Recent surges in trade policy uncertainty highlight the fragility of global supply chains, prompting businesses to consider reshoring—moving production from abroad to domestic locations. Reshoring can be costly, creating incentives for businesses to automate. Evidence suggests that businesses facing heightened trade policy uncertainty in industries more exposed to international trade reshore more and automate more than those that are less exposed to trade. Automation appears to help mitigate the otherwise negative effects of trade policy uncertainty on production and labor productivity.

Following the end of World War II, countries signed a series of multilateral trade agreements designed to reduce trade barriers and increase global economic integration. These efforts led to steady increases in the share of imports and exports in global GDP over time. As a result, final products often use materials and components sourced from many different countries, creating complex global supply chain relations.

However, the COVID-19 pandemic highlighted important vulnerabilities in global supply chains. Disruptions in one market quickly spread to others, as firms had difficulties finding alternative sources for critical factors for production. Recent surges in trade policy uncertainty (TPU) have created additional risk for global production chains. These developments have led some businesses to reorganize production by reshoring manufacturing plants to their own country or by relocating them closer to domestic markets, accelerating the deglobalization that started after the Global Financial Crisis of 2008–2009.

Yet, reshoring comes with costs. Given lower labor costs in many foreign countries, it has often been cheaper for U.S. firms to offshore, moving labor-intensive production abroad. As firms consider reshoring production, they may turn toward automating some processes to contain the costs of domestic production.

In this Economic Letter, we consider the impact of TPU on firms’ decisions to reshore and automate production. Using industry-level data, we show that firms in industries more exposed to international trade respond to heightened TPU by shifting away from importing intermediate goods. In addition, they automate more by, for example, using more industrial robots. Given the macro-level evidence that trade uncertainty reduces investment and production (Caldara et al. 2020), our results thus suggest that automation may mitigate the effects for firms that are more dependent on international trade. As a consequence, those firms tend to experience smaller declines in production and labor productivity relative to other firms in industries that are less exposed to trade. However, the impact of TPU on employment is not that different across industries, likely because automation has both job-creating and job-displacing effects.

International trade since World War II

Following World War II, countries started to reduce trade barriers through a series of multilateral agreements. For instance, in 1947, 23 countries agreed to lower tariffs under the General Agreement on Tariffs and Trade. In 1992, the United States, Canada, and Mexico signed the North American Free Trade Agreement that gradually eliminated remaining tariffs between the three counties over time. In 2001, China joined the World Trade Organization, enabling the country to gain better access to the global market.

Fewer trade barriers combined with technological progress that reduced transportation costs led to a surge in international trade. Measured by the sum of exports and imports, total global trade volume increased from roughly 20% of world GDP in the early 1950s to about 60% by the end of the 2010s, as shown in Figure 1. The United States experienced a similar increase, though trade accounts for a smaller share of GDP. Many businesses took advantage of the reduction in trade barriers and shipping costs to offshore labor-intensive production processes to countries with lower labor costs. Goods production became more fragmented with different components produced in different parts of the world, creating increasingly sophisticated global supply chains.

Figure 1

Share of trade in GDP

However, Figure 1 also shows that global trade as a share of global GDP has stagnated since the Global Financial Crisis of 2008–2009, and the United States has experienced a similar stagnation in trade. In line with this evidence, the growth of U.S. trade in intermediate goods—a rough proxy for offshoring—has also declined.

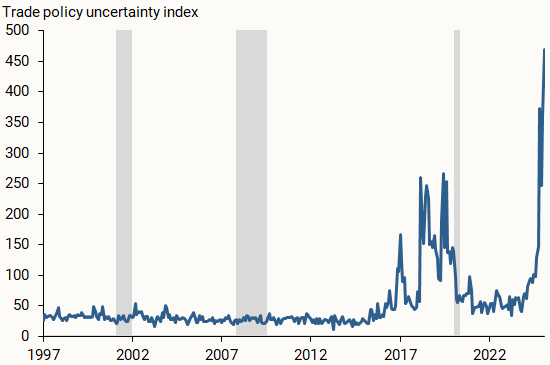

Several factors may have contributed to the stagnation of global trade after the financial crisis. Increased trade uncertainty stemming from changes in tariffs, shipping disruptions, or geopolitical risks is likely playing an increasingly important role. Figure 2 shows that a news-based measure of TPU increased notably during the years preceding the pandemic, a period with rising trade tensions between the United States and China. TPU surged to historically high levels in April 2025, following the U.S. announcements of new and reciprocal tariffs. This increasingly uncertain trade environment may prompt businesses to rethink their production networks and their reliance on offshoring and imported inputs.

Figure 2

Trade policy uncertainty

Reshoring and automation

Reshoring production is costly. To replace imported intermediate goods with domestically produced goods, a firm needs to find new domestic suppliers, which can be time-consuming. Furthermore, domestic production costs are likely higher than foreign production costs, especially for labor-intensive production processes that have been offshored to countries like China and Mexico, where labor costs are much lower than in the United States. However, given recent technological advances in robotics, machine learning, and artificial intelligence, firms may now be able to automate labor-intensive processes to keep production costs contained (Leduc and Liu 2024).

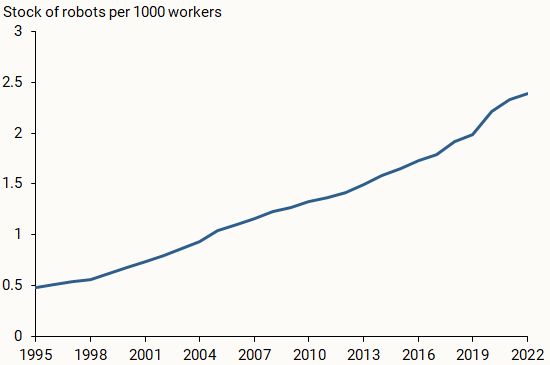

There are many ways to automate production, from computerization to the use of artificial intelligence and industrial robots. Improvements in automation technologies over the past several decades have steadily reduced the relative price of automation. Industrial robots, enhanced by recent advances in artificial intelligence, can now perform a wider array of tasks that could only be done by workers not long ago (Acemoglu et al. 2022). As a result, businesses have greater opportunities to automate. Reflecting this trend, the usage of industrial robots—that is, robot density, measured by the number of operational industrial robots per thousand workers—has steadily risen over the past 20 years (Figure 3).

Figure 3

Robot density in U.S. manufacturing

Given the rising automation trends, we examine how heightened TPU could affect firms’ reshoring and automation decisions. Specifically, we examine how TPU affects those decisions in industries that rely more on imported intermediate inputs relative to other industries. Intuitively, when trade uncertainty heightens, firms in sectors more dependent on trade would want to reduce their dependence on imported intermediate goods by using a greater share of domestic inputs. To contain the costs stemming from this reshoring process, those firms may also want to automate more, which could in turn improve productivity.

We examine these relationships by combining the measure of TPU in Figure 2 with data on imported intermediate inputs, employment, robots, and labor productivity by sectors, controlling for a host of factors that could potentially confound the relationship; see Firooz, Leduc, and Liu (2025) for more details about the underlying analysis.

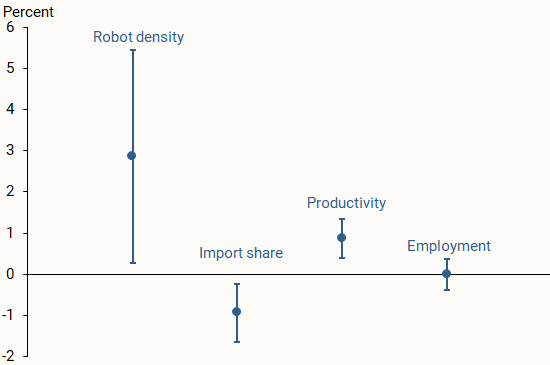

Figure 4 reports the estimated relationships of an industry’s robot density, imports of intermediate goods, productivity, and employment with the industry’s relative exposure to TPU. This exposure is determined by changes in TPU, combined with an industry’s initial exposure to trade measured by the share of imported intermediate goods in gross output at the start of our sample in 2004. The idea is that an industry that began with a greater share of imported intermediate goods would be more dependent on trade, thus firms in that industry are likely more sensitive to changes in TPU over time. Our industry-level data are available through 2022, so our sample includes the period of spikes in TPU in the late 2010s but not the most recent surges.

Figure 4

Effects of changes in trade policy uncertainty

In Figure 4, the dots denote the estimated relation between an industry’s outcome variables and its exposure to TPU, with the whisker bars indicating the 90% range of confidence around the point estimates. The figure shows that, following heightened TPU, industries that are more exposed to TPU experienced greater reductions in imported intermediate goods and larger increases in automation. Those industries also experienced a boost in productivity, partly reflecting the rise in automation. However, the estimated relationship between an industry’s employment and its exposure to TPU is close to zero, suggesting that the employment effects of TPU for firms in exposed industries are not much different from less-exposed industries. This is likely because automation leads to the elimination of some jobs and the creation of others (see, for example, Leduc and Liu 2024).

Caveats: Industry effects versus macro effects

Our evidence suggests that, when businesses consider reshoring in response to higher trade policy uncertainty, they also examine ways to automate production to contain cost increases. However, our findings capture relative changes across sectors and do not necessarily capture broader economic relationships that determine macro or aggregate outcomes. Existing studies have shown that an increase in TPU reduces aggregate investment and production (Caldara et al. 2020). Our findings suggest that automation could mitigate the negative effects on productivity for firms in industries that are more exposed to international trade, despite a reduction in aggregate productivity. Also, while we find that the mitigation effects for employment are not that different from those in industries that are less exposed to trade, changes in aggregate employment due to trade policy uncertainty may still occur. Finally, we stress that some of the estimates reported in Figure 4 are imprecise; this could be improved with additional data, including those during the recent episode of heightened uncertainty.

Conclusion

International trade environments have become more uncertain. Changes in trade policies, disruptions in shipping routes, and geopolitical risks are leading businesses to reconsider their global production chains. However, since reshoring is costly, businesses may turn to automation to reduce costs. This Economic Letter provides industry-level evidence that, when trade policy becomes more uncertain, firms in industries that are more exposed to international trade reshore production to a greater extent and automate more than those that are less exposed. This boosts labor productivity but results in little change in employment relative to firms in less exposed industries, likely because automation has both job-creating and job-displacing effects. Given the macro-level evidence that trade policy uncertainty reduces investment and production, our results suggest that automation may mitigate those negative effects for firms that are more dependent on international trade.

Looking ahead, the rapid improvements in new technologies such as generative artificial intelligence will likely broaden the ability of businesses to automate and thus facilitate reshoring if the trade environment becomes more uncertain.

References

Acemoglu, Daron, Gary W. Anderson, David N. Beede, Cathy Buffington, Eric E. Childress, Emin Dinlersoz, Lucia S. Foster, et al. 2022. “Automation and the Workforce: A Firm-Level View from the 2019 Annual Business Survey.” NBER Working Paper 30659, November.

Caldara, Dario, Matteo Iacoviello, Patrick Molligo, Andrea Prestipino, and Andrea Raffo. 2020. “The Economic Effects of Trade Policy Uncertainty.” Journal of Monetary Economics 109(C), pp. 38–59.

Faber, Marius. 2020. “Robots and Reshoring: Evidence from Mexican Labor Markets.” Journal of International Economics 127(103384).

Firooz, Hamid, Sylvain Leduc, and Zheng Liu. 2025. “Reshoring, Automation, and Labor Markets Under Trade Uncertainty.” Journal of International Economics 156(104091).

Leduc, Sylvain and Zheng Liu. 2024. “Automation, Bargaining Power, and Labor Market Fluctuations.” American Economic Journal: Macroeconomics 16(4), pp. 311-49. Available as FRB San Francisco Working Paper 2024-16.

Opinions expressed in FRBSF Economic Letter do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System. This publication is edited by Anita Todd and Karen Barnes. Permission to reprint portions of articles or whole articles must be obtained in writing. Please send editorial comments and requests for reprint permission to research.library@sf.frb.org