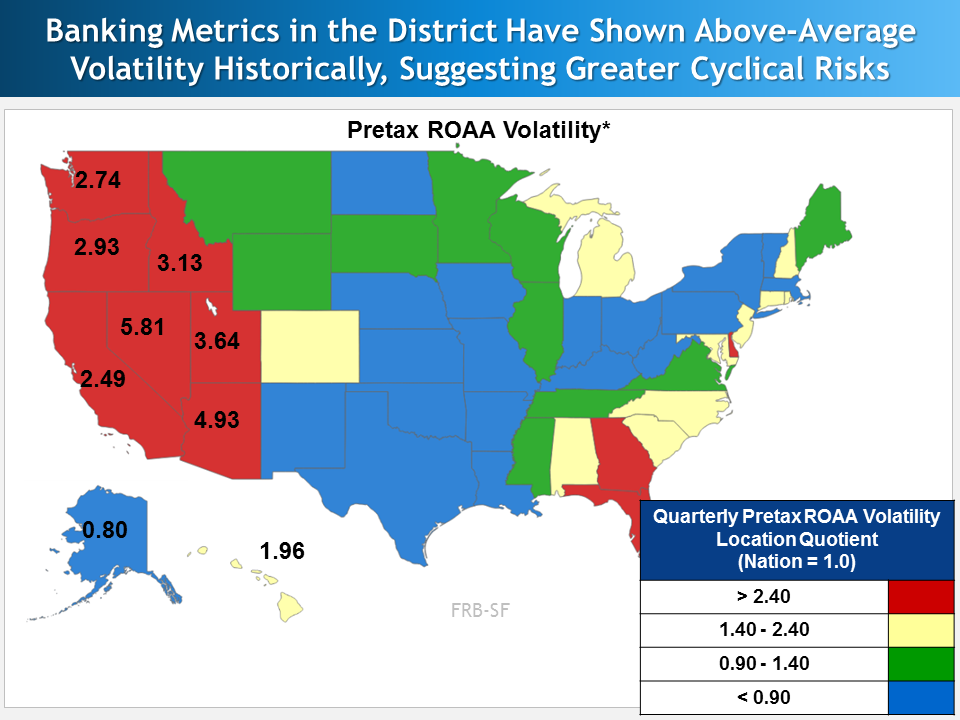

The First Glance 12L provides a first look at economic performance and the financial condition of banks headquartered within the 12th Federal Reserve District. According to the first quarter 2016 report, titled “Conditions Remained Healthy but Prone to Greater Volatility,” employment and bank loan growth continued to outpace the nation, bank profitability and credit quality improved further, and supervisory rating trends were favorable. Still, energy sector problems caused commercial credit weakening at mid- and large-sized banks and caution among investors and lenders contributed to tighter commercial credit standards, wider credit spreads, and lower venture capital activity. It also weighed somewhat on national commercial property price indices, in particular for downtown office space. Going forward, as rapidly-growing loan portfolios season, delinquency and charge-off ratios may lift from current near decade-long lows. Moreover, economic and banking metrics for the 12th District (e.g., job growth, home price appreciation, loan growth, profitability, and delinquencies) have historically been prone to higher peaks and lower troughs during economic cycles than the nation as a whole. This implies potentially greater downside risk in a recession and the need for vigilant monitoring of loan loss reserves (to cover expected losses) and capital (to cover unexpected losses). The report also summarizes a number of “Hot Topics” that bank supervisors are monitoring closely.