Demand for U.S. currency continues to grow with eighty-nine percent of American consumers holding cash to some extent. How much currency is out there and what factors could influence its demand? The latest infographic by the Cash Product Office explains the concept of currency in circulation.

![]()

U.S. CURRENCY IN CIRCULATION

Currency in circulation is comprised of all Federal Reserve notes held by the public, including businesses, banks, and consumers.

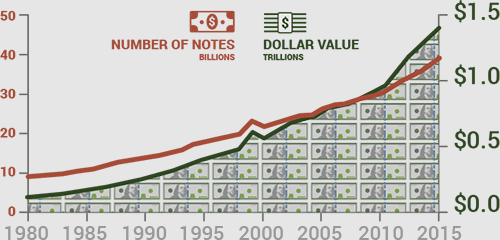

DEMAND FOR CURRENCY IS GROWING

Since the 1980s, the demand for U.S. currency has grown at a steady pace. Growth in the value of currency in circulation is driven largely by high denomination notes ($50 and $100).

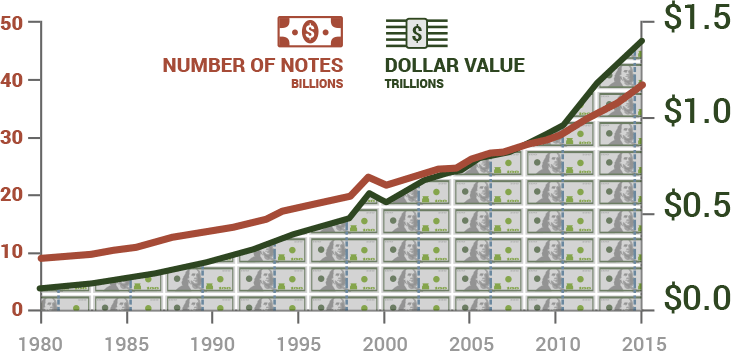

How much currency is out there?

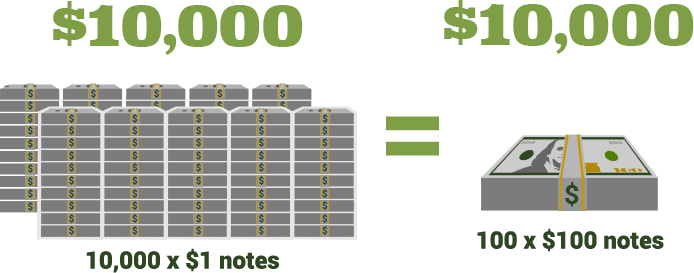

Number of notes vs. value of notes

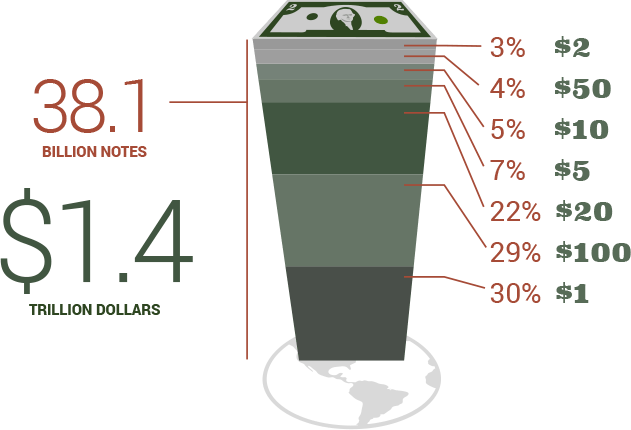

Because U.S. currency is available in a variety of denominations to meet consumers’ needs, the value of notes in circulation is much higher than the number of notes. Compare:

Why is demand for currency growing?

Currency in circulation grows when banks order more currency from the Federal Reserve than they return for processing, based on public demand. Here are some factors that could affect demand for currency:

CONCLUSION

Demand for currency continues to grow domestically and internationally, reflecting U.S. currency’s wide-spread use and its essential function as a means of payment and store of value.

Federal Reserve National Cash Product Office

© 2016 Federal Reserve Bank of San Francisco

Federal Reserve Cash Product Office

© 2016 Federal Reserve Bank of San Francisco

Download the infographic (png, 116 kb)