Zheng Liu, research advisor at the Federal Reserve Bank of San Francisco, provides his views on current economic developments and the outlook.

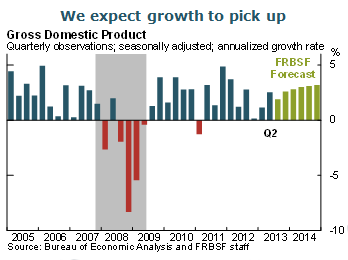

- Recent data have been mixed, consistent with moderate economic growth. Increases in long-term interest rates added to headwinds for the housing sector. However, recent construction spending data and broad-based house price increases indicate continued recovery in the housing market. Sales of light vehicles for August were firmer than expected, while durable goods orders and capital goods spending in July were weaker than expected. With the fiscal drag waning, we expect growth to pick up in the fourth quarter and next year.

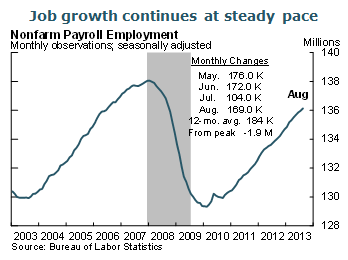

- The labor market continues to recover. Although the August employment report showed solid payroll job gains relative to July, the pace of growth has slowed in recent months compared with earlier in the year. On a 12-month basis, however, job growth has been quite steady since mid-2012.

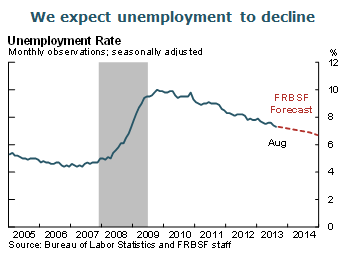

- The unemployment rate fell slightly in August, but this was propelled by weak labor force numbers rather than employment gains. As the economy gains strength, we expect that the unemployment rate will continue to decline gradually.

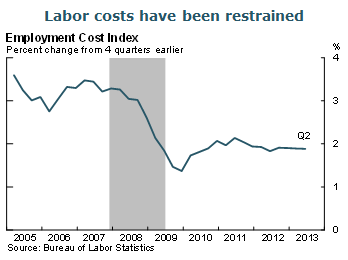

- Labor costs remain contained, reflecting substantial slack in the economy. The employment cost index, which measures total compensation to workers including wages and benefits, has continued to rise at a modest and steady pace in recent quarters.

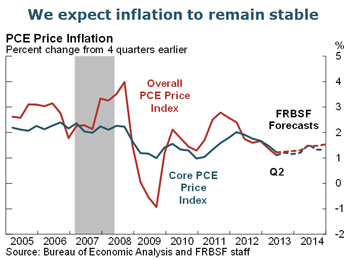

- With labor costs contained and inflation expectations anchored, headline and core measures of inflation have both remained low and stable in recent periods. As growth strengthens, we expect inflation to move back gradually toward the Fed’s long-term target of 2%.

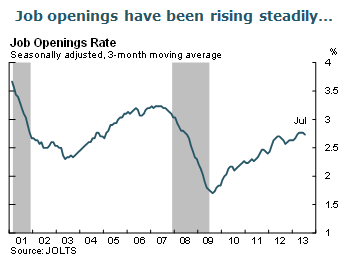

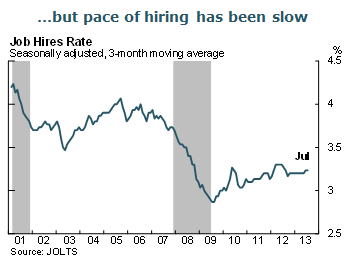

- The labor market recovery has been uneven in the past four years. In particular, the job openings rate has increased steadily, but the hiring rate has not increased as much.

- One potential reason for the slow pace of hiring is skills mismatch. For example, a worker formerly employed in construction might not be a good fit for a job opening in the health-care sector. But some recent studies have found that skills mismatch is unlikely to be the primary culprit for sluggish hiring since the recession.

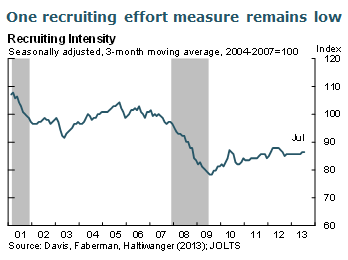

- An alternative explanation for the current slow pace of hiring is low levels of recruiting effort. In particular, employers may not feel any urgency to fill vacant positions unless they find the rare ideal candidate. One commonly cited measure of recruiting effort shows that it declined sharply in the recent recession and has remained depressed during the past four years.

- The depressed level of recruiting effort and the slow pace of hiring can be explained in part by heightened uncertainty. Employers facing high levels of uncertainty might be reluctant to enter a sustained employment relationship because future layoffs could be costly. An estimate from our staff research indicates that elevated policy uncertainty may have added about 1.3 percentage points to the unemployment rate in late 2012.

- As uncertainty recedes over time, we expect hiring to pick up.

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.