Foreign holding of onshore Chinese securities is expanding rapidly from a small base. Over the past 12 months, overseas investment in Chinese A-share stocks has gained momentum after the MSCI decided to add Chinese A-shares to the MSCI index family. This development will enhance the already growing interconnectedness between Chinese capital markets and the rest of the world.

Index Inclusion Adds to Foreign Funds Inflow

In June 2017, MSCI announced the partial inclusion of Chinese A-shares in various MSCI indices. The planned inclusion will take place in two phases on June 1 and September 1 of 2018. A-shares’ weighting in the MSCI emerging market index will grow from 0.39 percent to 0.78 percent during this period. Only five percent of China’s stock market capitalization, represented by some 230 large-cap companies, will be included.

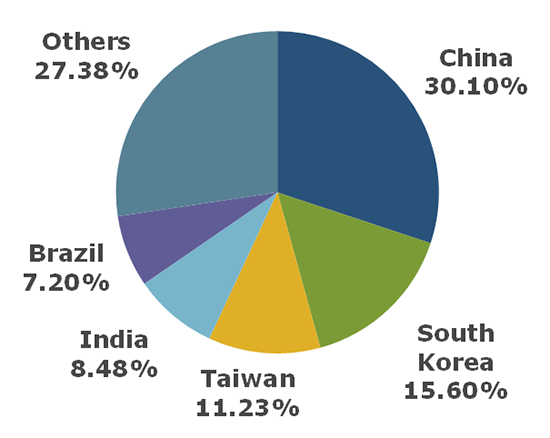

China already accounts for 30 percent of the MSCI emerging market index weight before the inclusion of onshore A-shares through earlier inclusion of overseas-listed shares and ADRs (Figure 1). In fact, seven of the top 10 MSCI emerging index constituents as of April 2018 are Chinese companies, including U.S.-listed technology giants Alibaba and Baidu.

Country Weighting of the MSCI Emerging Market Index (April 2018)

The partial inclusion is nevertheless a landmark event for China. The move will accelerate integration of China’s onshore markets into the global financial system and trigger considerable fund inflows. MSCI indices represent the performance of equity markets around the world. As of 2017, more than $1.9 trillion in global investments were benchmarked against the MSCI emerging markets indices. Because of the inclusion, cross-border portfolio investments in the Chinese stock markets will likely experience a steady increase in future months as passive investments track the industry and geographic allocation of the benchmark index. Historically, the initial inclusion of a country in MSCI indices has also resulted in more active investment by raising investor awareness in the newly included market. Analysts expect that China’s inclusion could bring between $200 billion and $500 billion in capital inflows in the next five to 10 years if China’s weighting continues to increase.

In a parallel move, Bloomberg recently announced the inclusion of renminbi-denominated onshore Chinese bonds to its Bloomberg Barclays Global Aggregate Index over a 20-month period starting in 2019. Two other major bond index providers, Citigroup and JPMorgan, are also reportedly weighing potential China inclusion in their flagship indices. Should China become part of all three major indices, the aggregate impact could be up to $250 billion investment in Chinese bonds in the next few years according to one estimate.

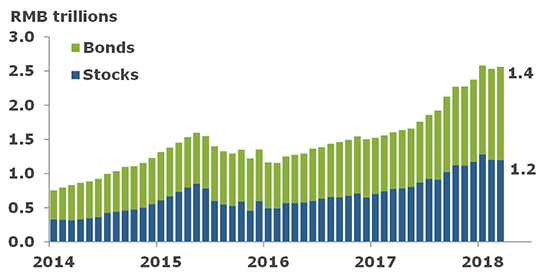

In anticipation that future fund flows will strengthen the Chinese capital markets, foreign investors have already started to increase their portfolio investments in China ahead of the actual inclusion. Foreign holdings of onshore Chinese stocks and bonds have increased by 55 and 64 percent, respectively, over the past twelve months, despite regional geopolitical tension and trade frictions. Total Chinese equities and bonds held by overseas investors reached RMB 2.6 trillion (US$394 billion) as of March 2018 (Figure 2), roughly 2 percent of total equity and bond market capitalizations.

Foreign Holdings of Onshore Chinese Securities

Financial Market Reform has Raised Global Investor Interest

The intensifying investor interest could be partially attributed to the strong performance of the renminbi in recent months. The renminbi strengthened by more than 7 percent against the U.S. dollar in the past twelve months, adding to the popularity of renminbi-denominated assets in the near term.

But policy factors have played a dominant role in attracting global investor interests in the long run. China’s gradual financial reforms were a crucial factor in the MSCI’s decision to include A-shares. In particular, the Shanghai and Shenzhen stock connect programs broadened overseas investors’ access to onshore Chinese securities and provided more flexibility for global investors compared to the Qualified Foreign Institutional Investor (QFII) and RMB Qualified Foreign Institutional Investors (RQFII) regimes that had previously been the sole source of access to onshore Chinese markets. Similarly, foreign investors now have better access to China’s onshore bond markets, after China opened up the market to public sector entities such as foreign central banks and sovereign wealth funds.

Investors generally anticipate that the continued opening up of the Chinese capital markets will lead to fund inflows in the years to come. Increased participation of foreign institutional investors with a long investment horizon will likely benefit the China’s capital markets by enhancing liquidity and market depth. Index inclusion and subsequent fund inflows will create a strong incentive for Chinese authorities to make further progress in financial reforms as China looks forward to playing a bigger role in the global financial system that is commensurate with the size of the Chinese economy.

China’s Growing Interconnectedness with the Rest of the World

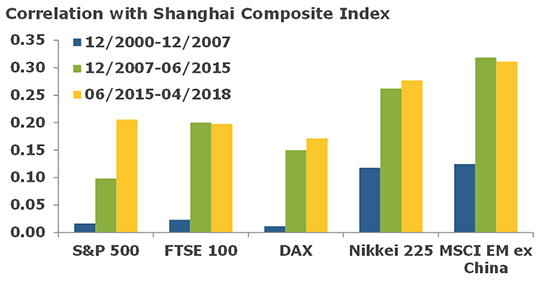

Correlations between Chinese and major global equity indices have risen in recent years, in part reflecting the growth in direct foreign exposures. An IMF study concluded that the correlation of broader Asian and Chinese stock markets had nearly doubled by 2015 from pre-crisis levels. A similar exercise reveals that the correlations of Chinese stock markets and other major international bourses have increased notably since the Global Financial Crisis (Figure 3).

China’s Correlation with Global Equity Markets is on the Rise

China’s higher interconnectedness with the rest of the world is unsurprising when considering the country’s importance as an integrated part of the global supply chain. Existing literature has well documented China’s potential spillovers to commodity exporters and neighboring economies, but only recently did disruptions in Chinese capital markets raise contagion concerns in major global financial markets, a sign that China’s financial linkages are also growing rapidly. Together with China’s recent measures to allow more foreign investor access to its domestic markets, index inclusions and rising foreign holdings of onshore Chinese securities will lead to a considerable deepening of financial linkages in the years to come.

The views expressed here do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System.