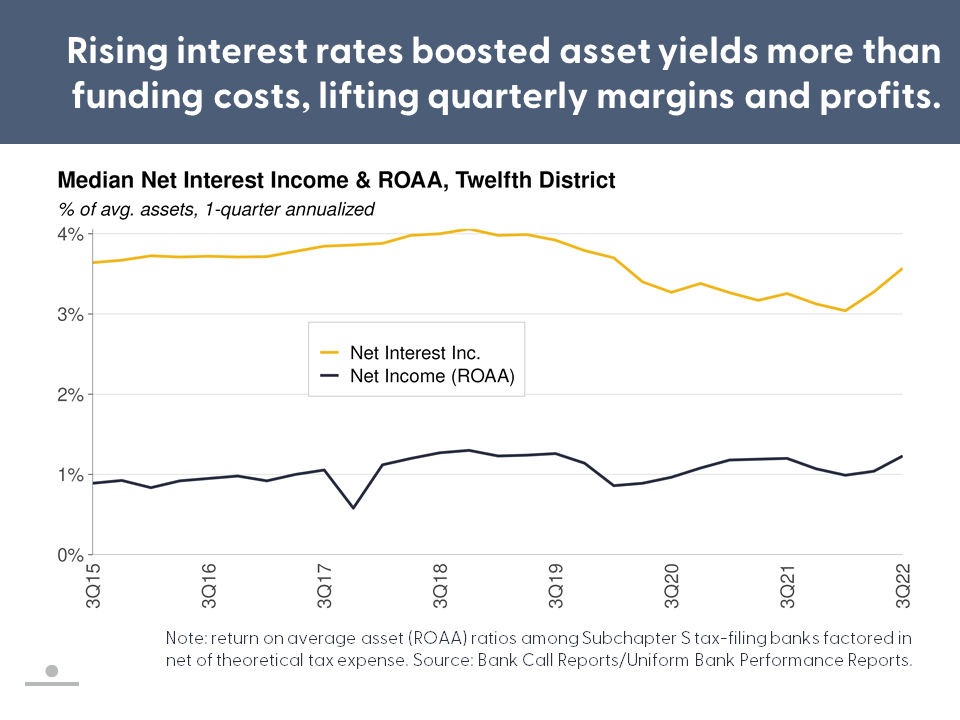

First Glance 12L provides a quarterly look at banking and economic conditions within the Federal Reserve System’s Twelfth District. Higher interest rates both helped and hurt banks’ performance. Yields on loans and securities repriced more quickly than funding costs, lifting median net interest margins and profits quarter-over-quarter. However, quarterly loan growth cooled, likely influenced by seasonal factors, higher financing costs, and an uncertain economic outlook. Problem loan levels remained low despite inflation and interest rate pressures on borrowers. Median on-balance sheet liquidity eased as banks re-deployed funds into loans but still exceeded pre-pandemic levels.

Job growth remained substantial through October but slowed relative to early 2022. The Districtwide unemployment rate ticked up to 3.9% in October, and initial claims for unemployment insurance rose notably in early November. Rising interest rates weighed on District housing market activity, with prices declining since May and existing home sales settling at their lowest level since early 2008. Commercial real estate transaction counts and price growth slowed in 3Q22. In the industrial and apartment sectors, vacancies persisted at low levels and rents remained strong despite cooling demand for space. But in most District markets, office occupancy and rental rates deteriorated further.