Surges of foreign investment into developing countries can amplify economic stress and potentially undermine their financial stability. New evidence suggests that excessive foreign capital inflows can also increase income inequality in emerging economies. Research shows that, as low global interest rates trigger more investment, those inflow surges benefit entrepreneurs by raising their returns, while lowering household earnings on bank deposits within the countries. The potential impact on income inequality provides another reason beyond financial stability for resisting abrupt surges in capital inflows.

Foreign capital inflows can benefit an emerging market economy (EME) by reducing the cost of financing domestic consumption and investment. However, surges and subsequent reversals of capital inflows can hurt financial and macroeconomic stability in EMEs. Recognizing the potential destabilizing impact of capital flow surges for EMEs, the International Monetary Fund (IMF) has become more amenable in recent years to using capital account restrictions as a “part of the policy toolkit to manage inflows” (Ostry et al. 2010).

This Economic Letter focuses on how capital surges into EMEs as a result of more open capital account policies can also distort the distribution of income in those countries. We present new evidence from 60 EMEs since the 1960s to show that increases in net inflows of private capital raise income inequality substantially. The potential impact on income inequality provides an additional motivation beyond financial stability to support policies that restrict surges in capital flows.

Relation between capital flows and income distribution

Income inequality within countries has been increasing around the world for a long time (Niño-Zarazúa et al. 2017). Recent evidence connects capital account policy with income distribution in emerging markets. For example, Furceri and Loungani (2018) found when capital account liberalization eased the flows of investment across country borders, these countries were associated with increased income inequality. In particular, using data from the 1960s through 2010, they found that the 1990s exhibited the greatest increases both in capital account openness and in income inequality. Moreover, easing restrictions on capital flows has stronger impact on income inequality in countries with less-developed financial markets.

Little research has explored the formal link between capital flows and income inequality. In a recent paper, Liu, Spiegel, and Zhang (2020) present a theoretical framework to study how international investment could affect earnings of different groups of the population in different ways. Their model considers two groups: entrepreneurs, who have access to capital markets—both domestic and foreign—and earn income from investment returns, and workers, who do not have access to investment opportunities and earn income from wages and interest on their savings. Domestic and foreign banks play an important role, providing savings options for households and loans for entrepreneurs to finance capital investments.

Under this framework, Liu et al. (2020) demonstrate that a surge in capital inflows to an EME triggered by a decline in the global interest rate can boost net local profits on capital and skew the income distribution in favor of entrepreneurs. In contrast, households suffer a reduction in interest earnings on their savings in domestic and foreign banks. The effect is symmetric: capital outflow surges are expected to skew the income distribution in favor of households.

Evidence from developing countries

This Letter extends the analysis in Liu et al. (2020) and provides new cross-sectional evidence regarding the short-run effects of capital flow surges on income distributions using a sample of 60 developing economies from 2001 to 2018. Our sample excludes countries that serve as offshore financial centers and those with populations of less than 2 million, because the capital flows to those economies are more likely to be reinvested outside the country.

We measure nominal gross private capital inflows by changes in national liabilities from Lane and Milesi-Ferretti (2018), then subtract each country’s government borrowing as reported in the World Debt Tables from the United Nations. We measure nominal gross private outflows by changes in national assets, also obtained from Lane and Milesi-Ferretti (2018), net of changes in total official reserves minus gold, from IMF International Financial Statistics. We then subtract gross outflows from gross inflows to obtain net inflows. We divide these measures of capital flows by nominal GDP for each economy in our sample.

We measure income inequality using a standard gauge known as the Gini coefficient for each country based on household pretax market income, taken from the Standardized World Income Inequality Database. Using after-tax income can produce a different measure of income inequality. However, the effects of redistribution policies in EMEs are not likely to be very large. The Gini coefficient has a value from 0 to 100, with higher values corresponding to higher levels of income inequality. For example, a score of 0 would imply complete income equality across households, while a score of 100 would imply that all income is held by a single household.

The values of the Gini coefficient vary widely in our sample. For example, in 2015, South Africa had the most unequal income distribution, with a Gini of 68.7; and Ukraine had the most equal distribution, with a Gini of 22.4. For comparison, in the same year, Mexico was near the middle of the range, with a Gini value of 46.5. While inequality levels are widely dispersed, movements in inequality within our sample tend to be very modest. Overall, the sample shows a 0.2 percentage point average annual decline in the Gini coefficient, indicating a movement towards greater equality.

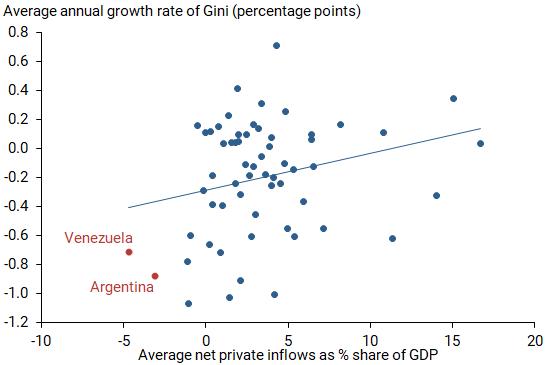

Focusing on net private capital inflows, Figure 1 shows how these inflows as a share in GDP on the horizontal axis relate to the year-over-year changes in the Gini coefficient on the vertical axis, each averaged over the sample years from 2001 to 2018. The upward slope of the trend line shows that capital inflows and income inequality have a positive relationship across countries, with a correlation coefficient of about 0.3. This suggests that economies with higher net capital inflows also experienced faster increases in income inequality.

Figure 1

Capital inflows relative to changes in income inequality

The data include some notable experiences that illustrate this point. For example, Argentina and Venezuela (red dots) reflect the low end of the spectrum: both countries experienced disruptive episodes of large capital outflows as well as net average outflows over our sample period. They also exhibited notable declines in income inequality, with Argentina’s Gini falling from 45.1 to 38.8, while Venezuela’s fell from 44.4 to 40.5. Note that as predicted by theory, the effect is symmetric: countries with large positive net capital inflows show a marked increase in income inequality, while those with large net capital outflows are associated with a decrease in income inequality.

One problem with this simple scatterplot is that it may not capture the true relationship between capital inflows and income inequality because countries can differ in size, capital account policies, or access to international markets. Those country-specific characteristics can also contribute to the observed changes in income inequality.

To more accurately estimate the relation between capital flows and inequality, we need to control for countries’ differences. To do so, we use a regression analysis to estimate the statistical relation between average changes in the Gini coefficient and net private capital inflows, controlling for the effects from such factors as initial levels of real GDP and population, and their growth over our sample period. We also control for the financial remoteness of each economy, measuring their great-circle distance from New York City, the financial center of the United States, which serves as a proxy for the country’s access to international financial markets.

Our estimation results indicate a positive and statistically significant relationship between net capital inflows and income inequality; detailed results are provided in an online appendix. However, because the Gini coefficient does not change frequently, only exceptional inflows or outflow surges—such as those experienced by Argentina and Venezuela in our sample—would be associated with notable movements in income inequality. We have tested the reliability of our estimation results by accounting for a variety of other factors, such as restrictions that countries place on capital flows. The results from these tests—which are reported in the appendix—are consistent with the findings in our baseline specification.

Do surges in capital inflows cause increases in income inequality?

While our cross-sectional study demonstrates a significant relation between capital inflows and income inequality, it does not establish that capital flows cause changes in income inequality. The reverse may be true: foreign investors may respond to changes in a developing country’s economic conditions, including changes in its income distribution.

Liu et al. (2020) isolate the causal effects of capital flows on income distribution through an instrumental variable regression approach. This ensures that the measured relationship between changes in income inequality and changes in capital flows in the data accurately reflects only the impact of capital flows on income inequality, and not spurious joint movements or causal links in the opposite direction.

Liu et al. implement this approach by proxying movements in capital flows with the changes in two-year U.S. Treasury yields, interacted with the measure of financial remoteness and a regional indicator for each EME. Since each country in their sample is a small open economy and takes the world interest rate as given, changes in an economy’s income distribution should not drive changes in the world interest rate, proxied by the U.S. Treasury yield. However, capital flows to each economy are sensitive to changes in the world interest rate. That sensitivity depends on the country’s ability to access international financial markets, as measured by its financial remoteness.

The instrumental variable estimation of Liu et al. based on panel data confirms our cross-sectional result that an increase in net private capital inflows significantly raises income inequality. Their paper estimates that a one-standard-deviation increase in net private inflows in a year leads to a 0.18 percentage point increase in the Gini coefficient, which is similar to our point estimate from the cross-sectional model.

Conclusion

This Economic Letter presents evidence of a positive and economically meaningful relationship between short-run surges in capital inflows and income inequality in a cross-sectional sample of emerging market economies. Our evidence suggests income inequality may provide an additional rationale for EMEs to resist short-term surges in capital inflows, beyond concerns about financial and economic stability. This consideration may soon become relevant if persistently low global interest rates result in a new round of capital flow surges to developing economies during the recovery from the COVID-19 pandemic.

Renuka Diwan is a research associate in the Economic Research Department of the Federal Reserve Bank of San Francisco

Zheng Liu is a vice president and director of the Center for Pacific Basin Studies in the Economic Research Department of the Federal Reserve Bank of San Francisco

Mark M. Spiegel is a senior policy advisor in the Economic Research Department of the Federal Reserve Bank of San Francisco

References

Furceri, Davide, and Prakash Loungani. 2018. “The Distributional Effects of Capital Account Liberalization.” Journal of Development Economics 130, pp. 127–144.

Lane, Philip R., and Gian Maria Milesi-Ferretti. 2018. “The External Wealth of Nations Revisited: International Financial Integration in the Aftermath of the Global Financial Crisis.” IMF Economic Review 66, 189-222.

Liu, Zheng, Mark M. Spiegel, and Jingyi Zhang. 2020. “Capital Controls and Income Inequality.” FRB San Francisco Working Paper 2020-14, September.

Niño-Zarazúa, Miguel, Laurence Roope, and Finn Tarp. 2017. “Global Inequality: Relatively Lower, Absolutely Higher.” Review of Income and Wealth 63(4), pp. 661–684.

Ostry, Jonathan D., Atish R. Ghosh, Karl Habermeier, Marcos Chamon, Mahvash S. Qureshi, and Dennis B.S. Reinhart. 2010. “Capital Inflows: The Role of Controls.” IMF Staff Position Note 10/04 (February).

Opinions expressed in FRBSF Economic Letter do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System. This publication is edited by Anita Todd and Karen Barnes. Permission to reprint portions of articles or whole articles must be obtained in writing. Please send editorial comments and requests for reprint permission to research.library@sf.frb.org