Mark Spiegel, vice president at the Federal Reserve Bank of San Francisco, provides his views on current economic developments and the outlook.

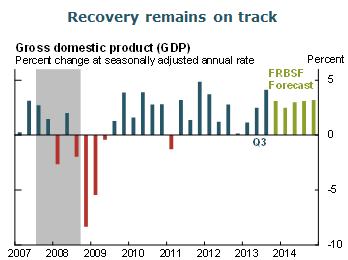

- Recent data continue to indicate a strengthening recovery. Third-quarter GDP growth was revised upwards to 4.1% at an annual rate. Recent data also suggest a stronger outlook for consumption and improved figures on net trade driven largely by falling oil imports. We expect a modest dip in GDP growth in the fourth quarter of 2013 and the first quarter of 2014, due in part to inventory adjustments in the wake of exceptionally strong accumulation during the third quarter. Nevertheless, we still expect more solid growth overall for 2014.

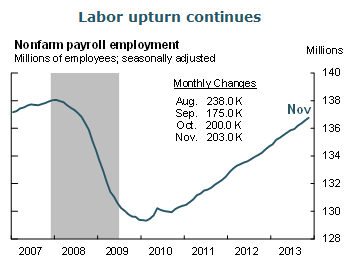

- We continue to see signs of strengthening in labor markets, although substantial slack still exists. Payroll employment growth averaged about 200,000 jobs per month from August through November, slightly above the pace over the past few years. However, the unemployment rate remains well above our estimate of the natural or equilibrium rate of unemployment.

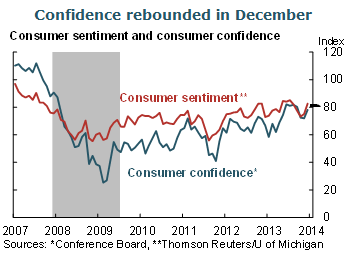

- Improvements in the real economy and the labor picture have reassured consumers. Indexes from the Conference Board and Thomson Reuters/University of Michigan both rebounded strongly from their recent dips around the time of the October federal government shutdown.

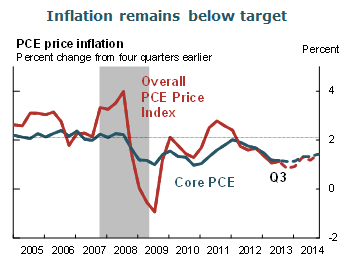

- Inflation remains below the Federal Open Market Committee’s (FOMC) longer-run goal of 2%. This is due in part to lower inflation in energy and medical expenses, which we expect to be temporary. As the temporary factors dissipate and economic slack narrows, we expect inflation to rise gradually towards the 2% objective over the next two years.

- In its December meeting, the FOMC announced that the pace of asset purchases would be reduced beginning in January. The Committee will add to its holdings of mortgage-backed securities at a pace of $35 billion a month rather than $40 billion a month, and will add to its holdings of longer-term Treasury securities at a pace of $40 billion a month rather than $45 billion per month. The statement noted that asset purchases are not on a preset course. The Committee also indicated that it now anticipates that it likely will be appropriate to maintain the current target range for the federal funds rate well past the time that unemployment declines below 6.5%.

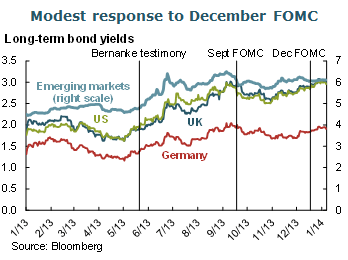

- The market response to the December announcements was relatively modest. For the day, 10-year Treasury yields rose 6 basis points, while three-month yields did not rise. This contrasts with market responses on earlier news days, such as the May 22, 2013, Congressional testimony by Chairman Bernanke when he discussed the possibility of the onset of tapering. Following that news, 10-year yields on U.S. Treasuries rose 11 basis points on that day and rose 92 basis points between then and the September 2013 FOMC meeting.

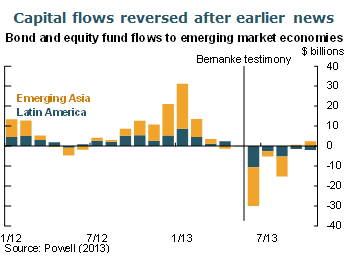

- The recent response among emerging market assets, which had moved even more aggressively after the May testimony, was also muted. Yields on the JP Morgan Emerging Market Bond Index for global sovereign yields rose less than 1 basis point on the day of the December 18 FOMC announcement. Still, yields on emerging market assets remained quite elevated, having risen substantially since discussions about the onset of tapering of FOMC asset purchases began in May 2013. Many emerging market economies experienced “sudden stops” in international capital inflows shortly thereafter, as previously large capital inflows were rapidly reversed and became substantial outflows.

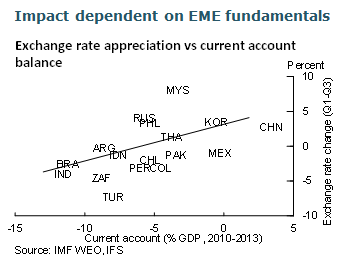

- Economic conditions played an important role in determining the severity of capital flow reversals. Exchange rate movements among emerging market economies between the first and third quarter of 2013 were highly correlated with current account positions held on average between 2010 and 2013. Countries that ran large current account deficits found themselves particularly vulnerable to the changes in market expectations concerning global interest rates.

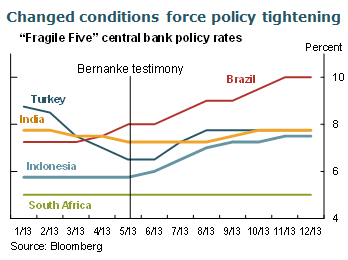

- Many countries whose currency values were threatened felt obligated to tighten monetary policy to stave off further depreciation. Four of the five countries dubbed the “fragile five” by private-sector analysts—Turkey, Brazil, India, and Indonesia—have all raised their policy rates since the May testimony by Chairman Bernanke, even though these countries generally continue to exhibit considerable slack in their domestic economies.

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.