The COVID-19 pandemic reshaped the way households work. Nearly a third of employees still worked from home part time or full time as of August 2022. This has significantly increased housing demand and is a key factor explaining why U.S. house prices grew 24% between November 2019 and November 2021. Analysis shows that the shift to remote work may account for more than half of overall house price increases and similar increases in rents. This fundamental evolution in work-related housing demand may be important for future house prices.

The U.S. labor market has seen a large and apparently persistent shift to working from home in response to the COVID-19 pandemic. Surveys show that 30% of work is still being done at home as of August 2022, and many employers and employees expect work from home to become a permanent fixture (Barrero, Bloom, and Davis 2021). Working from home may increase a worker’s housing demand, because activities that used to be done in offices now take up space and time at home.

At the same time, U.S. house prices have grown extremely rapidly. This has led to questions about whether the price increases are being supported by fundamental factors, such as the shift in demand from remote work, or driven by speculation, in part fueled by fiscal stimulus and accommodative monetary policy. One concern is that house prices could pose a risk to financial stability, like the bubble that preceded the Great Recession (Coulter et al. 2022). Furthermore, faster growth in housing costs has contributed to inflation, which has been running at its highest levels since the 1980s, creating challenges for achieving the Federal Reserve’s price stability mandate (Lansing, Oliveira, and Shapiro 2022).

In this Economic Letter, we study the evolution of remote work and house price growth in a cross section of U.S. cities, as described in Mondragon and Wieland (2022). We find that the shift to remote work accounts for more than half of overall house price growth over the pandemic. Our results suggest that rising house prices over the pandemic reflected a change in fundamentals rather than a speculative bubble. This implies that the evolution of remote work may be an important determinant of future housing costs and inflation.

More remote work leads to higher house prices and rents

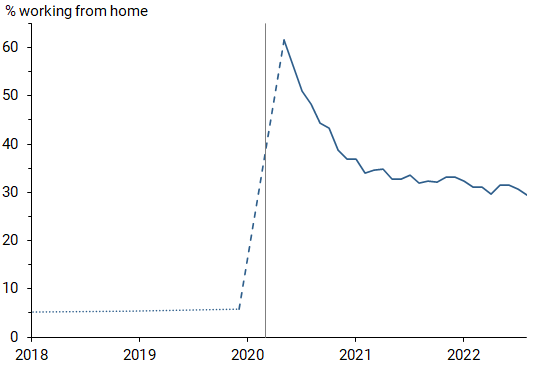

Following the spread of the COVID-19 pandemic, remote work increased dramatically across the entire country. Figure 1 shows that the share of work being done from home—either fully remote or hybrid—increased from a pre-pandemic level of around 5% to about 60% in spring 2020. After falling in early 2021, the share appears to have stabilized to near 30% as of August 2022. However, remote work varies substantially across cities, which can help us understand the effect remote work has had on housing markets.

Figure 1

Pandemic’s effect on share of people working from home

Source: Barrero, Bloom, and Davis (2021), with updates available online.

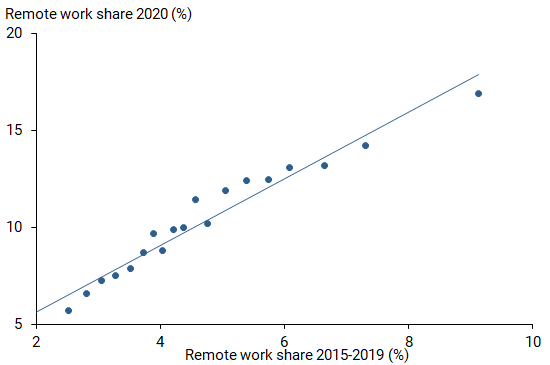

For this study, we consider a measure of cities and towns known as core-based statistical areas (CBSAs), which are county groups constructed around population centers and adjacent counties connected by commuting. Figure 2 plots the relationship between the share of jobs done remotely in 2020 and the pre-pandemic shares of remote work. The figure shows that CBSAs with more remote work before the pandemic saw larger increases in remote work during the pandemic.

Figure 2

Relationship of 2020 remote work to pre-pandemic trend

Note: Dots represents the average within a group of 5 percentiles (0-5, 6-10, etc.) of the remote work distribution, with fitted line reflecting overall average relationship.

Source: IPUMS/Census Bureau.

This reflects several factors. First, the types of jobs in a city matter because many jobs are not feasible to do from home. For example, cities with a lot of technology jobs would be expected to have more remote work opportunities than cities with mostly restaurant service jobs. Second, cities with relatively cheaper and more housing available attract more remote work because people working from home want more space at home instead of using space at an office. Finally, areas that have relatively pleasant climates tend to attract employees that can work remotely.

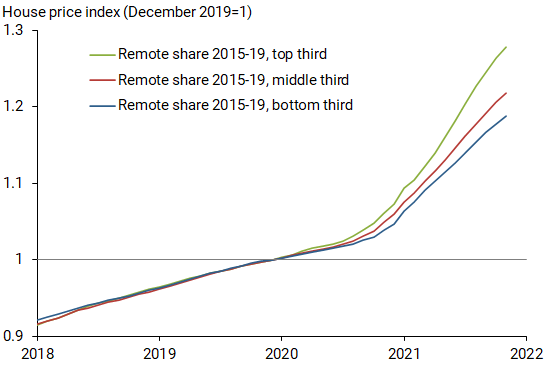

This variation in pre-pandemic remote work is helpful in that it allows us to isolate and quantify the effects of pandemic remote work on house prices. Figure 3 plots house price growth within three groups of CBSAs, organized by pre-pandemic remote work shares. We see that house price growth is essentially identical for the three CBSA groups before the pandemic. However, by late 2020, the CBSAs with higher shares of remote work had significantly higher house price growth than those with less remote work. The difference continued to expand into 2021.

Figure 3

House price growth for three CBSA groups

Note: Core-based statistical area (CBSA) groups organized by pre-pandemic remote work shares into thirds by percentiles.

Source: IPUMS/Census Bureau, Zillow.

Mondragon and Wieland (2022) document that this pre-pandemic remote work is uncorrelated with other shocks over the pandemic, such as unemployment. Thus, pandemic remote work that was caused by the preexisting share of work that was remote can be used to estimate the causal effect of remote work on pandemic house price growth. These estimates, which do not adjust for migration, show that a 1 percentage point increase in the share of workers doing remote work in 2020 caused a 1.5 percentage point increase in house price growth.

To the extent that remote work increases housing demand for all kinds of housing, we should expect to see similar effects on rent prices. Turning to the subsample of CBSAs that provide data on rental indexes, we find that remote work has essentially identical effects on rents as it does on house prices. At the same time, we find no evidence that the push to remote work had a similar effect on nonhousing-related prices and that it may have even had a negative effect on commercial rents. Together, this evidence suggests that remote work caused a relative increase in the demand for all types of housing.

This estimated effect of remote work on housing costs is very large and indicates that remote work was an important factor affecting house price growth in the cross section of CBSAs. However, this estimate is not directly informative about the effect of remote work on aggregate house prices. Part of the effect we observe across cities is potentially due to migration caused by access to remote work. As workers shifted to remote work in the pandemic, they were able to relocate to cities with cheaper housing or more attractive amenities. Therefore, we need some additional analysis to isolate the effect of remote work on housing demand as distinct from the effect of migration.

Remote work drove house prices

Mondragon and Wieland (2022) show that if we have an accurate measure of migration across CBSAs then we can isolate the effect of remote work on housing demand. This estimate can then be extrapolated to give a lower bound for the true effect of remote work on overall house prices.

We use consumer credit bureau data to construct an accurate measure of migration across CBSAs. These data allow us to observe locations for a 5% monthly representative sample of anonymized consumer credit records. We then use changes in locations for the reported CBSAs of these records to infer migration rates over the pandemic.

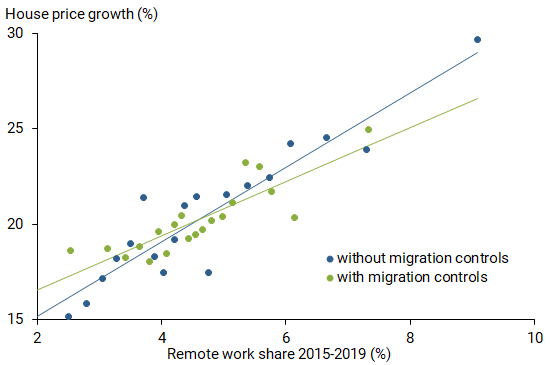

After controlling for migration, we find that most of the effect of remote work on house prices arises from its direct effect on housing demand. Figure 4 shows the relationship between remote work and house prices with and without controls for migration. The dots reflect groups of 5 percentiles; the fitted line for each group reflects the estimated relationship between remote work and house prices. The slopes of the lines indicate the strength of remote work’s effect on house prices. Even after adjusting for migration, most of the effect of remote work on house prices is present. This shows that most of the effect of remote work on house prices operates through the shift in housing demand. However, Mondragon and Wieland (2022) do find that migration, house prices, and remote work are connected. Cities more attractive to remote work tended to see more residents moving in, which drove up house prices, while cities less amenable to remote work lost residents and saw slower house price growth. Even so, after adjusting for the role of migration, our estimates show that 1 percentage point more remote work causes house prices to increase by about 0.9 percentage point, smaller than the initial estimates but still very large.

Figure 4

Migration effect on remote work, house price relationship

Note: Each dot represents the average within a group of 5 percentiles (0-5, 6-10, etc.) of the remote work share distribution, with fitted line reflecting overall average relationship.

Sources: IPUMS/Census Bureau, Zillow.

This effect suggests that the national increase in remote work indeed caused an increase in housing demand. We can extrapolate our estimate to give a sense of the effect on overall house prices. For this, we use data from the 2020 American Community Survey, which allows us to measure remote workers as employees that do not commute. This measure, however, tends to understate the level of remote work given by other surveys, such as Barrero et al. (2021). This may be the result of the way households answer the survey and the timing of when they were surveyed.

According to our data, remote work increased to 16 percentage points. Along with our estimate, this implies that remote work resulted in house prices rising by about 15% from November 2019 to November 2021, accounting for more than 60% of the overall increase in house prices.

Conclusion

The transition to remote work because of the COVID-19 pandemic has been a key driver of the recent surge in housing prices. Using variation in how attractive cities are for remote work, Mondragon and Wieland (2022) demonstrate that the transition to remote work was directly responsible for 15 percentage points of national housing price growth since November 2019. This suggests that the fundamentals of housing demand have changed, such that the persistence of remote work is likely to affect the future path of real estate prices and inflation.

Augustus Kmetz is a research associate in the Economic Research Department of the Federal Reserve Bank of San Francisco.

John Mondragon is a research advisor in the Economic Research Department of the Federal Reserve Bank of San Francisco.

Johannes Wieland is an associate professor at the University of California, San Diego.

References

Barrero, Jose Maria, Nicholas Bloom, and Steven J. Davis. 2021. “Why Working from Home Will Stick.” National Bureau of Economic Research Working Paper 28731.

Lansing, Kevin J., Luiz E. Oliveira, and Adam Hale Shapiro. 2022. “Will Rising Rents Push Up Future Inflation?” FRBSF Economic Letter 2022-03 (February 14).

Coulter, Jarod, Valerie Grossman, Enrique Martínez-García, Peter C.B. Phillips, and Shuping Shi. 2022. “Real-Time Market Monitoring Finds Signs of Brewing U.S. Housing Bubble.” FRB Dallas, Dallas Fed Economics (March 29).

Mondragon, John, and Johannes Wieland. 2022. “Housing Demand and Remote Work.” FRB San Francisco Working Paper 2022-11.

Opinions expressed in FRBSF Economic Letter do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System. This publication is edited by Anita Todd and Karen Barnes. Permission to reprint portions of articles or whole articles must be obtained in writing. Please send editorial comments and requests for reprint permission to research.library@sf.frb.org