Inflation targeting is often considered the most appropriate monetary policy framework for central banks seeking price stability. While a target can help stabilize inflation, the implications for a country’s growth are less clear. Advanced economies experienced higher economic growth immediately following the transition to inflation targeting. However, developing economies experienced only modest gains that were close to their trend growth. One explanation is that transitioning to a low-inflation regime can be more costly for less stable countries that have higher inflation expectations and less credible policies.

Most modern central banks include among their goals some version of price stability, that is, maintaining the purchasing power of the country’s currency. In some countries central banks have stated what inflation rate or range is consistent with price stability and have explicitly committed to target that rate over time. Other central banks have not set explicit inflation targets.

In this Economic Letter we examine whether the adoption of inflation targeting makes a difference to a country’s economic results. In the past two decades, inflation rates have generally declined in countries that have formally adopted an inflation target as well as in those that have not announced an explicit target. We compare the declines in inflation among countries from these two groups. In addition, we examine how adopting an inflation target affects a country’s economic growth. We distinguish between advanced and developing economies because of large differences in their initial conditions as well as their trends for inflation and GDP growth rates.

Our results show that those countries that adopted a target experienced lower inflation within at least three years; this was particularly true for developing economies. The effects on growth are less clear. Advanced economies that adopted inflation targeting experienced relatively higher growth than those that did not. In contrast, developing economies that adopted an inflation target did not show any substantial gains in growth in the medium term compared with those that did not adopt a target. One possible interpretation is that, because of the costs associated with bringing inflation rates down, developing economies have to wait longer for economic gains from inflation targeting to materialize.

Pros and cons of adopting an inflation target

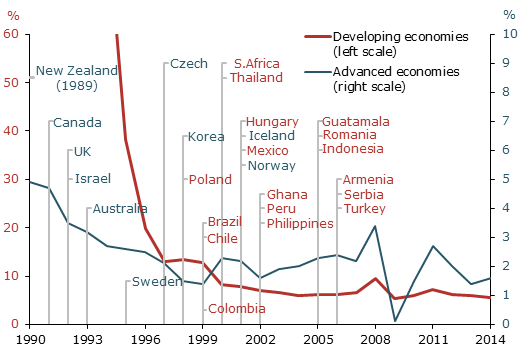

Since 1990, inflation has declined in many countries. Figure 1 shows that the average inflation rate fell for both advanced and developing economies, around the same time that many countries of both types adopted inflation targeting regimes. We use the definition from Hammond (2012) to assign the year in which countries de facto adopted an inflation targeting regime, which does not always coincide with the year of their official announcement. We exclude euro-area countries because their independent monetary policies ended in 1999. Note that the causality between lower inflation and inflation targeting can go both ways—an environment of falling inflation makes the transition to inflation targeting possible; in turn, adopting an inflation target leads to further drops in inflation.

Figure 1

World inflation and inflation targeting regime adoption

Source: International Monetary Fund.

Adopting an inflation targeting regime means a central bank sets an explicit target for inflation and also places greater emphasis on transparency, credibility, and accountability in conducting monetary policy. This allows policymakers to more easily manage inflation expectations, and it has proven to be an effective method of controlling inflation (Gürkaynak et al. 2006). Rudebusch and Svensson (2002) show that, in theory, inflation targeting leads to lower inflation than a traditional alternative of monetary targeting. Theory also suggests that the impact of an inflation targeting regime on GDP growth is likely to be positive. In particular, higher inflation is detrimental to growth because it generates uncertainty and therefore reduces investment. By reducing or eliminating this uncertainty and creating an environment in which positive productivity shocks translate more fully into increased investment and production, an inflation targeting regime increases economic growth.

Some critics of inflation targeting argue that lower inflation in some countries was simply a result of a stronger commitment to this goal and not the result of inflation targeting per se. Others worry that the focus on inflation could generate instability in other parts of the economy, such as output. In practice, however, monetary policymakers who institute inflation targeting also track its effects on other conditions, such as real growth or unemployment (Lin and Ye 2007 and Svensson 2010).

Nearly two decades ago, Rudebusch and Walsh (1998) summarized the arguments for and against inflation targeting regimes. Since then, a number of empirical studies have examined the impact of inflation targeting regimes on growth. Some studies show a positive association, while others claim that there is no association or a negative effect. This variety of estimates results from using different samples of countries and years as well as different approaches to identify causal effects.

Empirical evidence

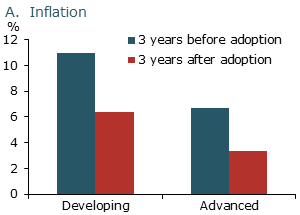

To compare the effects of inflation targeting on different types of economies, we look at a sample of countries that adopted inflation targeting regimes, including 10 advanced countries in the Organisation for Economic Co-operation and Development (OECD) and 16 developing economies. Inflation targets in the OECD economies range from 2 to 3%, while in developing economies they are much more varied, with 3 and 4% targets being most common. We find that the average inflation rate in the three years following the policy adoption was substantially lower than the average in the three years before, as shown in Figure 2A. For developing economies the decline was 4.4 percentage points on average, while for advanced economies it was 3.2.

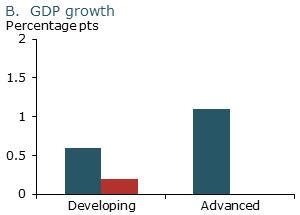

To understand the effects of an explicit inflation targeting regime more fully, we also need to investigate its impact on economic growth. At first glance, the adoption of inflation targeting appears to have boosted GDP growth about half a percentage point in advanced economies and did not make much difference in developing economies (Figure 2B). However, such simple comparisons can be misleading because many other factors affect GDP growth.

Figure 2

Inflation, GDP growth in countries that adopted inflation targeting

As we mentioned earlier, one cannot conclude that these declines in inflation resulted from target adoption because of the downward trend in inflation and a possibility of reverse causality. One challenge of evaluating the impact of inflation targeting on growth empirically is that the timing of adoption is not likely to be independent of current and expected future economic conditions. For example, if a country is likely to adopt inflation targeting when the economy is slowing down, thus facing less inflationary pressures, then GDP growth is likely to be lower after the target is instituted than before. Conversely, if targeting is more likely to be adopted when the economy is on the upswing, an increase in the growth rate may follow adoption. In either case, attributing the change in growth to the adoption of the inflation targeting regime would not necessarily be correct.

One way to deal with this problem is by treating the change as an experiment and comparing the results with a control group, as used in medical drug trials. We can think of the adoption of an inflation targeting regime as a treatment applied to a group of countries at different times. To reveal the effect of such treatment on inflation and growth, we can construct a group of “control” countries and years that had characteristics similar to countries that adopted inflation targeting in the year they adopted it and, as a result, had a similar probability of adopting an inflation targeting regime but did not do so. We can then simply compare growth and inflation outcomes for the two groups of countries.

To use this method we first estimate the probability that a country will adopt an inflation targeting regime depending on its macroeconomic conditions. We then select from among the non-adopters those countries and years for which the estimated probability of inflation target adoption was different by less than 5 percentage points compared with countries that adopted the policy in the year they adopted it. These countries, then, form our control group of “matched non-adopters.” For example, Canada adopted inflation targeting in 1991 and is in the adopter category. Italy and Switzerland in 1994, Greece in 1992, and Spain in 1987 faced similar economic situations but did not adopt inflation targeting, so they are among countries that form a control group for Canada. We then compare inflation and GDP growth of Canada in 1992–94 to average inflation and GDP growth of the control group countries in the three years following their matching year.

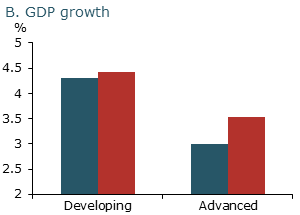

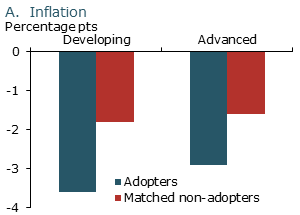

Figure 3 presents percentage point changes in inflation and GDP growth from the average rate in the three years before the inflation targeting adoption—or non-adoption, for the control group—and the three years following. We can see in panel A that inflation fell almost twice as much in countries that adopted inflation targeting (blue bars) compared with countries that were in similar macroeconomic situations but did not adopt targeting (red bars). The drop in inflation for non-adopters can be explained by an overall global trend of declining inflation during the period we focus on, 1995 to 2007.

Figure 3

Change in inflation, GDP growth before and after adopting target

Note: Changes are from three years before to three years after inflation target adoption for adopters and from three years before to three years after matching conditions for matched non-adopters.

We can also see in panel B that there was a substantial increase in the GDP growth rate for advanced economies that adopted inflation targeting, while there was no change, as one would expect, for the control group. The effect was much less pronounced for developing economies, with lower increases in the growth rate and a much smaller difference between adopters and non-adopters.

Why the difference? As we have shown in Figure 2, developing economies entered inflation targeting regimes in an environment of much higher inflation and had to bring their inflation rates down much more than advanced economies. Since reducing inflation tends to be contractionary, this cost of targeting is likely to be more pronounced, nearly offsetting any growth benefits that arise from the stable inflation and less uncertainty that are associated with an inflation targeting regime.

Conclusion

Our empirical analysis shows that inflation declined in countries following the adoption of an inflation targeting regime, consistent with past studies. This clearly is an intended consequence of such policies. We also find that such policies have a positive effect on economic growth in advanced economies, as most of the theoretical models would predict. However, we find that developing economies do not benefit from similar growth increases following inflation targeting adoption, at least not in the first three years. It is likely that these economies have to go through substantially more tightening to achieve their inflation targets than advanced economies, perhaps due to higher inflation expectations.

Galina Hale is a research advisor in the Economic Research Department of the Federal Reserve Bank of San Francisco.

Alexej Philippov is a student at Moscow State University in Russia.

References

Gürkaynak, Refet S., Andrew T. Levin, and Eric T. Swanson. 2006. “Does Inflation Targeting Anchor Long-Run Inflation Expectations? Evidence from Long-Term Bond Yields in the U.S., U.K., and Sweden.” FRB San Francisco Working Paper 2006-09.

Hammond, Gill. 2012. State of the Art of Inflation Targeting. Centre for Central Banking Studies Handbook 29, Bank of England.

Rudebusch, Glenn D. and Lars E.O. Svensson. 2002. “Eurosystem Monetary Targeting: Lessons from U.S. Data.” European Economic Review 46(3), pp. 417–442.

Rudebusch, Glenn D., and Carl E. Walsh. 1998. “U.S. Inflation Targeting: Pro and Con.” FRBSF Economic Letter 1998-18 (May 29).

Svensson, Lars E.O. 2010. “Inflation Targeting.” In Handbook of Monetary Economics, vol. 3B, eds. Benjamin Friedman and Michael Woodford. Amsterdam: Elsevier.

Opinions expressed in FRBSF Economic Letter do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System. This publication is edited by Anita Todd and Karen Barnes. Permission to reprint portions of articles or whole articles must be obtained in writing. Please send editorial comments and requests for reprint permission to research.library@sf.frb.org