In last week’s Pacific Exchange blog, we examined foreign debts across Asia, with a keen eye to understanding how external indebtedness in Asia compares to obligations in Argentina and Turkey. This second installment highlights situations where current account deficits compound challenges associated with external liabilities, and examines Asian economies’ ability to pay obligations based on the size of their foreign exchange reserves.

Asia Generally Avoids the Current Account Deficits That Compound External Vulnerabilities

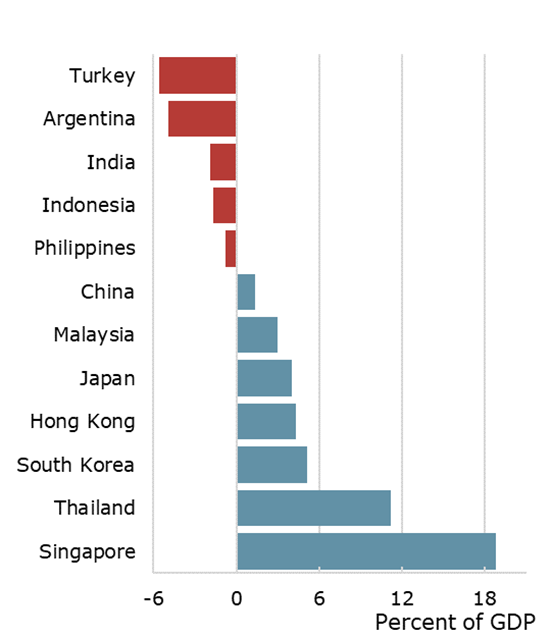

Current account deficits pose a compounding challenge for countries with large external debt stocks. Rising trade deficits cannibalize resources available to service a country’s external debt. Moreover, when borrowing is not deployed to productivity-boosting purposes, persistent deficits can lead to concerns over a country’s ability to pay off liabilities in the future. Large and rising current account deficits are key features of the current challenges facing Argentina and Turkey (Figure 1). By comparison, a few Asian deficit countries (the Philippines, Indonesia, and India) have smaller external imbalances, while the remaining balance of Asian economies generally run sizeable current account surpluses.

Current account deficits reached or exceeded 5 percent in Argentina and Turkey in 2017, and are expected to remain elevated in both countries over coming years. Argentina’s current account deficit rose to 4.9 percent of GDP in 2017, reflecting a strong rebound in domestic demand that pushed the trade balance from surplus to deficit. Similarly in Turkey, rapid import growth drove up the current account deficit to 5.6 percent of GDP in 2017.

2017 Current Account Balance

The few current account deficit economies in Asia carry much smaller imbalances by comparison. The Philippines, Indonesia, and India all recorded small current account deficits in 2017 (below 2 percent of GDP). The Philippines’ external balance moved into deficit in 2016 for the first time in over a decade, falling to 0.8 percent of GDP in 2017. The shift reflected a strong upswing in domestic investment that brought with it a surge in imports of capital goods, raw materials, and oil. Though the deficit is expected to increase modestly over the near term, the rise in imports related to infrastructure investment are ultimately likely to support gains in productivity and improve the country’s repayment capacity. Elsewhere, India’s current account balance widened notably in 2017, to 1.9 percent, due to strong demand for imports and rising oil prices, warranting further monitoring if recent increases in energy prices are sustained in the coming years. Indonesia, by contrast, was able to reduce its non-oil trade balance over recent years, sustaining ongoing improvements in the external balance and bringing its deficit down to 1.7 percent in 2017. The remaining Asian economies have historically run (often large) current account surpluses, allowing them to build buffers against external risks.

But Can They Pay? Foreign Currency Reserves Remain High Across Asia

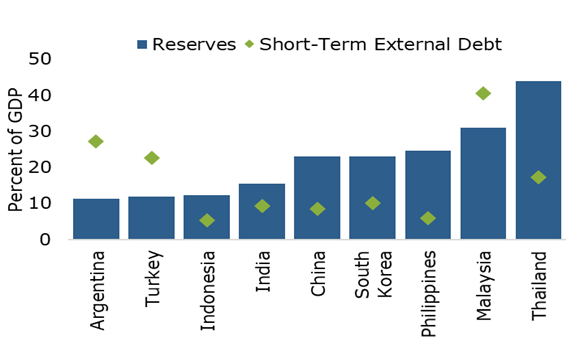

Capital outflows and concerns over Argentina and Turkey’s economies in 2018 have placed acute pressure on foreign exchange reserves. In times of crisis, countries can draw on these reserves to continue paying obligations if previously-available foreign funding has evaporated. In the context of external debt, a common approach to assessing the adequacy of a country’s foreign reserves is to benchmark them against total external debt due within the coming year.1 According to IMF data, Argentina, Turkey and Malaysia all had insufficient reserves to meet short-term external obligations. Argentina’s shortfall was most acute, with reserves equal to 11 percent of GDP, versus short-term debt rising to 27 percent of GDP—a reserves gap of roughly 16 percent. The reserves gap for both Turkey and Malaysia was closer to 10 percent of GDP.

Reserve adequacy appears more robust across the rest of Asia, with foreign exchange reserves comfortably exceeding short-term debt (Figure 2). Moreover, many have allowed their currencies to bear the brunt of adjustment—as opposed to spending down reserves to maintain a certain level of the exchange rate—while raising domestic policy rates to stem outflows. Economies like Hong Kong and China face more significant challenges because they actively manage the value of their currencies; current market volatility could prove a significant drain on their reserves. Of course, both economies retain substantial coffers of foreign reserves precisely for this purpose.

Reserves Adequacy

Managing External Debt for Sustainability

Our two-part analysis has shown that Asian economies generally appear less vulnerable than Argentina and Turkey in terms of external debt metrics. To start with, the size of their external debts is manageable. Moreover, most Asian economies have run large and persistent current account surpluses in prior years that help put money back in their coffers for rainy-day risks. Past structural reforms and solid fundamentals have made a material difference in improving resilience. In general, Asian economies appear well positioned to service and repay their foreign debt, thanks to a prolonged period of growth and abundant foreign exchange reserves.

With all that said, challenges could appear on the horizon if global growth slows, financial conditions tighten further, or global investors abruptly recede from risk. It is up to policymakers to soundly manage domestic policies, build and maintain buffers, and promote strong and sustainable domestic growth.

*All figures denoted as share of GDP are scaled to the country’s 2017 nominal GDP in U.S. dollars.

1. For more on the Greenspan-Guidotti rule, see the IMF’s research on capital adequacy. The IMF also assesses countries’ reserve adequacy along a number of dimensions. Interactive visualizations are available.

The views expressed here do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System.