Global supply chain disruptions due to the COVID-19 pandemic have increased the costs of trade between countries. Given the interconnectedness of the U.S. economy with the rest of the world, higher trade costs can have important impacts on U.S. labor markets. A model of the U.S. economy that incorporates variation in industry concentrations across regions can help quantify these effects. The analysis suggests that recent global supply disruptions could cause a sizable and persistent reduction in labor force participation.

The U.S. economy has become increasingly integrated with the rest of the world over the past four decades. Trade with other countries is broader and plays a greater role in the overall performance of the economy, with a commensurate impact on the type and availability of jobs. In this context, disruptions to the flow of products between countries can affect the U.S. labor market in significant ways, impacting labor force participation, unemployment, and the distribution of jobs across industries.

Given this increase in trade reliance, U.S. labor markets have been highly exposed to global supply chain disruptions induced by the COVID-19 pandemic. The pandemic strained international trade due to ports being closed or operating at partial capacity, fewer workers being available for health reasons, and a shortage of shipping containers, among other challenges. In this Economic Letter, we analyze the implications of such global supply chain disruptions for U.S. labor markets by studying the effects of increased transportation costs in a model of the U.S. economy that incorporates variation in industry concentration across regions. Our analysis finds that these challenges could have large effects on U.S. labor force participation for several years, even as global supply chain disruptions ease.

A framework of international trade with unemployment

To assess the implications for the U.S. labor market of the pronounced increase in trade costs brought about by the pandemic, we require an economic framework that reflects the interconnectedness of U.S. industries with the rest of the world. The framework also needs to consider that workers can move across economic sectors, but that this is a costly process.

The framework we use is detailed in Rodriguez-Clare, Ulate, and Vasquez (2022). It enables us to analyze the local labor market impact of a shock to the cost of international trade, accounting for the effects across many economic sectors operating in a large number of regions. To be more precise, our framework incorporates 87 regions—50 U.S. states, 36 other countries, and an aggregate “rest of the world” region—and 15 sectors—12 manufacturing sectors, plus services, agriculture, and “home production.” Home production refers to the activities people engage in outside of paid work in the labor market that contribute to their well-being. Additionally, the framework incorporates trade costs for sending products between countries. We will focus on assessing how sudden changes in these costs due to pandemic-induced supply chain disruptions have affected the U.S. labor market.

Extending standard models of international trade, which assume that there is full employment at all times, our framework incorporates the possibility that unemployment could increase after economic disruptions. In particular, we follow Schmitt-Grohe and Uribe (2016) in assuming that wages sometimes do not adjust downward quickly enough in response to shocks. As such, after certain economic disruptions, wages might not be able to drop in line with underlying economic fundamentals, leading to increased unemployment.

To study the labor market impacts of trade shocks, we need to carefully consider the decisions individuals make about spending their time in or out of the labor market. People in our framework can either engage in home production, which means they are outside of the labor force, or search for work in the labor market. For our study, we assume that those people participating in home production are not directly affected by labor market conditions. By contrast, working outside the home in a particular industry exposes workers to the wages and amount of unemployment in that sector. The decision of which industry to work in depends in turn on wages in that industry and individual preferences about job conditions, along with the costs of switching between sectors, meaning for example, any extra costs of job search and retraining.

Consequences of an increase in the costs of international trade

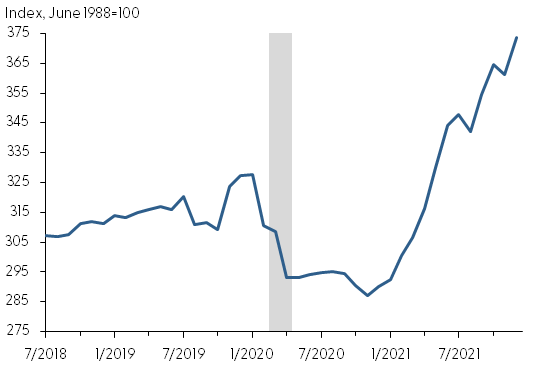

We next use our framework to analyze the consequences of disruptions in global supply chains. As an illustration of some of these disruptions, Figure 1 depicts the producer price index of deep sea freight transportation services. The index rose about 12% from roughly 330 before the pandemic to 370 in December 2021. We use this 12% magnitude as the increase in the cost of sending products across countries in our model. We assume that this trade-cost shock persists for three years, from 2020 through 2022, after which trade costs revert to their pre-pandemic level.

Figure 1

Producer price index for deep sea freight transportation

Source: Bureau of Labor Statistics.

Note: Gray shading indicates NBER recession dates.

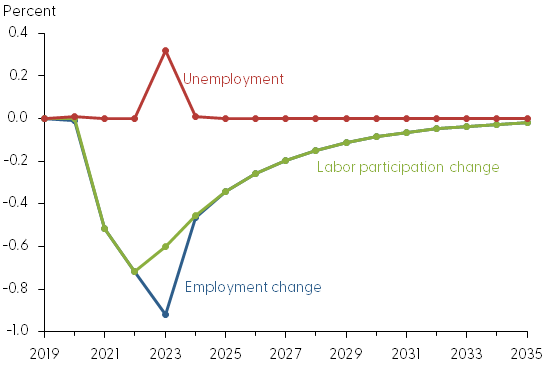

Figure 2 displays the model-generated paths of employment-related quantities for the United States in response to the trade-cost shock, extended out to the year 2035. The blue line depicts the cumulative percentage change in employment since 2019, the green line shows the cumulative percentage change in labor force participation since 2019, and the red line shows the unemployment rate.

Figure 2

Paths of overall labor market responses to trade-cost shock

Source: Authors’ calculations.

Our model suggests that overall U.S. labor supply declines during the years when trade costs are elevated and then begins to recover. The biggest cumulative drop of 0.7% occurs in 2022 and the recovery is slow. By 2027, labor supply is projected to still be 0.2% lower than its pre-shock level. The fall in labor supply occurs because, while trade costs are higher, focusing on home production activities that are not reliant on the labor market temporarily becomes more attractive for some people than working in industries that are affected by the trade disruption.

Our model’s projected path for a slow recovery in labor force participation is notable and worthy of explanation. Our framework incorporates the costs of moving in and out of the labor force and between different market sectors based on the patterns observed in the pre-pandemic period. These patterns indicate that there are significant costs of changing sectors, which is why people trickle back into the labor force slowly. The costs of moving between sectors could also be affected by the unique challenges of the pandemic, but our analysis does not take these potential changes into account.

The trade-cost shock generates a peak amount of unemployment of 0.32%. Interestingly, unemployment mostly occurs around 2023, when trade costs normalize, instead of around 2020 when the trade disruptions first materialize. The reason is that, during the years with high trade costs, wages are increasing faster than usual, so the downward inflexibility of wages is not an issue and unemployment does not arise. By contrast, when the trade disruption ends, wages must adjust downward. However, the sluggishness of wages to the downside implies that this adjustment does not occur fast enough, and unemployment thereby increases. It is important to note that, as with all other variables, this is the path of unemployment due exclusively to the trade shock. That is to say, the framework does not feature a contraction in economic activity from the pandemic itself.

The blue line in Figure 2 for the cumulative change in employment since 2019 combines the separate effects from labor force participation and unemployment (green and red lines). Even though the low point for labor supply occurs in 2022, our model does not project that the low point for employment will happen until 2023, due to the additional unemployment that is generated when the trade-cost shock dissipates. Notice that the unemployment generated by the shock has almost fully dissipated by 2025, leading the blue line to converge with the green line.

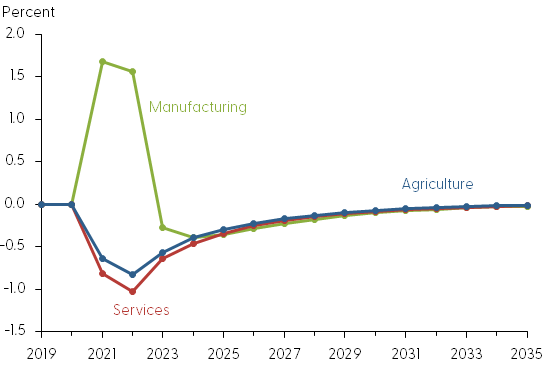

Our framework also allows us to compare the impacts of the trade disruptions across different industry groups. Figure 3 displays the cumulative percentage change since 2019 of labor force participation in three different sectors for the United States as a whole: manufacturing (green line), services (red line), and agriculture (blue line). The number of individuals working in manufacturing goes up while trade costs are elevated. By contrast, the number of workers employed in services and agriculture declines.

Figure 3

Model-generated labor participation changes by sector

Source: Authors’ calculations.

Our framework accounts for various factors to generate the changes in employment by sector shown in Figure 3. For example, several forces affect manufacturing employment. First, there is a general decrease in demand due to the fall in overall employment, reflecting that spending power drops when people are out of work. Second, foreign inputs are more expensive, making production less efficient and decreasing labor demand. Third, there is an “expenditure-switching” effect across countries: imports become more expensive and tend to be substituted with local production, increasing labor demand in net-importing sectors. The United States is a net manufacturing importer, so in this sector the expenditure-switching effect dominates the other two effects and labor participation increases. Conversely, the United States is a net exporter of services and has roughly balanced trade in agriculture. As a result, the expenditure-switching effect is less powerful in those sectors, the other two effects—the fall in aggregate demand and the increase in input costs—dominate, and labor participation decreases.

Conclusion

In this Letter, we analyzed the implications of an increase in the costs of transporting products across countries in a model of the U.S. economy that incorporates variation in industry concentrations across regions. This exercise is meant to capture some aspects of the global supply chain disruptions that have occurred due to COVID-19. We find three main results. First, there is a temporary but long-lived fall in labor force participation. Second, there is a temporary increase in manufacturing employment. Third, unemployment is generated mostly around the time when the trade disruptions disappear.

The main takeaway of our analysis is that global supply disruptions might have worsened the effects of the pandemic on U.S. labor force participation. We note that our model does not account for many relevant pandemic-induced issues, such as pent-up demand and fiscal support. As such, while our findings are not directly useful to answer questions related to the proper conduct of monetary policy, they can provide insights into how trade disruptions can be expected to affect labor supply going forward.

Andrés Rodríguez-Clare

Edward G. and Nancy S. Jordan Professor of Economics, University of California at Berkeley

Mauricio Ulate

Senior Economist, Economic Research Department, Federal Reserve Bank of San Francisco

Jose P. Vasquez

Assistant Professor, Department of Management, London School of Economics

References

Rodríguez-Clare Andrés, Mauricio Ulate, and Jose P. Vasquez. 2022. “Trade with Nominal Rigidities: Understanding the Unemployment and Welfare Effects of the China Shock.” National Bureau of Economic Research Working Paper 27905.

Schmitt-Grohe, Stephanie, and Mauricio Uribe. 2016. “Downward Nominal Wage Rigidity, Currency Pegs, and Involuntary Unemployment.” Journal of Political Economy 124(5), pp. 1,466–1,514.

Opinions expressed in FRBSF Economic Letter do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System. This publication is edited by Anita Todd and Karen Barnes. Permission to reprint portions of articles or whole articles must be obtained in writing. Please send editorial comments and requests for reprint permission to research.library@sf.frb.org