Consumers use cash for roughly half of all transactions valued at less than $50, and they choose to use cash more frequently than any other payment instrument, including debit or credit cards.1 Cash is either the most used or second most used payment instrument across a wide array of spending categories.

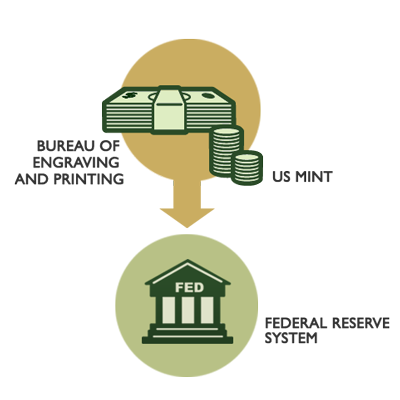

In addition to being a popular payment instrument, U.S. currency is used widely as a trusted store of value, with over $1.4 trillion in circulation globally.2 The Cash Product Office (CPO) of the Federal Reserve System works closely with financial institutions, merchants, and other industry partners and conducts research to understand trends in cash use and the important role that cash plays in consumer transactions. Select an icon below to learn about a few of these programs.

1. Cash Continues to Play a Key Role in Consumer Spending: New Evidence from the Diary of Consumer Payment Choice, FRBSF FedNotes (April 2014)

Learn More

The following resources discuss the role of cash in a changing payments landscape.

Cash Connect Video: Who Holds Cash?, FRBSF (May 2016)

Shopping Experience Trends and their Impact on Cash, FRBSF FedNotes (April 2016)

Who Holds Cash? Evidence from the 2012 Diary of Consumer Payment Choice, FRBSF FedNotes (December 2015)

Is Cash-Free Really The Way To Be? Maybe Not For Millennials, NPR All Tech Considered (April 2015)

A Five-Year Glimpse Into Consumer Payment Preference, PYMNTS.com (December 2014)

Consumer Preferences and the Use of Cash: Evidence from the Diary of Consumer Payments Choice – Working Paper, FRBSF FedNotes (June 2014)

Cash Continues to Play a Key Role in Consumer Spending: New Evidence from the Diary of Consumer Payment Choice, FRBSF FedNotes (April 2014)

Trends in Retail Cash Automation: A Market Overview of Retail Cash Handling Technologies FRBSF FedNotes (March 2014)

Federal Reserve Financial Services: In Pursuit of a Better Payment System

Cash is Dead! Long Live Cash! An essay by President and CEO John C. Williams (April 2013)