China’s household saving rate has risen substantially during the past two decades. Research suggests that increased job uncertainty following reforms and massive layoffs in state-owned enterprises during the late 1990s contributed significantly to the increase. Facing higher unemployment risks after the reforms, workers in state-owned enterprises have tended to save more as a precaution. A recent study estimates that precautionary saving driven by the reforms explains about a third of Chinese urban household wealth accumulation from 1995 to 2002.

In the past two decades, China has experienced double-digit annual economic growth. Equally remarkable is China’s high and rising saving rate. Chinese household savings have doubled from 15% of disposal income in 1990 to about 30% in 2010. This has far-reaching implications for both the Chinese economy and the rest of the world. Many commentators argue that China’s high saving rate reflects financial repression and the lack of a social safety net, and call for structural reforms to encourage more consumption. Others point out that, to the extent that Chinese saving exceeds domestic investment, it shows up as large current account surpluses, contributing to global imbalances (e.g., Bernanke 2006). Understanding the causes of China’s high savings is important for improving the management of China’s domestic economic policy and the coordination of that policy with the rest of the world.

Why do Chinese households save so much? The high and rising saving rate since the 1990s seems particularly puzzling because, during that period, the country has experienced rapid economic growth. According to standard consumption-savings theory, known as the permanent income hypothesis, Chinese households should behave differently, consuming more and saving less in anticipation of higher future wealth.

This Economic Letter examines the precautionary saving motive stemming from the large structural changes that Chinese households have experienced. During the past two decades, China has gone through a dramatic transformation from a closed economy under tight government control to a global economic power with greater reliance on free markets. Structural changes associated with policy reforms have liberated productivity, but have also led to increased job uncertainty. The so-called “iron rice bowl” of cradle-to-grave socialism, with guaranteed lifetime employment and benefits, was gradually abolished. Workers in state-owned enterprises (SOEs) have experienced massive layoffs. All else equal, higher uncertainty leads to more precautionary saving. In recent research, coauthors and I estimated that precautionary savings stemming from job uncertainty following the large-scale SOE reforms in the late 1990s accounted for about one-third of the overall increase in Chinese urban household savings from 1995 to 2002 (see He et al. 2013).

Breaking the iron rice bowl

Before 1978, China’s central planning imposed tight government control over the economy. The government assigned most workers secure jobs in state-owned sectors, with guaranteed benefits, including near-free housing, health care, and pensions. SOE workers were treated essentially the same as workers in the government sector.

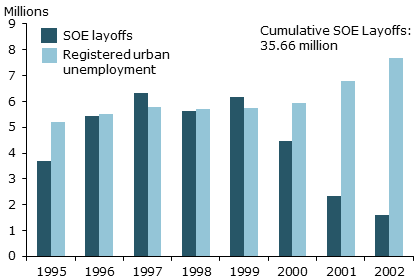

Figure 1

SOE layoffs and registered urban unemployment

Source: China Labor Statistical Yearbook, 1996–2002, and Giles, Park, and Zhang (2005).

The economic reforms and open-door policy that began in the late 1970s and early 1980s started to break the iron rice bowl. China moved gradually from central planning toward greater reliance on free markets. By the mid-1990s, many money-losing SOEs had been closed or privatized. Larger and more profitable SOEs were preserved, but substantially restructured. Many redundant workers were laid off. Between 1995 and 2002, about 35 million SOE workers lost their jobs. Figure 1 shows that during the peak years in the late 1990s, SOE layoffs often exceeded total registered urban unemployment in China. (In China, laid-off SOE workers are not counted as unemployed).

The reforms were limited to the SOE sector and did not lead to material changes in job security or benefits for government workers. The massive SOE layoffs, coupled with reductions in government-provided benefits for SOE workers, fundamentally changed the perception of Chinese urban households about their future job security and income.

Data and methodology

China’s large-scale SOE reforms provide a natural experiment to help identify large and unexpected changes in perceived job uncertainty and income risk. Before the reform, the SOE and government sector were like twins. Workers in both sectors were treated similarly and benefited from the iron rice bowl. After the reform, SOE workers lost the bowl, but government workers kept it. Consequently, we have a treatment group of SOE workers and a control group of government workers, which allows us to study the effects of changes in job uncertainty on precautionary saving.

We use data from the Chinese Household Income Project (CHIP) survey to study the relationship between job uncertainty and precautionary saving. The survey includes data on employment, education, income, expenditures, wealth, and other demographic information for a nationally representative sample of roughly 15,000 households in 1988, 1995, 2002, and 2007 (for details, see He et al. 2013). We focus on urban households in the SOE and government sectors, and restrict our sample to prime-age workers between 25 and 55. We concentrate on the 1995 and 2002 surveys, which mark the beginning and end of the SOE reform episode.

We design a statistical model that links a household’s liquid financial wealth to a measure of permanent income. Financial wealth includes balances in checking accounts, saving accounts, CDs, bonds, stock holdings, business investment, and a housing fund. Permanent income is constructed from the income reported by a household for the past five or six years (this approach is the same as that used in Fuchs-Schündeln and Schündeln 2005). The wealth/income ratio can be interpreted as holdings of financial wealth in years of permanent income, measuring the household’s cumulative savings relative to permanent income.

Similar to the standard model of precautionary savings (for example, Lusardi 1998), the independent variables in our model include a measure of past income risks, a household’s permanent income, and a set of demographic control variables such as age, education, and occupation. Different from the standard model, our model also includes an additional independent variable that indicates whether a household worked in the SOE sector. If the hypothesis of precautionary saving is correct, then we should observe that, all else equal, the SOE reform leads to larger increases in savings for SOE workers than for government workers because the former face greater job uncertainty.

Job uncertainty and precautionary saving: Evidence

Our initial results support the precautionary saving hypothesis. Controlling for other factors, working in the SOE sector or the government sector made no difference for the wealth/income ratio before reforms began in 1995. However, after that time, the difference in saving behavior between SOE workers and government workers is statistically and economically significant. We estimate that, in 2002, the wealth/income ratio of SOE workers was notably higher than that of government workers, with the SOE workers saving just under five months more permanent income than government workers saved.

However, this initial estimation is probably biased downward because our simple model neglects workers’ potential selection of occupations. More risk-averse workers have an incentive to move to less risky occupations. These individuals may also tend to save more because of their aversion to risk, not because of income uncertainty. Thus, after the reform, more risk-averse SOE workers may have wanted to move to the government sector, where jobs were relatively secure. This would push saving in the government sector higher and make the difference in savings between the two sectors smaller. Thus, occupational selection could cause downward bias in the estimated contribution of income uncertainty to precautionary saving (for example, Fuchs-Schündeln and Schündeln, 2005).

To correct for this selection bias, we focus our sample on workers whose jobs were assigned by the government. In our sample, 80% of jobs were assigned by the government in 1995 and 70% in 2002. Since the government makes the final decision on job assignments, workers’ occupations are probably unrelated to their risk attitudes.

After correcting for selection bias, our estimation shows that workers in the SOE and government sectors had comparable saving behavior before the reform in 1995, similar to our finding before correcting for selection bias. However, after the reform, correcting for selection bias causes the estimated difference in savings between SOE and government workers to double. In particular, in 2002, SOE workers saved just under 10 months more of their permanent income compared with government workers.

One could argue that, even after correcting for selection bias, our estimation is still inaccurate because the reform might have also affected household expectations of future income. If expected future income declines, then a household would save more today, although that is because of a pessimistic outlook for the future, not greater uncertainty. In contrast, if a household expects its income to rise, then it would tend to save less today.

To disentangle precautionary saving caused by job uncertainty from saving caused by a pessimistic outlook, we use a question in the 2002 survey that asks households whether they expect their income to increase, decrease, or not change over the next five years, a question that was not in the 1995 survey. By restricting our sample to households that expected their income to increase or stay unchanged, we generate a conservative estimate of precautionary saving stemming from job uncertainty. The estimation implies that, among all workers who expected their income to rise or stay the same, SOE workers on average held about eight months more financial wealth than did government workers in 2002 because of differences in perceived job uncertainty.

Using our results that control for selection and pessimistic outlook, we calculate the contribution of precautionary saving to the overall increase in financial wealth of SOE workers. To do this, we first use our model to predict the value of the financial wealth of all SOE workers. We then compute the value of the financial wealth of an SOE worker whose job security is identical to that of a government worker. The difference between our model’s predicted wealth of an SOE worker and the wealth of an SOE worker with a government-sector level of job security captures the extra savings in the SOE sector stemming from job uncertainty. Our calculation shows that, from 1995 to 2002, precautionary saving contributed about one-third of the increase in overall financial wealth for urban households working in the SOE sector.

Conclusion

An important challenge for estimating precautionary saving is to identify large and unexpected changes in income uncertainty (Carroll and Samwick 1998). We use China’s large-scale SOE reform in the late 1990s as a natural experiment to identify large and unexpected variations in job uncertainty. We then estimate their effects on savings of SOE workers. In our estimation, we correct an occupational selection bias and disentangle savings induced by job uncertainty from savings driven by pessimistic income expectations. We find that breaking the iron rice bowl of SOE workers led to an increase in precautionary saving that contributed about one-third of the total increase in financial wealth held by urban households working in the SOE sector.

Zheng Liu is a research advisor in the Economic Research Department of the Federal Reserve Bank of San Francisco.

References

Bernanke, Ben S. 2006. “The Chinese Economy: Progress and Challenges.” Speech at the Chinese Academy of Social Sciences, Beijing, China (December 15).

Carroll, Christopher, and Andrew Samwick. 1998. “How Important Is Precautionary Saving?” Review of Economics and Statistics 80, pp. 410–419.

Fuchs-Schündeln, Nicola, and Matthias Schündeln. 2005. “Precautionary Savings and Self-Selection: Evidence from the German Reunification ‘Experiment.’” Quarterly Journal of Economics 120(3), pp. 1085–1120.

Giles, John, Albert Park, and Juwei Zhang. 2005. “What Is China’s True Unemployment Rate?” China Economic Review 16(2), pp. 149–170.

He, Hui, Feng Huang, Zheng Liu, and Dongming Zhu. 2013. “Breaking the ‘Iron Rice Bowl’ and Precautionary Savings: Evidence from Chinese State-Owned Enterprises Reform.” FRB San Francisco Working Paper 2014-04.

Lusardi, Annamaria. 1998. “On the Importance of the Precautionary Saving Motive.” American Economic Review, Papers and Proceedings 88, pp. 449–453.

Opinions expressed in FRBSF Economic Letter do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System. This publication is edited by Anita Todd and Karen Barnes. Permission to reprint portions of articles or whole articles must be obtained in writing. Please send editorial comments and requests for reprint permission to research.library@sf.frb.org