Download PDF (pdf, 556 kb)

The way consumers shop today is much different than ten years ago, largely due to the proliferation of new technologies like smartphones and tablets. Today’s new methods of shopping often blur the line between “in-person” and “online” purchases and influence how consumers choose to pay for their purchases. This paper identifies five themes that describe today’s shopping experience and how this new experience may impact cash’s position in the payment landscape.

1. How the consumer buys affects how the consumer pays

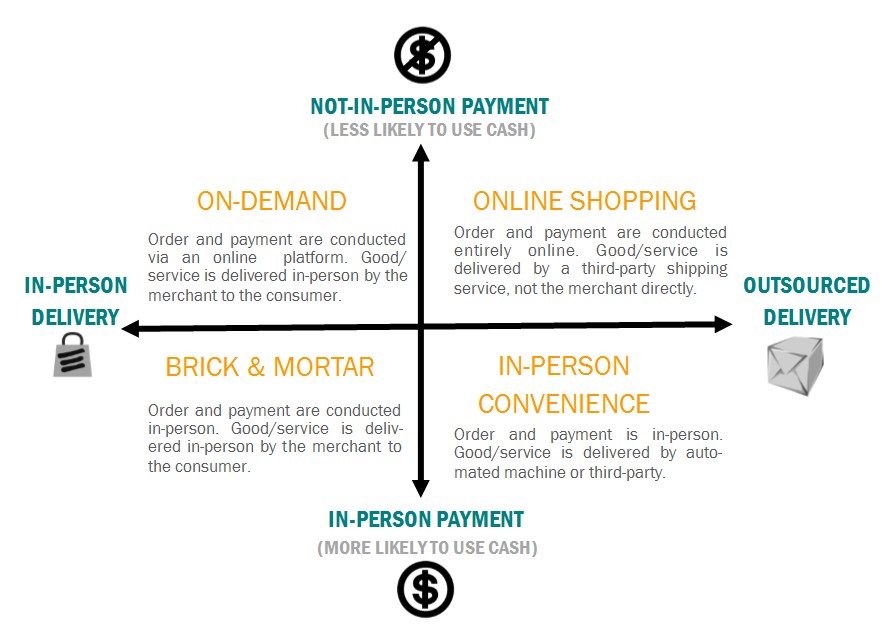

Consumers have a variety of choices in the way they purchase goods and services today. To explore these different shop/buy pathways, the Cash Product Office developed a framework to classify today’s shopping experiences by categorizing them as either “in-person” or “not-in-person” across two dimensions. The first dimension determines how a payment is made, and the second aspect establishes how the good or service is acquired, as shown below.

Classifying transactions in this manner creates four possible shopping pathways: “brick-and-mortar,” “online shopping,” “in-person convenience,” and “on-demand.” While “brick-and-mortar,” “online shopping,” and “in-person convenience” are all well-established pathways, the “on-demand” quadrant has only emerged in recent years. Two of these four quadrants (“on-demand” and “online”) typically involve a website or mobile app for making payments and therefore do not provide an option for paying with cash. Consequently, how a consumer shops affects how a consumer pays.

2. Prominent “on-demand” examples demonstrate strong but narrow effects on cash use

On-demand companies like the ride-sharing service Uber have seen their usage expand rapidly in recent years. However, these services’ impact on cash has been limited.

The “Uber Effect on Cash” infographic shows how large disruptions in industries offering certain goods and services do not necessarily translate to a large shift in overall cash usage:

View the infographic (png, 547 kb)

Our infographic shows that a national expansion and adoption of Uber would reduce cash usage by only 1.4 percentage points. The effect of the on-demand economy on transportation cash may be strong, but its impact on overall cash use is limited.

3. Even moderate expansion of “on-demand” services to cash-heavy categories could have a significant impact

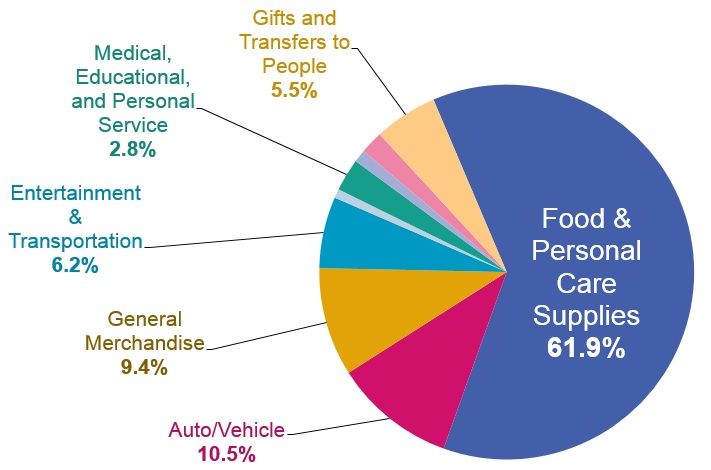

A service like Uber has a small impact on cash because transportation accounts for only a small share of overall cash usage. The 2012 Diary of Consumer Payment Choice found that nearly two-thirds (62 percent) of all cash transactions were used to pay for food and personal care supplies.1 For comparison, only 6.2 percent of cash transactions were used for entertainment and transportation, and within that, only 2.2 percent were used for transportation alone.

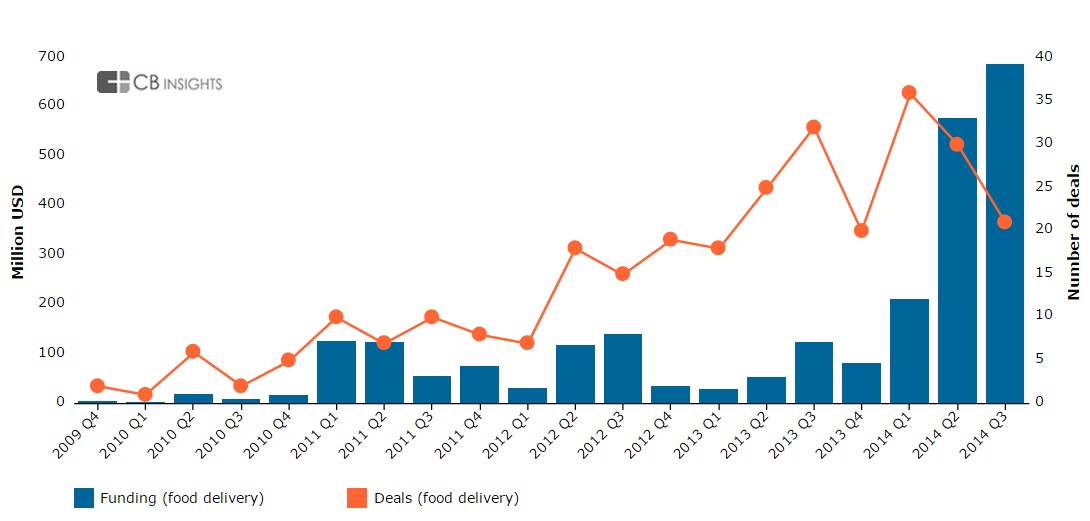

In recent years, “on-demand” investments in the cash-heavy “food” sector have grown rapidly. The “on-demand” food delivery industry has grown to nearly $10 billion since 2010, making up almost 9 percent of the off-premises dining industry. In 2013, off-premises dining, which includes takeout and delivery, totaled $118.7 billion.2 Companies are listening to consumer demands for easier and quicker food deliveries and offering more “on-demand” food delivery choices, all available at the push of a smartphone button.

Source: CB Insights3

As investments in these businesses grow, consumers may switch to “on-demand” channels to purchase food and personal care. This shift would reduce the number of cash transactions in these industries. While reduced opportunities to use cash and fewer cash transactions in the transportation industry may have a limited impact on overall cash usage, a similar decrease in more cash-intensive markets like “food and personal care supplies” could have a greater impact. A hypothetical 65 percent conversion to on-demand in “food and personal care supplies” would equate to a 40 percent reduction in overall cash use. It is not yet clear whether independent food delivery business models are sustainable outside of dense, urban settings, or sustainable in the long-term, so the overall risk to cash in light of this growing industry remains to be seen.

4. Despite growing “on-demand” investment, most shopping still occurs at brick-and-mortar stores

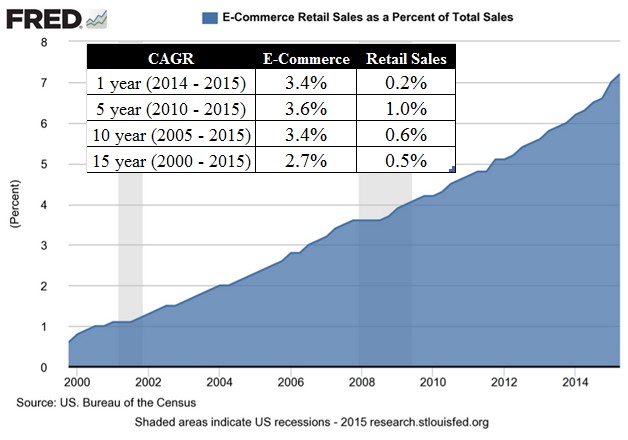

Source: Economic Research, Federal Reserve Bank of St. Louis4

While investment in e-commerce and the “on-demand” economy is growing, the majority of shopping still occurs in brick-and-mortar stores. According to the Census Bureau, e-commerce accounts for approximately seven percent of total retail sales, indicating that most retail sales still occur at brick-and-mortar locations, not online.

5. Brick-and-mortar changes pose risk but not demise for cash

While increased investment in online and “on-demand” shopping channels portrays a somewhat gloomy outlook for cash, its impact on cash likely remains small compared to the shifting payment trends occurring in the brick-and-mortar space. Consumer behavior continues to shift from cash to cards for “in-person” payments. Market research firm Javelin, for example, expects cash’s share of all point-of-sale purchases to drop from 27 percent in 2011 to 23 percent in 20175, replaced by greater use of debit and credit cards.

Parting thoughts

The rise in payment alternatives may be chipping away at some consumer opportunities to use cash, but it does not suggest an end to cash’s role as a reliable, enduring payment mechanism. From a cash perspective, there are still many unknowns about how the e-commerce market will change over time. Furthermore, despite the growing shift of “in-person” payments from cash to cards, many merchants believe cash is not going away and continue to invest in cash-handling equipment.

Cash has withstood the advent of paper checks, credit and debit cards, and electronic transfers – all of which brought on predictions of an impending cashless society – and yet it is still used for a majority of small-dollar transactions. While we continue to see shopping experiences change, cash maintains a relevant and important position as a payment instrument in our modern day society. Its role may evolve, but its sizable presence will remain.

The views in this paper are solely the responsibility of the authors and should not be interpreted as reflecting the views of the Federal Reserve Bank of San Francisco or the Board of Governors of the Federal Reserve System.

Footnotes

1. Food & Personal Care Supplies are defined in the Diary of Consumer Payment Choice as Fast food, food trucks, snack bars, grocery, pharmacy, liquor store, convenience stores, restaurants, and bars.

2. Statista. (2015, August 10). Statistics and facts on the food delivery industry in the U.S.

3. CB Insights. (2014, November 26). Led by International Players, Online and Mobile Food & Grocery Funding Smashes Previous Five-Year High in Q3’14.

4. Economic Research, Federal Reserve Bank of St. Louis. (2015, October 1). E-Commerce Retail Sales as a Percent of Total Sales.

5. New, C. (2012, June 7). Cash Dying As Credit Card Payments Predicted To Grow In Volume: Report.