Financial markets and professional forecasters expect central banks to hit their inflation targets. But U.S., British, and Japanese consumers expect inflation to be higher. Data suggest that consumers in these countries don’t pay attention to central bank inflation targets and react sluggishly to persistent shifts in the inflation rate. However, the price of oil apparently influences inflation expectations strongly. It’s possible that consumers use highly volatile oil prices in a rule of thumb for updating their inflation expectations.

Monetary policymakers care about the public’s inflation expectations for many reasons. For instance, consumers will find a 5% interest rate far more attractive when they expect inflation to be 5% instead of 2%. So, when policymakers make decisions on interest rates, they need to know how much inflation the public expects. Expectations also provide information about central bank credibility. If an inflation-targeting central bank is credible, the public’s inflation expectations will lie close to the inflation target, especially over a longer time horizon.

Central banks are now taking great pains to spell out the likely path of monetary policy, hoping to influence public expectations and thereby affect the economy. Ample evidence suggests that financial market participants listen to these pronouncements. The Bank of Japan’s announcement in January that it was moving to a 2% inflation target was followed by a drop in the yen and a jump in Japanese stock markets, though more than just the announcement of an inflation target was involved. Professional forecasters have also responded. For instance, the consensus forecast for Japanese inflation in 2014 has increased by close to three-quarters of a percentage point since the beginning of the year.

Financial markets and professional forecasters pay close attention to these announcements. But do consumers? This Economic Letter looks at data on consumer inflation expectations from the United Kingdom, the United States, and Japan to explore this issue.

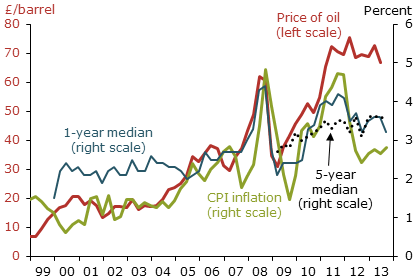

Figure 1

Inflation expectations in the United Kingdom

Note: Price of oil=European Brent Blend crude oil spot price.

Sources: Bank of England/GfK NOP Inflation Attitudes Survey, UK Office for National Statistics, Bloomberg.

Evidence from the United Kingdom

Figure 1 shows British data on median expected inflation and two other variables. The Bank of England has conducted a survey on year-ahead expected inflation since the fourth quarter of 1999. Also shown are longer-term consumer inflation expectations, “say in five years,” according to a survey question asked since 2009. Both measures have been rising in recent years and are currently around 3½%. This compares with the Bank of England’s long-standing official 2% inflation target.

What explains this divergence? Research on U.S. consumers shows that they form expectations based on inflation rates over the past few years and that they are highly sensitive to changes in the price of oil (see Trehan 2011). Figure 1 suggests a similar relationship in Britain. While year-ahead expected inflation was consistently above the four-quarter change in actual inflation from 1999 to 2003, the two have moved quite closely since then. Median expected inflation and the price of oil also move closely together except at the end of the sample period. Statistical analysis confirms these relationships. It shows that more than three-quarters of the variation in expected year-ahead inflation can be explained by recent inflation data and the price of oil.

Thus, long-run expected inflation that exceeds the central bank’s target may not mean that consumers are inattentive. Instead, U.K. inflation expectations could well reflect high oil prices and the fact that inflation has been almost continuously above target since 2005. Consumers may be aware of the central bank’s inflation target, but may question its credibility in view of recent inflation rates.

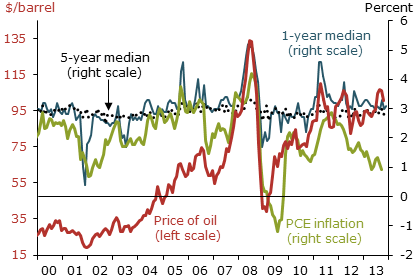

Figure 2

Inflation expectations in the United States

Note: Price of oil=West Texas Intermediate spot oil price from Energy Information Association/Wall Street Journal.

Sources: Thomson Reuters/University of Michigan Surveys of Consumers, Bureau of Economic Analysis, Energy Information Association/Wall Street Journal.

The U.S. caseU.S. inflation recently has evolved somewhat differently from British inflation. Figure 2 shows year-ahead and five- to ten-year-ahead median expected inflation from the Thomson Reuters/University of Michigan Surveys of Consumers. Both year-ahead and long-term expected inflation have been running near 3% for a long time, above the Fed’s 2% target.

But do these expectations reflect recent inflation experience? The personal consumption expenditures price index (PCEPI), based on the same U.S. Commerce Department data series used to estimate gross domestic product, is the Fed’s preferred inflation measure. Figure 2 shows the 12-month PCEPI inflation rate since 2000. Swings in the price of oil, also shown in the figure, have caused notable volatility in inflation. Nevertheless, PCEPI inflation has averaged just 1.8% since the beginning of 2009, below the average over the first half of the sample. But the expectations data show no evidence of a comparable shift. In fact, year-ahead expected inflation has risen in recent years, mirroring the increase in the price of oil. U.S. consumers, like British consumers, seem extremely sensitive to the price of oil. But, unlike in the United Kingdom, inflation has recently been below target. Therefore, U.S. inflation expectations are not high relative to the Fed’s target because consumers are projecting that recent inflation rates will continue.

The Fed’s policy committee, the Federal Open Market Committee (FOMC), first announced a 2% inflation target in January 2012. But the expectations data provide little, if any, evidence that consumers have paid attention to the target. Arguably, the FOMC had an implicit 2% target before the announcement. Clearly though, the Committee saw a benefit in adopting an explicit target, such as a reduction in uncertainty about monetary policy. Therefore, some response in the expectations data should be expected, most likely in the form of a decline in consumer inflation expectations.

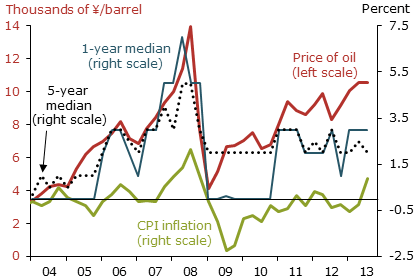

Figure 3

Inflation expectations in Japan

Note: Price of oil=Ministry of Finance Japan Crude Cocktail imported price.

Sources: Bank of Japan Opinion Survey, World Bank.

Last but not least, Japan

Figure 3 plots Bank of Japan survey data starting in 2004. In broad terms, consumer price index inflation measured over four quarters was generally around zero through 2007, but has been below zero almost continuously since 2009. Inflation jumped to around 2% in 2008 and then swung to 2% deflation in 2009, echoing movements in the yen price of crude oil.

The way that consumer expectations respond to the price of oil is surprising. Year-ahead expected inflation rose to 7% when oil prices jumped in 2007–08. Long-term inflation expectations didn’t react as much, but nonetheless the rise was larger than seems reasonable.

Japanese inflation expectations are hard to explain at other times as well. Since late 2010, consumers have been expecting year-ahead inflation to average around 2½% even though the inflation rate has been negative for most of this period. And long-term expectations have been at or above 2% since the first quarter of 2006. By contrast, the Bank of Japan’s medium- to long-term price stability goal was 1% as recently as January.

Did Japanese consumers overpredict future inflation because of significant, unexpected shocks to the inflation rate? The fact that the actual inflation rate over this period was relatively stable suggests that this explanation is incorrect. In fact, the range of actual inflation was noticeably smaller than the range of expected inflation. Moreover, professional forecasters do not appear to have made similar mistakes during this period.

The data are too limited to draw definitive conclusions about how consumers form expectations, but statistical analysis provides some suggestive evidence. Together, recent inflation and the price of oil explain a bit more than three-fourths of the variation in year-ahead inflation expectations. By contrast, these two factors explain only about a quarter of the variation in actual inflation. Long-term inflation expectations are also disproportionately influenced by recent inflation and the price of oil.

The Japanese case is particularly interesting now because in January the Bank of Japan announced major stimulatory measures meant to get the economy out of a deflationary slump. Importantly, the inflation goal of 1% became an explicit target of 2%. These steps together with associated fiscal measures were substantial enough to have been labeled a “regime change” (see Romer 2013). How did consumers react? Consumers now expect 3% inflation in 2014, which has prompted some analysts to conclude that the Bank of Japan’s policy is succeeding (see Sharp 2013). However, Figure 3 shows that inflation expectations have been bouncing between roughly 2% and 3% since 2010. Thus, it may be premature to conclude that the announcement caused consumers to raise their inflation expectations. More fundamentally, since consumer inflation expectations were already above the new inflation target, it is not obvious that a further increase in expected inflation would be evidence that the Bank of Japan’s 2% target announcement has succeeded.

An assessment

Consumer inflation expectations turn out to be above the central bank’s inflation target in all three countries. In the United Kingdom, inflation has been running above target for a while now, which may explain some of the gap. But that is not the case in the United States and especially Japan, where inflation expectations do not appear to have responded fully to relatively long-lasting shifts in the inflation rate. Above-target consumer expectations are ironic since the Fed and the Bank of Japan have been worrying, to different degrees, about deflation.

The data also show that consumer inflation expectations are extremely sensitive to oil prices. Somewhat alarmingly, those expectations seem to be related to the level of oil prices, not the rate of change as economic theory would suggest.

These two characteristics of consumer inflation expectations may be related and could arise from the way consumers form expectations. Rational inattention theory, which emphasizes the costs of processing information, suggests that households may not spend a lot of time and effort rethinking their estimate of the prevailing inflation rate (see Sims 2010). These information processing costs tend to make consumers update their inflation expectations infrequently, especially during periods when inflation is relatively stable. Moreover, instead of using sophisticated models to predict inflation, consumers are more likely to rely on a few simple rules of thumb. Because oil prices are highly volatile, one such rule of thumb could be linked to the price of oil.

The apparent importance of the level of oil prices may be related to this casual way of forming expectations. Consumers may well have been feeling the pinch of rising oil prices over the past few years. In an era of stagnant incomes, they could be equating high oil prices with high inflation, an association that presumably will weaken over time.

By contrast, the evidence indicates that consumers have not reacted much to central bank inflation target announcements in recent years. This insensitivity is at least partly the result of the prevailing low and stable inflation rates and could go away if the behavior of inflation changed significantly. And even if it were long-lived, the insensitivity of consumer inflation expectations to inflation targets or other central bank announcements does not mean that monetary policy cannot influence consumer behavior. There is no doubt that financial market participants react to monetary policy announcements, and those reactions often have important economic effects. As financial markets respond, the resulting changes in asset prices affect consumer behavior. For instance, if a central bank announces that it expects to ease monetary policy in the future, the currency exchange rate would probably drop. That in turn would tend to lead to higher inflation over time, which would affect consumer behavior.

Bharat Trehan is a research advisor in the Economic Research Department of the Federal Reserve Bank of San Francisco.

Maura Lynch is a research associate in the Economic Research Department of the Federal Reserve Bank of San Francisco.

References

Romer, Christina. 2013. “It Takes a Regime Shift: Recent Developments in Japanese Monetary Policy through the Lens of the Great Depression.” Forthcoming in NBER Macroeconomics Annual 2013, volume 28, eds. Jonathan Parker and Michael Woodford. Chicago: University of Chicago Press.

Sharp, Andy. 2013. “Japan Expects 3% Inflation in 2014 in Sign Reflation May Succeed.” Bloomberg.com, July 4.

Sims, Christopher. 2010. “Rational Inattention and Monetary Economics.” In Handbook of Monetary Economics, volume 3, eds. Benjamin Friedman and Michael Woodford. Amsterdam: Elsevier, pp. 155–181.

Trehan, Bharat. 2011. “Household Inflation Expectations and the Price of Oil: It’s Déjà Vu All Over Again.” FRBSF Economic Letter 2011-16 (May 23).

Opinions expressed in FRBSF Economic Letter do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System. This publication is edited by Anita Todd and Karen Barnes. Permission to reprint portions of articles or whole articles must be obtained in writing. Please send editorial comments and requests for reprint permission to research.library@sf.frb.org