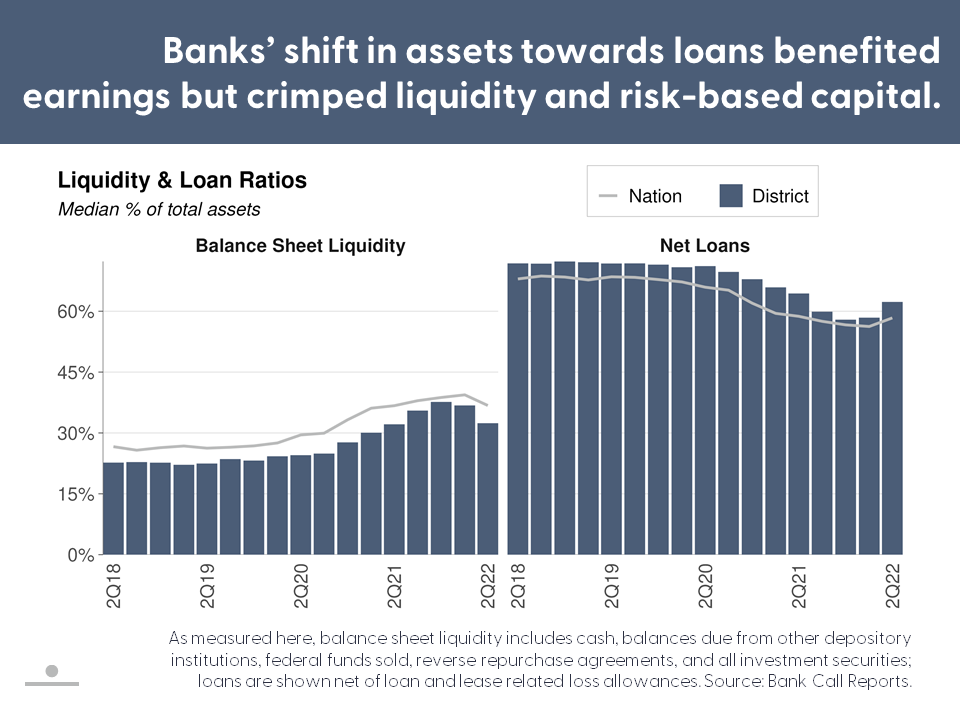

First Glance 12L provides a quarterly look at banking and economic conditions within the Federal Reserve System’s Twelfth District. Excluding Paycheck Protection Program loans, median loan growth accelerated to nearly 16% year-over-year among the District’s banks, the fastest pace since 2006. Rising interest rates and higher loan-to-asset ratios lifted bank net interest margins and profits relative to 1Q22. Problem loan levels remained low, but bankers expressed increasing caution about the economy. On the downside, liquidity eased as banks tapped temporary investments to fund loan growth and net unrealized losses among bond portfolios intensified.

District payroll employment also continued to grow in 2Q22, despite rising interest rates and declining consumer and business confidence. By June, the District recovered practically all the payroll jobs it lost early in the pandemic. Unemployment rates were near or below pre-pandemic levels in most District states. However, sharply higher mortgage rates slowed home sales and 1-4 family permit activity, and home price growth in some District states turned negative in June. Meanwhile, commercial property dynamics continued to favor the apartment and industrial sectors. The outlook is uncertain, however, as monetary tightening and negative sentiment may weigh on the economy.