Policymakers often consider temporarily redistributing income from rich to poor households to stimulate the economy. This is based in part on the idea that poor households spend a larger share of their income than rich ones do. However, ample evidence suggests that the difference in spending between these groups is significantly smaller than commonly assumed. A second assumption is that redistribution through policy is more efficient than through capital markets. Whether this is true is important to consider when proposing this type of stimulus policy.

The idea of taking from the rich and giving to the poor goes back long before the legend of Robin Hood. This kind of redistribution sounds desirable out of a sense of fairness. However, economists often judge a policy less on whether it is fair, and more in terms of whether it is efficient or inefficient, as well as whether it stimulates or slows economic activity.

In this Economic Letter we evaluate the stimulative effect of redistributing income from rich to poor households in a few distinct steps. We first provide a simple back-of-the-envelope calculation of the potential stimulus from redistributive policies. We then review the two main assumptions behind this policy prescription. We argue that the stimulative impact of such policies is likely to be lower than the simple calculation suggests.

Potential stimulative impact of redistribution

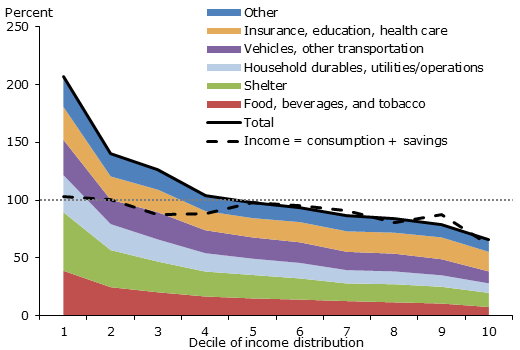

The starting point for our simple estimate is the Consumer Expenditure Survey, which gives an annual picture of complete consumption patterns for U.S. households. The solid black line in Figure 1 plots the share of income that households consumed in 2013. The survey ranks households by income from low to high and divides them into 10 groups called deciles, with the 1st decile showing households in the bottom 10% of the income distribution, and the 10th decile showing households in the top 10%. Spending is then averaged for each decile of the income distribution. The shaded areas below the solid line reflect the share of income spent on different major expenditure categories.

Figure 1

Average propensity to consume by level of income, 2013

Source: Bureau of Labor Statistics, Consumer Expenditures Survey.

Note: Average as a percent of 2013 after-tax income.

The figure suggests that households at the lower end of the income distribution spend more than twice what they make. At the upper end, households spend about two-thirds of what they make. Given this large difference in the propensity to consume between low- and high-income households, we consider the economic impact of levying a $1 tax on the rich and transferring it to the poor. This would reduce the high-income household’s spending by about $0.66 and increase the low-income household’s spending by $2, assuming each group spent additional dollars at their average rates. On net, it would create an increase in spending of more than $1.25. Even if the average for households in the bottom decile is overstated and they simply consume all the income they make, Figure 1 suggests every $1 of redistribution from the top earners to the bottom one-third of the income distribution would boost spending by at least $0.33.

Although this calculation assumes that a household’s propensity to consume an additional dollar of income will be the same as its average propensity to consume, the two can be different. The average propensity to consume shown by the solid black line in Figure 1 is the percent of total income that goes to consumption. However, the percentage of any additional income that goes to consumption is called the marginal propensity to consume. Households may choose to consume less of their additional income than they do of their regular income. This has policy implications because the effectiveness of redistribution policies is determined by the marginal rather than the average propensity to consume. In principle we could use the estimated consumption profile in Figure 1 to account for the difference between average and marginal propensities to consume. In practice, however, the difference between the marginal and average propensities to consume does not affect the main conclusion of the initial back-of-the-envelope result. There are still two main reasons why this result overstates the stimulative effect of redistributing income.

Measurement error

A closer look at the data in Figure 1 suggests that actual differences in average propensities to consume across households may be much smaller than the figure suggests. Measurement errors in the levels of consumption and income across the household income distribution are likely to have overstated the difference in propensities to consume.

First, let’s focus on the lower end of the income distribution. Figure 1 suggests that spending of the 10% of households with the lowest levels of income is about twice as much as they make a year. Households in the second and third deciles of the income distribution spend, on average, 40% and 26% more than they make, respectively. In fact, taking these data at face value we would conclude that only households in the top 60% of the income distribution have positive saving rates on average. This would imply that a large segment of the population, approximately 40%, is spending well beyond its means.

Standard economic theory (Friedman 1956) suggests that if households can borrow and save, they will smooth their consumption over their lifetime. This means that their level of spending is determined by the total income over their lifetime, also called permanent income, rather than by their income on a period-by-period basis. Thus, part of the high reported rates of spending for low-income households in the data may reflect households that faced a temporary reduction in income, for example because of a spell of unemployment or self-employment business losses, or because households expected their income to otherwise significantly increase in the future. For such households, if current income falls substantially below their permanent income, they may end up borrowing money and spending a lot more than they make in a given year. Moreover, such households may not change their spending a lot if they receive a temporary redistribution through fiscal policy, since it would only slightly increase their permanent income. However, research by Johnson, Parker, and Souleles (2006) finds that there is a substantial fraction of households, especially with low liquid wealth and low income, whose behavior is not consistent with the permanent income hypothesis. Such households actually do adjust their spending quite a bit more than predicted by the theory, even in response to a temporary uptick in their income.

Another measurement issue that may explain the observed high spending rates of households in the bottom of the income distribution is that they may understate their actual income. This could result from underreporting government transfer payments, as documented in Meyer, Mok, and Sullivan (2009), or other sources of income.

There is a simple way to see whether this might be the case. By definition, income equals consumption plus savings. In addition to the consumption and income data we used to calculate the propensity to consume in Figure 1, the Consumer Expenditure Survey also contains data on household savings. One can calculate an alternative measure of propensity to consume using the sum of consumption and saving as the measure of income rather than the income reported in the survey. The resulting alternative profile of the propensity to consume across the household income distribution is shown by the dashed black line in Figure 1. This alternative measure results in a flatter profile of the propensity to consume than the conventional measure, largely because the estimates for low-income households are much lower. The revised estimates suggest these households report consumption and savings levels that are consistent with a substantially higher income than they report in the survey. At the other end of the distribution, high-income households tend to underreport their consumption, especially for basic items like food. This results in an understatement of their propensity to consume (Aguiar and Bils 2011).

Combining the measurement biases at the lower and upper ends of the income distribution suggests that the actual profile is much flatter than the initial one we discussed. According to the dashed line, the difference in average propensity to consume between poor and rich households appears closer to 30 percentage points rather than the 100-plus percentage points implied by the solid black line.

Capital market imperfections

Our discussion of the permanent income hypothesis touched on the importance of access to credit for household consumption levels relative to income. If households have access to credit then they are able to smooth their spending in response to a temporary negative shock to income. Even if they do not have access to credit, households can still self-insure by setting aside savings to cover expenses in times of unexpected income losses. In both cases, peoples’ consumption decisions are driven mainly by their permanent income, and so a high propensity to consume in 2013 may simply reflect a temporary loss of income. The fact that households at the low end of the income distribution can consume substantially more than they earn may also suggest that they have more access to credit than is apparent. In this case, the simple back-of-the-envelope calculation may overstate what fraction of additional income these households would consume.

For redistributive policies to have a stimulative effect, the bulk of households on the receiving end must have limited access to credit and limited savings to cover their spending in case of a loss of income. McKay and Reis (2013) study a formal model that includes redistributive policies as an automatic stabilization tool to provide stimulus during economic downturns. They find that, in general, monetary policy is the preferred stabilization tool. However, when monetary policy is constrained, as it was during the most recent recession, redistributive policies could have a noticeable stimulative impact.

Finally, it is important to realize that we have discussed stimulative policy in terms of a temporary redistribution. More permanent shifts in redistribution of income will have a substantial impact on the relative labor supplies of low- and high-wage workers, on the incentives to save, and on expected permanent income levels. All of these influence how policy might affect the overall economy and are not part of our simple calculation here.

Conclusion

Surveys show low-income households tend to spend a larger share of their income than high-income households. Because of this, temporarily redistributing income from the rich to the poor could stimulate consumption and, through that, the economy as a whole. However, there is evidence that differences in propensities to consume this additional income across households are smaller than commonly assumed. Moreover, capital markets provide the opportunity for lower-income households to smooth their consumption and maintain it at an acceptable level even when their incomes decline, thereby providing an alternative source of economic stimulus. Thus, how stimulative a redistributive policy is depends crucially on how effective and efficient redistributing through policy is compared with the opportunities already available in financial markets.

Bart Hobijn is a senior research advisor in the Economic Research Department at the Federal Reserve Bank of San Francisco.

Alexander Nussbacher is an economics and statistics undergraduate student at the University of California at Berkeley.

References

Aguiar, Mark A., and Mark Bils. 2011. “Has Consumption Inequality Mirrored Income Inequality?” NBER Working Paper 16807.

Friedman, Milton. 1956. A Theory of the Consumption Function. Princeton, NJ: Princeton University Press.

Johnson, David S., Jonathan A. Parker, and Nicholas S. Souleles. 2006. “Household Expenditure and the Income Tax Rebates of 2001.” American Economic Review 96(5), pp. 1,589–1,610.

McKay, Alisdair, and Ricardo Reis. 2014. “The Role of Automatic Stabilizers in the U.S. Business Cycle.” NBER Working Paper 19000.

Meyer, Bruce D., Wallace K.C. Mok, and James X. Sullivan. 2009. “The Underreporting of Transfers in Household Surveys: Its Nature and Consequences.” NBER Working Paper 15181.

Opinions expressed in FRBSF Economic Letter do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System. This publication is edited by Anita Todd and Karen Barnes. Permission to reprint portions of articles or whole articles must be obtained in writing. Please send editorial comments and requests for reprint permission to research.library@sf.frb.org