The United States announced new, higher tariff rates this year. Tariffs can affect supply chains, investment, and firms’ input costs, resulting in supply-side effects such as higher inflation and higher unemployment. However, tariffs can also affect spending, the demand side of the economy. Weaker demand translates to higher unemployment but lower inflation. Estimates using 40 years of international data show that, following a change in tariffs, initially the unemployment rate increases and inflation declines. Over time, however, the unemployment rate returns to normal levels while inflation increases.

The United States has pursued a wide range of import tariffs against its trading partners since the beginning of the year. Considerable uncertainty remains about their implementation and overall impact on the economy. How tariffs end up impacting the economy will depend on how households, businesses, and trade partners respond going forward.

Assessing the varied effects of tariffs and their evolution over time is complicated. In this Economic Letter we rely on an empirical analysis of historical data for a group of advanced economies. We estimate the effects of changes in tariff rates on domestic unemployment and inflation rates by relying on the average historical experience observed across these countries when tariffs were modified. Our results depend on how well we can isolate the effect of tariffs from other explanatory factors. Moreover, because the new U.S. tariff rates far exceed what we observe historically, we interpret the evidence with caution.

Our results suggest that, immediately following an increase in tariff rates, the unemployment rate tends to increase, and inflation tends to fall. This pattern suggests that, at first, the effects of tariffs more closely resemble a negative demand shock—that is, consumers and businesses pull back their spending, which slows economic activity and also slows down inflation. Over time, however, economic activity picks up and inflation increases to a higher rate than would have been the case without the tariff increase.

Challenges in assessing tariff impacts

Why is it so hard to determine the impact of tariffs on the economy?

They increase the price of imported goods, but as long as the new tariff rate remains constant, consumers might expect a one-time level effect on prices and, hence, temporarily higher inflation. However, economies are dynamic and respond to changes in their environment over time. For example, businesses that import tariffed intermediate goods may consider reorienting their supply chains. They may also choose to pass only a portion of the increased cost of inputs to consumers. That is, they may be willing to reduce their profit margins to keep the price of final goods relatively unchanged. Similarly, decisions by firms on where and how much to invest will depend on perceptions of trade policy over the coming years.

Add to this scenario the response of consumers themselves. When faced with higher prices for some goods, they may adjust their purchase choices or simply tighten their belts and reduce spending. Any of these responses by businesses and consumers will depend on how permanent or transitory tariffs are perceived to be, possible retaliation by trading partners that may affect exporting industries, and general uncertainty associated with subsequent trade agreements, legal decisions, and other factors.

There are a few ways to quantify these complicated effects and their evolution. For example, a modeling framework could simplify an economy’s complexity down to the key relationships between the relevant economic variables of interest. From this simplified model one could then extract the implications of tariffs on the economy (see, for example, Paulson et al. 2025). Alternatively, an accounting framework could assess the impact of tariffed imported intermediary inputs and final goods on overall prices (Hobijn and Nechio 2025). However, accounting frameworks don’t address how firms and consumers may adjust their behavior in response to tariffs.

While each of these approaches has its own advantages and disadvantages, we take a complementary approach, relying on an empirical analysis of historical data for a group of advanced economies. This allows us to estimate average effects of changes in tariffs in advanced economies.

Tariff rates declined steadily for 60 years…until now

Recent U.S. trade policy has sharply reversed a worldwide historical decline in tariffs. Figure 1 reports average world and U.S. tariff rates since the 1960s. The average world tariff rate corresponds to an average percentage of duties over all imports across 35 advanced and emerging economies, using updated data from Feenstra and Taylor (2014). U.S. tariffs correspond to average effective rates up to 2024. The blue dashed line corresponds to the estimated average U.S. tariff rate for 2025 as calculated by the Budget Lab at Yale (data as of October 30, 2025). Both world and U.S. tariff rates show a pronounced downward trend up to 2024, when the magnitude of the sharp reversal of this trend in U.S. tariff rates becomes evident.

Figure 1

Historical average world and U.S. tariff rates

Underlying the world average in Figure 1, tariff rates have varied substantially across countries, with some countries having tariffs as low as 0% and, at times, others exceeding 100%. This variation over time and across countries is useful to estimate the impact of the new U.S. trade policy on the domestic labor market and on inflation.

Is it tariffs or is it something else?

The main difficulty with any empirical analysis based on observed data is that confounding factors generally obscure measurement of the policy effects being studied. For example, how much is the strength of a trade policy driven by fiscal deficits, geopolitical considerations, industrial policy, trade balances, exchange rates, or some other consideration? Ideally, we would want to compare two situations: one with tariffs versus one without, all else being equal.

Disentangling these effects can therefore be difficult. We approach this problem in a couple of ways. First, we adjust for a variety of factors to isolate the effect of tariffs only. In particular, we account for past values of the unemployment rate, consumer price index (CPI) inflation, real exchange rates, short-term interest rates, equity returns, the trade balance over GDP, and changes in productivity. We also account for potential country-specific characteristics and an overall trend in tariffs. Such a specification allows us to get closer to the causal effect of tariffs without the feedback effects from other macroeconomic factors.

We base our analysis on data from Australia, Belgium, Denmark, Finland, France, Germany, Italy, Japan, the Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, the United Kingdom, and the United States. We use yearly data from the World Bank, with two exceptions. We update the average world tariff rate data from Feenstra and Taylor (2014), and the short-term interest rate comes from both Jordà et al. (2017) and the Organisation for Economic Co-operation and Development. The sample generally starts in the 1980s and goes to 2022.

The effect of tariffs on the economy varies over time

Using a statistical method known as local projections (Jordà 2005), we examine the evolution over time of the unemployment rate, CPI inflation, and tariff rates themselves following a 1% change in the average tariff rate in our sample. The idea is simple. Using unemployment as an example, we construct two projections on the future path of the unemployment rate. In one scenario, we include information on changes in tariffs. In the other scenario, we exclude it. Differences between the two projections are a measure of the influence of a change in tariffs, net of the set of variables that we include in these predictive models. We do similar calculations for tariffs and inflation.

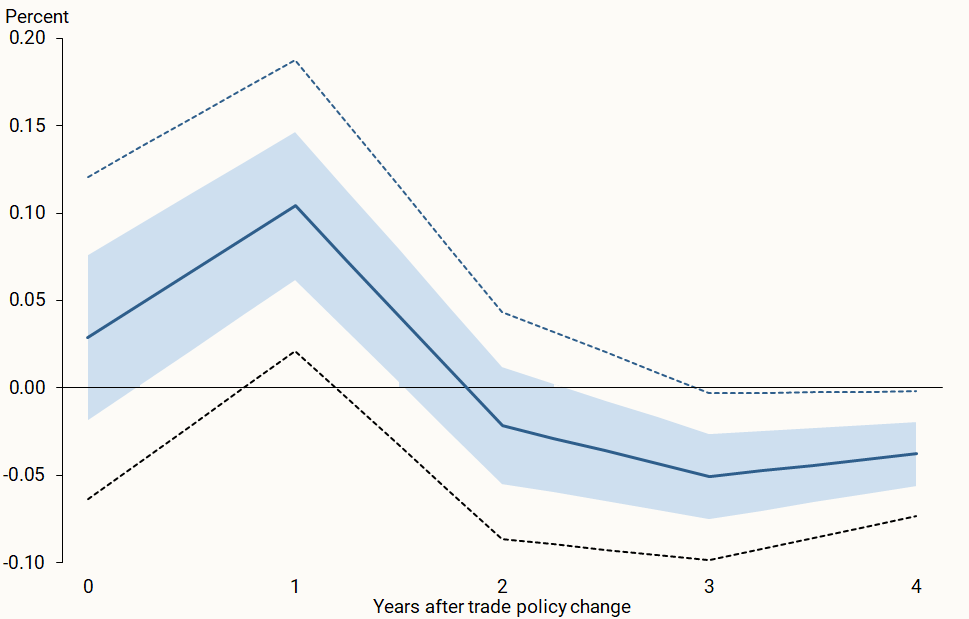

Figure 2 displays the evolution of the unemployment rate after an increase of 1% in the tariff rate. The contemporaneous impact of tariffs on the unemployment rate is relatively muted, with an increase in the first year of about 10 basis points (one-tenth of a percentage point) per 1 percentage point change in tariffs. That is, a 10% increase in tariffs would be expected to raise the unemployment rate by 1 percentage point. The unemployment rate then settles back down by year two and declines slightly over the next two years.

Figure 2

Response of unemployment rate to 1% increase in tariffs

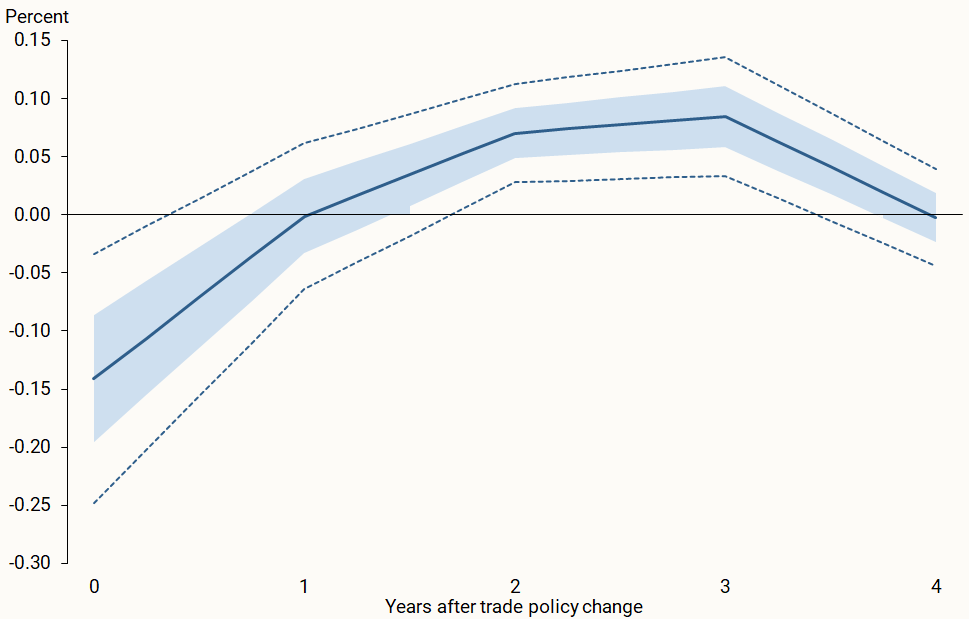

Figure 3 shows that the decline of inflation at the time of a tariff change is 10 basis points for a 1% increase in tariffs, which would imply 1 percentage point decline for a 10% increase in tariffs. By year one, the reduction in inflation dissipates, then inflation surges about 10 basis points per 1% increase in tariffs over the next two years, an effect that slowly starts to wane by year four.

Figure 3

Response of inflation to 1% increase in tariffs

The initial increase in the unemployment rate together with the drop in inflation both suggest that tariffs act like a brake on the demand side of the economy. Firms may withhold investment spending until there is more clarity on future trade policy, since tariff policies will prompt them to reconsider how they arrange their supply chains. Consumers may respond cautiously to the new environment by slowing down their demand for products and services. Over time, the economy adjusts: The unemployment rate returns to its original level or even declines slightly, whereas inflation picks up and peaks three years after the initial change in tariffs, relative to the scenario where tariffs remain unchanged.

Our estimates should be interpreted with caution. The tariffs recently enacted are unprecedented in magnitude and scope, and they are surrounded by a great deal of uncertainty. The sample used in our analysis is based on historical evidence that does not contain such large tariff changes. Thus, extrapolating our results to the current environment is somewhat fraught.

However, our findings are consistent with those in Hobijn and Nechio (2025), who rely on an accounting framework based on input–output tables. They show that the estimated effects of tariffs on equipment investment prices can be somewhat larger than their impact on consumer price inflation. Higher equipment costs raise production costs, and over time these higher costs are passed on to final goods prices. This may explain why higher consumer price inflation takes longer to show up in overall statistics.

Conclusion

What do the results in this Letter mean for evaluating trade policy? Ultimately, our results show that the effects of tariffs on the economy do not go in a single direction. On impact and early on they depress labor markets and inflation. Over time these effects reverse course. In other words, it seems that demand factors prevail in the short run but supply factors dominate in the long run. It is important to understand the timing of the different effects of trade policy on the economy to craft the appropriate monetary policy response, more so since monetary policy tends to act on the economy with some delay.

References

Feenstra, Robert C., and Alan M. Taylor. 2014. International Economics (4th edition). Worth Publishers.

Hobijn, Bart, and Fernanda Nechio. 2025. “The Effects of Tariffs on Inflation and Production Costs.” FRBSF Economic Letter 2025-12 (May 19).

Jordà, Òscar. 2005. “Estimation and Inference of Impulse Responses by Local Projections.” American Economic Review 95(1, March), pp. 161–182.

Jordà, Òscar, Katharina Knoll, Dmitry Kuvshinov, Moritz Schularick, and Alan M. Taylor. 2019. “The Rate of Return on Everything, 1870–2015.” Quarterly Journal of Economics 134(3, August), pp. 1,225–1,298.

Jordà, Òscar, Moritz Schularick, and Alan M. Taylor. 2017. “Macrofinancial History and the New Business Cycle Facts.” In NBER Macroeconomics Annual 2016, volume 31, ed. by Martin Eichenbaum and Jonathan A. Parker. Chicago: University of Chicago Press.

Paulson, Caroline, Aditi Poduri, Aayush Singh, and Mauricio Ulate. 2025. “The Economic Implications of Tariff Increases.” FRBSF Economic Letter 2025-17 (July 14).

Opinions expressed in FRBSF Economic Letter do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System. This publication is edited by Anita Todd and Karen Barnes. Permission to reprint portions of articles or whole articles must be obtained in writing. Please send editorial comments and requests for reprint permission to research.library@sf.frb.org