Bharat Trehan, research advisor at the Federal Reserve Bank of San Francisco, provides his views on current economic developments and the outlook.

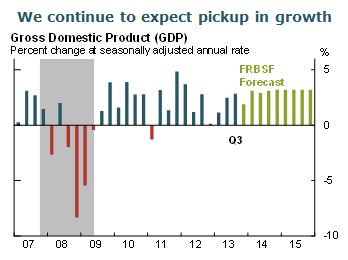

- Our forecast is relatively unchanged from October, with real GDP projected to grow a bit more than 3% in 2014 and in 2015.

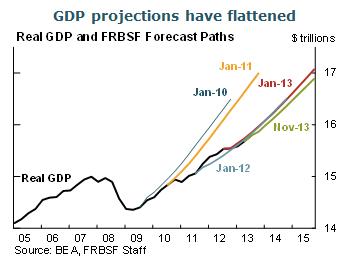

- While prospects for economic growth have not changed much over recent months, they have changed quite substantially over the past few years. In this FedViews, we take a closer look at these changes, including how our forecast has evolved.

- We start by looking at our predictions for the path of real GDP every January for the past four years. Our 2010 and 2011 forecasts proved to be too optimistic, projecting that growth would rebound too rapidly after the recession. Our 2012 and 2013 forecast trajectories have been considerably flatter and appear to have matched actual output more closely.

- So, why did we overpredict economic growth early in the recovery, and why are we predicting slower growth now? Part of the answer to the first question lies in the unusually large negative demand shocks that slowed the economy early in the recovery. The European debt crisis that began in late 2009 and intensified in 2010 pushed one of our major trading partners back into recession. The Japanese earthquake and tsunami in 2011 delivered another major shock. And the U.S. government’s fiscal retrenchment and 2011 debt ceiling crisis created more headwinds. All these events have pushed down demand for U.S. products.

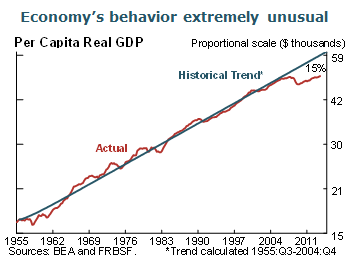

- As significant as these demand shocks were, surprises on the supply side were at least as important in restraining future growth and seem likely to persist. The financial crisis appears to have caused extraordinarily deep-seated damage to the U.S. economy. One way to measure the extent of this damage is to consider what would have happened if per capita output had grown at a constant rate every quarter from 1955 onwards. Specifically, we consider the historical average growth rate from 1955 to 2004 extended through 2013. At the beginning of 2005, this historical average growth rate would seem to have been a relatively safe bet for how much the economy would grow over the next decade. Unfortunately, as the chart indicates, the deep recession has resulted in a gap between actual per capita GDP and the historical trend that is noticeably larger in 2013 than ever before and is showing no tendency to close.

- As this comparison suggests, the financial crisis appears to have damaged the supply side of the economy in a number of ways that have continued into the recovery. Prolonged durations of unemployment have caused those out of work to lose skills, and many have become discouraged and left the labor force. Business investment has been weak, which has damped the growth of the capital stock. And productivity growth and net business formation have also slowed.

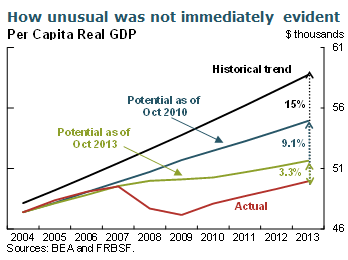

- The extent of the damage to the supply side of the economy became evident only gradually. By October 2010, our estimate of what the economy could produce in 2013—given the capital stock, the labor force, and our level of technology—was already about 6% below the estimate from the simple historic trend. But, we were still underestimating the effects of the crisis and had not lowered potential output enough.

- One more development played a major role in the subsequent downward revision of our potential GDP estimate: History changed. For example, in the middle of 2010, the Bureau of Economic Analysis estimated that real GDP rose roughly ¾% from the end of 2006 to the end of 2009. Now, though, the revised data show that real GDP fell close to 1¼% during that period. That is, estimates of the state of the economy in 2010 simply did not reveal the extent of the damage to the supply side.

- This helps us answer the second question posed earlier: Why are we predicting only a moderate pickup in growth going forward? Our recognition of deep and fairly long-lasting damage to the supply side of the economy, and the resulting downward revisions to our estimate of potential growth, explain much of why our recent forecast paths have been flatter than they were early in the recovery.

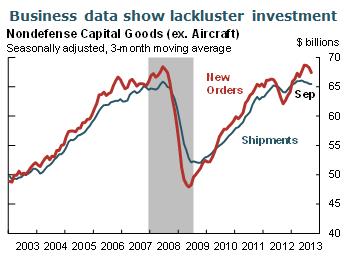

- Of course, our current estimate of supply-side conditions or potential GDP could be revised lower. There are other downside risks as well. Recent surveys show waning consumer confidence, which could lead to slower consumption growth. Another risk is that business equipment spending may not pick up. Orders for nondefense capital goods have fallen at nearly a 15% annual rate over the past three months, reversing most of the gains of the prior three months. These orders provide information about near-term business equipment spending and suggest that this category of spending is likely to remain soft for a while. This is especially discouraging following the November 7 GDP report, which showed that real equipment investment in the third quarter fell slightly below its first-quarter level.

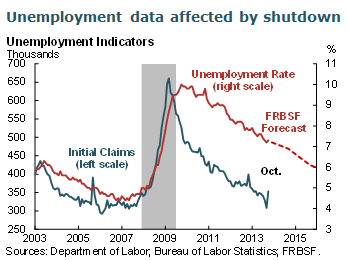

- Another big data release was the employment report for October. In the household survey, the unemployment rate ticked up from 7.2% to 7.3%, while the labor force participation rate fell from 63.2% to 62.8%. This survey reflected the government shutdown, as furloughed government workers were classified as “unemployed on temporary layoff.” However, the reliability of some of these data may be questionable, partly because the government shutdown delayed data collection and partly because some furloughed workers may have been incorrectly recorded as “employed, but absent from work.” November data from the household survey should provide a clearer picture.

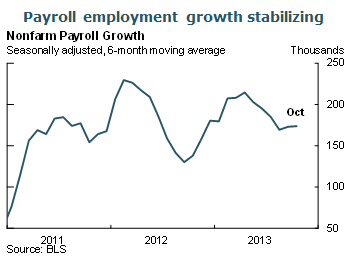

- Data from the establishment survey look considerably better. Payroll employment rose by a larger-than-expected 204,000 in October, while data for the previous two months were revised to add 60,000 jobs. Over the past three months, the economy has created an average of nearly 202,000 jobs per month. Furloughed government workers were considered employed in the establishment survey.

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.