The idea that business cycle fluctuations may stem partly from changes in consumer and business confidence is controversial. One way to test the idea is to use professional economic forecasts to measure confidence at specific points in time and correlate the results with future economic activity. Such an analysis suggests that changes in expectations regarding future economic performance are important drivers of economic fluctuations. Moreover, periods of heightened optimism are followed by a tightening of monetary policy.

Indicators of consumer confidence have been at depressed levels in recent months. Business sentiment is also low, reflecting uncertainty about U.S. fiscal policy and the perception that economic weakness may be prolonged. This lack of confidence raises the risk that pessimism can become entrenched and self-reinforcing, further damping the nascent recovery.

The idea that changes in consumer and business confidence can be important business cycle drivers is an old but controversial idea in macroeconomics. It assumes that confidence reacts not only to movements in economic fundamentals but is itself an independent cause of economic fluctuations distinct from those fundamentals. In recent decades, cycles of boom and bust in Japan, East Asia, and the United States have focused renewed attention on the question of confidence. These experiences suggest that optimism about the future helped fuel economic booms and that subsequent buildups of pessimism contributed to the busts. Moreover, these episodes fostered intense debate about the role of monetary policy in boom-and-bust cycles. Central banks have been sharply criticized for stoking the booms and inflating confidence by setting excessively accommodative monetary policy.

This Economic Letter considers the role of confidence in macroeconomic models. Specifically, the Letter examines professional economic forecasts to investigate whether relative optimism and pessimism—that is, expectations that good or bad times are ahead—may be important business cycle drivers. It also analyzes how monetary policy responds to buildups of confidence.

Confidence as a source of business cycle fluctuations

Psychological factors such as optimism and confidence played an important role in business cycle theories formulated in the 1920s and 1930s. For example, the British economist Arthur Pigou stressed the importance of changes in expectations as a determinant of business cycles: “The varying expectations of business men…constitute the immediate cause and direct causes or antecedents of industrial fluctuations.” In other words, when people are confident about the future, they may consume, invest, and work more today. John Maynard Keynes also argued that confidence played a large role in driving economic activity: “Our decisions to do something positive, the full consequence of which will be drawn out over many days to come, can only be taken as a result of animal spirits—of a spontaneous urge to action rather than inaction, and not as the outcome of a weighted average of quantitative benefits multiplied by quantitative probabilities.”

Economic booms are often characterized by waves of optimism and the view that the economy is entering a new era in which the business cycle has been tamed. The idea that “this time, things are different” became pervasive during the expansion of the mid-2000s, just before the worst financial crisis since the Great Depression. New financial products were thought to have protected market participants by spreading risk widely, thereby justifying the surge in mortgage lending and the phenomenal run-up in house prices. Similarly, the emergence of new information technologies fueled a wave of euphoria that drove the stock market boom of the late 1990s and the longest economic expansion in U.S. history. A similar sense of confidence developed during the Roaring Twenties, spurred by new technologies such as autos and radio, financial innovations, and improved business practices. The Japanese boom of the 1980s with its ballooning property prices also shared some of these characteristics. Each of these episodes ended with a stock market crash when overly optimistic expectations were dashed.

The proposition that confidence can influence the business cycle raises the question of how expectations are translated into actions that affect economic activity. One way that confidence can cause business cycle fluctuations is when people’s actions are influenced by what they think other people might do. For example, if customers start to fear that a bank may not be able to honor deposits, they may rush to withdraw their money before other customers do, triggering a run. The bank may fail and some people may lose their deposits. If this is repeated widely, a general loss of confidence in the financial sector can occur. Since fear is not always a rational process, even a solvent bank could suffer a run that mushrooms into a broad financial panic. Such a crisis of confidence could squeeze liquidity throughout the banking system, causing a contraction in credit that harms broad economic activity.

If such a banking panic occurs, the economy settles in a bad equilibrium. But if there is no broad crisis of confidence in the financial system, the economy may settle in a good equilibrium. Clearly, confidence can ultimately dictate the outcome. Economists use what are called models of multiple equilibriums to describe this process. In these models, the economy can settle in different resting points. The level of confidence becomes one variable that can determine which one of these points the economy settles in. Banking crises often triggered sharp and deep downturns in the 19th and early 20th centuries. The creation of the Federal Reserve in 1913 as a lender of last resort and the introduction of deposit insurance in 1933 greatly reduced runs in the banking sector. However, confidence continues to play an important role. It was crucial during the 2007–2008 financial crisis when investors worried about which financial institutions were solvent. Investment banks and other nonbanks were particularly vulnerable because they did not have the option of emergency borrowing from the Federal Reserve through the discount window. Confidence is also a vital factor in the current European debt crisis as investors consider the possibilities of sovereign defaults.

Over the past 10 years, macroeconomists have noted that confidence can also affect the economy if it is related to developments that might influence future economic performance. For instance, confidence could increase because of the emergence of innovative technologies that potentially boost future productivity and economic growth, as in the late 1990s or the 1920s. However, because such information is often very noisy, people may end up overreacting to it by being either too optimistic or pessimistic (see Jaimovich and Rebelo 2007). In macroeconomic models, this information changes people’s expectations about the future and thus their current economic decisions. Since it often takes time to deploy workers and build capital stock, businesses will add jobs and boost investment today in anticipation of future economic growth (see Den Haan and Kaltenbrunner 2009). In this way, optimism about the future can lead to an economic boom today, along the lines suggested by Pigou. But the boom may ultimately lead to a bust if new developments fail to fulfill the original expectations and sentiment sours.

Recent empirical work

Figure 1

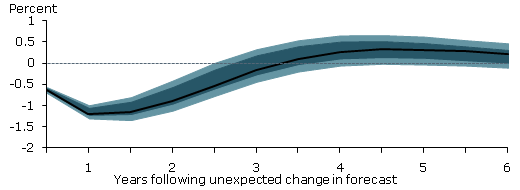

Responses to an unexpected fall in the unemployment rate forecast

A. Actual unemployment rate

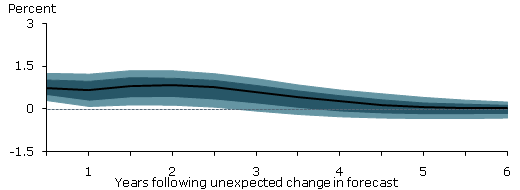

B. Inflation rate

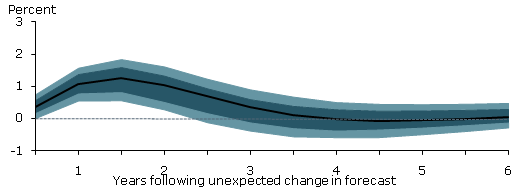

C. Short-term interest rate

Note: Figures are generated from a six-variable system with the forecast of the 12-month-ahead unemployment rate, the actual unemployment rate, the inflation rate, stock prices, and the 10-year and 3-month Treasury rates. The system is estimated over

the period 1960 to 2009.

The role of confidence as a source of business cycle fluctuations remains controversial partly because it is difficult to measure its importance empirically. Clearly, confidence reacts to a host of economic developments. Identifying a causal link between confidence and economic performance is therefore challenging. Is confidence higher because the economy is booming or vice versa?

In an influential paper that emphasizes the role new information and changes in expectations play in driving economic fluctuations, Beaudry and Portier (2006) use statistical methods to identify the economic impact of news affecting future productivity growth. They find that expectations of higher productivity have substantial effects, boosting current consumption, investment, and real GDP, and pushing stock prices higher in a pattern reminiscent of the 1990s. Moreover, they find that such news significantly drives business cycle fluctuations, accounting for more than 40% of changes in consumption, investment, and hours worked.

Another way to assess how confidence affects economic activity is to look at surveys of professional forecasters. The surveys directly measure expectations, providing unique insights into how confident respondents are about future economic performance. Survey timing can be used to examine how changes in expectations affect the economy (see Leduc and Sill 2010 and Leduc, Sill, and Stark 2007). Since we know when surveys were conducted, we know what information was available when the forecasts were prepared. Clearly, forecasts can’t be affected by data that haven’t been released. On the other hand, forecasts can affect future data. We can therefore use the dates of data releases to help assess how changes in expectations affect economic performance.

The three panels in Figure 1 examine the Livingston Survey, which compiles professional forecasts twice a year. The panels show how a fall in the survey’s median forecast of the unemployment rate correlates with the actual rates of unemployment and inflation, and a short-term interest rate. The black solid lines represent the response of a given variable, while the shaded areas are confidence bands that indicate how much confidence we can have that the mean response is different from zero. The figure demonstrates that optimism about economic performance about a year ahead leads to a significant pickup in activity today, represented by a fall in the actual unemployment rate and a rise in the inflation rate.

Monetary policy

Periods of the kind of strong confidence that drives economic booms have repeatedly generated criticisms that monetary policy fueled excessive levels of optimism by keeping policy overly accommodative. For instance, theoretical work by Christiano, Motto, and Rostagno (2006) suggests that central banks that focus heavily on inflation may end up stoking confidence-driven booms. In their model, expectations that good times are ahead lead to upward pressure on real wages as the demand for labor increases. If nominal wages adjust slowly, pressures develop for prices and the inflation rate to fall. As inflation declines below their target rate, policymakers respond by lowering interest rates. In this way, they end up fueling the boom.

The evidence presented in panel C of Figure 1 suggests instead that historically, following an increase in confidence, monetary policy becomes more restrictive as the short-term policy interest rate rises. Monetary policy attempts to damp the boom by leaning against the rise in economic activity and inflation generated by rising expectations. Similarly, a wave of pessimism translates into a more accommodative monetary stance, as the economy weakens and inflation declines.

Conclusion

The boom-and-bust cycles in the United States and other parts of the world over the past two decades and the stock market collapses in 2000 and 2008 have prompted macroeconomists to take another look at the extent to which confidence, optimism, and changes in expectations may drive and amplify business cycle fluctuations. Recent empirical work indicates that these sentiments contribute significantly to economic ups and downs. Typically that means monetary policy remains accommodative when weakness in confidence becomes entrenched.

References

Beaudry, Paul, and Franck Portier. 2006. “Stock Prices, News, and Economic Fluctuations.” American Economic Review 96(4), pp. 1293–1307.

Christiano, Lawrence, Roberto Motto, and Massimo Rostagno. 2006. “Monetary Policy and Stock Market Boom-Bust Cycles.” Manuscript.

Den Haan, Wouter, and Georg Kaltenbrunner. 2009. “Anticipated Growth and Business Cycles in Matching Models.” Journal of Monetary Economics 56(3), pp. 309–327.

Jaimovich, Nir, and Sergio Rebelo. 2007. “Behavioral Theories of the Business Cycle.” Journal of the European Economic Association (April-May), pp. 361–368.

Leduc, Sylvain, and Keith Sill. 2010. “Expectations and Economic Fluctuations: An Analysis Using Survey Data.” FRBSF Working Paper 2010-09.

Leduc, Sylvain, Keith Sill, and Tom Stark. 2007. “Self-Fulfilling Expectations and the Inflation of the 1970s: Evidence from the Livingston Survey.” Journal of Monetary Economics 54(2), pp. 433–459.

Pigou, Arthur C. 1927. Industrial Fluctuations. London: MacMillan and Co., p. 29.

Keynes, John Maynard. 1936. The General Theory of Employment, Interest, and Money. New York: Harcourt, Brace, and Company, pp. 321–322.

Opinions expressed in FRBSF Economic Letter do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System. This publication is edited by Anita Todd and Karen Barnes. Permission to reprint portions of articles or whole articles must be obtained in writing. Please send editorial comments and requests for reprint permission to research.library@sf.frb.org