U.S. labor market conditions have improved over the past few years. But the average duration of unemployment has remained very high, suggesting that job prospects for the long-term unemployed have stagnated. However, a closer look at the data indicates that the incidence of long-term unemployment has declined over the past few years, and that job prospects for the long-term unemployed are not as downbeat as the average duration data suggest.

U.S. labor market conditions reached a low point in late 2009 and early 2010. Since then, the nation’s economy has added 4¾ million payroll jobs and the unemployment rate has fallen by over two percentage points, from 10.0% in October 2009 to 7.8% in December 2012. At the same time though, the average duration of unemployment rose from about 28 weeks to a peak of nearly 41 weeks in late 2011. Since then, it has dropped only slightly, to 38 weeks. Persistently high unemployment duration in the face of an improving labor market raises the possibility that a significant share of current joblessness is structural, or essentially permanent, in nature.

This Economic Letter examines in detail unemployment duration, the characteristics of the long-term unemployed, and their prospects of finding a job. While unemployment duration remains near historical highs, the characteristics of the long-term unemployed and their recent job-finding rates suggest that a sustained cyclical recovery will largely eliminate long-term joblessness.

Measuring unemployment duration

Estimates of unemployment duration are based on data from the Current Population Survey (CPS), a monthly survey of 60,000 households conducted by the U.S. Census Bureau for the Bureau of Labor Statistics (BLS). The CPS is the source of official labor force statistics, such as the unemployment rate. Individuals who are identified as unemployed—that is, people without a job who are actively seeking work, or on temporary layoff—are asked to report the number of weeks they have been unemployed. Their responses provide information on the length of unemployment spells, or unemployment duration.

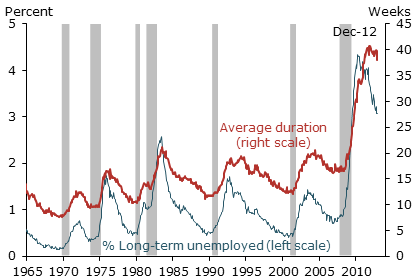

Figure 1

Unemployment duration

Sources: BLS/Haver Analytics and FRBSF calculations. Percent long-term unemployed is the number unemployed for more than six months as a share of the labor force. Gray bars denote NBER recession dates.

The severe job losses during the 2007–09 recession and subsequent weak job growth caused unemployment duration to reach historical highs. Figure 1 displays two measures of unemployment duration: average duration, calculated for the pool of unemployed individuals; and the incidence of long-term unemployment, which is the percentage of people in the labor force who have been unemployed for longer than six months.

One point to note: about three weeks of the increase in average duration over the past few years reflects a change in BLS measurement procedures adopted in early 2011 (U.S. BLS 2011). This change explains only a small portion of the approximate 13-week increase in average duration over the past three years.

Figure 1 shows that, while average duration has remained very high, the incidence of long-term unemployment has fallen significantly since early 2010. This apparent disconnect reflects several key trends over the past few years. Job losses have declined substantially since the peak of the recession. That means a reduction in the number of people who are newly unemployed, whose durations are by definition short. The decline in the number of the short-term unemployed tends to increase the average duration of unemployment. Meanwhile, job creation has remained sluggish. As a result, people who have been out of work a very long time represent a rising share of the unemployed. For example, the unemployment share of those who have been out of work 99 weeks or more rose from about 6% in late 2009 to 14% in late 2012. This shift towards very long-term unemployment also tends to increase average duration.

At the same time, as average duration has risen, job losses and the overall unemployment rate have declined. This general improvement in the labor market over the past few years has reduced the absolute number and labor force share of both the long-term and short-term unemployed, even as average duration for the pool of unemployed individuals increases.

Although the incidence of long-term unemployment has dropped, it remains abnormally high well into the economic recovery, creating substantial hardship for many people. Sustained long-term joblessness may reflect factors that will keep the unemployment rate high even after the economy has fully recovered. To investigate this question, this Letter examines the composition and persistence of long-term unemployment in more detail.

Who are the long-term unemployed?

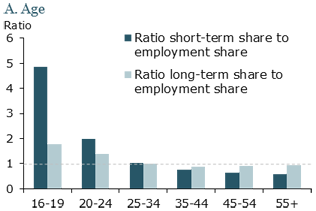

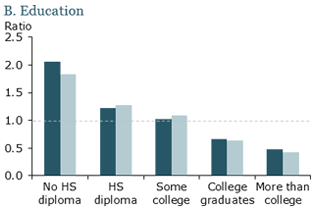

Figure 2

Short-term and long-term unemployment shares by characteristic

Source: Author’s calculations using CPS data (January 2012 to December 2012).

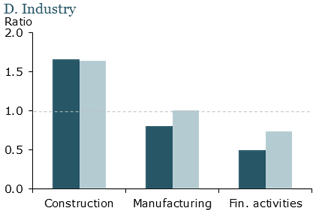

Figure 2 uses CPS data for the 12 months of 2012 to look at unemployment duration according to the age, education, and race/ethnicity of the jobless, and for three selected industrial sectors: construction, manufacturing, and finance. Unemployment duration is divided into short-term, that is, individuals who have been seeking jobs for six months or less, and long-term, those seeking jobs for more than six months. Each group’s incidence of short-term or long-term unemployment is tabulated and expressed relative to the overall share of civilian employment for that category. A number above 1 indicates that a category is overrepresented relative to its share of overall employment. If particular groups of workers are less likely than average to find jobs within six months, they will have higher relative long-term unemployment shares than short-term shares.

For each category in Figure 2, the first bar represents that category’s share of short-term unemployment relative to its overall employment share. The figure confirms some well-known patterns. Short-term unemployment is most frequent among younger workers, the less educated, nonwhite workers other than Asians, and people who previously worked in construction.

Figure 2 also shows that, for most categories of workers, the share of long-term unemployment differs little from the share of short-term unemployment. The primary exception is younger workers. They have disproportionately high rates of both long-term and short-term unemployment. At the same time though, they are much more heavily overrepresented among the short-term unemployed than among the long-term unemployed.

Older workers, blacks, and individuals whose previous jobs were in the manufacturing or the financial sector have disproportionately higher rates of long-term unemployment compared with short-term unemployment. However, except for blacks, the shares of long-term unemployment for these groups are near or below their overall employment shares. The incidence of long-term unemployment also is relatively evenly distributed across industry sectors not shown in the figure and across broad occupational categories. The incidence varies primarily based on differences in average educational attainment across those sectors or occupational categories.

These long-term unemployment patterns have largely been stable since the recession ended. Aaronson, Mazumder, and Schecter (2010) examined the composition of long-term unemployment in 2009, comparing it with the pre-recession period and the early 1980s downturn. The main difference between their findings and the patterns shown in Figure 2 is a lower incidence of long-term unemployment among workers formerly employed in manufacturing. This is consistent with the solid growth in U.S. manufacturing jobs over the past few years. Overall, the tabulations examined in this Letter and the findings of Aaronson et al. suggest that long-term unemployment is widely distributed across the labor force. This is true both in absolute terms and in comparison with the early 1980s downturn.

Job-finding prospects for the long-term unemployed

A key concern about the long-term jobless is that they may face unusually weak job prospects that will keep the unemployment rate elevated even after the economy has regained the ground lost in the recession. To explore this issue, this Letter looks at job-finding rates for unemployed individuals using CPS micro-data matched across consecutive months. Procedures are followed as outlined by Rothstein (2011) to correct the data for potential reporting errors that may overstate unemployment-to-employment transitions. Suspect transitions are those followed by a return to unemployment in the month immediately following, which suggests random reporting errors. However, the results are similar when uncorrected data are used.

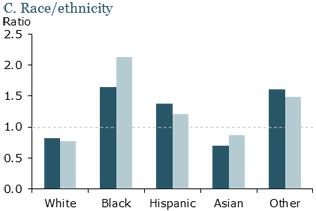

Figure 3

Monthly job-finding rates

(unemployment-to-employment transitions)

Source: Author’s calculations using matched monthly CPS data (corrected following Rothstein 2011). Values in figure smoothed across adjacent duration bins.

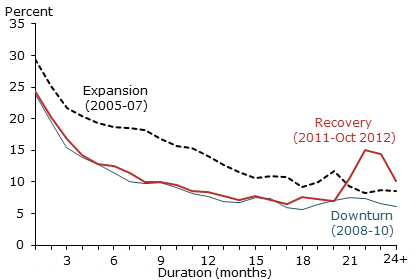

Figure 3 displays job-finding rates over different time horizons for the pre-recession years of 2005–07, the recession and its immediate aftermath in 2008–10, and the ongoing labor market recovery period of 2011 through October 2012, the latest available month of matched, corrected data. Job-finding rates are calculated for each month of unemployment duration. The chart illustrates the well-known phenomenon that job-finding rates decline as unemployment duration lengthens. Such a pattern implies that the long-term unemployed face greater obstacles to finding jobs than the short-term unemployed, which holds in economic expansions as well as downturns. The 2008–10 and 2011–12 lines generally lie below the 2005–07 line, which suggests that job prospects have declined substantially across the duration spectrum since the recession began.

At the same time though, job-finding rates in each period are largely flat for durations beyond about 12-15 months. Moreover, after about 15 months, job-finding rates since the recession have not been substantially different than during the pre-recession period of 2005–07. For the longest duration groups, those out of work for 20 months or more, job-finding prospects appear to have improved since 2010. These results suggest that the long-term unemployed are able to find jobs at rates similar to the past. Importantly, that finding implies that the current elevated level of long-term unemployment is likely to disappear over time (see Elsby et al. 2011).

Conclusions and implications

This analysis suggests that the characteristics of the long-term unemployed in the United States are not unique and that long-term unemployment has started to dissipate as labor market conditions have improved. Nevertheless, long-term unemployment has persisted remarkably in the aftermath of the recession. The unprecedented extension of unemployment insurance (UI) benefits up to 99 weeks from 2009 through mid-2012 appears to have lengthened duration by a small to moderate amount (Rothstein 2011, Daly et al. 2012). This effect has diminished as UI recipients have exhausted their maximum benefits and Congress has scaled back the program. On the other hand, some degree of elevated long-term unemployment may be here to stay. Recent research shows evidence of a modest increase in U.S. structural unemployment since the recession (see, for example, Daly et al. 2012, Elsby et al. 2011). However, this research also suggests that the primary explanation for historically high long-term unemployment is the persistent weakness in overall economic activity and demand for labor.

References

Aaronson, Daniel, Bhashkar Mazumder, and Shani Schechter. 2010. “What Is Behind the Rise in Long-Term Unemployment?” FRB Chicago Economic Perspectives 2Q/2010, pp. 28–51.

Daly, Mary, Bart Hobijn, Ayşegül Şahin, and Robert G. Valletta. 2012. “A Search and Matching Approach to Labor Markets: Did the Natural Rate of Unemployment Rise?” Journal of Economic Perspectives (Summer), pp. 3–26.

Elsby, Michael, Bart Hobijn, Ayşegül Şahin, and Robert G. Valletta. 2011. “The Labor Market in the Great Recession: An Update.” Brookings Papers on Economic Activity 103 (Fall), pp. 353–371.

Rothstein, Jesse. 2011. “Unemployment Insurance and Job Search in the Great Recession.” Brookings Papers on Economic Activity 103 (Fall), pp. 143–209.

U.S. Bureau of Labor Statistics. 2011. “Changes to Data Collected on Unemployment Duration.”

Opinions expressed in FRBSF Economic Letter do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System. This publication is edited by Anita Todd and Karen Barnes. Permission to reprint portions of articles or whole articles must be obtained in writing. Please send editorial comments and requests for reprint permission to research.library@sf.frb.org