Young adults are more likely to own a home if their parents are homeowners than if their parents are renters. New research reveals how parents owning a home can lead to an increase in the persistence in homeownership across generations. Specifically, homeowner parents are often able to extract the equity value from their home to help their children purchase a home. This “dynastic” home equity enables children of homeowner parents who extract equity to accumulate approximately one third more housing wealth by age 30 than children of renters.

Wealth is highly correlated between parents and their children. Among the possible explanations for this relationship, little research has focused on the role of parental housing, even though it is the largest component of wealth for most households—and a key source of inequality—in the United States and other developed countries.

This Economic Letter summarizes recent work by Benetton, Kudlyak, and Mondragon (2022), studying the role that housing wealth plays in perpetuating wealth inequality across generations. We quantify a particular channel we call dynastic home equity, which is the ability of parents to borrow against their home equity to help their children buy a home. We show that this channel is economically and quantitatively important, such that children with parents who extract equity are over three times more likely to buy a home than children whose parents do not extract equity. We also find that dynastic home equity generates large differences in children’s ability to accumulate housing wealth. Our estimates suggest that a child of homeowners who extract wealth at typical rates will have 13% more housing wealth by age 30 than a child of homeowners who never extract wealth and 39% more housing wealth than a child of renters.

Intergenerational homeownership

We use data from the FRBNY ConsumerCredit Panel/Equifax Data (CCP), a random sample of 5% of all individuals with credit reports in the United States, from 2006 to 2021. The data include records on mortgage and housing debt, which we use to create proxies for homeownership status and home equity extraction events. Our approach misses data for households that own their home outright, which could lead us to underestimate the dynastic home equity channel. Although the CCP does not explicitly identify family linkages, it provides credit report data on all household members currently living with individuals in its sample. We classify household parents as those who are at least 36 years old and live at the same address as the child in the year the child turns 18. We focus on households with at most two such adults to reduce the chance of spurious connections.

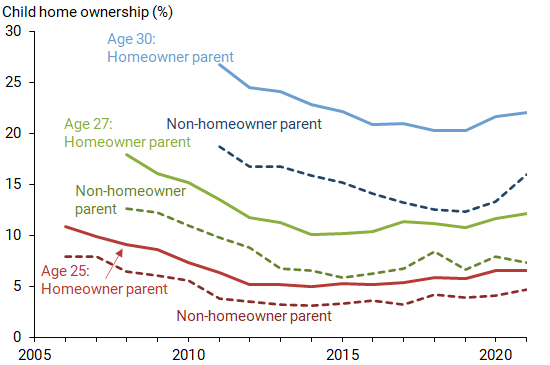

Figure 1 shows trends in children’s homeownership rates over time by age and parent homeownership status. For all ages, children of homeowners are more likely to own a home than children of renters.

Figure 1

Relationship between child and parent homeownership

Source: Authors’ calculations using the FRBNY ConsumerCredit Panel/Equifax Data.

Home equity extraction as a transfer of housing wealth

The differences in homeownership rates between children of homeowners and children of renters are large and conform with the existing research on intergenerational wealth inequality. To consider how to reduce this gap, one must understand the mechanisms that are driving it. If the connection between child and parent homeownership rates mainly reflects the child’s familiarity with the homebuying process and advantages of homeownership, then educating the children of renters on how and why to buy a home could be effective. If instead the connection is primarily driven by better credit availability associated with parent homeownership, for example through assistance with a mortgage down payment, then providing more accessible and attractive credit options to renters’ children may be necessary to improve wealth equity.

To explore the latter possible mechanism of credit availability, we define equity extraction as an increase in one or both parents’ total mortgage, home equity loan, and home equity line of credit balance of at least 5% and $1,000, following Bhutta and Keys (2016). To isolate the effect of parental equity extraction on child home purchasing, we analyze data before and after parent borrowing, known as an “event study.” We restrict this analysis to children of parents who extract equity, and we use a time window of five years before and after the extraction event. We then estimate the likelihood that the child will purchase a home relative to our reference period of two years before the extraction event.

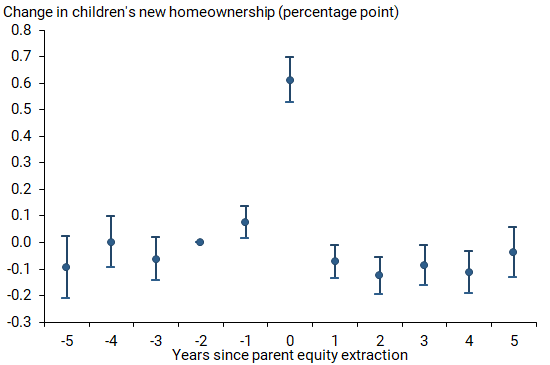

As shown in Figure 2, we find that a child is 0.6 percentage point more likely to buy a home in the year when their parents extract equity, about a 54% increase in the rate of home purchases. In all other years, the likelihood is nearly equal to the reference period, although the estimates immediately following the equity extraction are slightly negative. This is reasonable since children who used parental equity to finance a purchase are unlikely to purchase another home again. The timing shown in our results suggests that parental equity extraction is often used to support home purchases by their children.

Figure 2

Parental equity extraction and children’s homeownership

Note: Bars above and below the estimates indicate 95% confidence intervals.

Source: Authors’ calculations using the FRBNY ConsumerCredit Panel/Equifax Data.

Other conditions could confound the relationship between parental equity extraction and child homebuying. We use two approaches to account for such cases.

First, we consider whether parental equity extraction raises the probability of concurrent home purchases by all homeowners’ children. We estimate this relationship using a statistical method known as a regression. We account for parent and child credit scores, parent age, and three-year parent county house price growth. For each year, we group children by age and zip code and compare those whose parents have extracted equity with those whose parents have not. Similar to our event study, this method estimates that parental equity extraction increases the likelihood of a child’s home purchase by 0.6 percentage point.

Next, we focus on the subsample of homeowner parents only and consider how lending constraints affect how much equity parents can extract from their homes. It becomes significantly more difficult for parents to extract equity when their mortgage balance is large relative to the value of their home. A loan-to-value (LTV) ratio of 80% is an important threshold for mortgage underwriting decisions. As a result, parents with ratios above 80% are much less likely to extract equity than parents with ratios below this threshold. We compare parents above and below this threshold to understand how much access to home equity affects children’s homeownership.

To include LTV constraints in our analysis, we use Equifax Credit Risk Insight Servicing McDash and Black Knight McDash data. These data match individuals in the CCP to mortgage servicing data, which allows us to compute the parents’ LTV ratio.

With this approach, we estimate that parental equity extraction increases the likelihood of a child’s home purchase more than 3.6 percentage points to over three times the average rate of transition into homeownership in the overall sample. These results confirm our argument that parental access to housing wealth has quantitatively large effects on whether children become homeowners.

Importance of dynastic home equity across various subsamples

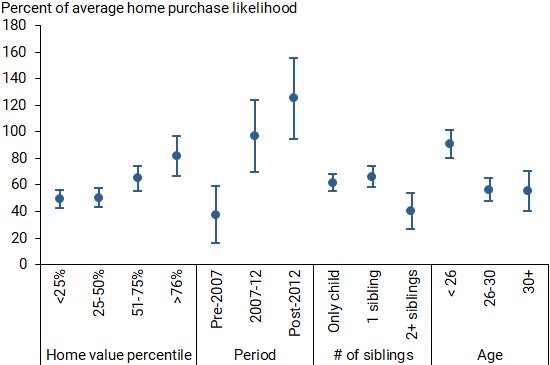

Finally, we estimate the effect of parental equity extraction on child home purchase rates for various subsamples to understand how the effect of equity extraction varies across time and according to a child’s age and location. Although these groups are too small to use our LTV measure reliably, they are still informative for understanding the broader relationship between equity extraction and child homeownership. Figure 3 plots these estimates along with 95% confidence intervals.

Figure 3

Importance of dynastic home equity for child’s home purchase

Note: Shares by subgroup reflect the difference in home purchase likelihood between children whose homeowning parents extract equity and children whose homeowning parents do not extract equity. Each estimate is divided by the overall child home purchase rate in its subsample. Bars show 95% confidence intervals around each estimate.

Source: Authors’ calculations using the FRBNY ConsumerCredit Panel/Equifax Data and the Census Bureau American Community Survey.

The first set of results indicates that the importance of dynastic home equity increases with the child’s local cost of housing. This suggests that, as housing becomes more expensive, children with access to intergenerational wealth have a relative advantage in accessing the housing market.

Turning to variation across time, the second set of estimates shows that equity extraction became more important after the collapse of house prices during the 2007–09 recession. We also find that equity extraction is less important for families with more than two children, consistent with the idea that a fixed amount of equity from parents is less useful when spread across numerous children. Finally, access to home equity is relatively more important when children are younger, potentially because they have accumulated fewer assets to use as a down payment.

Implications for inequality

To assess how much dynastic home equity affects inequality, we consider how housing wealth accumulates as an individual ages from 18 to 30 for three cases: a child of renters, a child of homeowners who never extract equity, and a child of homeowners who extract equity at the rates represented in the data. These calculations rely on our estimates of the effect of equity extraction on homeownership.

To simplify our calculations, we assume that a child who buys a home cannot transition back to renting. We also assume housing wealth appreciates at a constant rate of 6.6% per year, following the findings of Flavin and Yamashita (2002). Finally, we assume that the transition rate into homeownership in any given year is constant across years for each type of individual but varies across types.

We estimate average homeownership transition rates from our data for each of the three cases. For a child of renters, we estimate the transition rate as the average homebuying rate for renters’ children in our panel. For a child of homeowners who never extract equity, we estimate the transition rate as the average homebuying rate of our panel’s children of homeowners during the years in which their parents don’t extract equity. For a child of homeowners who extract equity at typical rates, we estimate the transition rate as that of never-extracting homeowners’ children plus the product of the likelihood of parental equity extraction and our estimate of the effect of equity extraction on child homeownership.

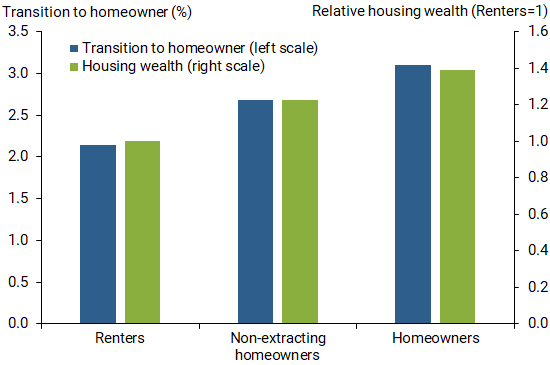

Figure 4 plots homeownership transition rates and housing wealth accumulation by age 30 for each category relative to the wealth accumulation of renters’ children, with the renter’s housing wealth equal to 1. Our estimates suggest that a child of homeowners who extract wealth at typical rates will have 13% more housing wealth by age 30 than a child of homeowners who never extract wealth and 39% more housing wealth than a child of renters.

Figure 4

Homeownership transition and housing wealth

Note: Housing wealth is each group’s average by age 30 relative to children of renters, which is normalized to 1.

Source: Authors’ calculations using FRBNY ConsumerCredit Panel/Equifax Data.

Conclusion

We find that dynastic home equity is an important factor in determining which younger households can enter the homeownership market. The size of these transfers may be tempered by the borrowing costs parents incur to help their children. Still, these results have important implications for our broader understanding of the dynamics of intergenerational wealth and what policies might be most useful in helping children from families with less wealth enter the homeownership market.

Matteo Benetton is an assistant professor at the Haas School of Business, University of California, Berkeley.

Marianna Kudlyak is a research advisor in the Economic Research Department of the Federal Reserve Bank of San Francisco.

Louis Liu is a research associate in the Economic Research Department of the Federal Reserve Bank of San Francisco.

John Mondragon is a research advisor in the Economic Research Department of the Federal Reserve Bank of San Francisco.

Mitchell Ochse is an economist at the Bureau of Labor Statistics.

References

Benetton, Matteo, Marianna Kudlyak, and John Mondragon. 2022. “Dynastic Home Equity.” FRB San Francisco Working Paper 2022-13.

Bhutta, Neil, and Benjamin J. Keys. 2016. “Interest Rates and Equity Extraction During the Housing Boom.” American Economic Review 106(7), pp. 1,742–1,774.

Flavin, Marjorie, and Takashi Yamashita. 2002. “Owner-Occupied Housing and the Composition of the Household Portfolio.” American Economic Review 92(1), pp. 345–362.

Opinions expressed in FRBSF Economic Letter do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System. This publication is edited by Anita Todd and Karen Barnes. Permission to reprint portions of articles or whole articles must be obtained in writing. Please send editorial comments and requests for reprint permission to research.library@sf.frb.org