The COVID-19 pandemic disproportionately affected the health and financial well-being of communities of color. Over the past year, minority banks that specialize in providing financial services to underserved communities and minority borrowers have also performed significantly worse than other banks of similar size. Minority banks projected higher loan losses and had lower profits than nonminority banks. To the extent that underperforming minority banks may be more reluctant to expand lending—whether to avoid risk or minimize regulatory scrutiny—it could further exacerbate the unevenness of the recovery.

Minority banks play an important role in serving the financial needs of historically underserved communities and minority populations. Acknowledging this role, U.S. legislation in 1989 set multiple goals for minority depository institutions (MDIs) to preserve their character, maintain their solvency, and promote their creation. The law defines an MDI as any depository institution with 51% or more of its stock owned by one or more socially and economically disadvantaged individuals, as described in U.S. statute. In providing loans to underserved communities and minority borrowers, MDIs originate a greater share of their mortgages to borrowers who live in low- and moderate-income census tracts and to minority borrowers, relative to nonminority banks. MDIs also serve a substantially higher share of minority home mortgage borrowers. In lending to small businesses, MDIs originate a greater share of small business loans guaranteed by the U.S. Small Business Administration to borrowers in low- and moderate-income census tracts, and to borrowers in census tracts with higher shares of minority residents (FDIC 2019).

When COVID-19 began to spread in the United States last year, it hit the communities served by MDIs particularly hard. The Centers for Disease Control and Prevention (CDC) noted that underlying health and social inequities put many racial and ethnic minority groups at increased risk of getting sick, having more severe illness, and dying from COVID-19. Racial and ethnic minority groups have also been unequally affected by unintended economic consequences of strategies to mitigate the disease, such as social distancing (CDC 2020).

Against this backdrop, MDIs are likely to be more financially exposed to the pandemic than non-MDIs. This raises a question we address in this Letter: while the banking system is resilient and well capitalized to withstand the economic shock, how well are the more financially exposed MDIs holding up during the pandemic? Research shows that negative shocks to banks have negative effects on their lending that can amplify the effects of the shocks (see, for example, Bernanke and Gertler 1995 and Peek and Rosengren 1997). This could be due to underperforming banks’ risk aversion and concerns about regulatory scrutiny. Given the special roles of MDIs in providing financial services to individuals and small businesses in minority communities, how well MDIs perform has important implications for the recovery and the economic parity of the people who rely on them.

Comparing minority and nonminority banks during the pandemic

Among the 5,000 federally insured financial institutions across the United States at the end of 2020, there were 142 MDIs. Those included 72 Asian American MDIs, 32 Hispanic American MDIs, 20 African American MDIs, 17 Native American MDIs, and 1 multiracial MDI. The median total assets of MDIs in 2020 was $361 million, which was comparable to the median size of non-MDI community banks. MDI balance sheets also generally resemble those of community banks that accept core deposits to make loans. A typical MDI loan portfolio includes mostly residential mortgages and commercial real estate lending, while some larger MDIs have more diversified loan portfolios. MDIs are geographically linked to the communities they seek to serve and are concentrated in certain metropolitan areas, including San Francisco, New York, Atlanta, and Dallas.

To examine how well MDIs have been withstanding the COVID-19 pandemic, we compare them to other nonfarm community banks using data from the end of 2019—just before the pandemic—and the end of 2020. As a basis for comparison, we use a group of 3,600 nonfarm nonminority community banks, each with total assets of less than $10 billion and agricultural lending making up less than 25% of the loan portfolio. About 85% of MDIs have headquarters in more highly populated metropolitan statistical areas, compared with 77% of the control group.

We focus on three areas to assess the financial performance of MDIs: profitability, credit risk, and capitalization. We measure profitability by the return on assets (ROA) and return on equity (ROE). We measure credit risk by the provision for loan losses, which is a bank’s projection of what it expects to lose through delinquent or defaulted loans. Finally, we measure capitalization by the common equity tier-1 risk-based capital ratio banking supervisors use to set capital requirements.

Pandemic widened the profitability gap for MDIs

Before the pandemic, the median ROA was 0.9% for MDIs, slightly below the 1% median for our control group of non-MDIs. By the end of 2020, the median ROA of MDIs fell to around 0.7%, while the median ROA of non-MDIs fell to around 0.9%. Looking at the entire population, our statistical tests confirm that ROAs were significantly lower for minority banks than for others in both years.

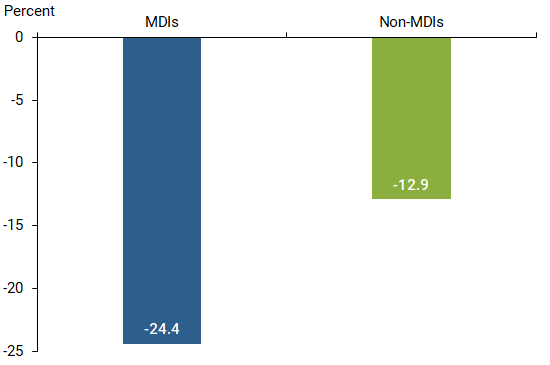

Looking at individual banks, our tests further show that MDIs suffered a significantly bigger drop in profitability than other banks during the pandemic (Figure 1). The median decline in ROA among MDIs was 24.4%, nearly double the drop for non-MDIs. Thus, not only did MDIs tend to be less profitable than other similar size banks, but the profitability gap also widened further during the pandemic.

Figure 1

Median decline in ROA for minority and other banks

Using ROE—the return on owners’ equity—to measure profitability provides qualitatively similar results. The pre-pandemic median ROE of MDIs was 7.1%, compared with 8.8% for non-MDIs. The median decline in ROE for MDIs was 13%, which was nearly double the median decline in ROE for nonminority banks. ROEs were significantly lower for MDIs than for non-MDIs in both years, and the drop in ROE among MDIs during the pandemic was significantly worse than for non-MDIs.

Expected loan losses skyrocketed during pandemic

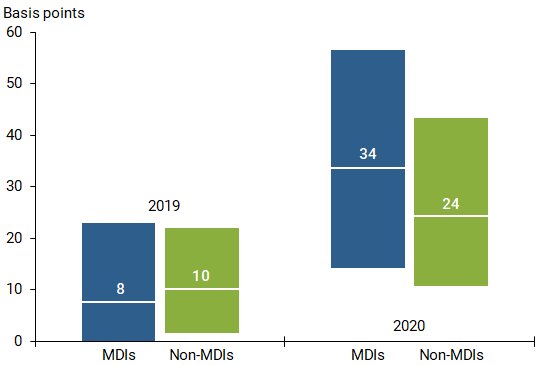

Turning to credit risk, we use the ratio of loan loss provision to total loans outstanding. This reflects what the bank expects for its future loan losses triggered by the pandemic, taking into consideration various pandemic-related forbearance programs as well as the Paycheck Protection Program. Figure 2 shows the ratio of loan loss provision in 2019 and 2020 for both MDIs and our control group, measured in hundredths of a percentage point, known as basis points.

Figure 2

Median loan loss provisions for minority and other banks

Note: Bars show 25th to 75th percentiles; median is shown in white.

Loan loss projections were very similar between the two groups of banks before the pandemic. This indicates that MDIs expected similar credit risk among borrowers in the minority communities they serve as non-MDI banks expected among their borrowers before the onset of COVID-19.

In 2020, the pandemic drove the median provision for loan losses in MDIs to 34 basis points, four times the median in the prior year. In the control group, the median provision for loan losses rose more than two times to 24 basis points. Our statistical test confirms that MDIs had significantly higher loan loss provisions than non-MDIs in 2020. While both groups projected higher loan losses as a result of the pandemic, MDIs raised their loan loss projections significantly more than non-MDIs. This appears to reflect their high exposure to minority groups that tended to be disproportionately affected by the virus. It is also consistent with the bigger decline in profitability of MDIs than non-MDIs last year.

Minority banks remain resilient

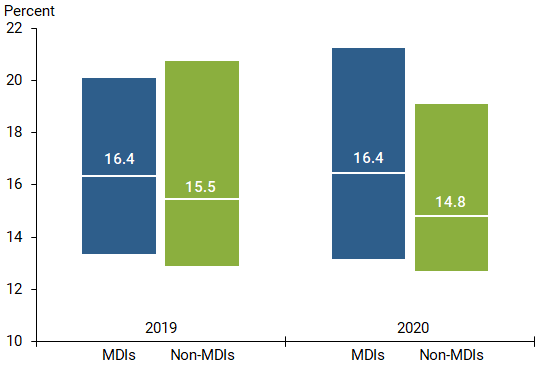

With higher projected loan losses and lower profitability, how resilient are MDIs? To assess this, in Figure 3 we show the common equity tier-1 (CET1) risk-based capital ratio that bank supervisors use to set capital standards for banks.

Figure 3

Median capital ratios for minority and other banks

Note: Bars show 25th to 75th percentiles; median is shown in white.

The median CET1 ratios in 2019 were very close between the two groups, with 16% for MDIs and 15.4% for non-MDIs; both medians were about twice the amount of capital that supervisors consider as indicating being well capitalized. Despite the financial fallout from the pandemic, the median CET1 of MDIs was unchanged at the end of 2020. The median CET1 of non-MDIs fell to 14.8% but remained well above the regulatory threshold for being well capitalized.

Calculating the change in CET1 ratios for each bank suggests that the median change for MDIs was 0.5%, and the median change for the control group of non-MDIs was 1.0%. Thus, the majority of banks in both groups had a higher capitalization in 2020 than in 2019 by retaining more earnings. Moreover, the changes in CET1 from 2019 to 2020 were statistically indistinguishable between MDIs and non-MDIs. Judging from both the level of capital and the change in capitalization, MDIs remained well capitalized in 2020 despite the pandemic.

Conclusions

The COVID-19 pandemic severely disrupted the health and financial well-being of many Americans, but the effects were uneven. Communities of color were disproportionately affected by the virus and the related economic fallout. Minority banks that specialize in working with underserved communities and minority groups performed significantly worse than nonfarm nonminority community banks during the pandemic. Minority banks projected significantly higher loan losses and had lower profits than nonminority banks. Despite performing worse than their peers, minority banks remain well capitalized and resilient.

During the pandemic, both MDIs and non-MDIs expanded their lending in response to the higher loan demand that was driven in part by the federal Paycheck Protection Program (PPP). The median MDI provided significantly more credit in 2020 to their minority borrowers than the median non-MDI. This was consistent with the disparity in credit needs among the more severely affected minority populations. With the end of the PPP in May 2021, how well MDIs can meet the future credit needs of their borrowers is uncertain. To the extent that underperforming minority banks may be more reluctant to expand lending due to risk aversion or concerns about regulatory scrutiny, it could further exacerbate the unevenness of the recovery.

Sophia Friesenhahn is a former research associate in the Economic Research Department of the Federal Reserve Bank of San Francisco.

Simon Kwan is a senior research advisor in the Economic Research Department of the Federal Reserve Bank of San Francisco.

References

Bernanke, Ben S., and Mark Gertler. 1995. “Inside the Black Box: The Credit Channel of Monetary Policy Transmission.” Journal of Economic Perspectives 9(4), pp. 27–48.

Centers for Disease Control and Prevention. 2020. Unintended Consequences of COVID-19 Mitigation Strategies: Racial and Ethnic Health Disparities. Updated December 10.

Federal Deposit Insurance Corporation. 2019. Minority Depository Institutions Structure, Performance, and Social Impact.

Peek, Joe, and Eric S. Rosengren. 1997. “The International Transmission of Financial Shocks: The Case of Japan.” American Economic Review 87(4), pp. 495–505.

Opinions expressed in FRBSF Economic Letter do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System. This publication is edited by Anita Todd and Karen Barnes. Permission to reprint portions of articles or whole articles must be obtained in writing. Please send editorial comments and requests for reprint permission to research.library@sf.frb.org