 163.4 percent from a peak of 166.8 percent reached in Q2 2016. The corporate sector’s debt servicing capacity is also showing signs of improvements as profitability recovered against the backdrop of stronger global demand.

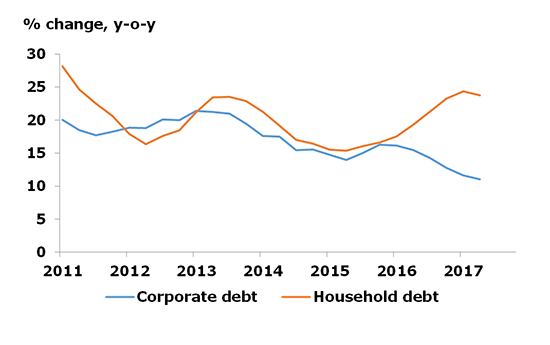

In sharp contrast, household debt growth accelerated after 2016, as shown in Figure 1. In the second quarter of 2017, Chinese households saw their borrowings increase by 23.8 percent y-o-y, propelling the total to 46.8 percent of GDP. As the largest contributor to the increase in global household debt over the past decade, China added $4.6 trillion in outstanding household credit after 2008.

Growth of China’s corporate and household debt

Structure and risks of household debt

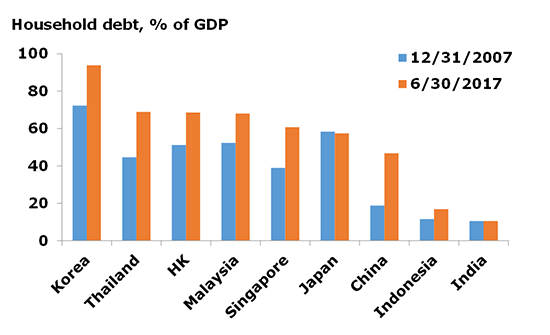

At an aggregate level, Chinese households are not excessively leveraged. As measured by GDP, China’s household debt is much less than other Asian economies such as South Korea, Thailand, and Malaysia (Figure 2). But economists are worried that the rapid growth of household debt will eventually add to financial system vulnerability.

Household debt in select Asian economies

Most of the new debt is mortgage lending as a renewed housing market boom since 2015 has made home buying less affordable. Despite having healthy savings, households have to assume larger mortgages as a result of higher prices, even after meeting higher down payment requirements.

The growth in consumer loans1 is even more significant, mirroring the consumption take-off. They now account for nearly one quarter of outstanding household loans, up from 8 percent a decade ago, according to CEIC data.

Risks associated with the rapid growth in household loans are obvious. The increase in residential mortgages mostly reflects the higher valuation of properties in recent years, but an abrupt correction of housing prices could lead to deterioration of the quality of mortgage loans extended to highly leveraged households. Still worse, consumer loans are often uncollateralized and have higher default rates than mortgage loans on average.

Nonbanks have changed the game for consumer loans

The emergence of consumer loans is a relatively new development in China. Due to the absence of a nationwide credit registry system for individual borrowers, banks are reluctant to extend uncollateralized consumer loans. Credit card issuers typically only grant credit to long-time bank customers with substantial funds in their savings accounts. But the rise of nonbank lenders has dramatically altered the sector and made it easier for average Chinese households to finance purchases of high value items.

Main nonbank players in this sector include consumer finance companies, auto finance companies, and online lenders (a loosely defined term that embraces all internet and mobile lending activities). All of them experienced significant growth in recent years, but online lenders have attracted the most media attention due to their disruptive business model.

The wide adoption of mobile devices has been a catalyst for the explosive growth of online consumer loans. Internet giants such as Alibaba and JD.com are able to leverage their successful e-commerce and online mutual fund platforms to attract investors and use big data to conduct due diligence on individual borrowers based on transaction history. Small peer-to-peer (P2P) lending platforms also saw rapid increases in the issuance of small-amount open-end loans that are used to finance day-to-day consumption. According to one estimate, online lenders originated a total of RMB 4.4 trillion (US$ 677 billion) of consumer loans in 2017, compared to only RMB 437 billion in the previous year, far exceeding the growth of other types of consumer finance products.

Online lenders are also actively securitizing their consumer loan portfolios. According to Reuters, the total issuance of consumer loan-backed securities in 2017 was RMB 489 billion (US$75 billion), up from RMB 99 billion in 2016. Alibaba’s Ant Financial alone accounted for 60 percent of consumer ABS origination in 2017.

Risks and regulatory tightening

The fast growth of consumer loans has raised new regulatory challenges. Consumer finance companies and auto finance companies are licensed and regulated by the China Banking Regulatory Commission (CBRC). Some online lenders have licenses to issue micro loans. But most online lenders, including P2P lending platforms, actually do not hold a license to lend.

Online consumer loans can be fraught with privacy and consumer protection issues. P2P lending platforms in particular became a burning issue after news media reported predatory lending behavior aimed at students and other financially vulnerable borrower groups. Moreover, the fragmented nature of the consumer lending sector makes it difficult for small online lenders to get a full picture of leverage that a borrower has already taken on, leading to higher default rates. According to one estimate by Guangfa Securities, 3-6 percent of P2P loans were nonperforming in 2016, compared to 1.2-2.7 percent for bank-originated consumer loans.

The ready availability of nonbank lenders also makes prudential measures targeted at banks less effective in controlling overall risks. For example, they provided a way around loan-to-value requirements by allowing households with insufficient savings to also finance the down payments, a business model that was subsequently banned by regulators.

Over the past year, financial regulators have launched multiple rounds of crackdowns on P2P lending platforms. As of end-2017, only 1,931 P2P lenders were still in normal operation, down from 2,448 a year ago. Most recently, the CBRC also tightened regulation on consumer finance companies and put a stop to the securitization of consumer loans, hoping to curb credit growth.

Outlook

Demand for household loans is solid and on track to grow further. Rising household leverage is an inherent consequence of the ongoing rebalancing of the Chinese economy. A more efficient, liberalized financial system will facilitate household borrowings. The authorities’ push to encourage domestic consumption will also support future growth of consumer loans.

At the moment, Chinese households have relatively healthy balance sheets. The household sector has abundant savings, and debt is still growing from a small base. The economy is expanding at a comfortable pace, and households anticipate their debt servicing capacity to stay stable over time. However, pockets of risks are emerging for highly leveraged households with relatively weak loan repayment capacity. The rapid growth of consumer loans in particular warrants close monitoring, and calls for more advanced, granular due diligence conducted by lenders. Financial regulators have taken actions in recent months to tighten regulation on both licensed and non-licensed lenders. Going forward, they will likely enforce more restrictions in view of potential risks accompanying the viral growth of consumer loans.

1. The PBoC classifies household loans into two categories: loans for consumption purposes and operational loans. The former category includes household mortgage loans and consumer loans.

The views expressed here do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System.