Banks may be indirectly exposed to trade policy through lending and through the broader effects of trade on the economy. Analysis finds that exposure to recent trade shocks was concentrated in large banks, including the six largest U.S. banks with strong ties to the global financial system. The cost of insuring large banks against default jumped following the April 2025 U.S. tariff announcement, indicating that investors perceived a higher risk of failure. This implies that future trade shocks could raise the risk of financial stress as assessed by market participants.

Financial markets dropped sharply following announced changes in U.S. trade policy in early 2025 but have since recovered. While the financial system remained resilient, the full impact of the trade policy on the economy remains uncertain, including the effects on cash flows and business performance.

Although banks have little direct exposure to trade, they may provide credit to borrowers who rely heavily on trade or have extensive supply chains in foreign countries affected by trade policy. Moreover, all borrowers are affected by changes in economic conditions resulting from trade policy. The banking sector is an important pillar in our economy—providing credit to businesses and households and serving as financial intermediaries in the financial system—and so the effects of trade policies on the safety and soundness of banks are relevant to both the overall economy and financial stability.

In this Economic Letter, I study banks’ exposure to trade policy through the lens of the financial market’s reaction in the days surrounding the April 2 tariff announcement. The returns on bank stocks around the time of the announcement can be used to measure the effects of the trade policy on banks. Because bank stock prices should encompass all available information about banks’ future cash flows, changes in bank stock prices around the announcement therefore capture banks’ overall exposure to trade policy and provide insights into effects on the larger financial system.

Event study methodology

The event study methodology has been widely used in financial research to examine the effects of unanticipated events on a firm’s value. Equity holders have claims on a firm’s future cash flows after all debt holders’ claims are fully paid. In an efficient capital market, stock prices fully reflect all available information that affects firms’ future cash flows instantaneously. Therefore, studying the changes in stock price, or stock returns, around a window bracketing the event after controlling for systematic market-wide movement measures the effects of the event on equity valuations. For example, Kwan and Mertens (2020) studied the effects of the onset of the COVID-19 pandemic on firm values.

In this Letter, I use the U.S. tariff announcement on April 2, 2025, as the unanticipated event to study the effects of a trade policy shock on the economy. I focus on the effects of the trade policy on banks because banks are major providers of credit and an important pillar of the financial system. While the stock market has rebounded and bank stocks have recovered since the tariff announcement, understanding banks’ exposure to trade can improve our understanding of the role of the banking system in the economy.

The historically large and widespread decline in stock prices following the April 2 tariff announcement affected all sectors of the economy. To examine how bank stocks performed relative to the rest of the market, I account for the systematic market reaction to the tariff announcement to reveal the bank-specific effects. Using daily stock returns over a one-year period before the announcement, I estimate the systematic co-movement of each bank’s stock with the Standard & Poor’s (S&P) 500 index, commonly referred to as the bank stock’s beta that measures its co-movement with the stock market. This systematic component captures both news about aggregate cash flows and changes in risk pricing. The abnormal stock return, that is, in excess of the expected return based on the stock’s beta, provides a market-based measure of the additional impact of an event on the bank beyond what would be expected from the broader market reaction. When the event window is longer than one trading day, I cumulate the abnormal returns over the event window to yield the cumulative abnormal return.

I divide the cumulative abnormal return by its standard deviation to yield the standardized cumulative abnormal return (SCAR), which is measured as a t-statistic as in MacKinlay (1997). By accounting for the systematic risk or co-movement with the market, the SCAR isolates the bank-specific shock from the broader stock market shock.

Financial firms and trade shock

To provide a broader context, I first compare the group performance of financial firms in response to the tariff announcement with that of nonfinancial firms. Figure 1 shows the SCARs for each of the 11 sectors in the S&P 500 from April 2 to April 4, computed by value-weighting firms in each sector according to their share of market capitalization. While equity valuations declined for all sectors, the tariff announcement had significantly different sector-specific effects for each (see Garimella, Kwan, and Mertens 2025). Specifically, firms in the financial sector (red bar) had the second-worst abnormal stock return, which was both statistically significant and economically large.

Figure 1

Abnormal stock returns among S&P 500 sectors

Source: Author’s calculations using stock price data from Bloomberg.

The large negative abnormal stock return indicates a decline in financial firms’ market valuation beyond their expected co-movement with the stock market. This suggests lower perceived profitability in response to the trade shock, and hence less capital accumulation going forward to defend against future shocks, increasing the risk to financial stability.

Banks’ exposure to trade shock

Using the event study methodology, I compute the two-day standardized cumulative abnormal stock return for each of the 265 publicly traded banking organizations during the time around the tariff announcement. Out of more than 4,000 banks in the United States, 265 banks are publicly traded and are disproportionately large, together controlling 87% of all assets in the U.S. banking system.

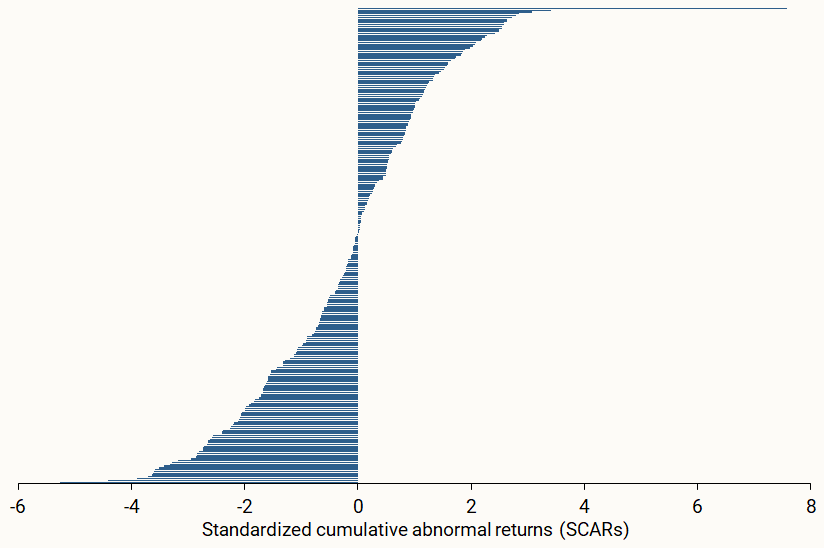

Figure 2 shows the abnormal stock returns in descending order for each publicly traded bank. Out of the 265 publicly traded banks, 126 have positive abnormal stock returns and 139 have negative abnormal stock returns. In addition to more banks having negative abnormal returns than positive abnormal returns, the distribution of the abnormal returns is skewed towards negative returns. Thus, on balance, market participants perceived the trade shock as having significantly negative effects on bank valuation, beyond the systematic effect of the broader market.

Figure 2

Distribution of abnormal stock returns for U.S. banks

Source: Author’s calculations using stock price data from Bloomberg.

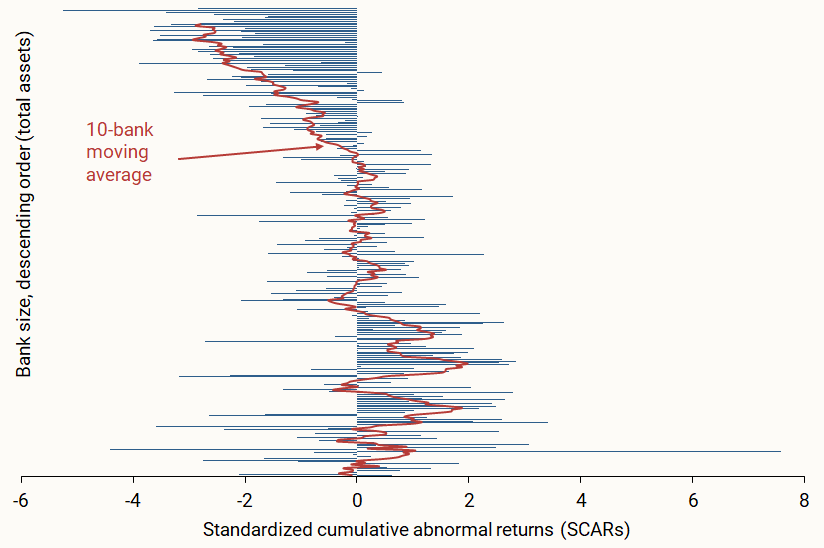

To delve deeper into banks’ exposure to the trade shock, Figure 3 shows the bank-level abnormal stock returns ordered by bank size, which is measured by total assets with the largest publicly traded bank at the top and the smallest at the bottom. The red line smooths the variation for individual banks using a 10-bank moving average across the distribution. Figure 3 shows that the abnormal stock return is negatively related to bank size. Large banks tend to be more exposed to the trade shock than smaller banks. This may reflect that borrowers that are dependent on trade tend to be larger firms, and larger firms are more likely to obtain credit from larger banks. Moreover, larger banks are more likely to have a broader international footprint to serve their international borrowers, and international borrowers are more likely to have bigger trade exposure (Kwan et al. 2024).

Figure 3

U.S. bank exposure to trade shocks by bank size

Source: Author’s calculations using stock price data from Bloomberg.

Implications for financial stability

The negative abnormal stock returns among large banks depicted in Figure 3 suggest that large banks are vulnerable to the trade shock. The six largest banks in the United States are identified as global systemically important banks (G-SIBs) by the Financial Stability Board and the Basel Committee on Banking Supervision. This designation means that they are so large and interconnected with the rest of the financial system that their failure could threaten the stability of the global financial system. Below the handful of G-SIB banks are dozens of other large banks and regional banks that are systemically important enough to warrant special supervisory attention, such as being subject to the annual stress test exercise conducted by the Federal Reserve. The clustering of large negative abnormal stock returns among very large banks suggests that disruptions to trade may give rise to financial stability concerns stemming from the safety and soundness of the banking system.

To gauge the likelihood of increased financial stability risk from large banks’ exposure to the recent trade shock, I gathered data from the credit default swaps (CDS) market for large banks whose outstanding debt obligations are large enough that they can be protected against default using CDS contracts. A CDS is a financial contract that pays off in the event of a default and thus reflects market-based assessments of the likelihood of failure. The price of the default protection in a CDS contract is expressed in basis points (hundredths of a percentage point), referred to as the CDS spread that a buyer pays to a seller for protection against a borrower’s default on their debt. Larger CDS spreads signal that the market perceives a higher probability of default for that borrower.

Before the tariff announcement in April, the average CDS spread for the G-SIB banks was about 50 basis points. Figure 4 shows the two-day change in CDS spreads between April 2 and April 4 for large banks that have CDS contracts outstanding, ordered by bank size. For the six U.S. G-SIB banks, the jump in CDS spreads in response to the trade shock ranged from 16 to 21 basis points. This translates to about a 30 to 40% increase in the insurance premium against default. Market participants clearly raised their assessment of default probability by G-SIBs, indicating higher financial fragility, although the risk of failure is still relatively small in absolute terms.

Figure 4

Changes in bank CDS spreads from April 2 to April 4, 2025

Source: Bloomberg.

Conclusions

Using event study methodology, this Economic Letter examines banks’ exposure to potential disruptions to trade and the implications for overall financial stability. Based on the April 2025 tariff announcement event, banks were adversely affected by the change in trade policy, beyond the systematic effects on the broader economy. The negative effect of the trade shock was concentrated in large banks, including the six G-SIB banks in the United States. In response to the tariff announcement, market participants raised the cost of insuring against large banks defaulting on their debt obligations, indicating that large banks’ probability of failure had risen. To the extent that large banks are systemically important, these findings imply that a significant disruption to trade could increase the risk of financial stress.

References

Garimella, Rohit, Simon Kwan, and Thomas M. Mertens. 2025. “Market Reactions to Tariff Announcements.” FRBSF Economic Letter 2025-23 (October 6).

Kwan, Simon H., Kelvin Ho, Cho-hoi Hui, and Eric T.C. Wong. 2024. “The International Transmission of Shocks through the Lens of Foreign Banks in Hong Kong.” Journal of International Money and Finance 142(103027, April), pp. 1–14.

Kwan, Simon H., and Thomas M. Mertens. 2020. “Market Assessment of COVID-19.” FRBSF Economic Letter 2020-14 (May 28).

MacKinlay, A. Craig. 1997. “Event Studies in Economics and Finance.” Journal of Economic Literature 35(1), pp. 13–39.

Opinions expressed in FRBSF Economic Letter do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System. This publication is edited by Anita Todd and Karen Barnes. Permission to reprint portions of articles or whole articles must be obtained in writing. Please send editorial comments and requests for reprint permission to research.library@sf.frb.org