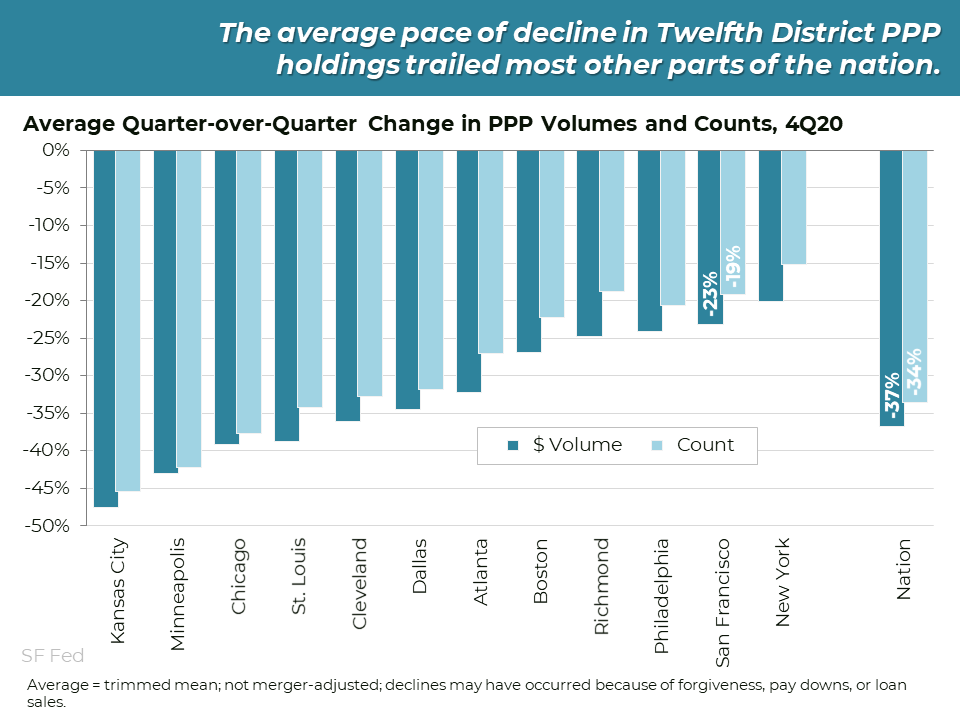

First Glance 12L provides a quarterly look at banking and economic conditions within the Federal Reserve System’s Twelfth District. During 4Q20, quarterly loan growth among District banks turned negative as Paycheck Protection Program (PPP) forgiveness got under way. However, forgiveness also fueled accelerated recognition of yield-enhancing PPP fees, which along with lower credit loss provisions, boosted average quarterly bank profits. Notwithstanding quarterly improvement, full-year bank earnings trailed 2019 levels. Problem loan ratios ticked up slightly, remaining low amid stimulus measures and waning loan accommodations. Some surveyed lenders expressed concern about loan performance in 2021 for certain loan categories.

Employment in the District declined in December for the first time since April as the late-2020 surge in COVID-19 cases led to reduced mobility. In contrast, home price gains and one-to-four family permit activity strengthened, supported by low interest rates and limited for-sale inventories. Commercial real estate performance was mixed, with occupancy and rental rates deteriorating across most property sectors, but prices and transaction volumes more resilient for industrial and apartment properties than office and retail.

The report recaps several key banking risks such as the cybersecurity breach of SolarWinds and takes a closer look at state and local government fiscal challenges.