The financial crisis has been worldwide in scope, but the severity has differed from country to country. Those countries whose banks played a more central role in the global financial system, were important intermediaries, or had extensive direct relationships tended to be less seriously affected, as measured by the extent of the decline in their stock markets in 2008.

The current economic and financial crisis hit globally, but its impact differed across countries. Understanding why some countries were more severely affected than others would enable us to draw valuable lessons. However, explaining differences among countries is not a simple task. Rose and Spiegel (2009a,b) show that explanations such as financial conditions, financial policies, and macroeconomic policies do not go far in illuminating cross-country differences in crisis severity.

A particular feature of the crisis is that financial institutions were affected in much more direct and severe ways than in a conventional recession. This suggests that precise and narrowly defined financial indicators may shed light on the reasons for cross-country differences. For example, Hale and Razin (2009) and Hale, Razin, and Tong (2009) find that countries with higher degrees of legal creditor rights protections were affected less in this crisis than countries in which legal creditor protection was weaker. Moreover, Trehan (2009) concludes that indicators such as housing price indexes and the credit gap, a measure based on the ratio of credit to GDP, could provide early warnings of a financial crisis.

This Economic Letter looks at another aspect of the financial system. We show that the degree of connectedness of a country’s banks to the global banking system is correlated with the depth of the financial crisis. Banks were by far the institutions most affected by the crisis, and linkages among banks played an important role in the way the crisis spread from the U.S. subprime mortgage market to the rest of the global financial system. A natural question is whether international linkages among banks help explain why some economies were affected to a greater extent than others.

Measuring the depth of the crisis

One way of measuring how much a country was affected during the crisis is to look at how much its stock market declined. In high-income OECD countries in 2008, the most intense crisis period, declines in stock market indexes corrected for inflation ranged from just over 30% in the United Kingdom, Switzerland, and Canada to over 60% in Greece and Ireland. The dispersion is even greater among developing countries. For example, Tunisia and Ecuador experienced less than 20% declines, while, at the other extreme, Iceland, Bulgaria, and Ukraine posted stock market index falls of more than 80%.

How important are a country’s banks in a global banking system?

Banking researchers have long understood that relationships between borrowers and lenders are important determinants of lending decisions. This is also true when both borrowers and lenders are banks. Given the central part the interbank market played in transmitting the crisis globally, it is natural to expect that bank relationships may explain the degree to which different countries were affected. However, measuring relationships among banks is not a straightforward task.

We attempt to do so by using data on syndicated international interbank lending between January 1980 and August 2007. Loans are usually extended by a group, or syndicate, of banks to a single bank borrower. Each loan is recorded. Based on this information, a network, or web, of bank relationships can be constructed and two measures of the degree of connectedness of each bank in the network can be computed. In the literature on networks, these measures are frequently referred to as “betweenness” and “closeness.”

The betweenness of a given bank, which we call bank X, measures how many pairs of other banks are not directly connected but are only related through bank X. Betweenness reflects the importance of bank X as an intermediary in the global banking system. Banks that exhibit high levels of lending and borrowing usually end up with high betweenness values. However, it is also possible that bank X is borrowing and lending heavily, but only to banks that also do business with each other directly, in which case bank X’s betweenness indicator will equal zero. Such a zero betweenness value means that other banks don’t have to go through bank X in order to do business with other banks in the network. It is probable that historical betweenness values remained more or less steady during the crisis. Although betweenness is computed based on past lending relationships, the measure was not likely to change in the midst of the financial crisis because new banking relationships were difficult to develop during such a period of stress.

We compute an average betweenness value for each country’s banks. We would expect that countries whose banks exhibit higher average betweenness–that is, countries in which banks are important links in the global banking system–were less likely to be affected during the crisis because both borrowers and lenders assigned high value to maintaining their obligations to that country’s banks.

Closeness of a given bank, which we call bank Y, is the inverse of the number of banks that bank Y has to go through on average to reach other banks in the network. The smaller the closeness value of bank Y, the more remote bank Y is from other banks as a group. For example, a bank with a closeness indicator of one is directly related to all other banks, while a bank with a closeness indicator of one-third needs to go on average through three intermediaries to reach other banks in the network. Thus, if a bank with a low closeness indicator needed to borrow during the crisis, there was a greater chance that some links in the chains that connect the bank to the network were broken, thereby depriving it of liquidity. That contrasts with a bank with a high closeness indicator, which had many direct relationships with other banks in the network.

We compute country closeness averages to indicate how remote on average a country’s banks have been in the global banking network. We would expect that countries whose banks show low average closeness would have been hurt more during the crisis because liquidity in the interbank market was more difficult for that country’s banks to obtain.

Banks’ position in the global banking system and the depth of the crisis

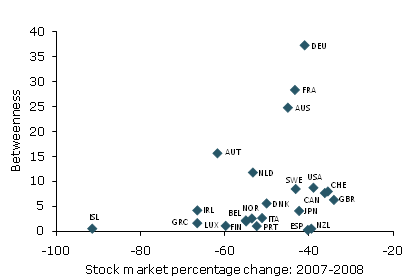

Figure 1

Developed countries with higher average betweenness suffered less during the crisis

Previous financial crises during the past two decades, such as the Asian crisis of the late 1990s or the European Exchange Rate Mechanism crisis of 1992, tended to be regional in nature and were limited to groups of either developing or developed countries. By contrast, the current financial crisis is global and has affected both developed and developing countries in all regions.

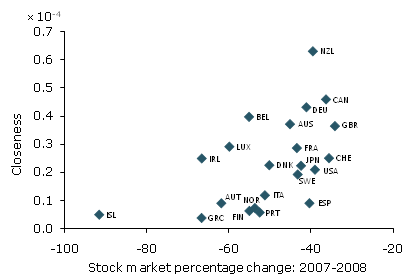

Figure 2

Developed countries with higher closeness suffered less during the crisis

Nonetheless, it is important to recognize that the level of financial development in developing countries is still very far from that in advanced economies. Thus, one would not expect the mechanism of crisis transmission and the importance of banking network indicators to be the same for advanced and for developing economies. We therefore split our sample into two groups: high-income OECD countries and developing countries. We find that average betweenness helps us understand differences in the depth of the crisis among high-income OECD countries, while average closeness helps us understand these differences among both developing and developed countries. This is to be expected because banks in developing countries play a less important role in the global financial network and, consequently, average betweenness values for developing countries tend to be low, with little variation. At the same time, average closeness varies substantially in both groups of countries.

Figure 1 shows the relationship between average betweenness and the percentage change in stock market indexes in high-income OECD countries. In countries with banks that on average are more central in the global banking system, such as France and Germany, the crisis was less severe than in countries such as Iceland, Ireland, and Greece, whose banks play a less central role in the global banking network. Of course, the correlation of betweenness and stock market performance during the crisis does not line up perfectly because many other factors also affected the size of the stock market decline.

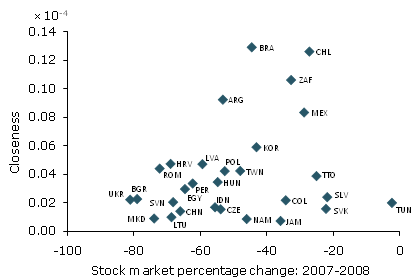

Figures 2 and 3 show the relationship between average closeness and the percentage change in stock market indexes in developed and developing countries, respectively. In both cases, countries with banks that on average have been more remote from the center of the banking network experienced more severe stock market declines. When credit markets dried up during the crisis, these countries were likely to experience more stringent credit shortages than countries in which banks had more direct relationships with the rest of the global banking network.

Conclusion

Figure 3

Developing countries with higher closeness suffered less during the crisis

This research suggests that the international relationships banks established with other banks during almost three decades preceding the current financial crisis proved valuable in providing access to liquidity.

Analyzing data at an aggregate country level, we find that, for advanced economies, the extent to which a given country’s banks served as intermediaries in indirect bank relationships was an important indicator of crisis severity. The more important a country’s banks were as intermediaries in the global banking network, as measured by betweenness, the less severe was the decline in that country’s stock market in 2008. This may reflect a tendency of counterparties to assign high priority to maintaining relationships with these banks and therefore continuing to provide them liquidity and meet other obligations.

For developing countries, the less connected a country’s banks were on average, the more severe was the drop in its stock market. For banks that had not established many direct relationships and had relied on many intermediaries to obtain credit, the liquidity shortage may have been especially acute, amplifying the effects of the financial crisis.

These findings point to the importance of bank relationships in determining a country’s access to credit during times of duress. Notably, measures of bank relationships seem to have been correlated with the change in a given country’s stock market index in 2008, a key indicator of the depth of the financial crisis in that country.

References

Hale, Galina, and Assaf Razin. 2009. “Does Creditor Protection Mitigate the Likelihood of Financial Crises and Their Effect on the Stock Market?” VoxEU.org.

Hale, Galina, Assaf Razin, and Hui Tong. 2009. “The Impact of Credit Protection on Stock Prices in the Presence of Credit Crunches.” NBER working paper 15141.

Rose, Andrew K., and Mark Spiegel. 2009a. “Cross-Country Causes and Consequences of the 2008 Crisis: Early Warning.” NBER working paper 15357.

Rose, Andrew K., and Mark Spiegel. 2009b. “Predicting Crises, Part II: Did Anything Matter (to Everybody)?” FRBSF Economic Letter 2009-30.

Trehan, Bharat. 2009. “Predicting Crises, Part I: Do Coming Crises Cast Their Shadows Before?” FRBSF Economic Letter 2009-29.

Opinions expressed in FRBSF Economic Letter do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System. This publication is edited by Anita Todd and Karen Barnes. Permission to reprint portions of articles or whole articles must be obtained in writing. Please send editorial comments and requests for reprint permission to research.library@sf.frb.org