Download PDF (pdf, 1.0 mb)

The Federal Reserve conducted a follow-up Diary of Consumer Payment Choice in 2016. Read the FedNotes paper on Understanding Consumer Cash Use: Preliminary Findings from the 2016 Diary of Consumer Payment Choice.

Abstract

This paper provides new evidence on the determinants of cash usage for small value payments, and particularly how consumers’ stated payment instrument preference and the amount of the purchase affect their propensity to use cash. Participants who stated a cash preference have a predicted probability of a cash payment of 80 percent overall. However, if the amount of the transaction is less than $20, the probability increases to 91 percent. If the transaction is greater than $20, the probability decreases to 57 percent. Individuals who stated a payment card preference were estimated to have approximately a 30 percent probability of a cash transaction overall, but that probability increases to 49 percent when the transaction is less than $20 and drops to 8 percent when purchases are over $20. These estimates were conducted using the Federal Reserve October 2012 Diary of Consumer Payment Choice dataset, which includes all the recorded financial transactions of approximately 2,500 individuals who participated in the diary during their variously assigned three consecutive-day periods within the month of October 2012. In addition to recording all their financial transactions, they answered questions regarding payment instrument and cash handling preferences. These regressions suggest cash continues to play a large role as a payment instrument especially in lower value transactions for all demographic groups.

The Federal Reserve conducted a follow-up Diary of Consumer Payment Choice. Read the FedNotes paper, The State of Cash: Preliminary Findings from the 2015 Diary of Consumer Payment Choice to see how current findings compare to the 2012 data.

Introduction

The growth of electronic payments in the U.S. continues to be impressive, as it has been for the past 20 years. The triennial Federal Reserve Payment Study from 2012 shows that debit cards have increased from 8.3 billion transactions in 2000 to 47.0 billion transactions in 2012, more than a fivefold increase. Credit cards, while declining slightly during the financial crisis in 2009, have increased from 15.6 to 26.2 billion transactions over the same 12 year period.1 However, the limited amount of information regarding cash usage at the transaction level makes it difficult to determine how this influx of electronic payments impacts the demand for cash as a payment instrument. Currency in circulation data from the Federal Reserve can give some insight into how the demand for cash has been affected by these electronic payments, but these data cannot distinguish between cash usage as a payment instrument and usage as a store of value.

To determine the effect of electronic payment adoption on the use of cash as a payment instrument, individual transactional level data could be used to see who is using cash, as well as how and where cash is being used. Previous studies have shown that higher ticketed goods and services are more associated with non-cash payment instruments, but the dollar value where a consumer is likely to switch from a cash payment to a non-cash instrument remains unknown. This paper uses transaction level data that will shed light on how cash and payment card usage can be quite different for different populations, the extent of substitution between cash and payment cards at different transaction amounts, and the effect that an individual’s payment preference has on the likelihood of a cash payment.

This paper utilizes two datasets. The first is the Survey of Consumer Payment Choice (SCPC) from Federal Reserve Bank of Boston and the other is a new dataset collected by the Boston, Richmond and San Francisco Federal Reserve Banks called the Diary of Consumer Payment Choice (DCPC). The SCPC is a survey conducted annually since 2008 where individuals are asked about their usage of different payment instruments over a period of time, such as a week, month, or a year. The October 2012 SCPC surveyed 3,176 individuals, while the DCPC followed 2,468 individuals2. Between both datasets, there were 2,348 individuals who participated in both the SCPC and the DCPC. The framework for the Diary was based on similar studies conducted by central banks in other countries,3 as well as pilot diaries conducted by the Federal Reserve in 2010 and 2011 [Foster (2013)]. Participants in the DCPC were assigned a specific three day period in October 2012. During their three day period, participants were asked to record all financial transactions including bill payments, automatic bill payments, purchases of goods and services, cash deposits and withdrawals, and daily cash holdings. In addition to the transactional and demographic information, people were asked what payment method they prefer to use as well as the backup payment instrument they use when their preferred method is not available. This paper examines both demographic and socioeconomic factors that influence an individual’s stated payment preference and, more importantly, how an individual’s stated payment preference determines the level of substitution of cash for payment cards at different transaction amounts.

Previous work on payment instrument usage from national diaries shows that demographic characteristics, such as increased levels of education and household income, and increased transaction amount are negatively correlated with the probability of cash usage, yet the probability of cash usage, on average, is quite different for each country. Kalckreuth, Schmidt, and Stix (2009) use the “Payment Habits in Germany” dataset from the spring of 2008, which shows that over 80 percent of transactions take place in cash, and their regression results find little difference in cash usage for different age groups after controlling for additional demographic factors. Interestingly, payment card adoption does influence cash usage but could not explain why cash usage remains so high relative to other developed countries. Bounie and Francois (2006) use a diary dataset from France that was conducted from March to May of 2005. As is the case with the U.S. market, checks are primarily used for bill payments and cash is the dominant small value payment instrument, with payment cards being used for larger non-bill purchases. What is also similar is the “specialization” of payment instruments within a spending category, where cash is heavily used for “food and beverage” and “newspapers, tobacco, and lotteries” while cards are used for “transport” and “equipment and personal care.” Arango, Hogg, and Lee (2012) use the Bank of Canada’s Method of Payment survey and find that while cash transactions account for over 50 percent of transaction volume, for transactions under $25, cash accounts for about 70 percent of transactions. However, the probability of a cash payment drops by 30 percent when cards are accepted, suggesting that acceptance of cards in more locations and for smaller values may reduce cash usage. Boeschoten (1998) uses transactional data from Dutch households from 1990 to 1994 and finds that the size of the transaction is the most important factor determining which payment instrument is used; doubling the purchase amount reduces the probability of a cash payment by 20 to 30 percent. More recently Bagnall, Bounie, Huynh, Kosse, Schmidt, Schuh, and Stix (2014) compare diary results from Australia, Austria, Canada, France, Germany, Netherlands, and the United States. Their results show that across all countries the use of cash varies widely by countries, but is still the most used payment instrument despite level of debit cards ownership ranging between 76 and 93 percent. Consistent with other results is the probability of a cash payment decreases as the transactions value increases across all countries and demographic characteristics are strongly correlated with age, education, and household income.

The remainder of this paper is laid out as follows: Section 2 describes aggregate results from the DCPC; Section 3 discusses the methodology; Section 4 discusses the regression results; and Section 5 is the conclusion.

Diary of Consumer Payment Choice: an overview

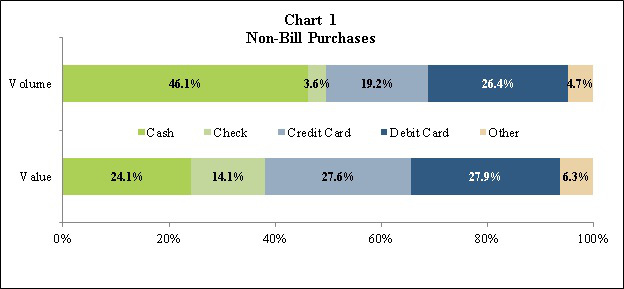

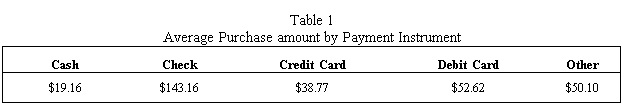

The aggregate results from the DCPC show that in October 2012 each consumer, on average, made 58.7 transactions, of which 50.5 were non-bill transactions. Chart 1 shows that 46 percent of the non-bill transactions took place with cash, by far the largest percentage of any payment instrument. Even when debit and credit cards are combined (45.6 percent), the number of cash transactions is still greater than the number of card transactions. Yet, the difference for cash transactions in the volume and value percentages indicates that cash is used mostly for small value transactions (as shown in Table 1). In contrast, debit and credit cards make up 19.2 percent and 26.4 percent of the volume of transactions and 27.6 percent and 27.9 percent of the value of transactions, respectively. These comparative differences between the volume and value percentages for cash and cards indicate that in the aggregate, cash and cards are used differently by consumers.

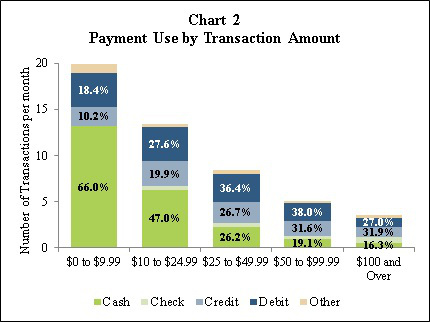

Chart 2 shows the number of non-bill transactions by payment instrument sorted by transaction amount. What is evident from the bar charts is that cash is the dominant small value payment instrument. The majority of the purchases (33.1 out of 50.5) made by consumers are for transactions where the value is less than $25. Within this range, cash accounts for 66 percent of transactions under $10 and 58 percent of the transactions under $25. In contrast, cash makes up less than 20 percent of the transactions when the purchase amount is over $50. The number of debit and credit card transactions does not vary much as purchase amount rises. However, the shares of both generally rise in terms of volume and value as the ticket size increases.

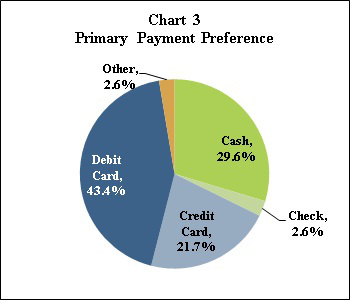

Previous work by Klee (2006), Zinman (2009), and Schuh and Stavins (2010, 2013) have shown that payment adoption and use are not the same across different populations. While charts 1 and 2 provide interesting insight into aggregate payment instrument use, they do not provide discernment into whether different populations are using cash more than others. To help identify who is more likely to use one payment instrument over another, the DCPC asked each person to specify their preferred method of payment. Chart 3 shows the responses in percent of the population4 where 43.4 percent of people prefer debit cards, 21.7 percent prefer their credit cards, and 29.6 percent prefer cash. Looking at the table from a cash-card perspective, payment cards are preferred to cash at a ratio of more than 2-1.

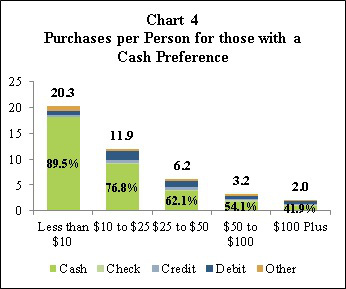

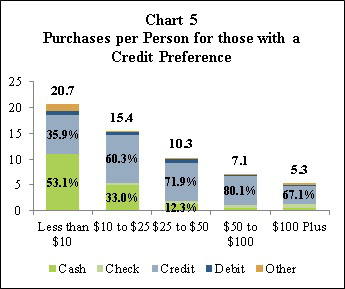

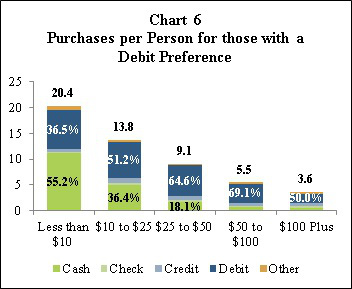

While cash is not the most preferred payment instrument, those who indicated that payment cards are their preferred payment instrument are still using cash for a significant number of transactions. Charts 4, 5, and 6 group the participants based on their payment preference and then graph their payment usage by purchase amount. Chart 4 shows payment usage patterns for those with a cash preference and, not surprisingly, cash is the payment instrument that is used most often. A majority of transactions under $100 and 42 percent of transactions over $100 take place in cash for this population. There is also little substitution between cash and cards for this population when compared to those who prefer to pay with cards. When cards are used by those who prefer to pay with cash, debit cards are used two thirds of the time, suggesting that the direct substitute for cash is likely debit cards, rather than payment cards in general.

Chart 5 shows the same information as Chart 4 but for participants with a credit preference rather than those with a cash preference. A majority of the purchases made by this group are with their preferred payment instrument, credit cards. The only exception where the majority of transactions, 53 percent, take place with cash is for purchases valued at less than $10. What is unknown is whether the cash purchases were made because the individual considered cash more convenient than cards for smaller value transactions or whether the person may have been forced into using cash if cards were not accepted for these low value purchases.5 The data from the DCPC does not contain information that allows one to determine if the payment instrument was made as a choice or if the preferred instrument was not accepted.6

Chart 6 shows the payment choice for those with a debit card preference, and this chart is nearly identical to the chart showing those with a credit card preference. A majority of the transactions are made using a debit card except for transactions less than $10 where 55 percent of the transactions take place with cash.

Klee (2006a) analyzes U.S. payment usage behavior by using the Survey of Consumer Finance (SCF) from 1995, 1998, and 2001 to determine the factors that have influenced the increase in electronic payment instruments. Similar to the diary studies referenced above, she finds “financial characteristics” such as income, number of financial institutions, homeownership, and education, as well as demographic characteristics, are correlated with electronic payment adoption and usage. Those characteristics that influenced adoption remain “relatively constant” in the SCF from 1995 to 2001. Yet adoption of electronic payments increased during that period indicating that “multihoming,” or adoption of more than one payment instrument, was likely taking place.

While adoption of both credit and debit cards expanded over that time period, the data from the DCPC suggests that these two payment instruments may not be complements. People who prefer to use debit cards, on average, use credit cards for only 6.7 percent of their transactions, and people who prefer to use credit cards use debit cards only 4.2 percent of the time. While most consumers have access to both debit and credit cards, individuals who prefer to use cards tend to use only two types of payment instruments for most of their transactions: their preferred instrument and cash, as shown in the preference charts above.

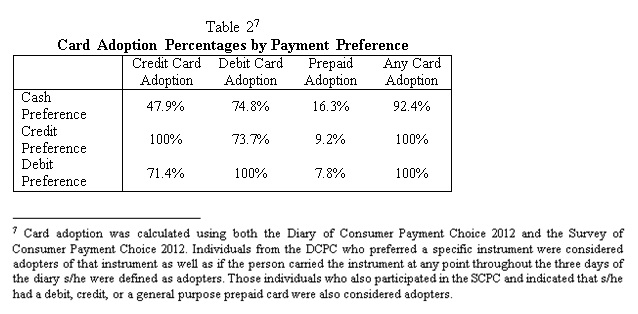

The data in Table 27, which shows the relationship between payment preference and payment card adoption, suggests that lack of access to a particular payment instrument does not determine preference. In most cases, preference does not preclude adoption of other options

Those with a cash preference have a credit card adoption rate of 47.9 percent, 74.8 percent rate for debit cards, and 16.3 percent for prepaid cards; yet despite the availability of a card for more than 92 percent of this group, they still prefer to use cash. The adoption of a card is a necessary but not sufficient condition to explain an individual’s preference for a payment card.

Table 3 (pdf, 195 kb) shows the demographic breakdown by payment preference. There are clearly large differences in payment preference by race, ethnicity, gender, and education. However, this table cannot tell us which characteristics independently influence payment preference. To determine which of these characteristics influence preference for one payment instrument over another, this study uses the regressions outlined in the methodology section to assess the independent impact each variable had on preference. Given one’s payment preference, this study then assesses the impact these demographic characteristics and transaction specific variables have on the likelihood that a consumer will use cash versus their preferred instrument.

Methodology

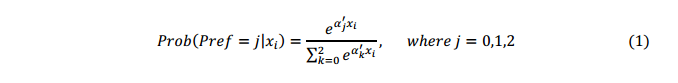

Chart 3 above shows that 94.6 percent of individuals chose cash, credit, or debit as their preferred option; as such, this analysis focuses on those individuals who selected said payment instruments. Individuals who selected checks, prepaid, online banking bill payment, bank account number, text, or mobile payments as their primary payment preference are not included in the regressions below. Because an individual can choose any one of the three payment options as the preferred payment instrument, a multinomial logistic regression is used where preference is regressed on demographic variables.

For equations (1) – (3), ![]() is a vector of exogenous variables for each individual, i, which includes race, gender, education, household income, employment status, and age. The variables j and k represent the possible preferences where cash = 0 (base outcome), credit = 1 and debit = 2, and is a

is a vector of exogenous variables for each individual, i, which includes race, gender, education, household income, employment status, and age. The variables j and k represent the possible preferences where cash = 0 (base outcome), credit = 1 and debit = 2, and is a ![]() is a vector of coefficients for the j-th preference.

is a vector of coefficients for the j-th preference.

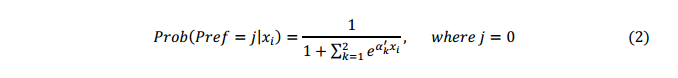

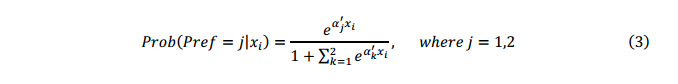

The results are estimated relative to a base outcome, the cash preference in this case. Setting ![]() where

where ![]() for those who prefer to use cash as their primary payment instrument allows equation (1) to be rewritten as:

for those who prefer to use cash as their primary payment instrument allows equation (1) to be rewritten as:

and

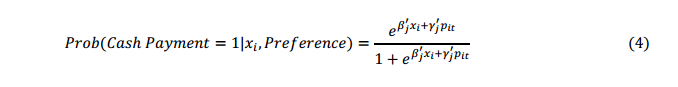

While the first set of regressions estimates the effects of observables on preference, charts 4, 5, and 6 show that once a primary preference has been selected by the individual, the payment choices are predominantly cash and the primary payment choice. To determine the probability of a cash payment for each of the preference populations, a dummy variable indicating a cash payment is regressed on a set of explanatory variables using a random effects logistic model.

In equation (4), ![]() is, again, a vector of exogenous variables for each individual i, and

is, again, a vector of exogenous variables for each individual i, and ![]() is a vector of variables associated with each purchase. The variables for each transaction include the merchant type9, the value of the transaction, dummy variables in $5 increments from $0 to $25, and interaction terms between the amount dummy variables and the transaction amount. The dummy variables and interaction terms between $0.01 and $25.00 allow for a better fit of the model without a predefined functional form. The dummy variables allow for different intercepts and the interactions permit different slopes within the $5 dollar increments. Estimating separate regression for those who prefer to pay with cash, debit, or credit allows for different coefficient estimates for each population on the transaction variables,

is a vector of variables associated with each purchase. The variables for each transaction include the merchant type9, the value of the transaction, dummy variables in $5 increments from $0 to $25, and interaction terms between the amount dummy variables and the transaction amount. The dummy variables and interaction terms between $0.01 and $25.00 allow for a better fit of the model without a predefined functional form. The dummy variables allow for different intercepts and the interactions permit different slopes within the $5 dollar increments. Estimating separate regression for those who prefer to pay with cash, debit, or credit allows for different coefficient estimates for each population on the transaction variables, ![]() , and the demographic variables,

, and the demographic variables, ![]() . Because these regressions are examining the probability of a cash payment, participants must also be able to make a non-cash payment. Therefore, only individuals who have access to pre-paid, debit, and credit cards are included in these regressions.

. Because these regressions are examining the probability of a cash payment, participants must also be able to make a non-cash payment. Therefore, only individuals who have access to pre-paid, debit, and credit cards are included in these regressions.

Results

Preference Regressions

The first set of regressions in Table 4 (pdf, 90 kb) show the odds ratios10 from the multinomial regressions of preference regressed on the observables and are compared against those with a cash preference as the base group for comparison purposes. The group not included in the regression is an employed, unmarried, white male under the age of 25 who graduated from high school, was born in the U.S., lives in the Pacific census region, and makes less than $25,000 per year. The numbers in parentheses are the z-scores calculated from the standard errors.

The race and ethnicity estimates from table 3 shows that cash is the preferred payment method for minorities, and that minorities are much less likely to state that either debit or credit cards are their preferred payment instrument. Asian individuals are much less likely to prefer debit cards, but are 75 percent more likely to prefer credit cards than cash. Black individuals show a statistically significant difference in preference between cash and cards where they are 79 percent (1/0.56) less likely to prefer debit cards and four times less likely to prefer credit cards. Similarly, Hispanic individuals are much less likely to prefer credit cards and about equally likely to prefer debit cards when compared to cash. Women are more likely to prefer cards over cash and are twice as likely to state they prefer debit cards.

What does not statistically affect payment preference is an individual’s age. Only three of the Age variables were significant, and the largest impact was individuals over 65 preferring credit to cash by more than a 4 to 1 ratio. Overall, older individuals tend to prefer credit cards, but the z scores indicate that age does not significantly impact an individual’s payment preference.

The likelihood that an individual will prefer a card payment over cash is largely dependent on one’s household income and to a lesser extent, though not insignificant, one’s level of education. The type of card one is likely to prefer is dependent on the level of education. Increased levels of education are correlated with a card preference, but higher levels of education are correlated with a credit card preference. Individuals with an associate’s degree are about 60 percent more likely to prefer a debit card and, statistically, just as likely to prefer cash as one is a credit card. People with at least a bachelor’s degree are also more likely to prefer debit cards over cash, but unlike those with an associate’s degree, those people who have earned at least a four year degree are three times more likely to prefer credit cards over cash.

Household earnings between $25,000 and $199,999 increase the likelihood of preferring debit cards by two to four times when compared with those who earn less than $25,000. The effect of earnings on the likelihood that a person will want to pay with a credit card is even more dramatic. Household earnings between $25,000 and $74,999 will increase the likelihood of preferring a credit card by four to seven times. Those earning $75,000 or more are at least 14 times more likely to say they prefer to pay with a credit card than pay with cash. In general, the results show that the higher one’s household income the greater the probability that a person will prefer to pay with a card, and increased household income increases the odds that the payment preference will be credit cards rather than debit cards.

Cash Payment Regressions

The tables show how the probability of a cash payment is affected by demographic and transactions level variables. Table 5 (pdf, 109 kb) shows the marginal probabilities of cash payments for each payment preference for the random effects logistic regressions. Each column shows selected variables from each of the three regressions. The regressions for those with a cash preference only include individuals who have acquired a debit, credit, or a prepaid card so that the lack of card adoption does not bias the estimates. The Amount Variables include the amount of the purchase, dummy variables in $5 dollar increments from $0.01 to $25.00, as well as interactions between the dollar amount and the $5 dollar dummy increments. These Amount Variables allow for a non-predetermined functional form with respect to how the transaction amount influences the probability of a cash payment. These additional transactional level data will give insight into where consumers use cash, as well as the probability of a cash payment for different transaction values.

In general, all individuals are less likely to pay with cash as the purchase amount increases. The variable “Amount” shows the marginal probability of a cash purchase for the merchant category Food and Personal Care Supplies above $25. While the marginal probabilities for those with a card preference are lower, overall the probability of a cash payment for those with a cash preference is higher. When making purchases between $0.01 and $10.00, the dummy variables for each population are positive, indicating that despite preference there is still statistically significant cash usage in lower transaction amounts. Those with card preferences are between 40 and 65 percent more likely to pay with cash when the purchase amount is less than $5 dollars and 37 to 45 percent more likely when the purchase amount is between $5.01 and $10.00 dollars.

For this series of regressions, the main variables that influence the probability of a cash payment are amount, age, and spending category. Unlike in the preference regression results, the observable characteristics do not show much influence after individuals have sorted themselves into their primary preferences. This shows that behavior is driven by preference which, in turn, is driven by demographic and socioeconomic factors, but once people have decided on their preferred payment method, regardless of most demographic variables, everyone within that group behaves in a similar fashion.

The one demographic variable that is important in the probability of cash usage is age. The full cohort of 25 to 34 year olds does not have a statistically higher probability of using cash than 18 to 24 year olds. Part of the similarity between 18 to 24 and 25 to 34 year olds may be one’s stage of life since these results are consistent across payment preferences. For those who prefer to use cash, older individuals are less likely to use cash than those under the age of 35. This is not a surprising result as these individuals are more likely to be financially stable and able to make larger value purchases, which have a higher probability of card usage.11

Individuals 45 and older who prefer to use cards are at least 14 percent more likely to use cash for a transaction than 18 to 24 year olds and 6 to 10 percent more likely than 35 to 44 year olds. Assuming payment habits stay relatively constant, these results suggest that if the younger cohorts prefer to use a payment instrument other than cash, cash usage as a payment instrument will drop as individuals age. The assumption that a person’s payment habits remain constant after reaching their 30s seems reasonable when one looks at the difference in coefficients between 35 to 44 year olds and compares them to 45 to 54 year olds. The older cohort for both card preferences is 10 percent more likely to use cash than their 35 to 44 year old counterparts. Both groups are in their prime working age, and it is reasonable to assume that the difference seen is a generational difference rather than a stage of life difference.

The merchant category also has a major influence on the probability of a cash payment. Those who prefer to pay with cash are less likely to use cash when purchasing goods and services that are not from the merchant category Food and Personal Care Supplies. The other merchant categories have negative coefficients ranging from -17 percent for Housing Related to -1.5 percent for Government and Nonprofit. The two exceptions are Gifts and Transfers to People and Other where people are 10 and 20 percent more likely to pay with cash, respectively.

The estimated coefficients on the merchant categories for those who prefer to pay with cards are quite different than those who prefer to pay with cash. Individuals who prefer debit and credit are about 10 percent less likely to use cash for Auto and Vehicle Related and General Merchandise, which are the second and third most frequented merchant types after Food and Personal Care Supplies. The one area where people who prefer to use cards are significantly more likely to use cash than they are in Food and Personal Care Supplies purchases is for Gifts and Transfers to People. The reason for this increase in probability is the lack of alternatives within these categories. People will use cash when alternative payment instruments are limited. The only convenient way to transfer money from one person to another is either a check or cash. There are fast ways to transfer money from one person to another if both people happen to belong to the same bank, but even transferring money through PayPal without fees takes longer than it does to simply deposit a check.12 Not surprisingly, merchant categories that accept payment cards see a decrease in the probability of cash usage by those who prefer to pay with cards. While payment options for transactions with the merchant category Gifts and Transfers to People may not impact the overall demand for cash, large-scale acceptance of cards for small value transactions with Food and Personal Care Supply merchants has the potential to decrease the overall demand for cash.

Predicted Probabilities

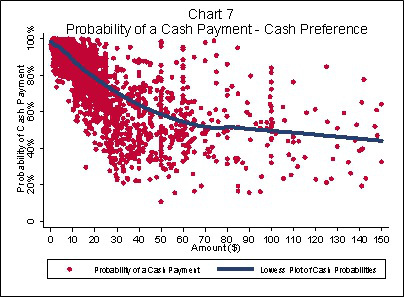

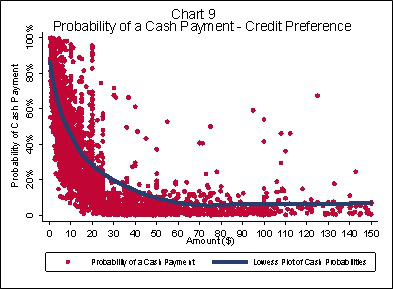

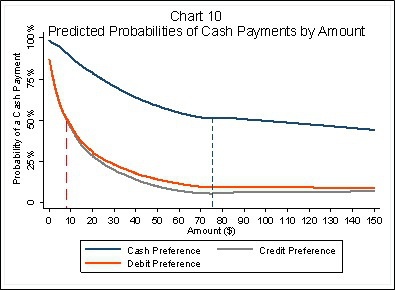

Charts 7, 8, 9, and 10 show the predicted probabilities by purchase amount from the regression results in table 4 for each payment preference. Each dot within the chart represents a predicted probability for a specific transaction. The displayed line is a locally weighted scatterplot smoothing (Lowess) line that averages ± 5 predicted values to produce the weighted probabilities by amount. The predicted probability for those who prefer cash is approximately linear with a slope of about -0.66 when the purchase amount is between $0.01 and $75 dollars. The slope of the line then changes and flattens out to about -.18 when the purchase amount is greater than $75. For individuals who prefer to pay with cash, the probability of a cash payment for purchases $20 or less is about 91 percent and for purchases greater than $20 and less than $50 the probability is about 60 percent.

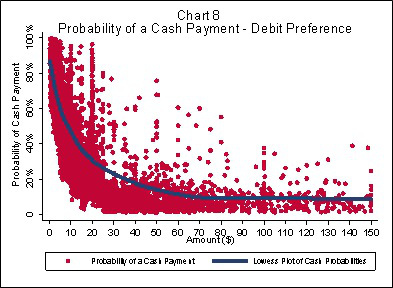

Charts 8 and 9 show the predicted probabilities of a cash payment for debit and credit cards, respectively. The two Lowess plots are very similar for the two card populations, which suggests that those who prefer debit and credit cards show a “card preference behavior” rather than a “debit preference behavior” or “credit preference behavior.” Similar to those with a cash preference, people who prefer to use cards have a very high likelihood of using cash for smaller value transactions. The slope of the Lowess plots for purchases less than $20 dollars is quite steep and, over all, the functions are asymptotic. For purchases less than $20 the probability of using cash for people who prefer debit cards is 51 percent and 49 percent for individuals with a credit preference, and for purchases greater than $20 and less than $50 the probability of a cash payment is 13 and 9 percent, respectively for individuals with a debit or credit preference. For purchase amounts greater than $70, the probability of a cash payment levels off at 8 percent for those who prefer debit and at 6 percent for those that prefer credit.

Chart 10 shows the Lowess plots of the predicted probabilities for the cash, debit, and credit preference populations. The red dashed-dot line and the blue dashed lines show the point estimate where the probability of a cash payment is equal to 50 percent. For those with a card preference, that amount is just below $9 dollars and those with a cash preference that amount is about $75 dollars. Clearly, an individual’s payment preference is the primary determinant of the payment instrument use for higher value transactions, but these results show that all individuals are likely to use cash for small value transactions. Whether these cash transactions are made with cash because of convenience or because merchants do not accept cards for small value transactions is not ascertainable from the data. Even so, the average transaction in the diary is $14 and, indicating even with the growth of electronic payments, the continued use of cash for small value transactions is likely even among those who prefer to use a non-cash payment instrument.

Conclusion

This paper uses the Diary of Consumer Payment Choice and the Survey of Consumer Payment Choice from 2012 to estimate the influence of various demographic and socioeconomic characteristics on payment preference. Then, conditional on an individual’s payment preference, this paper estimates the probability that the individual will use an alternative to their preferred instrument based on transaction details.

Once consumers sort themselves into their respective “payment preference populations,” they tend to use their preferred payment instrument most of the time, followed by cash. The results show that education and household income are the largest factors explaining consumer payment preference. The cash payment regressions show that most demographic variables have little influence on the probability of a cash payment once individuals have sorted into their “payment preferences populations.” The variables that have the largest correlation with an increased probability of a cash payment are age, spending category, and amount.

A majority of consumers prefer to make payments with either a debit or a credit card, while only 30 percent of the population prefers to pay using cash. However, because cash is the preferred payment method for small value transactions, and the majority of transactions are low value transactions, cash is used 46 percent of the time for transactions. Despite the expansion of electronic payment instruments, cash is still the most used payment instrument and understanding how individuals use cash is vital for the Federal Reserve to estimate the future demand for cash in a dynamic payment landscape. Further research into small merchants’ acceptance of cards, the development of mobile payment systems, and how continued data breaches influence a consumer’s use of cash is needed to more accurately estimate an individual’s future demand for cash, as well as the role cash will play in a more diversified payment environment.

Footnotes

* Policy Analyst, Cash Product Office, Federal Reserve Bank, 101 Market St., San Francisco, CA 94105, shaun.o’brien@sf.frb.org. The views in this paper are solely the responsibility of the author and should not be interpreted as reflecting the views of the Federal Reserve Bank of San Francisco or the Board of Governors of the Federal Reserve System.

1. The 2013 Federal Reserve Payments Study

2. The population is nationally representative with respect to age, race/ethnicity, and education after applying the population weights so the percentages would constitute a similar composition to that of the Current Population Survey conducted by the Bureau of Labor Statistics.

3. The diaries that were used as a framework, Australia, Austria, Canada, France, Germany, and Netherlands, are the same countries used by Bagnall, Bounie, Huynh, Kosse, Schmidt, Schuh and Stix (2014)

4. Percentages are weighted

5. Klee (2006b) uses grocery store data to show that the payment instrument choice is greatly dependent on transaction costs in the form of time. Her analysis shows the importance of time in the use of payment instruments. For small value transactions, cash may be quicker and easier to use than a payment card, while using cash for a larger transaction may in fact lead to a second transaction to acquire more cash if the stock of cash on hand is depleted.

6. For most transactions, cash is the payment instrument that is always accepted, but for online transactions, a person who prefers to pay with cash is usually forced to pay with a non-cash instrument.

7. Card adoption was calculated using both the Diary of Consumer Payment Choice 2012 and the Survey of Consumer Payment Choice 2012. Individuals from the DCPC who preferred a specific instrument were considered adopters of that instrument as well as if the person carried the instrument at any point throughout the three days of the diary s/he were defined as adopters. Those individuals who also participated in the SCPC and indicated that s/he had a debit, credit, or a general purpose prepaid card were also considered adopters.

8. Weighted Values

9. The merchant categories in the DCPC were aligned with the categories North American Industry Classification System (NAICS).

10. Odds ratios are interpreted in such a manner that values less than one represents a lower likelihood of a person from a population choosing that payment preference when compared to those in the base group, which in this case is the population with a cash preference. Therefore, the odds ratio of 0.5 for variable “x” comparing debit preference to a cash preference is the inverse of an odds ratio of 2.0 for variable “x” comparing a cash preference to a debit preference. Both ratios are conveying the same information.

11. All individuals in the second set of regressions have obtained at least one payment card, whether debit, credit, or prepaid.

12. Assuming one does not have money already in their PayPal account, since it takes 3-5 days to move money from a bank account to one’s PayPal account without fees.

References

Arango, Carlos, Dylan Hogg, and Alyssa Lee, 2012. “Why Is Cash (Still) So Entrenched? Insights from the Bank of Canada’s 2009 Methods-of-Payment Survey,” Bank of Canada Discussion Paper.

Bagnall, John, David Bounie, Kim P. Huynh, Anneke Kosse, Tobias Schmidt, Scott Schuh, and Helmut Stix, 2014. “Consumer Cash Usage: A Cross-Country Comparison with Payment Diary Survey Data,” Bank of Canada, Working Paper

Boeschoten, Willem C. 1998. “Cash Management, Payment Patterns and the Demand for Money,” De Economist, Vol. 146, No. 1, 1998.

Bounie, David., and Abel François. 2006. “Cash, Check or Bank Card” The effect of transaction characteristics on the use of payment instruments,” Télécom Paris, Department of Economics and Social Sciences.

Foster, Kevin. 2013, “Four Experimental Design Results for Diary Surveys,” Forthcoming, Federal Reserve Bank of Boston

Gerdes, Geoffrey R., James M. McKee, May X. Liu, Scott Drake, Jason P. Berkenpas, Patrick Dyer, Matthew C. Chen, Dave Brangaccio, Matthew C. Hayward, and Nancy Donahue. 2013. “The 2013 Federal Reserve Payments Study: Recent and Long-Term Payment Trends in the United States: 2003 – 2012 Summary Report and Initial Data Release,” Federal Reserve System

Greene, William H. 2005. “Econometric Analysis, 6th Ed.” Upper Saddle River, NJ.

Humphrey, David B., Lawrence B. Pulley, and Jukka M. Vesala. 1996. “Cash, Paper, and Electronic Payments: A Cross-Country Analysis.” Journal of Money, Credit and Banking, Vol. 28, No. 4.

Kalckreuth, Ulf von, Tobias Schmidt, and Helmut Stix. 2009. “Choosing and using payment instruments: evidence from German microdata,” Deutsche Bundesbank Euroesystem Discussion Paper Series 1.

Klee, Elizabeth. 2006a. “Families’ Use of Payment Instruments During a Decade of Change in the U.S. Payment System,” Board of Governors of the Federal Reserve System.

Klee, Elizabeth. 2006b. “Paper or Plastic? The Effect of Time on Check and Debit Card Use at Grocery Stores,” Board of Governors of the Federal Reserve System.

Schuh, Scott, and Joanna Stavins. 2010. “Why are (some) consumers (finally) writing fewer checks? The role of payment characteristics,” Journal of Banking & Finance, Vol. 34.

Schuh, Scott, and Joanna Stavins. 2013. “How Consumers Pay: Adoption and Use of Payments,” Accounting and Finance Research, Vol. 2 No. 2.

Wooldridge, Jeffrey M. 2002. “Econometric Analysis of Cross Section and Panel Data,” Cambridge, MA

Zinman, Jonathan. 2009. “Debit or Credit?,” Journal of Banking & Finance, Vol. 33