Vasco Cúrdia, senior economist at the Federal Reserve Bank of San Francisco, provides his views on current economic developments and the outlook.

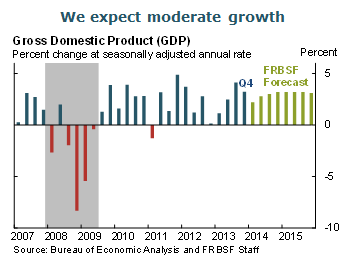

- Recent data continue to indicate a strengthening recovery. Fourth-quarter real GDP growth suggested a little less momentum than we expected in domestic demand. We expect a further modest dip in GDP growth in the current quarter, reflecting two main factors. First, firms are likely to reduce their accumulation of inventories following a sizable increase in the second half of 2013. Second, weak retail sales in January suggest somewhat weaker near-term growth in consumption. Some of this weakness is likely associated with bad weather and the termination of extended unemployment benefits. Nevertheless, we expect more solid growth overall for 2014.

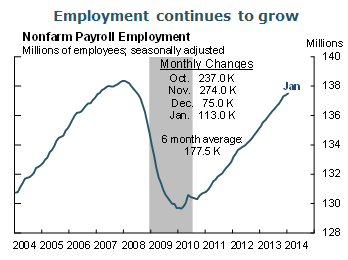

- The January labor market report confirmed that jobs continue to grow. The average increase in nonfarm payroll employment was almost 180,000 over the past six months. December and January fell well short of that pace, partly due to inclement weather. Other elements of the January report were more encouraging, with increases in labor force participation and employment-to-population ratios.

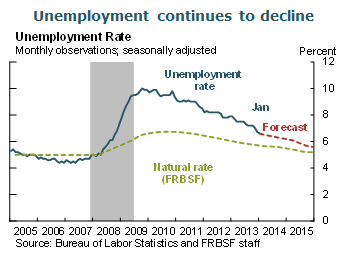

- The unemployment rate declined again in January, and we expect it to keep declining. However, the rate remains above our estimate of the natural rate of unemployment, which signals persisting slack in the economy. Overall, we view these data as consistent with a sustained but gradual recovery in the labor market.

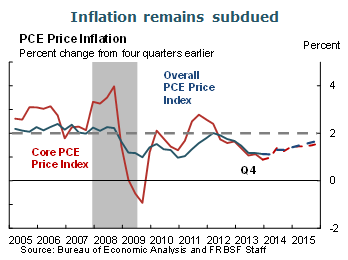

- Inflation remains subdued and well below the longer-run goal of 2% set by the Federal Open Market Committee (FOMC). This is due in part to lower inflation in energy and medical services, which we expect to be temporary, as well as ongoing economic slack. As the temporary factors dissipate and economic slack narrows, we expect inflation to rise gradually towards the 2% objective.

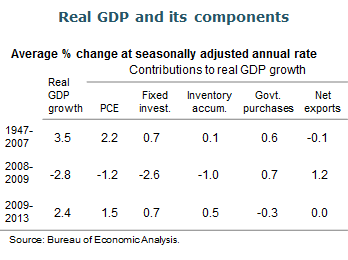

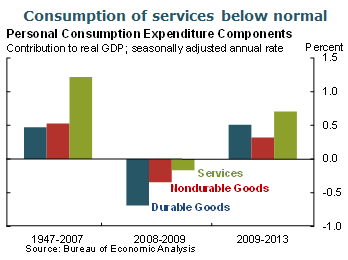

- Consumption is historically the main demand-side driver of GDP growth. In the six decades prior to the Great Recession, consumption contributed an average of 2.2 percentage points to annual GDP growth of 3.5%. Since the beginning of the recovery in mid-2009, consumption has contributed only about 1.5 percentage points per year. Although this is an improvement over the 2008–09 recession, it is still below the historical norm.

- The contribution of durable consumption goods to real GDP growth has recovered to levels similar to its historical average, around 0.5 percentage point. The shortfall in the consumer contribution has been in nondurables and, especially, services.

- The pattern among the components of consumption in the recovery can be partly explained by low interest rates resulting from monetary policy actions since the recession. Consumption of durables is highly responsive to interest rates. By contrast, nondurables and services consumption are more dependent on a broad-based improvement in economic conditions, including labor income and consumer confidence. It is therefore normal to expect consumption of services to be slower in response to monetary policy stimulus.

- We expect consumption growth to pick up as the labor market continues to recover, improving households’ labor income and economic prospects. Additionally, lower debt and higher net worth—boosted by higher equity and housing prices—should make households gradually more confident and willing to consume more.

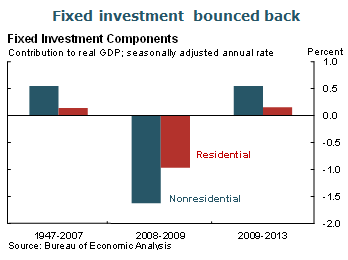

- Fixed investment is another important component of GDP, normally accounting for about 0.7 percentage point per year of growth. Investment was a substantial drag in the recession but has since bounced back to its historical patterns, supported by low interest rates. Importantly, the housing market was considered a significant headwind early in the recovery, but it has improved substantially in the last two years, returning the contribution of residential investment close to levels consistent with historical patterns.

- Unlike other components of GDP, government purchases continued to support growth during the recession. During the recovery, government spending has fallen, which has subtracted from growth. However, we expect this headwind to abate.

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.