Thomas M. Mertens, vice president at the Federal Reserve Bank of San Francisco, stated his views on the current economy and the outlook as of July 17, 2025.

Economic activity in the United States has expanded at a moderately above-trend pace on a four quarter basis, and the labor market has remained solid. But risks have become elevated, and the outlook is mixed. Inflation remains slightly above the Fed’s 2% goal, and a near-term rise appears likely. Equity market indicators and measures of inflation compensation have reversed the movements that took place in April and May of this year following new tariff announcements. While equity market volatility has since receded, measures of policy uncertainty remain high. The federal funds futures market is projecting that monetary policy easing will begin later this year.

Labor market balanced while inflation is expected to rise over the next year

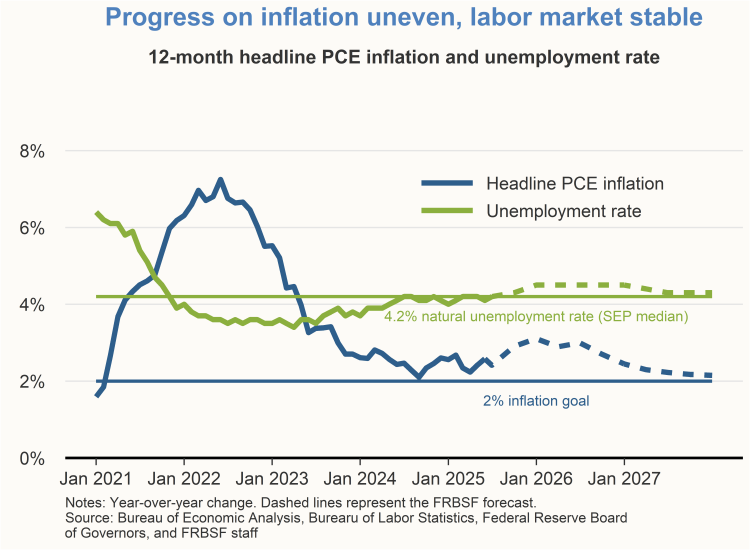

The Federal Reserve has a dual mandate to promote price stability and maximum sustainable employment. The 12-month headline PCE inflation rate, which is the Fed’s preferred measure of inflation, has declined substantially from the June 2022 peak of 7.2%. While downward progress has been uneven, the May 2025 inflation reading of 2.3% was only slightly elevated relative to the Fed’s 2% longer-run goal. However, inflation is expected to pick up somewhat later this year in response to changes in trade policy. Risks to the inflation outlook appear broadly balanced to the upside and the downside.

Labor market indicators continue to be solid. The unemployment rate has increased modestly from its low of 3.4% in April 2023 to 4.1% in June 2025. Since mid-2024, the unemployment rate has been close to the median estimate of the longer-run natural unemployment rate from the Federal Open Market Committee (FOMC)’s June 2025 Summary of Economic Projections (SEP).

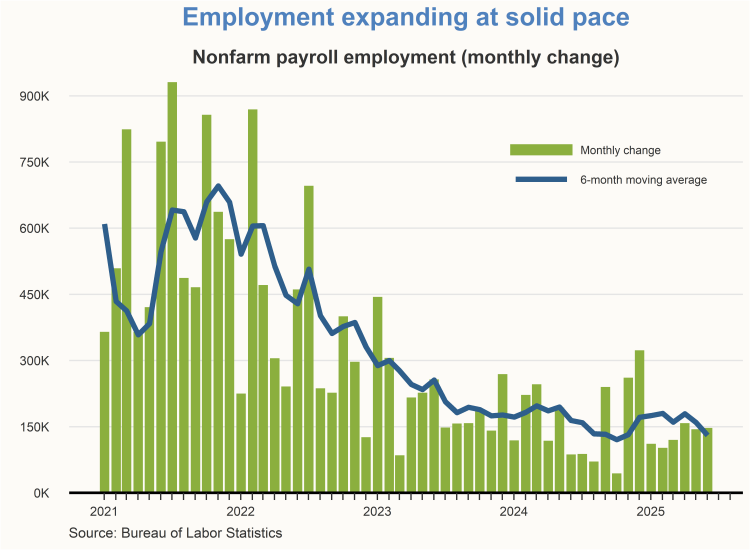

The view of a stable labor market is further supported by measures of job gains. Monthly employment gains have slowed from their post pandemic peaks but remain solid, averaging about 130,000 new jobs per month over the past six months.

Going forward, labor market indicators may soften somewhat. The unemployment rate is expected to edge up by the end of the year and return gradually to the natural unemployment rate thereafter. However, the risk of a more pronounced slowing of job gains with a sharper rise in unemployment remains.

Changes in market-based inflation expectations have largely reverted

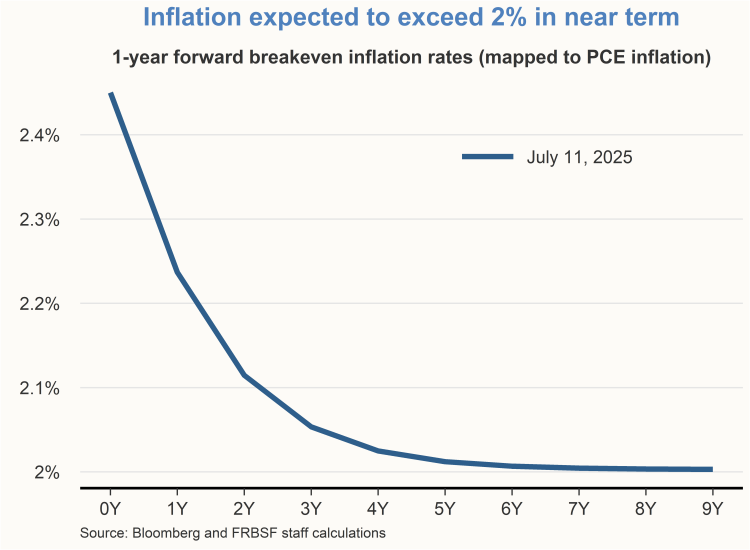

Market-based breakeven inflation rates predict that inflation will remain above 2% over the next year before returning gradually to the Fed’s 2% goal. Longer-term inflation expectations continue to appear well anchored.

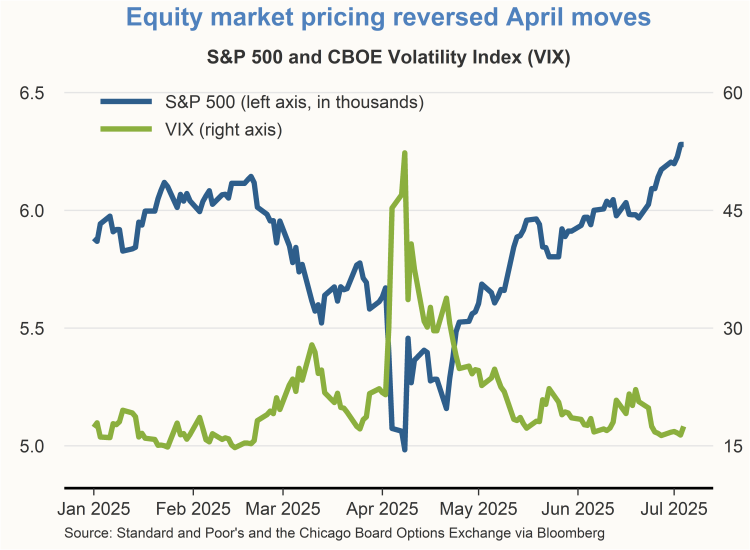

Equity market indicators have reversed the strong moves from early April 2025 when tariff announcements led to volatility in markets. The S&P 500 stock index currently stands near a record high and is up slightly from its level at the start of the year. Market pricing of uncertainty in equity markets, as measured by the Chicago Board Options Exchange Volatility Index, or VIX, has receded from its April high and is close to historically normal levels.

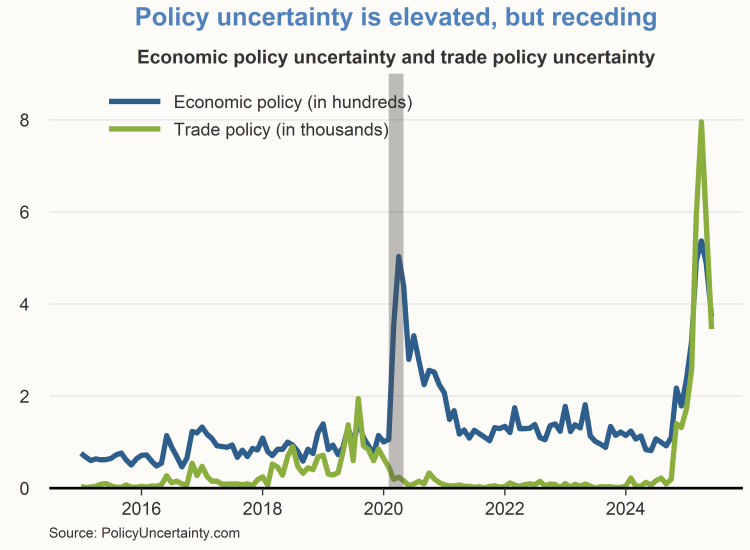

Measures of policy uncertainty are elevated, but receding

Uncertainty in equity markets, as implied by the VIX, is relatively muted. Measures of policy uncertainty have recently started to recede but remain unusually high. Economic policy uncertainty peaked in April 2025 at a level close to that observed in March 2020 at the onset of the pandemic. Trade policy uncertainty reached a record high in April, far exceeding the previous peaks recorded in 2018 and 2019.

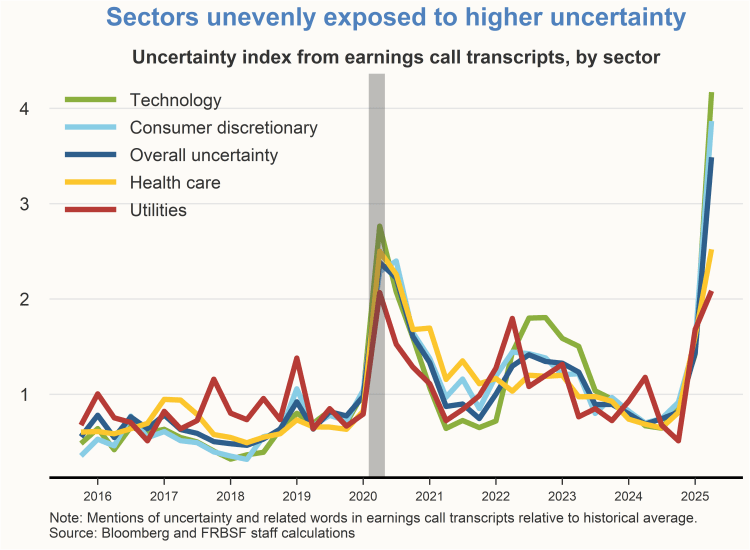

Businesses across different sectors share a general sentiment of elevated uncertainty but to varying degrees. An index based on the number of times the word “uncertainty” and other related words are mentioned during earnings calls increased substantially over the course of this year. The most recent index reading across all firms from the second quarter far exceeds previously observed levels. But not all businesses are equally affected by this sentiment: Uncertainty appears highest in the technology sector followed by the consumer discretionary sector. Both sectors have a high exposure to trade policy as well as overall economic conditions. The mention of “uncertainty” appears less often for utilities and health care, sectors which have less exposure to both tariffs and the business cycle.

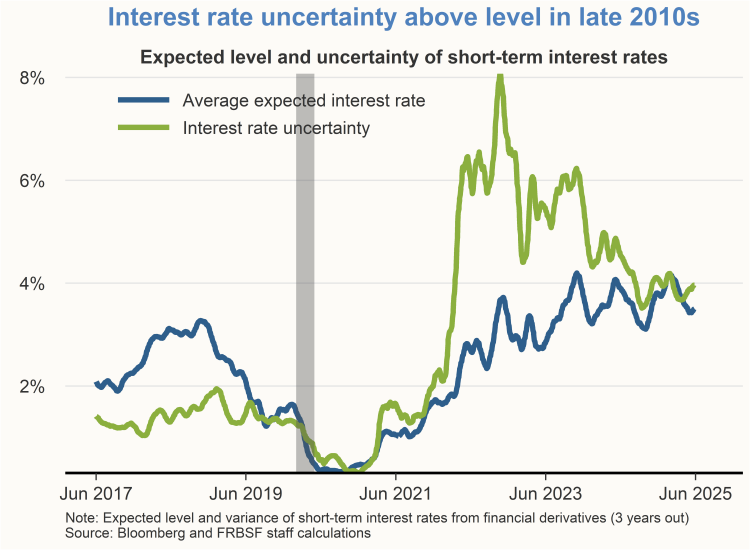

Monetary policy is uncertain but expected to ease

Within this environment of heightened economic policy uncertainty, the path of the federal funds rate continues to be difficult to forecast. According to interest rate derivatives, monetary policy uncertainty remains well above pre-pandemic levels but has receded from its peak in 2022 when the federal funds rate was rising rapidly.

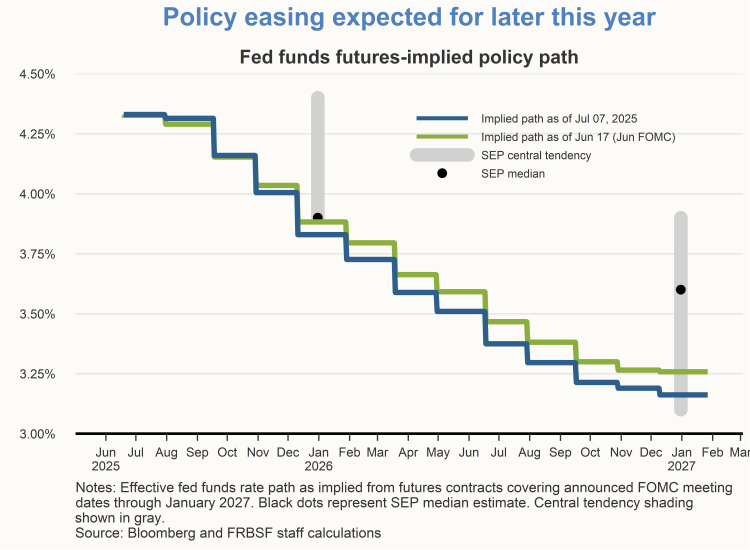

At the conclusion of its latest meeting on June 18, the FOMC maintained the target range for the federal funds rate at 4.25% to 4.50%. This decision marked the fourth consecutive meeting without a rate adjustment. The median projected path for the federal funds rate from the FOMC’s June SEP indicated two 25 basis point rate cuts by the end of 2025. At the time, the projected path from the federal funds futures market reflected a similar view for the policy rate at year-end. While the median SEP path projects one more rate cut in 2026, the market-implied path penciled in a steeper decline in the policy rate.

There is, however, a substantial amount of uncertainty around these projections. While eight FOMC members and the median estimate projected two rate cuts by the end of the year, seven members projected no change in the federal funds rate for the remainder of this year. The different projections are another indication of elevated policy uncertainty.

Charts were produced by Rohit Garimella.

The views expressed are those of the author with input from the Federal Reserve Bank of San Francisco forecasting staff. They are not intended to represent the views of others within the Bank or the Federal Reserve System. This publication is edited by Kevin J. Lansing, Karen Barnes, and Hamza Abdelrahman. SF FedViews appears eight times a year. Please send editorial comments to Research Library.