During the recent recession, unemployment duration reached levels well above those of past downturns. Duration has continued to rise during the uneven economic recovery that began in mid-2009. Elevated duration reflects such factors as changes in survey measurement, the demographic characteristics of the unemployed, and the availability of extended unemployment benefits. But the key explanation is the severe and persistent weakness in aggregate demand for labor.

Unemployment duration—the length of time that workers are unemployed—reached alarming levels during the recent recession and showed little or no sign of easing through late 2011. The comparison between the recent downturn and the 1981-82 recession is particularly stark. Although the unemployment rate peaked at a higher level in the 1981–82 recession, the average duration of unemployment has been running much higher in the recent episode. Prolonged spells of unemployment cause substantial hardship. People who are unemployed for a long time struggle not only with a loss of financial well-being, but also with a likely deterioration of their re-employment prospects.

In this Economic Letter, we examine unemployment duration in detail, considering why it has been so high in the recent recession and recovery. Although changes in the measurement of duration and demographic characteristics of the unemployed have contributed to rising unemployment duration over the past few decades, the recent spike is due primarily to the combination of massive job losses and a subsequent recovery marked by weak job growth.

Measures of long-term unemployment

Estimates of unemployment duration are based on data from the Current Population Survey (CPS), a monthly poll of 60,000 households conducted by the U.S. Census Bureau for the Bureau of Labor Statistics (BLS). The CPS is the source of official labor force statistics, such as the unemployment rate. Individuals who are identified as unemployed—people without a job who are actively seeking one, or those on temporary layoff—are asked to report the number of weeks they have been unemployed.

The CPS duration measure has undergone several changes in the maximum recorded value allowed. In January 1994, the maximum was increased from 99 weeks to approximately 117 weeks. A further increase to a maximum of five years was introduced at the beginning of 2011. The 1994 survey changes also included a questionnaire adjustment that slightly raised measured unemployment duration for individuals who are unemployed in consecutive survey months (see Valletta 2011).

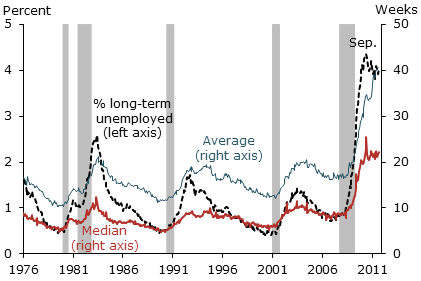

Figure 1

Measures of unemployment duration

Note: Data are seasonally adjusted. Percent of long-term unemployed is the number unemployed for more than six months as a share of the labor force.

Sources: BLS and authors’ calculations

Figure 1 plots three series based on reported unemployment duration from the CPS: average duration; median duration; and the incidence of long-term unemployment, that is, the number of workers unemployed for longer than six months expressed as a share of the labor force. All three series have reached unprecedented highs for the post-World War II period. Average and median duration reached levels about twice as high as their peaks in the early 1980s downturn, even though the peak unemployment rate in the earlier recession was 10.8% compared with 10.1% in the 2007–09 recession. Similarly, the long-term unemployed as a percentage of the labor force reached a high of about 4.4% in mid-2010 and hovered around 4% during much of 2011, well above the high of 2.6% in the early 1980s. Since early 2010, the long-term unemployed have consistently accounted for about 40–45% of all unemployed individuals.

The increase in average duration in 2011 partly reflects the impact of the recent measurement change, which raised the average duration of unemployment by about three weeks as of June 2011 (see U.S. BLS 2011). However, three weeks is small relative to the elevated average duration noted above. This suggests that factors affecting the labor market itself, not changes in measurement, are primarily responsible for the increase in unemployment duration over the past few years.

Sources of rising duration

The changing demographic characteristics of the labor force are one potential source of rising unemployment duration. For example, workers under the age of 24 tend to experience short unemployment durations despite high unemployment rates because they frequently move in and out of the labor force. The substantial decline in the labor force share of young workers over the past three decades caused unemployment duration to rise independent of economic conditions. Aaronson, Mazumder, and Schechter (2010) assessed the contribution of changes in age and other workforce characteristics, concluding they could account for only a small portion of the higher duration observed in 2009 compared with the early 1980s recession.

Another factor that may help explain the recent surge in duration is the extension of unemployment insurance (UI) benefits from the normal 26 weeks to a maximum of 99 weeks for most eligible workers. This program was authorized from late 2009 through 2011, and recently extended for several additional months into 2012. However, estimates from Aaronson et al. and other research (see Daly et al. 2011 and Rothstein 2011) suggest that the contribution of extended UI to prolonged durations has been modest.

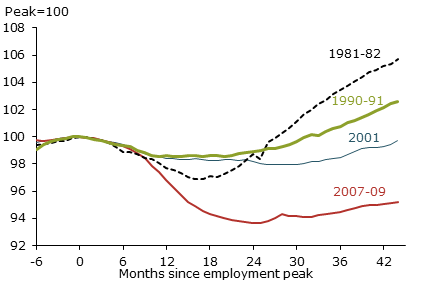

Figure 2

Nonfarm employment relative to pre-recession peak

Sources: BLS and authors’ calculations.

The limited impact of workforce characteristics and extended UI suggests that other factors bear primary responsibility for the recent spike in unemployment duration. The most obvious one is the severity and persistence of employment losses compared with past recessions. Figure 2 shows employment patterns during and after the last four U.S. recessions, in each case measured relative to the pre-recession employment peak. At the recent employment trough in early 2010, employment was down 6.3%, compared with a cumulative decline of less than half that during the early 1980s. Moreover, employment has recovered little following the trough, growing on net by less than two percentage points through late 2011. That’s about 10 percentage points below the growth path from the early 1980s recession.

It is likely that the recent pattern of massive job losses and a weak jobs recovery is the primary explanation for elevated unemployment duration. The contribution of these elements can be examined more formally by performing a regression, a standard statistical technique for measuring the relationships among variable factors. We follow the approach of Aaronson et al. (2010), who calculate the extent to which rising duration can be explained by changes in characteristics of the workforce. We extend their approach by incorporating measures of cumulative employment losses. For each month of CPS data on individual unemployment duration, we calculate the percentage change in payroll employment relative to the pre-recession peak and include it as an explanatory variable in our statistical exercise. We use payroll employment for each individual’s state of residence for this calculation (see Valletta 2011). The data used are for periods covering the latest recession and its aftermath, and the corresponding periods from the early 1980s recession. These are matched by counting months forward from the pre-recession employment peak. The recent duration data are adjusted for the 1994 and 2011 changes in survey measurement.

The results of this exercise indicate that changes in workforce characteristics and cumulative employment losses largely explain the excess unemployment duration of recent years compared with the early 1980s. For example, 15.7 extra weeks of unemployment duration are observed for the 12 months ending in August 2011 compared with the corresponding period ending in January 1985. Of that, slightly over a fourth, or 4.1 weeks, is accounted for by changes in workforce characteristics. Nearly a half, 7.5 weeks, is accounted for by the greater extent and persistence of employment losses in the recent recession. The remaining unexplained portion of about 4.1 weeks is only slightly larger than the estimated 3.5-week effect of extended UI discussed in Daly et al. (2011).

These results strongly suggest that weak labor demand plays a key role in prolonged unemployment duration. But they do not directly disprove explanations related to the supply of labor, such as mismatches between worker skills and employer skill needs. Mismatches may cause available jobs to go unfilled and thereby hold down employment growth. In this case, our variable measuring cumulative employment losses reflects labor supply frictions as well as weak demand.

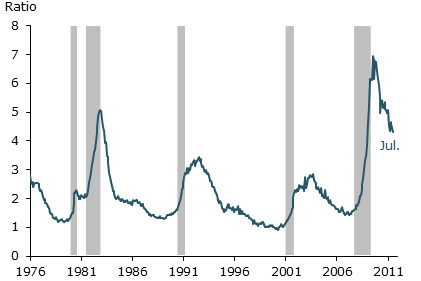

Figure 3

Ratio of unemployment to vacancies

Sources: BLS and authors’ calculations.

We can separate supply and demand factors by incorporating a direct measure of labor demand into the analysis to replace our employment growth measure. Our direct measure of labor demand is job vacancies, essentially the hiring employers want to do rather than the hiring they actually do. The number of job vacancies is available in the BLS Job Openings and Labor Turnover Survey (JOLTS) data available for months beginning in December 2001 (see Valletta 2005 for a method of estimating the number of vacancies for prior periods). We use the ratio of the number of unemployed individuals to the total number of job vacancies at the national level to measure labor market tightness or net demand. The higher the ratio, the weaker is the demand for labor relative to available supply.

Figure 3 displays the series. After reaching a post–World War II peak close to 7 in 2009, the ratio has declined somewhat. But, through July 2011, it has been only slightly below the peak reached in 1982. When this variable replaces cumulative employment declines in our statistical analysis, the results suggest an even larger role for weak aggregate labor demand. The ratio of the total number of unemployed workers to job vacancies accounts for about 11.5 weeks of the 15.7 extra weeks of duration in 2010–11, explaining virtually all the increase in duration when workforce characteristics are also taken into account.

Conclusions and implications

The analyses discussed here suggest that weak labor demand is the primary explanation for prolonged unemployment duration observed in the recent recession and recovery. The weak recovery of employment is similar to the jobless recoveries that followed the 1990–91 and 2001 recessions. This suggests that the labor market has changed in ways that prevent the cyclical bounceback in the labor market that followed past recessions. The shift towards jobless recoveries probably reflects a reduction in temporary layoffs during cyclical downturns. Stricter market incentives to control costs in the face of stiff domestic and international competition may also be factors. In addition, anecdotal evidence suggests that recent employer reluctance to hire reflects an unusual degree of uncertainty about future growth in product demand and labor costs. These special factors are not readily addressed through conventional monetary or fiscal policies. But such policies may be able to offset the central obstacle of weak aggregate demand.

References

Aaronson, Daniel, Bhashkar Mazumder, and Shani Schechter. 2010. “What Is Behind the Rise in Long-Term Unemployment?” FRB Chicago Economic Perspectives 2Q/2010, pp. 28–51.

Daly, Mary C., Bart Hobijn, Aysegul Şahin, and Robert G. Valletta. 2011. “A Rising Natural Rate of Unemployment: Transitory or Permanent?” FRBSF Working Paper 2011-05, forthcoming in Journal of Economic Perspectives.

Rothstein, Jesse. 2011. “Unemployment Insurance and Job Search in the Great Recession.” Brookings Papers on Economic Activity, fall, forthcoming.

U.S. Bureau of Labor Statistics. 2011. “Changes to Data Collected on Unemployment Duration.” Labor Force Statistics from the Current Population Survey.

Valletta, Robert G. 2005. “Why Has the U.S. Beveridge Curve Shifted Back? New Evidence Using Regional Data.” FRBSF Working Paper 2005-25.

Valletta, Robert G. 2011. “Rising Unemployment Duration in the United States: Composition or Behavior?” Unpublished manuscript, April.

Opinions expressed in FRBSF Economic Letter do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System. This publication is edited by Anita Todd and Karen Barnes. Permission to reprint portions of articles or whole articles must be obtained in writing. Please send editorial comments and requests for reprint permission to research.library@sf.frb.org