The overall effect of the global financial crisis on emerging Asia was limited and short-lived. However, the crisis affected some countries in the region more than others. Two main crisis transmission channels, exposure to U.S. financial markets and reliance on manufacturing exports, determined how severely countries in the region were affected. Countries that were relatively less connected to global financial markets and relied less on trade fared better and recovered more quickly than countries that were more dependent on global financial and trade markets.

When the global financial crisis erupted in the summer of 2007, its spread was limited initially to the financial sectors of the United States and other advanced economies. After Lehman Brothers collapsed in the third quarter of 2008, the crisis became more widespread. During this time, the gross domestic product of the United States and western European countries fell from pre-crisis growth rates of around 3% to below zero. Yet, many emerging Asian countries were relatively unaffected, with annual GDP exceeding 5%. Most of the region did not feel the effects of the financial crisis until late 2008 and early 2009. Even after that, the impact on the region overall was less severe than on the rest of the world. Most countries bounced back relatively quickly (Tille 2011, Goldstein and Xie 2009).

Countries in emerging Asia were probably less exposed to the financial crisis than countries with more mature economies because these countries had adopted relatively conservative financial practices after the 1997–98 Asian financial crisis (Hale 2011). In addition, stimulus policies in emerging Asia were quite aggressive, which fostered fast recoveries.

Still, even with these elements in place, emerging Asia was not spared from the repercussions of the global crisis. The effects spread to the region through two important external channels. First, the collapse of asset prices in mature financial markets affected financial institutions worldwide, including those in Asia. Second, global trade declined in the second half of 2008 at the fastest rate since World War II. Because many Asian countries rely heavily on exports for economic growth, the decline in export demand had an immediate effect. Once asset prices and trade began to recover worldwide, so did emerging Asia’s economies.

However, a close look at the data suggests that these two channels did not affect all countries in emerging Asia equally. In this Economic Letter, we consider possible reasons for different responses. We find that Asian economies that were less exposed to U.S. financial securities and less reliant on exports of manufactured goods were less affected by the crisis.

Two different stories of crisis in emerging Asia

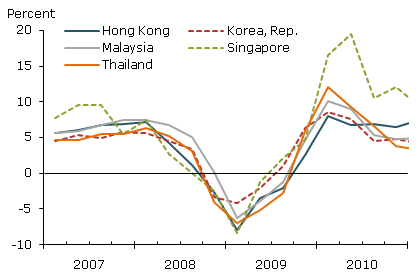

Figure 1

Year-over-year real GDP growth

A. Storm-tossed countries

B. Smooth-sailing countries

Sources: Bloomberg, FAME database.

To explore the divergent responses of emerging Asian economies to the financial turmoil of 2007–09, we study how well 10 countries weathered the crisis. We divide the countries into two groups according to their quarterly real GDP growth rates since the beginning of the episode. One group of “smooth-sailing” countries, including China, India, Indonesia, the Philippines, and Vietnam, was affected relatively less by the crisis. Another group of “storm-tossed” countries, including Hong Kong, Malaysia, Singapore, South Korea, and Thailand, suffered more.

Figure 1 plots GDP growth for these two groups. During the first quarter of 2009, after the crisis had intensified globally, overall Asian GDP growth hit a low point. The average GDP growth rate for the 10 countries in our sample fell to –1.3%. However, the storm-tossed countries in panel A fell much deeper, declining by –6.7%. By contrast, panel B shows that none of the smooth-sailing countries experienced a negative growth rate during the crisis. In fact, during the first quarter of 2009, these countries averaged a robust growth rate of 4.1%.

Researchers have analyzed a number of possible causes for these cross-country differences (see Rose and Spiegel 2009, Berkmen et al. 2009, and Lane and Milesi-Ferretti 2010). Their work cites a country’s relative exposure to U.S. assets and its reliance on trade as important factors. We focus on both of these explanations to explain cross-country differences. Other possible explanations include the quantity of foreign reserves a country holds and the extent to which foreign investment slows. However, we do not find these factors to be useful in explaining the differences in GDP growth between the storm-tossed and smooth-sailing countries.

Holdings of U.S. assets

One major cause of the global crisis was the collapse of the U.S. subprime mortgage loan market. Because emerging Asian countries held relatively few U.S. subprime and asset-backed securities compared with other developed economies, they were shielded from this direct channel of crisis transmission. However, emerging Asian countries were exposed to the U.S. crisis through their substantial holdings of other U.S. assets, as Goldstein and Xie (2009) note. Thus, we would expect that countries that were more exposed to U.S. assets would be more affected by the crisis.

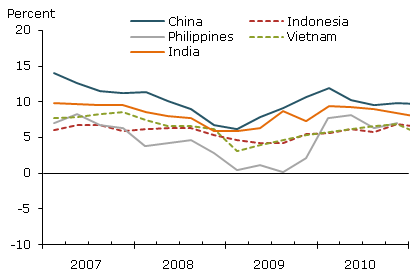

Figure 2

U.S. securities holdings vs. change in GDP growth

Sources: U.S. Treasury, World Bank, Bloomberg.

Figure 2 shows the level of U.S. securities other than those issued by the U.S. Treasury held by emerging Asian countries in 2007. For each country, holdings of U.S. securities are measured as a percentage of GDP and plotted against the change in real GDP growth between the first quarter of 2008 and the first quarter of 2009, the worst period of the crisis.

On average, the storm-tossed countries’ holdings of U.S. securities equaled 27.8% of GDP, compared with 4.3% for the smooth-sailing countries. This disparity is mainly driven by Hong Kong and Singapore, which respectively held U.S. securities equal to 39.2% and 79.6% of GDP. But, even for the other storm-tossed countries, a negative relationship is evident between exposure to U.S. assets and GDP growth during the worst part of the crisis. The countries that were more exposed to U.S. financial markets experienced relatively larger declines in economic growth. Even though Singapore, Hong Kong, and Malaysia held more foreign reserves as a share of GDP than other emerging Asian countries, this cushion did not protect them from losses on their exposure to U.S. assets.

Collapse in world trade

We also find that trade was an important transmission channel for the crisis. Trade has become an important driver of economic growth for emerging Asian economies in recent decades. Many countries have based their growth strategies on exports. This has led to high trade growth and given these countries an increased share of world trade (IMF 2007). Much of this growth has resulted from increased trade with regional partners. This regional trade growth reflects the fact that different countries in emerging Asia export intermediate goods at various stages of production.

However, final goods are still exported predominantly to Europe and the United States, which means that Asian exports are sensitive to demand from industrial countries. Thus, a decline in exports of final goods was one major channel through which Asian economies felt the effects of the global crisis. For example, at the end of 2007, more than 70% of China’s consumer goods exports went to the United States and the European Union. As the recession deepened in industrial countries, consumer demand collapsed, especially for manufactured durable goods.

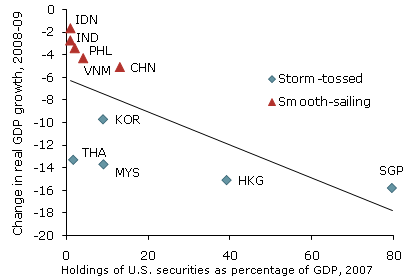

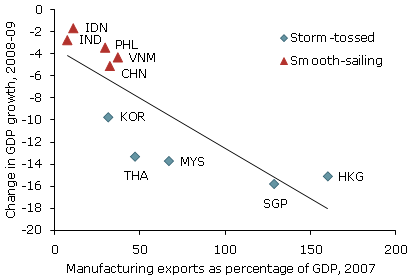

Figure 3

Manufacturing exports vs. change in GDP growth

Sources: World Trade Organization, World Bank, Bloomberg.

Goldstein and Xie (2009) point out that demand for manufactured exports is highly sensitive to income and wealth effects. Consequently, during the U.S. and European recession, when income fell and consumer wealth declined because of the collapse in asset values, demand for durable goods dropped sharply. At the same time, the banking sectors in industrial countries tightened credit. The volume of goods shipped internationally declined in part because some importers could not get the credit they needed to pay for shipments. We would expect that the resulting global collapse in international trade would have a larger impact on those emerging Asian countries that relied more heavily on exports for economic growth.

Figure 3 plots the relationship between manufactured goods exports as a share of GDP against the change in real GDP growth between the first quarter of 2008 and the first quarter of 2009. For the storm-tossed countries, manufacturing exports averaged 86.8% of GDP, compared with 23.7% of GDP for the smooth-sailing countries. Hong Kong, Singapore, and Malaysia have the highest share of manufacturing exports relative to GDP (159.9%, 128.5%, and 67%, respectively). These countries also had the largest declines in real GDP growth: –15.1% for Hong Kong, –15.8% for Singapore, and –13.7% for Malaysia. Thus, countries that relied more heavily on exports of manufactured goods were hit harder by the crisis.

Conclusion

While the financial crisis of 2007–09 spread globally, its effects were not felt evenly across countries. Emerging Asia fared relatively better than the rest of the world, but it was not spared. Moreover, within the region two different stories emerged. In terms of economic growth, the effects of the crisis were especially mild in China, India, Indonesia, the Philippines, and Vietnam. By contrast, the effects were more severe in Hong Kong, Korea, Malaysia, Singapore, and Thailand. We find that these differences are explained in part by two important channels of contagion during the crisis: global financial markets and trade. Of course, these may not have been the only reasons for the differences between the smooth-sailing and storm-tossed countries. For example, monetary and fiscal policy responses within these countries may have contributed to their divergent paths. In addition, the quantity of foreign reserves they held may have had some effect.

Importantly, our conclusion regarding financial and trade channels does not warrant a call for limiting a country’s openness to global markets. In most cases, international trade and openness to international capital are the same channels that allowed countries in emerging Asia to grow fast in the first place. The fact that countries that relied more heavily on global financial and goods markets were more vulnerable to fluctuations in those markets cuts both ways. When global demand and asset prices soared, these countries did well. Likewise, when global demand and asset prices faltered, these countries suffered. Emerging Asia’s storm-tossed countries recovered to their pre-crisis GDP growth levels by early 2010. This rapid rebound indicates that the costs of trade and open financial markets were relatively limited for countries where economic fundamentals were in order.

References

Berkmen, Pelin, Gaston Gelos, Robert Rennhack, and James P. Walsh. 2009. “The Global Financial Crisis: Explaining Cross-Country Differences in the Output Impact.” IMF Working Paper 09/280.

Goldstein, Morris, and Daniel Xie. 2009. “The Impact of the Financial Crisis on Emerging Asia.” In Asia and the Global Financial Crisis, eds. Reuven Glick and Mark Spiegel. San Francisco: Federal Reserve Bank of San Francisco.

Hale, Galina. 2011. “Could We Have Learned from the Asian Financial Crisis of 1997-98?” FRBSF Economic Letter 2011-06 (February 28).

International Monetary Fund. 2007. “The Evolution of Trade in Emerging Asia.” Regional Economic Outlook: Asia and Pacific (October).

Lane, Philip R., and Gian Maria Milesi-Ferretti. 2010. “The Cross-Country Incidence of the Global Crisis.” IMF Working Paper 10/171.

Rose, Andrew K., and Mark Spiegel. 2009. “Predicting Crises, Part II: Did Anything Matter (to Everybody)?” FRBSF Economic Letter 2009-30 (September 28).

Tille, Cedric. 2011. “Sailing through the Storm? Capital Flows in Asia during the Crisis.” Hong Kong Institute for Monetary Research Working Paper 20/2011.

Opinions expressed in FRBSF Economic Letter do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System. This publication is edited by Anita Todd and Karen Barnes. Permission to reprint portions of articles or whole articles must be obtained in writing. Please send editorial comments and requests for reprint permission to research.library@sf.frb.org