Simon Kwan, vice president at the Federal Reserve Bank of San Francisco, provides his views on current economic developments and the outlook.

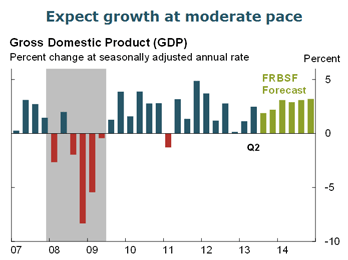

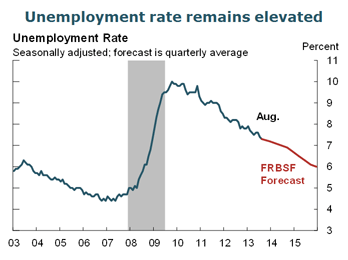

- Recent economic data suggest that, before the government shutdown, economic growth had lost a bit of momentum. The partial shutdown of the U.S. government since the beginning of October took even more wind out of the current quarter’s sails. Assuming the shutdown lasts through mid-October, we now expect real GDP to grow at about a 2% pace over the second half of 2013.

- Although the federal government makes up a relatively small share of the economy, a more protracted government shutdown could spill over into the private sector by undermining confidence and increasing uncertainty. In addition to the effects of the shutdown, the government’s inability to raise the federal debt limit poses substantial risk to the economy. Assuming these downside risks do not occur, we expect economic growth to firm as we go through 2014.

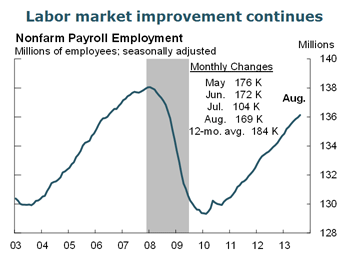

- The labor market has been improving steadily since last year. Nonfarm payroll employment gained 184,000 jobs per month on average over the 12 months ending in August, although the pace of job growth slowed a bit over the summer. The Bureau of Labor Statistics has not released the employment report for September due to the government shutdown. However, data on initial claims for unemployment insurance and estimates of private payroll gains from the privately produced ADP National Employment Report both suggest that the gradual improvement in the labor market is continuing.

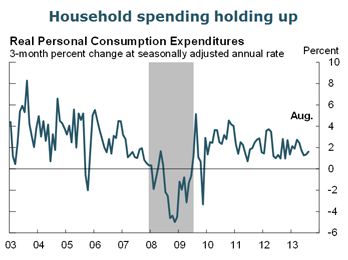

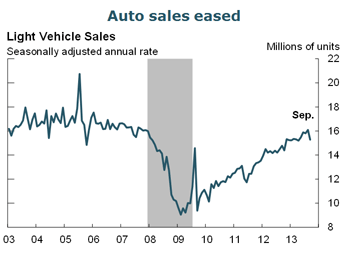

- Household spending has held up reasonably well, despite the moderate pace of economic growth and still-elevated unemployment rate. Nevertheless, light vehicle sales in September were weaker than expected, following a period of brisk sales earlier this summer. Smoothing monthly volatility, the underlying trend in auto sales remains strong.

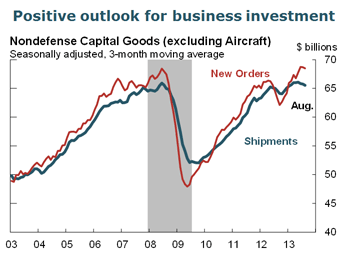

- Shipments of core capital goods have moved lower on average in recent months, and the August data were weaker than expected. However, new orders have outpaced shipments over the past few months, suggesting a positive outlook for business investment. Of course, it is quite possible that the government shutdown and related fiscal uncertainties could weigh on business spending, especially if the stalemate in Washington continues.

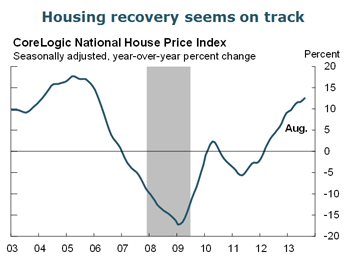

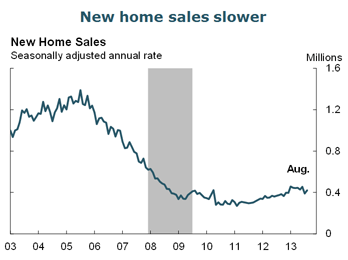

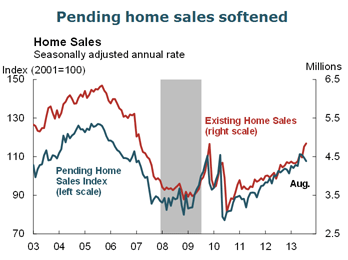

- The housing recovery still seems to be on track. The CoreLogic national home price index for August showed strong gains across much of the country. While new home sales have softened a bit lately, existing home sales have continued to rise. How higher mortgage rates will affect overall housing activities remains to be seen, but one indicator, the forward-looking pending home sales index, declined in August.

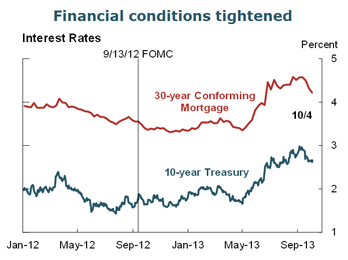

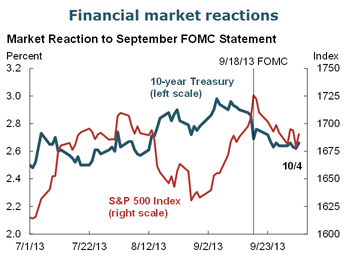

- Financial conditions tightened since summer as market participants revised their expectations about the Federal Reserve’s large-scale asset purchases. With less growth momentum, as well as the nontrivial risk from fiscal policy, the Federal Open Market Committee (FOMC) decided in its September meeting to continue purchasing additional securities at a pace of $85 billion per month. The Committee noted that “asset purchases are not on a preset course, and the Committee’s decisions about their pace will remain contingent on the Committee’s economic outlook as well as its assessment of the likely efficacy and costs of such purchases.”

- The September 18 FOMC decision eased financial conditions: Bond yields declined and stock prices rose in response to the announcement. Since then, bond yields have fallen further; but stock prices also fell amid the government shutdown and the lack of progress in raising the federal debt ceiling.

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.