The recent rapid rise in house prices has raised some questions about the potential risk to broader financial stability. However, credit quality in the mortgage market appears to be very high, and lending standards tightened in early 2020. While low interest rates increased the demand for refinancing, evidence from large nonconforming loans shows that credit supply contracted sharply in March 2020 and remained tight through the early pandemic period. The shift in credit supply suggests that lenders adjusted their standards to mitigate some risk in the housing market.

Since the onset of the COVID-19 pandemic, the growth in house prices has accelerated sharply: annual price growth jumped from about 6% to nearly 20% according to the Federal Housing Finance Agency price index. Because house prices and mortgage markets were central to the 2007–09 recession, the recent surge in prices has spurred concerns that the housing market may be a risk to financial stability. At the same time, many people lost their jobs early in the pandemic, which raised the prospect that they might be unable to make mortgage payments. The risk the housing market poses to the broader economy depends in part on how lenders respond to these developments.

This Economic Letter quantifies the impact of tight credit supply on mortgage refinancing during the early pandemic period. I compare how refinancing varied for loans characterized as conforming—approximately those having a notional amount below $548,250 in 2021 that can be sold to Fannie Mae and Freddie Mac—or nonconforming loans above that limit, also known as jumbo mortgages. Evidence on differences in access to refinancing across segments of the mortgage market shows that credit supply tightened sharply in response to the pandemic. This reduced refinancing by as much as 50% for borrowers with jumbo mortgages through March 2021, which may have alleviated the risk posed by a broader boom in lending and the rapid increase in house prices early in the pandemic.

Refinancing boom

The mortgage market has received significant support from historically low interest rates, in part thanks to Federal Reserve asset purchases, including mortgage-backed securities. The average interest rate on new loans fell quickly with the onset of the pandemic to as low as 2.6% in January 2021, before rising to about 3% on average as of May 2021. This was still well below the average rate of about 4% on existing loans at the time.

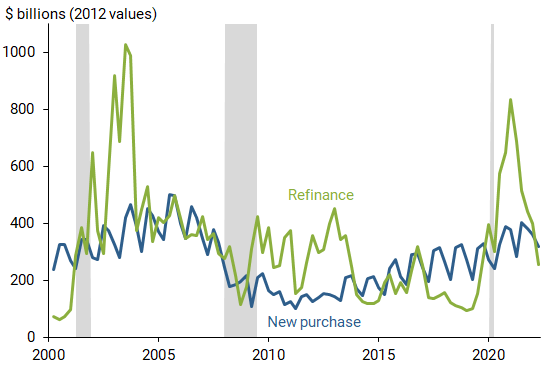

Figure 1 plots the inflation-adjusted value of new mortgage purchase and refinance originations and shows that mortgage refinancing increased significantly at the start of the pandemic. This refinancing wave reflects both the large savings available from low mortgage rates as well as the high levels of home equity, supported by the rise in house prices. However, it could also reflect a risk to financial stability if the high volumes were being driven by equity extraction from risky borrowers who were more likely to default on their loans.

Figure 1

New and refinanced mortgage originations since 2000

Note: Gray bars indicate NBER recession dates.

Source: Mortgage Bankers Association, Bureau of Economic Analysis/Haver Analytics.

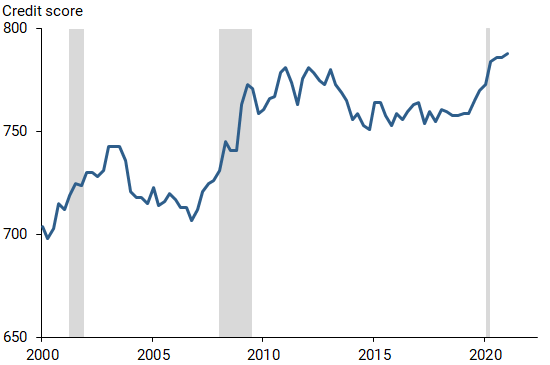

One way that financial stability risk can build up is if people refinancing mortgages have lower credit scores than in the past. To examine this, Figure 2 reports the median credit score on new mortgages from the FRBNY/Equifax Consumer Credit Panel. It shows that the credit scores of new mortgage borrowers increased sharply during the pandemic to the highest level in the past 20 years. The rapid increase is reminiscent of credit supply tightening in the 2007–09 recession, as opposed to the boom in the early 2000s when credit scores declined. This suggests that new refinance and purchase loans were going to borrowers with relatively low credit risk.

Figure 2

Median credit scores for new mortgage borrowers

Note: Gray bars indicate NBER recession dates.

Source: FRB New York/Equifax Consumer Credit Panel.

Similarly, data on mortgage characteristics show that the share of mortgage originations going to borrowers with credit scores below 680 fell to about 14% of purchase loans and less than 12% of refinance loans, again the lowest levels in the past 20 years. Borrowers were also taking out less-risky loans, with the leverage on borrower income and property value both declining over the pandemic.

The high level of credit quality would be consistent with lenders tightening credit supply in response to the pandemic. Most lenders in the Senior Loan Officer Opinion Survey reported tighter standards across all mortgage products, even those insured against default by the federal government or eligible for purchase by government-sponsored enterprises (GSEs). Lenders may have been concerned about default risk even in those markets due to the cost of servicing defaulted loans or because they could be forced to repurchase a loan (see Goodman, Parrott, and Zhu 2015 and Kim et al. 2018).

Effects of credit supply on refinancing in the jumbo market

Some of these trends in credit quality may reflect different demand for mortgages across borrowers, for example, if borrowers with high credit scores are more likely to respond to lower interest rates. To study these differences, I quantify the effects of tight credit supply on refinancing in the jumbo mortgage market. This refers primarily to mortgages that are too large to be sold to GSEs in the conforming market, making these loans riskier to hold and more difficult to sell to investors. So if credit supply in the mortgage market tightened in response to the pandemic, it was likely to be even tighter in the jumbo market where lenders face more default risk. For example, Fuster et al. (2021) documented an increase in the risk premium and decline in lender activity in the jumbo market at the onset of the pandemic.

I use a monthly panel of mortgage loans constructed from the Black Knight McDash Data and the Equifax Credit Risk Insight Servicing Data to estimate how shifts in credit supply affect a borrower’s probability of refinancing. To isolate this causal effect, I use borrowers in the conforming market as a baseline to compare refinancing for borrowers above and below the conforming limit before and after the onset of the pandemic. The comparison allows one to estimate how much the shift in credit supply in the jumbo market affected refinancing.

If lenders were relatively indifferent to the additional risk of lending in the jumbo market, then refinancing for borrowers with loans above the limit would be similar to that for borrowers below the limit. This would suggest that credit supply was not very constraining. However, if borrowers above the limit were less likely to refinance than borrowers below the limit, then it would indicate that lenders were responding strongly to the additional risk by reducing lending in the riskier jumbo market.

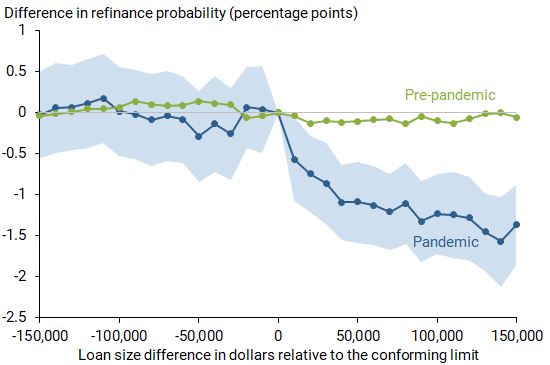

Figure 3 shows the monthly estimated probability of refinancing for borrowers above or below the limit relative to borrowers with loans exactly equal to the conforming loan limits, plotted on the vertical axis. The horizontal axis gives the difference in dollars between the borrower’s current loan and the conforming loan limit. Borrowers to the right of zero are dependent on the jumbo market while borrowers to the left have loans below the conforming limit. The green line shows pre-pandemic estimates for March 2019 to February 2020. The blue line shows estimates for March 2020 to March 2021, including the confidence range to show the 95% likelihood of the estimate’s accuracy (shaded area). These models also control for a broad set of important borrower-level factors such as credit scores and location.

Figure 3

Mortgage availability before and during the pandemic

Source: Equifax Credit Risks Insight Servicing McDash and Black Knight McDash data. Refinance probability by loan size measured relative to loan at conforming limit.

The pre-pandemic estimates essentially do not vary with the difference between the loan size and the conforming loan limit. Borrowers above and below the limits seemed to refinance at roughly the same rate as borrowers right at the limit. This shows that borrower demand for refinancing and credit supply conditions were extremely similar before the pandemic.

However, the early pandemic estimates show that borrowers with loans above the limit—those likely to depend on the jumbo market—were significantly less likely to refinance than borrowers right at the limit and those who had access to the conforming market. The relative declines are economically large, with jumbo borrowers being 0.5 to 1.5 percentage points less likely to refinance, about 50% less than similar borrowers with access to the conforming market. These results show the credit supply in the jumbo market contracted sharply during the pandemic, significantly affecting borrowers’ ability to refinance. While the demand for refinancing overall has increased, the shift in credit supply suggests that the boom in refinancing and house prices did not lead to lower credit standards.

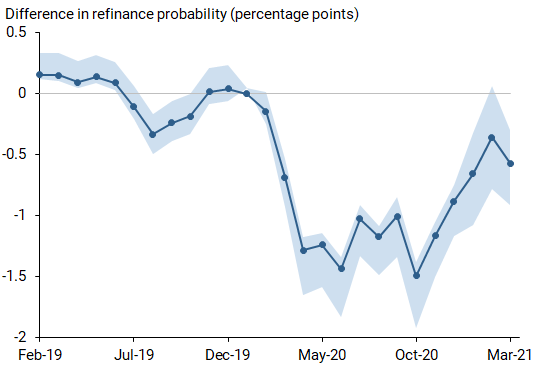

Figure 4 shows how credit supply affected refinancing in the jumbo market from February 2019 to March 2021. The coefficients plotted in the figure show how much the credit supply affected refinancing if a loan was above the conforming limit relative to loans below the limit, all relative to January 2020. For example, the estimate in December 2020 indicated that the borrowers above the limit at that time were 1 percentage point less likely to refinance than borrowers below the limit, as compared to January 2020 when the two borrower types had roughly similar refinancing chances.

Figure 4

Availability of jumbo loans relative to conforming loans

Source: Equifax Credit Risks Insight Servicing McDash and Black Knight McDash data. Refinance probability measured relative to loan below conforming limit.

These estimates show that there was relatively little difference in refinancing behavior leading up to the pandemic. However, borrowers with jumbo loans became significantly less likely to refinance than borrowers with loans below the limit starting in March 2020. Through mid-2020, borrowers in the jumbo market were 1 to 1.5 percentage points less likely to refinance their mortgage than similar borrowers in the conforming loan market. Again, these results show that lenders reacted to the increased risk in the jumbo market during the pandemic.

This difference in refinancing between borrowers above and below the limit remained large through March 2021, despite accelerating house prices and a recovering labor market. While these differences began to narrow by early 2021, borrowers in the jumbo market were still about half a percentage point less likely to refinance than borrowers below the limit in March 2021. This suggests that credit conditions began to normalize, but tight credit supply still constrained borrowing in riskier segments of the mortgage market.

Conclusion

While house prices have been rising rapidly, there is little evidence to suggest that credit standards eased during the first year of the pandemic in a manner reminiscent of the early 2000s housing boom. In fact, most measures of loan and borrower credit quality are at historical highs, and credit standards tightened sharply during the pandemic, although they appeared to be normalizing. It will be important to check if lenders reduce credit standards to compensate for lower demand given the rise in mortgage rates. If credit standards ease, borrowers in riskier or less liquid segments of the mortgage market could begin accessing home equity, potentially providing additional stimulus for spending (see Beraja et al. 2019 and Abel and Fuster 2021) while also possibly introducing more credit risk into the market.

John Mondragon is a research advisor in the Economic Research Department of the Federal Reserve Bank of San Francisco.

References

Abel, Joshua, and Andreas Fuster. 2021. “How Do Mortgage Refinances Affect Debt, Default, and Spending? Evidence from HARP.” American Economic Journal: Macroeconomics 13(2), pp. 254–291.

Beraja, Martin, Andreas Fuster, Erik Hurst, and Joseph Vavra. 2019. “Regional Heterogeneity and the Refinancing Channel of Monetary Policy.” Quarterly Journal of Economics 134(1), pp. 109–183.

Fuster, Andreas, Aurel Hizmo, Lauren Lambie-Hanson, James Vickery, and Paul S. Willen. 2021. “How Resilient Is Mortgage Credit Supply? Evidence from the COVID-19 Pandemic.” National Bureau of Economic Research Working Paper 28843.

Goodman, Laurie, Jim Parrott, and Jun Zhu. 2015. The Impact of Early Efforts to Clarify Mortgage Repurchases. Housing Finance Policy Center Brief, Urban Institute.

Kim, You Suk, Steven M. Laufer, Richard Stanton, Nancy Wallace, and Karen Pence. 2018. “Liquidity Crises in the Mortgage Market.” Brookings Papers on Economic Activity 2018(1), pp. 347–428.

Opinions expressed in FRBSF Economic Letter do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System. This publication is edited by Anita Todd and Karen Barnes. Permission to reprint portions of articles or whole articles must be obtained in writing. Please send editorial comments and requests for reprint permission to research.library@sf.frb.org