Median starting wages of recent college graduates have not kept pace with median earnings for all workers over the past six years. This type of gap in wage growth also appeared after the 2001 recession and closed only late in the subsequent labor market recovery. However the wage gap in the current recovery is substantially larger and has lasted longer than in the past. The larger gap represents slow growth in starting salaries for graduates, rather than a shift in types of jobs, and reflects continued weakness in the demand for labor overall.

Starting wages of recent college graduates have essentially been flat since the onset of the Great Recession in 2007. Median weekly earnings for full-time workers who graduated from college in the year just before the recession, between May 2006 and April 2007, were $653. Over the 12 months ending in April 2014, the earnings of recent college graduates had risen to $692 a week, only 6% higher than seven years ago.

The lackluster increases in starting wages for college graduates stand in stark contrast to growth in median weekly earnings for all full-time workers. These earnings have increased 15% from $678 in 2007 to $780 in 2014. This has created a substantial gap between wage growth for new college graduates and workers overall.

In this Economic Letter we put the wage growth gap in a historical context and consider what is at its heart. In particular, we find that the gap does not reflect a switch in the types of jobs that college graduates are able to find. Rather we find that wage growth has been weak across a wide range of occupations for this group of employees, a result of the lingering weak labor market recovery.

College graduates’ wage growth gap in a historical perspective

We compare wages of recent college graduates to the overall population over time using monthly data at an individual level from the Current Population Survey (CPS). The CPS is used by the Bureau of Labor Statistics (BLS) to calculate the official estimates of the unemployment rate, employment, and median weekly earnings. The CPS does not specifically identify recent college graduates, so we define them as workers who have a college degree and are between ages 21 and 25.

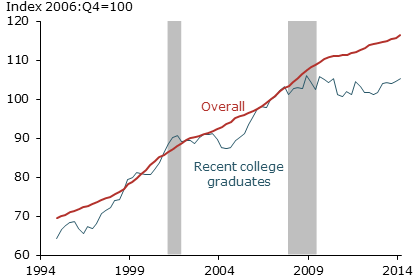

Figure 1 shows a comparison of full-time employees’ median weekly earnings for our CPS measure of recent college graduates and for the overall population, taken from the BLS. We use our results for graduates in the year before the recession began as a benchmark, indexing values to 100 in 2006:Q4. In this way, the lines after that point show by what percent median weekly earnings have grown since the recession started.

Figure 1

Median weekly earnings: Overall vs. recent graduates

Source: BLS/Haver Analytics, CPS, and authors’ calculations.

Typically, at least over the time period shown, the median weekly earnings of recent college graduates have tracked overall earnings relatively well, with some deviation. New graduates tend to exhibit stronger wage growth during economic booms, and slower wage growth in downturns (shown by gray bars) and subsequent recoveries. Put another way, wage growth for recent college graduates tends to fall during recessions and not pick up again until long into recoveries. In this context, the striking pattern we see since the 2007–09 recession is not without precedent. For example, a similar pattern would emerge if Figure 1 ended around the middle of 2005, in the later stages of the labor market recovery after the 2001 recession. Over this period, wage growth for recent graduates appeared to stall for a number of years after the recession, while overall wage growth continued to increase. Although the pattern in that earlier recovery is similar to recent years, wage growth for college graduates in the current recovery has remained flat for a longer period. Furthermore, the gap between the two groups of employees appears to be substantially wider and their paths appear more divergent.

Broad-based weakness in earnings growth

Even though the recent slow wage growth is not unprecedented, its apparent persistence raises the question of why it has remained so slow for so long. We explore two potential explanations. One is that recent graduates are now getting different types of jobs than they were before the recession, particularly jobs typically associated with lower wages and thus lower earnings. If this were true, comparing the occupational distribution of recent graduates before and after the recession should reveal a shift towards low-paid occupations and away from high-paid occupations, with reasonably stable earnings in each group. Another possibility is that recent college graduates are getting jobs in similar occupations as they did before the recession, but within each occupation, growth of starting wages has been slow. If this were the case, we would expect to see similar percentages of recent graduates in each occupation over time, but little wage growth within each occupation. Note that more recent graduates taking part-time jobs, which may generate lower weekly earnings, would not explain the gap in wage growth in Figure 1, which shows only full-time workers.

To explore our two potential explanations, we use the information about each respondent’s major occupation as reported in the CPS. For this and subsequent analysis, we redefine years as May of the prior year through April of the current year; this is to make the groups correspond more closely to annual cohorts of college graduates, who likely graduate starting in May. For example, 2014 runs from May 2013 to April 2014. We report data for three points in time: 2007, a year before the start of the recession; 2011, around the start of the recovery; and 2014, the most recent year of data available.

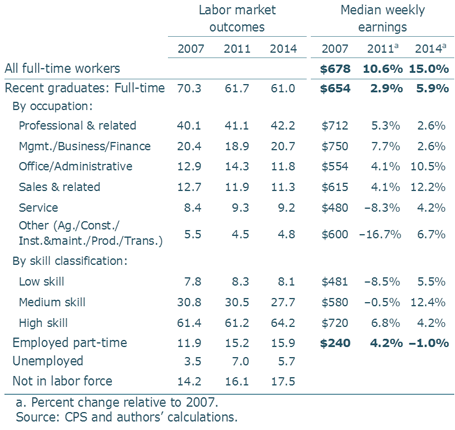

Table 1 presents the shares of recent college graduates employed in major occupations and according to labor market status. Occupational categories for full-time employment are rather broad, but they show recent college graduates were employed in a similar distribution of occupations before and after the recession. Notably, some of the changes between 2007 and 2011 were at least partially reversed by 2014, such as in the categories for professional and related occupations; management, business, and finance; office and administrative occupations; and “other” occupational skill groups, classified roughly according to Autor (2010). Although there have been some notable shifts towards a few categories such as service occupations, occupational distributions have remained generally stable. Next we turn to our second explanation, that recent college graduates are getting the same kinds of jobs, but at lower wages. The right side of the table presents median weekly earnings for recent college graduates. For 2007 the table shows the level of earnings, and the columns for 2011 and 2014 list the percent change relative to 2007. Also shown are overall earnings and earnings for recent graduates working part-time. With few exceptions, wage growth has been limited in all occupational groups for recent graduates. Note that professional and related occupations and management, business, and finance, which are the two most popular categories for recent graduates, have seen particularly low wage growth. The table also shows that earnings for recent graduates working part-time have fallen since the start of the recession, due to a combination of fewer hours worked and lower hourly wage growth.

Table 1

Recent graduates in occupations, labor markets

Thus, while comparing occupational distributions across years indicates some stability, there is a clear pattern of low earnings growth for most categories. In fact, for almost all occupations and skill groups for which we have enough data to compare recent graduates to all others, we find that recent graduates experienced lower wage growth than other workers.

It turns out that the sluggish wage growth of recent college graduates is fully accounted for by the slowdown in wage growth across occupations. When we calculate a change in wages by keeping the types of jobs held by recent graduates fixed at their 2007 occupational composition, we find that wage growth is exactly the same as when we use the actual distribution.

Macroeconomic and individual-level implications

The broad-based weakness in earnings growth for recent college graduates has both larger economic and individual-level implications.

The wage growth gap points to continued weakness in the overall labor market. This is largely because recent college graduates are the “marginal” high-skilled workers in the economy, who are not protected by factors that make other workers’ wages rigid and slow to adjust to conditions such as recessions (see Hobijn, Gardiner, and Wiles 2011, who argue that this labor market weakness is cyclical rather than structural). Because the wages of recent college graduates are less affected by wage rigidity, they are a good indicator of the true price of labor and thus of the underlying state of the labor market.

Other signs of the continued weakness in the labor market are the shares of recent graduates not in the labor force, unemployed, or working part-time, which are still elevated compared with the start of the recession (see bottom of Table 1).

At the individual level, the persistent wage growth gap has implications for both recent graduates and potential graduates. Potential graduates, seeing the difficulties faced by current graduates in finding any job, particularly a full-time job, might interpret this as a signal that it is not worth going to college. However, recent evidence suggests that this is a misguided conclusion. It is important to note that the relevant metric for the returns of a college education accounts for the cost of education in comparing the earnings of college graduates relative to the earnings of nongraduates.

Low growth in starting wages does not mean that going to college is a poor investment. It just reflects that it will take longer to recoup the cost of the college education for current graduates. Supporting this idea, Kahn (2010) finds that those who graduate from college during a recession have lower earnings than other grads, even many years in the future. Taking into account the relative costs and benefits of a college education, Daly and Bengali (2014) find that a college education is still a very worthwhile investment, it may simply have relatively lower returns and take longer to pay off for recent graduates than for those who graduate during economic booms.

Conclusion

In this Letter we explore evidence that recent college graduates were and continue to be hit hard following the 2007–09 recession. The past several annual cohorts of graduates have experienced low earnings growth across almost all occupations compared with the overall population. While this post-recession pattern was also present after the 2001 recession, earnings growth following the most recent recession has been held down longer than in the past, which reflects the depth and severity of the recession. Because college grads face wages and hiring conditions that are especially responsive to business cycle conditions, this low earnings growth, together with shifts in the distribution of graduates’ labor market status, suggests continued weakness in the overall economy.

Bart Hobijn is a senior research advisor in the Economic Research Department of the Federal Reserve Bank of San Francisco.

Leila Bengali is a research associate in the Economic Research Department of the Federal Reserve Bank of San Francisco.

References

Abel, Jaison R., Richard Deitz, and Yaqin Su. 2014. “Are Recent College Graduates Finding Good Jobs?” FRB New York Current Issues in Economics and Finance 20(1).

Autor, David. 2010. “The Polarization of Job Opportunities in the U.S. Labor Market: Implications for Employment and Earnings.” Paper jointly released by the Center for American Progress and the Hamilton Project.

Daly, Mary C., and Leila Bengali. 2014. “Is It Still Worth Going to College?” FRBSF Economic Letter 2014-13 (May 5).

Hobijn, Bart, Colin Gardiner, and Theodore Wiles. 2011. “Recent College Graduates and the Labor Market.” FRBSF Economic Letter 2011-09 (March 21).

Kahn, Lisa B. 2010. “The Long-Term Labor Market Consequences of Graduating from College in a Bad Economy.” Labour Economics 17, pp. 303–316.

Opinions expressed in FRBSF Economic Letter do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System. This publication is edited by Anita Todd and Karen Barnes. Permission to reprint portions of articles or whole articles must be obtained in writing. Please send editorial comments and requests for reprint permission to research.library@sf.frb.org