Japanese households are well known for their preference for cash1, which represents the majority of their financial assets. On the surface, this seems like a rational choice in an economy experiencing persistent deflation. Moreover, an aversion to risk similarly appears rational in the wake of Japan’s traumatic equity and real estate market collapse in the late 1980s, from which the country still has not recovered. But dig a bit deeper, one can find that Japanese households were stockpiling cash well before the 1990s. This blog explores Japan’s preference for cash—how much households really hold and what researchers believe to be the main drivers. A better understanding of these dynamics might help policymakers design more appropriately targeted financial sector infrastructure and policies.

So, How Much Cash?

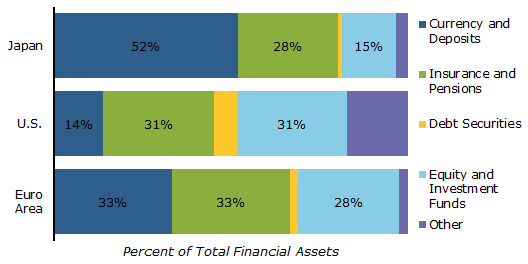

As of September 30, 2018, Japanese households had JPY 1,860 trillion (roughly USD 17 trillion) in total financial assets; over 50 percent was held in cash. Compared to other advanced economies, Japan’s financial assets skew heavily toward cash and are relatively shy on higher-risk assets. In the U.S. and Euro Area, for example, cash accounts for 14 percent and 33 percent of total financial assets, respectively (Figure 1).

Financial Assets Held by Households

What factors account for Japan’s obsession with cash? A good place to start is Japan’s economic history: decades of low or negative inflation, and a dramatic asset bubble collapse in the late 1980s, help explain why cash looks so attractive to Japanese investors.

Deflation and Market Crash Are Only Part of the Story

Indeed, some of the rationales behind Japan’s cash preference are self-evident. For one, Japan has experienced low or negative inflation for the vast majority of the past two and a half decades. During Japan’s infamous “Lost Decade” (1991 to 2001), the annual change in headline consumer prices averaged a meager 0.8 percent. Stagnant domestic prices continued to be a fact in the 21st century. Since 2001, annual inflation has averaged below 0.1 percent, with outright deflation in 10 of the last 17 years. A deflationary environment creates a strong incentive to hold cash, since the same amount of money is expected to buy more tomorrow than it can today.

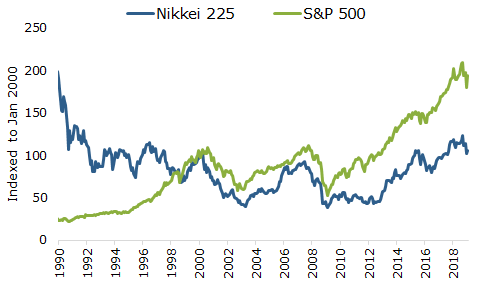

In addition, the late-80s real estate and equity market crashes continue to hold an important place in investor mentality. Following a peak in 1989, Japan’s benchmark equity index lost nearly half of its value in one year. The equity market stumbled over the following decades, stymied by domestic bank losses, the 1997-98 Asian Financial Crisis, and the 2007-08 Global Financial Crisis. Despite recent gains under Abenomics, Japanese equity indices remain roughly 50 percent below their historical high water mark (Figure 2).

Historical Equity Performance—Japan vs U.S.

Understandably, this anemic performance has deterred equity investors in Japan. Researchers have documented how personal experiences affect investment behavior—including, for example, an increase in risk aversion in the wake of economic or financial recessions. One body of research tracks a comparable phenomenon in the United States, when household savings climbed notably following the Great Depression.

Cultural and Structural Factors Also Play a Role

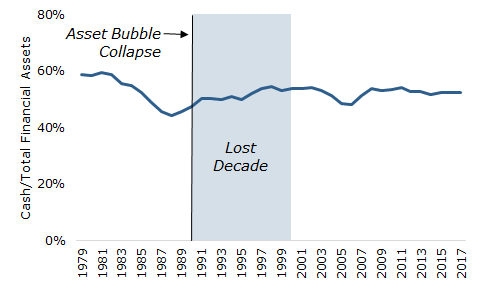

While these economic experiences undeniably play a role in Japan’s cash preference, they don’t tell the whole story. Official statistics show that household investments skewed heavily toward cash—even more so than in recent years—well before deflation or the market rout began—and in fact more so than in recent years (Figure 3). Of course, the factors responsible for Japan’s cash preference may have changed over time; deflation and memories of the market crash may have been the main drivers since the turn of the century, while other considerations dominated investment behavior prior to the 1990s. Therefore, it’s worth diving in further to understand some of the cultural and structural rationales and consider how they may be influencing investment behavior today.

Cash, Share of Total Household Financial Assets

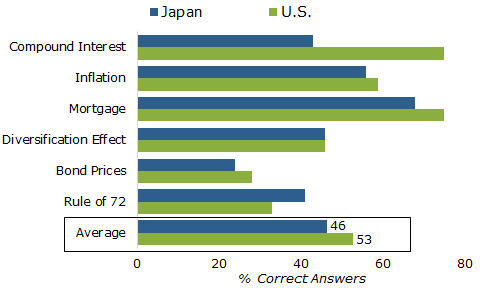

First, financial literacy may be a factor. In Japan, surveys suggest that financial literacy is lower compared to peers in other countries. For example, Japanese respondents scored an average of 7 percentage points lower on comparable questions in the most recent financial literacy survey than respondents in the United States, Germany, and the UK. Moreover, Japanese respondents’ results were lower across all subgroups of gender, age, and annual income compared to similar cohorts in the United States (Figure 4). Lower literacy could contribute to investors’ shyness towards riskier assets and preference for pooling savings in cash. Individuals with financial education generally have greater awareness of financial products, higher tolerance for near-term losses, and are more likely to own stocks. As a caveat, however, some reverse causality may be at play here: in a deflationary environment or an economy experiencing a prolonged market recession, there are fewer opportunities for individuals to acquire financial literacy through experience.

Financial Literacy Survey – Japan vs U.S.

Other drivers may have historical roots. In the years following World War II, the Japanese government tightly controlled domestic financial markets in pursuit of its reindustrialization goals. The government shaped regulations in a way that would drive up household savings and divert these savings into bank deposits. In turn, domestic banks would use these deposits as the basis for industrial reconstruction and investment loans. This bank-centric model helped Japan to channel financial resources into targeted domestic sectors and spur the rapid industrialization that unfolded over the following decades, but shackled household savings in bank deposits in the process.

Other research focused on the role of Japanese real estate investment offers an alternative explanation for the risk aversion. In Japan, a lack of liquidity in the real estate market related to low market values for existing homes, combined with an underdeveloped mortgage market, has led housing-related assets to behave more like high-risk investments. As a result, researchers posit that households overweight on cash in the financial portfolio to compensate for the lack of liquidity and safety in their real assets.

Government Policies are Pushing Households Away From Cash

Mobilizing this stock of household cash could bring important resources to the Japanese economy. For one, stronger household demand for equities would deepen the pool of funding available to Japanese corporates. At an individual level, diversifying away from cash and into higher-yielding investments earlier in life would move households toward greater financial sustainability in old age—a transition that’s exceedingly important as a steadily increasing share of Japan’s population heads toward retirement. Executing this transition will require targeted policies that respond to the factors cited above. In particular, key areas of focus will include policies that raise domestic inflation, improve financial literacy, amend housing policies and regulations to encourage more risk-taking in the financial portfolio, and catalyze shifts in cultural mentalities associated with investment.

Encouragingly, several policies are already in place that pursue these aims. In 2014, the government introduced Nippon Individual Savings Accounts (NISA), which offer individuals tax exemptions for higher-risk investments (i.e. listed shares, stock investment trusts, etc.). The program was designed to encourage individuals to prepare for the future via medium- to long-term asset accumulation, a particularly salient concern in Japan’s rapidly aging society. In addition, the government envisions the program serving as a conduit of capital for growth of promising domestic businesses. The latter point recalls the government’s post-war reindustrialization agenda, but shifts the focus to deepening capital markets rather than through the traditional channel of bank loans.

The government has also taken steps to understand and address financial literacy in Japan. In 2016, the Central Council for Financial Services Information (CCFSI, for which the Bank of Japan serves as secretariat) conducted Japan’s first large-scale survey to comprehensively gauge the current state of financial literacy among Japanese adults. The survey provided a basis to understand both different categories of financial literacy as well as how literacy varies with location, income, and age. Policies like these are an important part of transitioning Japanese households out of their heavy cash reliance. They will go a long way toward determining Japan’s success in undoing decades of entrenched investment preferences.

1. “Cash” encompasses domestic currency, transferable deposits, time and savings deposits, certificates of deposit, and foreign currency deposits.

The views expressed here do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System.