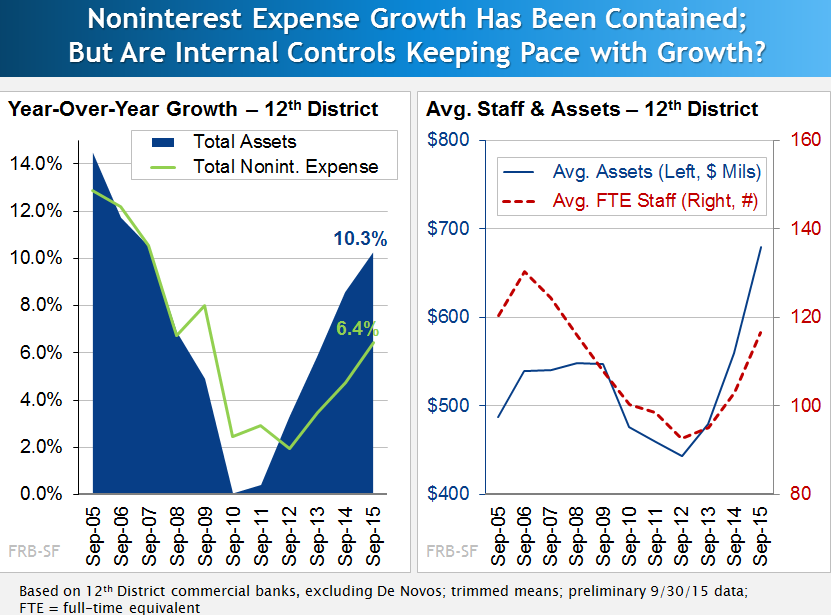

The First Glance 12L provides a first look at economic performance and the financial condition of banks headquartered within the 12th Federal Reserve District. According to the third quarter report, titled Banking Conditions Strengthened Despite Slowdown Abroad, the dollar’s strength vis-à-vis other currencies, and economic slowing among major trade partners, weighed on District export activity during the quarter, but did not dampen the District’s employment or banking loan growth. Meanwhile, commercial real estate market fundamentals remained solid and home prices increased further, especially in the Pacific Northwest and Mountain States. Cost controls and low or negative provision expenses propelled banks’ earnings higher in spite of continued net interest margin pressures. While greater efficiencies are a positive, the very mild increase in overhead expenses while balance sheets have grown fairly sharply in recent years raises some questions about whether banks are ensuring adequate internal controls. Favorably, among California’s more important agricultural producing areas, drought has not yet had a material impact on credit quality. Still, net interest margin compression among institutions focused on doing business in these areas led to weak earnings performance relative to all California-based banks. District CAMELS ratings continued to improve with upgrades outpacing downgrades for the 18th straight quarter. The percentage of District banks rated less than satisfactory (3, 4 or 5) continued to trend down to 18% in the third quarter (from 61% at the peak in 2010).