Data and Indicators

-

Remembering Teresa M. Curran

It is with great sadness and heavy heart that we acknowledge the passing of our friend and colleague, Executive Vice President Teresa Curran, who led our Financial Institution Supervision and Credit Division (FISC).

-

Can Private Capital Transform Banking in China?

China’s banking system has historically been dominated by large government-owned banks. However, several recent trends are challenging that status quo. Private and privatized banks are beginning to play an important role in the financial system with the potential to improve financial inclusion and efficiency while raising new regulatory questions.

-

The More Things Change, Cash Remains

The Federal Reserve’s Cash Product Office just released new preliminary findings from the 2015 Diary of Consumer Payment Choice. The study shows that while new payment options are emerging and gaining popularity, cash is still the most frequently used retail payment instrument.

-

Can Fintech Fill Asia’s SME Lending Gap?

Perhaps no sector has more to gain from innovations in financial technology than small- and medium-sized enterprise (SME) finance, especially in Asia. SMEs accounted for 42 percent of Asia’s GDP in 2014 yet received only 18.7 percent of bank lending according to the Asian Development Bank. Fintech can particularly leverage the rapid growth of Asia’s e-commerce and regional trade, trends that complement SME development.

-

Raising the Speed Limit on the Slow Growth Economy

The SF Fed Economic Education team attended the National Council on Economic Education Conference in Phoenix, AZ, on Friday, October 7. Economist Mary Daly also attended, speaking about the importance of investing in human capital to raise the speed limit on the slow growth economy.

-

Notes on the Go: Currency in Circulation Explained

Each day, millions of U.S. banknotes circulate throughout the economy. How much currency is out there? What factors influence currency demand? A new infographic from the Federal Reserve’s Cash Product Office explains the basics.

-

How You Shop Affects How You Pay

Whether you’re shopping for groceries, back-to-school supplies, or season tickets, modern commerce provides many ways to shop and pay for purchases. A new infographic from the Federal Reserve’s Cash Product Office (CPO) shows how the decision to shop in person, online, or on-demand can influence your payment choice.

-

The Growing Importance of China’s Money Market

China’s money market is growing rapidly and playing an increasingly important role in the financial system. It serves as both a key channel for monetary policy and as a source of funding for a variety of financial institutions. Recent data reveal that non-bank financial institutions have emerged as the largest borrowers, bringing along new risks to financial stability.

-

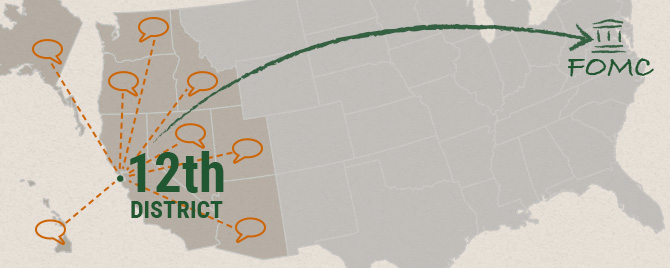

District Voices Go to Washington

How do business and community voices make their way to monetary policy decision makers in Washington D.C.? Often through Federal Reserve Bank branches. SF Fed branch managers share how they gain insights into the issues and concerns affecting people and micro-economies in their areas.

-

China’s Credit Growth: How Fast is Too Fast?

China now has one of the highest leverage ratios among emerging economies, with its corporate debt-to-GDP ratio greater than any other major economy. The debt overhang poses challenges to the country’s economic transition and financial stability, although a full blown banking crisis is unlikely.